Interest Rate Increases Continue in 2023

Key Points – Interest Rate Increases Continue in 2023

- February Begins with 0.25% Fed Funds Rate Increase

- How Much Longer Will These Interest Rate Increases Continue?

- All Indices in the Green for January

- The U.S. Treasuries Yield Curve Continues to Be More and More Inverted

- 2 Minutes to Read | 4 Minutes to Listen

The data in today’s article is as of February 1, 2023.

Our First Monthly Economic Update of 2023

While all major indices were up in January, the U.S. treasuries yield curve is inverted more than it was at any point of 2022 and Federal Reserve Chairman Jerome Powell is continuing interest rate increases in 2023. We’ll cover all that and more in our January Monthly Economic Update.

January Market Performances

Before we break down some big news to begin February with Powell’s announcement of a 0.25% increase of the Fed funds rate, let’s look at market performances for January.

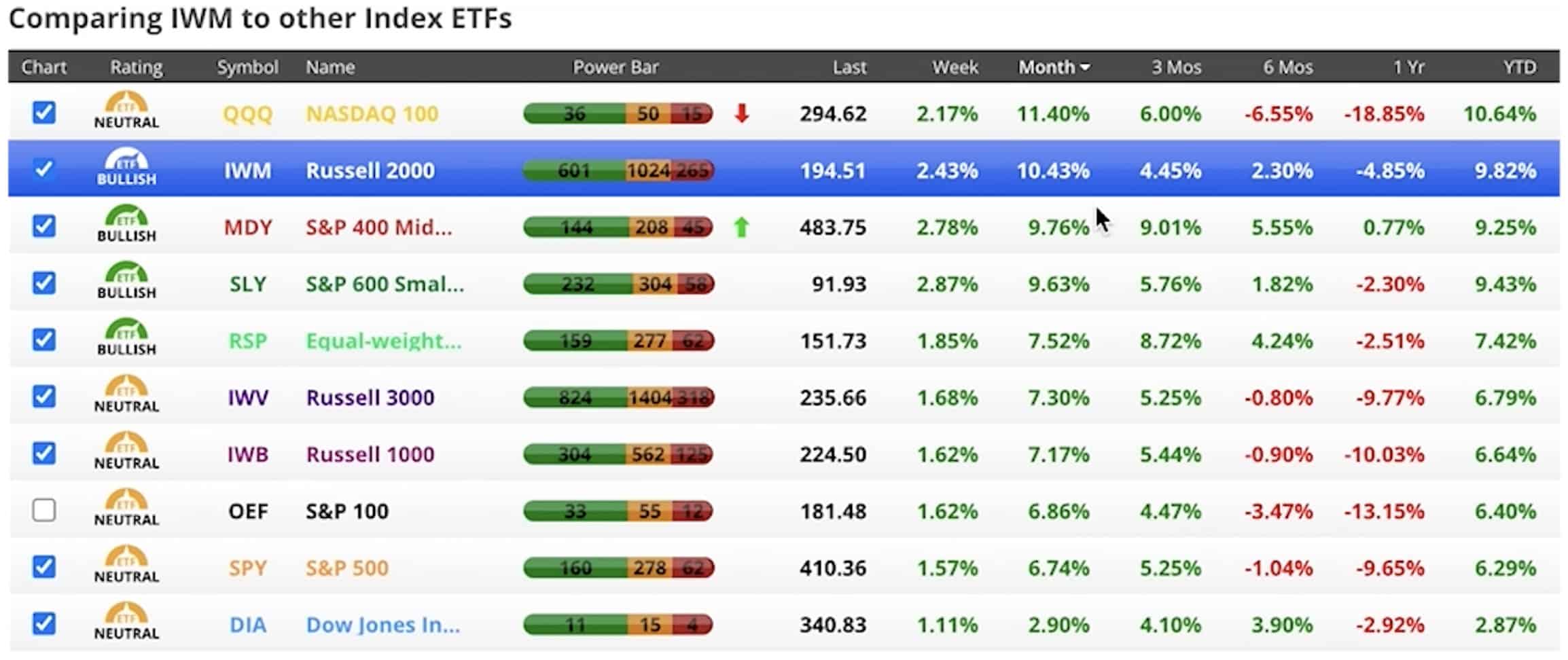

FIGURE 1 – January Market Performances – Chaikin Analytics

Above in Figure 1, you can see that four of the major indices—the Russell 2000, S&P 400 Midcap, S&P 600 Smallcap, and RSP Equal Weight—are showing bullish readings. All the other indices are still in the neutral position. The big winner of the month was the NASDAQ 100, up 11.4%. The Dow Jones Industrial Average, which was the big winner last year, was the lagger with being up just 2.9% for January. But we had green across the board for January. Why do we think that is, though?

Powell’s Reasoning for Continuing with Interest Rate Increases

Well, Powell said on February 1 that he needs to continue with interest rate increases. He said that inflation is still out there. But there’s something else that’s telling us a different story. Let’s look at the inverted yield curve in Figure 2.

