Inherited IRA Rules and the SECURE Act

Key Points – Inherited IRA Rules and the SECURE Act

- What Are the Rules for Inherited IRAs?

- The Final SECURE Act Regulations

- The Three Beneficiary Designations

- An Inherited IRA Case Study

- 7-Minute Read | 23-Minute Watch

Schedule a Meeting Get the Retirement Plan Checklist

What Are the Rules for Inherited IRAs?

The rules of inherited IRAs can be extremely difficult to understand due to the SECURE Act, yet they must be understood. The IRS has issued its final SECURE Act regulations, so we’re going to review the inherited IRA rules and explain how they can affect different beneficiaries.

Your Required Beginning Date for RMDs

Before we get to that, it’s important to understand that every person who has an IRA, 401(k), or 403(b)—any of those types of retirement plans— has something called a Required Minimum Distribution. That is the amount of money that needs to come out of the account, starting on your required beginning date.

That raises the question, “When is my required beginning date?” The answer to that isn’t exactly a straightforward one. Your required beginning date for RMDs is April 1 of the year after you turn age 73. So, someone could be 74 before they need to take a Required Minimum Distribution.

Let’s say that somebody turned 73 on January 1, 2024. Well, they’re not required to take their first RMD until April 1, 2025, at which time they would be 74 and three months.

RMDs for IRA Beneficiaries

It’s a goal for many of our clients to build generational wealth, so it’s not only important for the account owner to plan for RMDs—the beneficiaries of those accounts need to be prepared as well. There are additional rules to follow for beneficiaries of inherited IRAs.

Before the SECURE Act, many non-spouse beneficiaries could stretch their IRA withdrawals over their life expectancy. This estate planning strategy is typically referred to as a Stretch IRA. However, the SECURE Act largely eliminated Stretch IRAs. The IRS now requires most non-spouse beneficiaries to withdraw all funds from inherited IRAs by the end of the 10th year following the account owner’s death.

Relief for 2024 RMDs

It isn’t as simple as waiting until the end of that 10th year to empty the account. The IRS’s final SECURE Act regulations, which were issued on July 18, 2024, confirmed that non-spouse beneficiaries subject to the 10-year rule must also take annual RMDs over that period.1

The IRS granted relief for those beneficiaries who missed RMDs in 2021, 2022, 2023, and 2024. If you read that and immediately thought, “I don’t need to take an RMD in 2024, so I’m not going to,” you’re correct and are entitled to do so. That doesn’t mean that you shouldn’t still consider taking an annual RMD in 2024, though.

Why It May Make Sense to Still Take an RMD in 2024

Again, most non-spouse beneficiaries will need to empty the IRA within 10 years regardless. It’s also important to remember that the current tax rates of the Tax Cuts and Jobs Act are scheduled to sunset after 2025.2 If that happens, tax rates would revert to the rates from 2017, which are higher than today’s rates. If you take an RMD in 2024, you’ll get that money out at a lower tax rate and reduce the total of your RMDs that you’ll be subject to in 2026 or later.

You may also be thinking, “The IRS granted relief on RMDs the past four years. Why wouldn’t they do so again in 2025?” The IRS made it clear in its final SECURE Act regulations that missed RMDs after 2024 wouldn’t be excused or waived. There is a 50% excise tax for missed RMDs.

The Three Beneficiaries

We noted earlier that most non-spouse beneficiaries are subject to the 10-year payout rule, but we want to be clear that it applies to non-eligible designated beneficiaries. Non-eligible designated beneficiaries were one of three types of beneficiaries that were outlined within the SECURE Act. There are also non-designated beneficiaries and eligible designated beneficiaries. Which type of beneficiary you are will dictate the inherited IRA rules that you need to follow.

FIGURE 1 – IRA Beneficiaries

Non-Eligible Designated Beneficiaries

A non-eligible designated beneficiary is defined by the IRS as all designated beneficiaries who do not qualify as an eligible designated beneficiary.

