7 Reasons Why Retirement Planning Is Important

Key Points – 7 Reasons Why Retirement Planning Is Important

- Yes, Saving for Retirement Is Imperative, But There’s More to Why Retirement Planning Is Important Than Saving

- Your Retirement Goals Need to Be Top of Mind While Planning for Retirement

- Understanding How Your Retirement Is Unique to You

- Having a Financial Plan Truly Shows Why Retirement Planning Is Important

- 12 Minutes to Read

There’s More to Why Retirement Planning Is Important Than Just Saving

OK, you’re growing your retirement nest egg by you’re diligently saving for your financial future. Isn’t that your retirement plan? What else could you possibly need to account for in your plans to retire? Our goal is to help people prepare for and succeed in retirement. Whatever that looks like for you, we want to help get you there. The most important factor in navigating a successful retirement is having a retirement plan. Why is retirement planning so important you may ask? Because at end of the day, it’s not all about saving – it’s about much, much more.

So, let’s go through a quick list of seven reasons why retirement planning is important so you can make sure you’re not missing something crucial on your way to a successful retirement.

- Knowing You Can Achieve Your Goals

- Spend Less on Taxes Over a Lifetime

- Maximize Your Retirement Income

- Combat Inflation in All Directions

- Manage Your Risk

- Family and Philanthropy

- Clarity, Confidence, and Control

1. Knowing You Can Achieve Your Goals

We all have goals for life. For many of us those are career goals or family goals, but what about goals for when you’re retired? While some of you may have your dreams for retirement determined, others may have no idea what you will want to do with your years of rest and relaxation.

So, why is knowing you can achieve your goals a reason why retirement planning is important? Well, if you’re working with a financial professional like a CFP® Professional, they can help you determine your probability of achieving your goals in retirement with the resources available to you. If you want to learn more about how that probability is determined, check out our article, What Is a Monte Carlo Simulation?

The idea is that if you map your goals out for retirement, your financial professional should be able to help you determine that probability of success given your desired retirement date. Maybe you’ll need to work a few more years to achieve those goals in a probability that makes you more comfortable. Maybe you’re already there and you don’t even know it!

The point is, without setting goals for retirement and understanding your probability of success in achieving those goals, you’re really going into retirement blind. And for many pre-retirees and retirees, the risk of running out of money in retirement is a major worry. Knowing you’re able to achieve your goals can provide you with peace of mind as you venture into retirement. That is why knowing you can achieve your goals in retirement is a reason why retirement planning is so important.

7 Reasons Why Retirement Planning Is Important

on America’s Wealth Management Show

2. Spend Less on Taxes Over a Lifetime

In a couple of months, all Americans will feel the same impact on their accounts – the impact of Uncle Sam. Every April, we get our favorite American holiday, Tax Day. Obviously, we say this with tongue-in-cheek because we know it’s one of the most dreaded annual deadlines for most U.S. households. So, why pay more tax than you need to, especially when you get into retirement and likely have a more fixed income? Let’s look at why retirement planning is an important factor in lowering your tax burden over your lifetime.

Tax Buckets

You may have heard of diversifying your portfolio for retirement, but what about tax diversification? Tax diversification is the idea of spreading your retirement savings across different tax buckets to maximize your opportunities for tax savings in the future. This is the whole concept behind creating a forward-looking multi-year tax plan for retirement.

What are the tax buckets you may ask? Well, here is the quick breakdown from Corey Hulstein, CPA and Director of Tax.

Tax Planning

The reason why tax planning should be an obvious one to most. Keep more money in your accounts, send less money to Uncle Sam. But many conflate this concept with tax preparation. The reality is that tax planning is not tax preparation – even if tax prep season is an excellent time to do some tax planning.

What is tax planning then? Well, tax planning is the idea of looking at your current situation from a financial perspective, determining what tax rate you’re at now, projecting where your tax rates might be in the future and then developing a savings strategy for different phases of your life to minimize your tax burden over years instead of in a single year.

That’s the reason why tax planning is important in the retirement planning process. It allows you to keep more of your hard-earned dollars rather than sending them off to the government.