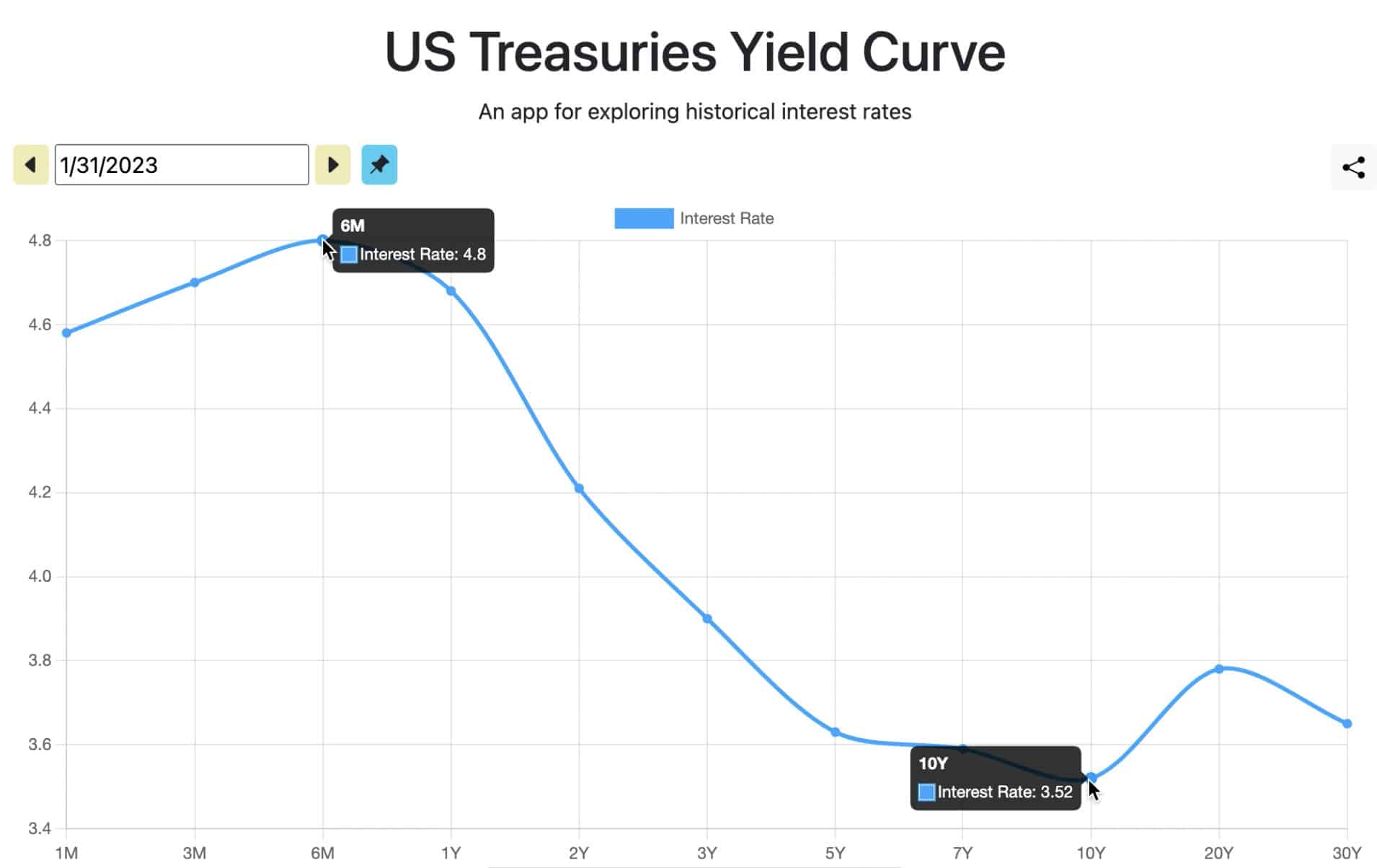

FIGURE 2 – U.S. Treasuries Yield Curve – U.S. Treasury

The Steeply Inverted Yield Curve

We looked at the yield curve several times last year. It’s more inverted now than it was in any point of 2022. The six-month treasury is at 4.8%, while the 10-year treasury is at 3.52%. Even the one-month treasury is paying more than the 10-year treasury 4.58%. The three-month treasury is as well at 4.7%.

Recession Fears Continue Amid Stock Market Rally

Anytime we have a steeply inverted like this is a strong indication that a recession is on the horizon. Remember that it’s possible that the economy can go into a recession while the markets take off. How is that possible?

The markets don’t like the threat of interest rate increases. Even though Powell hinted that there is more work to be done, the economy and the markets are both signaling that a recession is likely on the horizon. That leads the markets to believe that the Fed will be forced to pause the interest rate increases and at some point begin to reduce interest rates later this year.

Was January Another Bear Market Rally?

Will that happen? Only time will tell. The other question is whether January was just another bull run in a longer-term bear market. Again, only time will tell. We’re keeping our eye on things. As always, we encourage you to keep the lines of communication open with your advisor. Thanks for joining me for January’s Monthly Economic Update.

Stay in the Know with Our 2023 Retirement Planning Calendar

If you downloaded a copy of our 2023 Retirement Planning Calendar, you were already aware that the Federal Open Market Committee was meeting on January 31 and February 1. Those dates and many others that can impact your retirement are listed on our 2023 Retirement Planning Calendar, so make sure to get your copy today if you don’t already have one.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.