Eligible Designated Beneficiaries

So, if you want to know what a non-eligible designated beneficiary is, you first need to know what an eligible designated beneficiary is. Eligible designated beneficiaries include surviving spouses, minor children under 21 but not grandchildren, disabled individuals under strict IRS rules, chronically ill individuals, or individuals who are not more than 10 years younger than the IRA owner. That doesn’t mean that they can’t receive a distribution. It just means that they need to get it out in 10 years.

If the IRA owner passes away prior to their required beginning date, the non-eligible designated beneficiary can take money out at will. But it all must be emptied by the end of the 10th year following the year of death. If the IRA owner passes away after their required beginning date, then the non-eligible designated beneficiary must take annual RMDs and make sure that the account is completely emptied by the end of the 10th year following the year of death.

Non-Designated Beneficiary

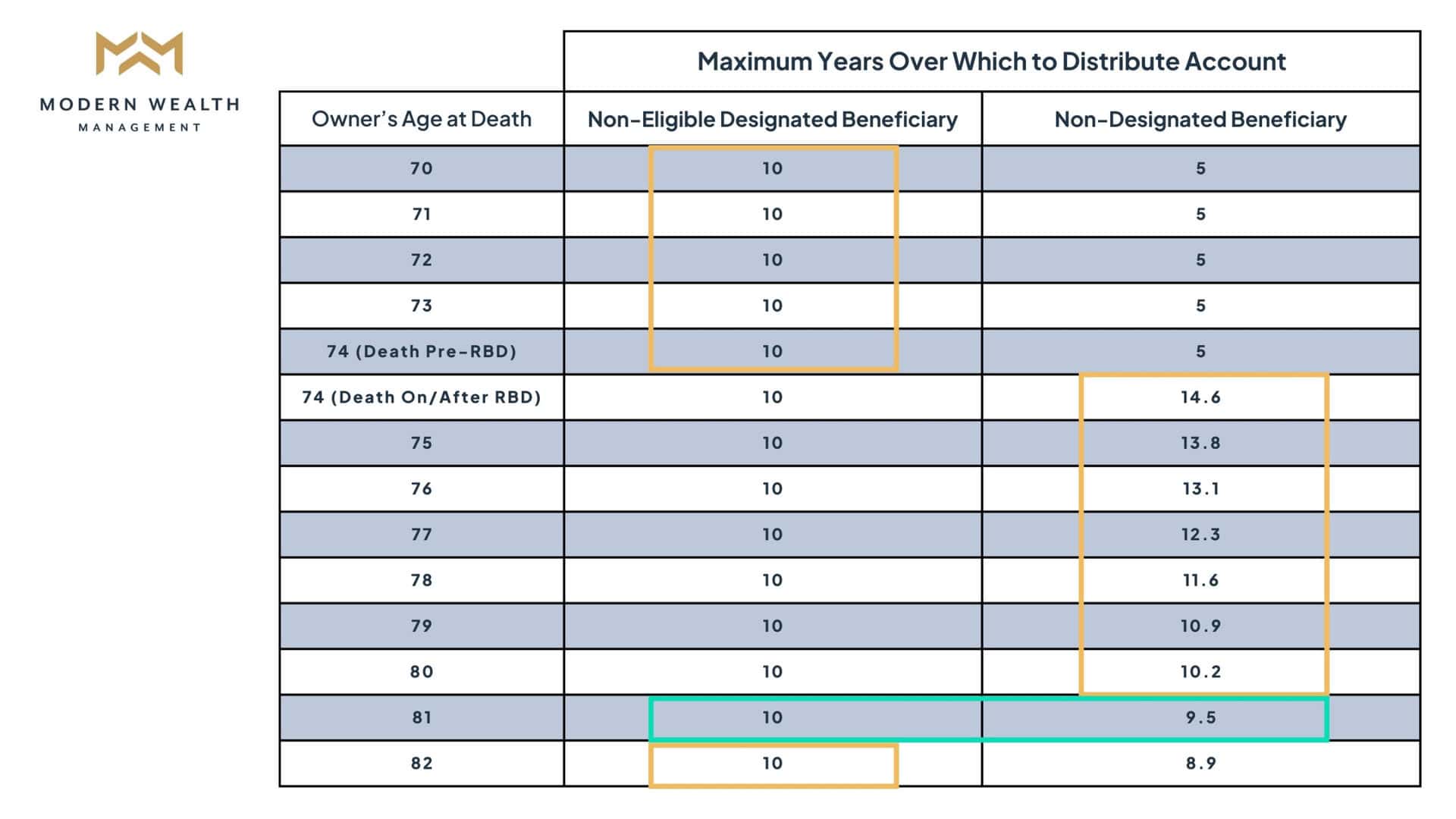

A non-designated beneficiary is an estate, charity, or non-qualifying trust. Typically, if an account owner dies before their required beginning date, the non-designated beneficiary must have the money out within five years. If the account owner did reach their required beginning date prior to their death, the non-designated beneficiary will be subject to RMDs that are based on account owner’s age when they passed away. You can see the difference in the maximum years over which to distribute the account for non-designated beneficiaries and non-eligible designated beneficiaries in Figure 2.

FIGURE 2 – Non-Designated Beneficiaries vs. Non-Eligible Designated Beneficiaries

An Inherited IRA Case Study

Let’s go over an inherited IRA case study to try to make more sense of the three types of beneficiaries. In this case study, Grandpa Earl had two IRAs, and we want to know the RMD implications for his grandson, Adam, who is the beneficiary of Earl’s IRAs. Let’s determine whether Adam is a non-eligible designated beneficiary or an eligible designated beneficiary.