3. Maximize Your Retirement Income

Going into retirement can be a scary situation when you know you’re no longer getting a regular paycheck. Instead, you’re relying on the savings you were able to sock away while you worked and the gains those savings can earn you while you’re no longer working. So, how do you make sure you don’t run out of money in retirement? How do you ensure you have enough income to live the life you want to live in retirement?

We’ve covered one way with establishing a tax plan alongside your retirement plan. Are there more ways to ensure your covered for your retirement years? Ensuring you have enough income is retirement is incredibly important to your plan. It’s the fuel for your retirement!

Get the Most You Can from Social Security

We are all familiar with one source or retirement income, Social Security. While Social Security is a great source of income in retirement, it’s usually not enough alone to achieve one’s goals. However, many people also only take Social Security at face value, claiming it as soon as they reach an age they can claim.

Why is that an issue? Well, if you claim as soon as possible, you’re likely leaving money on the table. For many, delaying when you claim your benefit can lead to a substantial increase in your monthly Social Security benefits.

Watch as Will Doty, CFP® breaks down the latest Social Security COLA for 2023. He explains how delaying your claim can lead to a higher benefit in retirement.

Plan Your Investments Around Your Goals

Oftentimes, the first thing prospective clients ask when we meet is how they should be investing. While investing is an important part of retirement planning, it’s not why we plan for retirement. We plan for retirement for the first item on this list – achieving your goals.

Investing is very important in the overall picture of your retirement plan. Obviously, we need to make sure you’re generating enough additional income in retirement to cover your expenses. By developing a retirement plan, your investments become a piece in the overarching puzzle rather than the focus of your retirement plan.

Remember that probability of success we discussed earlier? Well, when the market experiences downturns, instead of focusing on your losses in investment accounts, you can refer to your plan to see if it is impacting your probability to achieve your goals in retirement instead. This allows you to put perspective on market movement in the grander picture of your plans for retirement, not the market’s. Refocusing your attention to how investment movements impact your goals is so much more personal and relatable to you when you experience them.

4. Combat Inflation in All Directions

Last year (2022) was the year of inflation and rising interest rates, and in 2023 we’re not done yet. The Fed has continued to beat the drum that their target for inflation is 2% and there is a long way to go. So, while the Fed combats inflation with interest rate hikes, what can you do to protect your retirement plan?

Health Care

Even without considering the impact from the Fed’s efforts to combat inflation, we all know health care expenses have inflated exponentially in recent memory. That’s why we segment what we anticipate inflation for health care to be outside of regular inflation. More often, it’s a much higher inflation rate than what we calculate in for other expenses.

Education Expenses

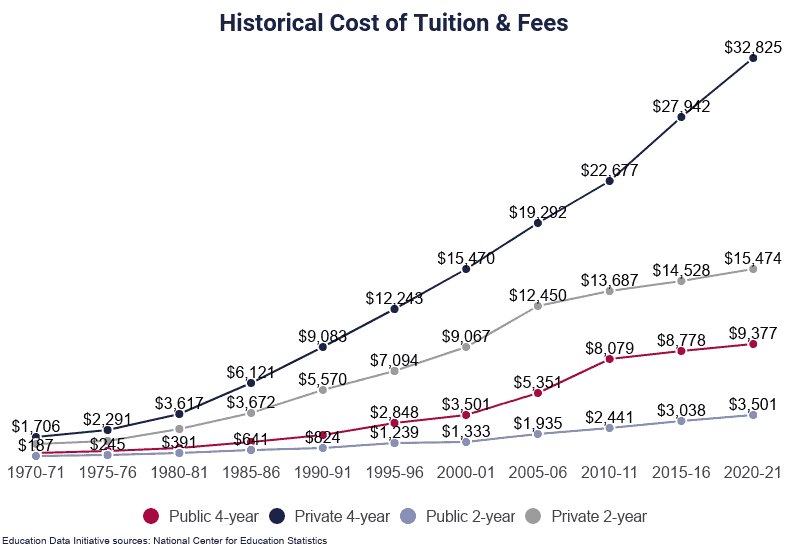

Outside of health care expenses, the cost of education has skyrocketed in the last 30 years. Looking at Figure 1 below, you can see that the average cost of education has over doubled for a private four-year school since 2000. For a public four-year school, it’s nearly tripled.

FIGURE 1 – Historical Cost of Tuition & Fees – EducationData.org

If you plan to provide support for your loved ones as they adventure into college, you better have a plan. Where do we think the cost of a college education will be in another 30 years?

Economy

We’ve all felt the impact of inflation at the gas pump and the grocery store. What was once a nice modestly priced meal at a local eatery now feels a bit exorbitant. Inflation has been rampant, and we all know the Fed has been fighting tooth and nail to bring it back to their 2% goal. The reasons why inflation is an important consideration for anyone planning for retirement should be clear. So, what do you do with your plan to make sure you can mitigate the impact of inflation on your retirement plan?

Luckily, we have a resource on ways to fight inflation in retirement here, but these are the main takeaways.

- Grow your money faster than the inflation rate.

- Investing in bonds (most of the time)

- Income like dividend-paying stocks, utilities, and energy

- Own real estate

- Adjust your withdrawal rate

- Harvest some gains

- Maximize your Social Security (we covered this above)

- Reduce your taxes (we also covered this above)

- Reviewing the financial planning techniques used in your retirement plan

- What about alternative investments like gold and crypto?

You can dig into that article some more. But it gives you some of the tools you might need to combat inflation in retirement and why it’s so important to factor into retirement planning.

5. Managing Your Risk

A large part of making sure your retirement is successful is managing your risk. Why is managing risk an important part of retirement planning? Well, we like to say, control what you can control. In this situation, it means to manage your exposure to risk, which is something you can control. There are many levels to risk management, but the primary one is insurance.

Long-Term Care

No one wants to imagine themselves spending time in a long-term care facility. Nevertheless, it’s something you absolutely need to factor into your plan. The reasons why planning for a long-term care stay in retirement are summed up pretty quickly by ACL.gov (LongTermCare.gov).

- Someone turning age 65 today has almost a 70% chance of needing some type of long-term care services and supports in their remaining years

- Women need care longer (3.7 years) than men (2.2 years)

- One-third of today’s 65-year-olds may never need long-term care support, but 20 percent will need it for longer than 5 years

If that doesn’t give you a kick in the rear to consider planning for a long-term care stay in retirement, then we are not sure what will. Just like any piece of the puzzle, planning for a long-term care stay is crucial. Just like we mentioned earlier, one of the main worries of pre-retirees and retirees is running out of money in retirement. This article from ACL.gov on the cost of care says the following:

- $225 a day or $6,844 per month for a semi-private room in a nursing home

- $253 a day or $7,698 per month for a private room in a nursing home

- $119 a day or $3,628 per month for care in an assisted living facility (for a one-bedroom unit)

- $20.50 an hour for a health aide

- $20 an hour for homemaker services

- $68 per day for services in an adult day health care center

And those were the numbers average numbers in 2016! With the current rate of inflation across the economy, that cost is likely even higher by today’s standards. You need to plan for a long-term care stay, no matter how uncomfortable the topic.

Life Insurance

Life insurance has had a bit of a resurgence as of late with the passing of bills like the SECURE Act and SECURE Act 2.0. The SECURE Act essentially removed the ability for most individuals to inherit an IRA and maintain that account throughout their lifetime. Nope! Now, Congress says most beneficiaries now need to take out the entire IRA in the 10th year following the original account owner’s death. That really rained on a lot of people’s plans for passing their wealth down to the next generation.

Enter life insurance. Life insurance is often considered unnecessary in retirement due to a dwindling amount of liability as your debt decreases, your children grow into adults, have families of their own, and life insurance policies of their own. Except now it’s become one of the best ways to hand wealth down to the next generation after the passing of the SECURE Act because life insurance payments are distributed tax-free to the beneficiaries.

This allows those beneficiaries to pay any excess taxes from Required Minimum Distributions and withdrawals they will have to make from inherited IRAs – with the goal to eliminate the tax man as much as possible. If you’re not considering a life insurance policy in retirement and plan to leave money to your loved ones, it’s something you should consider when planning for retirement.