Earl was born in 1942. He died in 2023 at 81. In 2013, Earl inherited an IRA from his sister, Susan, who was two years younger than him.

She was born in 1944. Susan was 69 when she died, which means that she died before her required beginning date. In 2014, Earl began taking stretch IRA distributions from the inherited IRA based on his age 72 in 2014. When Earl died in 2023, Adam inherited the IRA.

What Are Adam’s RMD Requirements?

Earl also left his own IRA for Adam along with the IRA that he inherited from Susan. Adam was 17 in 2023 when he inherited the IRAs. So, the question is, what are Adam’s RMD requirements? If Adam messes up the RMD rules, he’s subject to penalties and taxes.

Adam Is a Non-Eligible Designated Beneficiary

Since Adam was 17 when he inherited the IRAs, he is not an eligible designated beneficiary because he’s not the child of the deceased IRA owner. He’s the grandchild. As a non-eligible designated beneficiary, he is subject to the 10-year rule and must empty this inherited IRA by the end of 2033. That’s the 10th year after his grandpa’s death.

However, since Earl died after his required beginning date, Adam must take RMDs in years one through nine based on his age, 18, the year after Earl’s death beginning in 2024. Since Earl died after the required beginning date, Adam is now a non-eligible designated beneficiary and subject to the 10-year rule. And since Earl died after the required beginning date on the inherited IRA, Adam needs to take out his RMDs each year.

Different Rules for a Different Inherited IRA

Now, what about the IRA that Adam inherited from Earl, which Earl inherited from Susan? In this case, Adam needs to follow another set of inherited IRA rules because he is now a successor beneficiary rather than an eligible or non-eligible designated beneficiary.

In this case, Adam is subject to the 10-year rule, but he is also subject to a different set of RMDs and can’t use his own life expectancy. Adam must continue to use Earl’s remaining RMD schedule beginning in 2024. This is kind of like the old step-into-the-shoes-of-the-first owner-of-the-IRA rule.

Seeking Professional Guidance to Understand These Inherited IRA Rules

So, Adam has two IRAs that he inherited from Earl with totally different RMD amounts coming from each one. Can you see how difficult inherited IRA rules can be to follow, no matter how old you are?

The bottom line is that it’s the beneficiary’s responsibility to understand the rules for inherited IRAs. If you’re loved ones are unaware of the rules for inherited IRAs, make sure that you share this article with them so they don’t face substantial taxes and penalties.

Ed Slott, CPA, an independent expert, has helped educate several of our advisors on these complex inherited IRA rules. He considers IRAs to be a “retirement savings time bomb.” But there are strategies to manage that retirement savings time bomb for you and your beneficiaries.

Roth IRAs Can Make a Big Difference

One planning strategy is to convert an IRA to a Roth IRA. Inherited Roth IRAs will be subject to the same RMDs rules as inherited IRAs. The difference is that the distributions from the Roth are not subject to tax. You’ll be required to pay tax on the Roth conversion, but the tax-free growth on Roth IRA qualified distributions and the earnings may potentially serve as a big savings vehicle for you and your beneficiaries that inherit them.

Roth conversions could be done systematically—a little bit at a time—to stay in a lower tax bracket. There are a lot of different tax planning techniques to potentially reduce RMDs and overall tax burden for you and your beneficiaries. Remember that tax planning is all part of having a comprehensive financial plan.

There are many potential advantages of Roth conversions, but there are potential shortfalls to be aware of as well. Make sure to review our Roth Conversion Case Studies and Tax Reduction Strategies white papers and to consult a tax professional prior to taking any action.

Do You Have Questions About Inherited IRA Rules?

To learn more about how you and your loved ones can navigate inherited IRA rules, start a conversation with us below.

We have CFP® Professionals, CPAs, and estate planning specialists as part of our team at Modern Wealth. They work together on our clients’ behalf with the goal of building generational wealth for their family. Understanding the inherited IRA rules is a big component of that. We’re ready to apply those rules to your family’s unique situation.

Inherited IRA Rules and the SECURE Act | Watch Guide

00:00 – What are catch-up contributions?

03:20 – How long does it take to accrue $100,000?

05:54 – The power of maximizing 401(k) and catch-up contributions

10:33 – Trade offs

14:31 – SECURE Act 2.0 impact on catch-up contributions

16:37 – Tax Diversification and Roth accounts

Resources Mentioned in This Article

Past Episodes of America’s Wealth Management Show

- Reviewing RMD Rules as IRS Issues Final SECURE Act Regulations

- RMD Age for 2023: What’s Your Required Beginning Date?

- How to Build Generational Wealth

- The Retirement Savings Time Bomb Ticks Louder with Ed Slott, CPA

- How to Reduce RMDs with 5 Strategies

- Transferring Wealth: IRAs Are a Bad Option

- Converting to a Roth IRA: What Are the Pros and Cons?

- How Does a Roth IRA Grow?

- The Great Wealth Transfer Has Arrived

- Family Wealth Management Considerations

Other Articles/Videos

- RMD Strategies Before and After Retirement

- RMD Questions: What Are Required Minimum Distributions?

- Is the Stretch IRA Dead?

- New IRA RMD Rules Announced as IRS Offers Relief on 2024 RMDs

- Tax Rates Sunset in 2026 and Why That Matters

- What If We Go Back to Old Tax Rates?

- Roth Conversion Decisions for 2024

- 2024 Tax Brackets: What You Need to Know

- Tax Planning Tips with Corey Hulstein, CPA, and Marty James, CPA, PFS

- What Is the SECURE Act?

- Components of a Complete Financial Plan with Logan DeGraeve, CFP®, AIF®

- Why You Need a Financial Planning Team with Jason Gordo

Downloads

Additional Sources

[2] https://taxfoundation.org/blog/tcja-expiring-means-for-you/

Investment advisory services offered through Modern Wealth Management, Inc., a Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management a Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.