Health Care

We talked about health care earlier when discussing inflation, but it’s also something you consider when you’re planning for long-term care. You must make sure considering the impact of a health care related event may impact your plans for retirement. It needs to be factored into your overall plan so you can see how it influences your plan when something with your or your spouse’s health goes awry.

Investment Risk

We talked a little about investments earlier as well, but investments are an important part of a retirement plan. Managing your investment risk may be the most crucial part of investing. Why? Well, you obviously don’t want to be at a risk level you’re uncomfortable with, but also you don’t want to put more at risk than you need to achieve your goals in retirement.

Fear and greed are powerful emotions when talking about your money. Don’t let them take over when you’re making decisions with your retirement plan. This is another reason to rely on your probability of success to achieve your goals. If you’re in a place you’re comfortable with in that probability, it can take a lot of weight out of those situations that cause fear and greed.

6. Family and Philanthropy

Continuing a legacy is something many retirees consider as they plan for retirement. Whether that’s through passing money down to younger generations in their family or philanthropic endeavors, legacy and estate plans are often one of the main goals for retirees. Like any part of financial planning, there are many factors to consider in your estate plan.

Earlier we mentioned the SECURE Act and how it will impact how you can hand money down to the next generation. Similarly, there have been other laws passed recently like that Tax Cuts and Jobs Act that made charitable giving in retirement even more attractive. Not only for the philanthropic opportunities it provides, but for the potential tax savings it can bring to the table. First, let’s discuss estate planning.

Estate Planning

Matt Kasper, CFP® joined Dean Barber on a recent episode of The Guided Retirement Show to discuss family financial planning. Read the following quote from Matt and take a minute to reflect on it.

“There’s so much that goes into this big wealth transfer. We’re always thinking about how to best serve our clients and making sure that they have a plan in place so they can have a lasting retirement. The next conversation is about how this transfer takes place. How does this all pass on first to your survivorship? If you’re married, you want your spouse to be taken care of. And, of course, the next big transfer is going to be to the next generation or possibly to charity.” – Matt Kasper

Estate planning is very complex, and you want to make sure you take the necessary steps to avoid complicating things even more with probate court and prolonged legal proceedings. We’re not here to detail everything that goes into a full-fledged estate plan, but instead to impart the importance of having one. It’s not really for yourself, it’s to provide your family with some peace of mind for your finances when you pass.

Charitable Giving

As we mentioned earlier, charitable giving is often a huge goal for people in retirement. With the passing of the Tax Cuts and Jobs Act and the increased standard deduction, charitable giving has become quite a tax planning technique as well.

For example, qualified charitable distributions (QCDs), create a great opportunity to bunch a large donation in a year to create tax savings in future years and even satisfy RMDs. Additionally, donor-advised funds create opportunities for tax savings as well. And as we covered earlier, the less you send to the government in taxes, the more you keep in your pockets.

7. Clarity, Confidence, and Control

Finally, one of the most important reasons why retirement planning is so important is that it can provide you with clarity in your financial future, which will give you the confidence to make the decisions you want effectively putting you in control of your retirement. Not the markets, not the government, and not the economy, you’re in control. When you have clarity, confidence, and control in your retirement plan, you’re that much more able to achieve you goals for retirement.

As we opened this article up, our goal is to help people prepare for and succeed in retirement. Whatever that looks like for you, we want to help get you there. The most important factor in navigating a successful retirement is having a retirement plan. We hope that this piece has helped you understand why retirement planning is important, but also that it’s more than just saving.

We’re Happy to Further Explain Why Retirement Planning Is Important to You

Another resource that we have that explains why retirement planning is important specifically to you is our financial planning tool. Our clients have seen our CFP® Professionals use it to highlight how all seven of the reasons we’ve reviewed for why retirement planning is so important. You also have the chance to begin building your plan from the comfort of your own home at no cost or obligation by clicking the “Start Planning” button below.

If you’re interested in starting your plan for retirement, let us know. We do this every day and would be delighted to work with you. You can schedule a call, virtual meeting, or in-person meeting with a CFP® professional by clicking here. We look forward to hearing from you.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.