6 Habits of Self-Made Millionaires and Their Expectations

Key Points – 6 Habits of Self-Made Millionaires and Their Expectations

- What Does It Take to Become a Self-Made Millionaire?

- How Do the Expectations of Self-Made Millionaires Compare to Aspiring Millionaires?

- Assessing Data from the Knight Frank Next Gen Survey and Northwestern Mutual Planning and Progress Study

- Why You Need a Wealth Management Team

- 8 Minutes to Read | 23 Minutes to Watch

Who Wants to Be a Millionaire?

Were you a big fan of the game show, Who Wants to Be a Millionaire?, with the late Regis Philbin?1 Of course, everyone wants to be a millionaire, but unless you were a rare winner of the popular game show, becoming a millionaire isn’t as easy as answering 15 trivia questions. Let’s review some habits of self-made millionaires and how their expectations compare to aspiring millionaires.

Schedule a Meeting Get the Retirement Plan Checklist

Having the Expectations of a Self-Made Millionaire

Before we review some specific habits of self-made millionaires, we want to share some compelling data from the Knight Frank Next Gen Survey that was included Knight Frank’s 2024 Wealth Report.2 The Knight Frank Next Gen Survey polled 600 high-net worth individuals from around the world. For reference, they consider a high-net worth individual to be someone with $1 million or more.

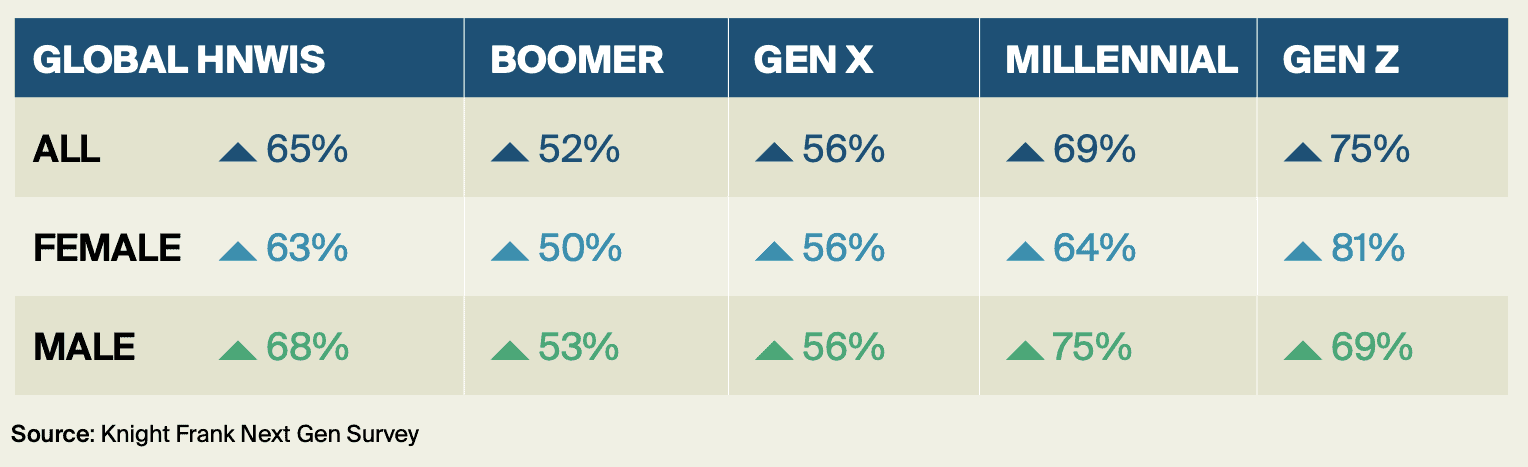

One of their goals with the survey was to assess how men and women of different generations expected their wealth to increase in 2024. The survey found that men have more confidence than women that their wealth would increase in 2024, but Gen Z females had the most confidence out of the high-net worth individuals who were surveyed. See Figure 1 below for Knight Frank’s full breakdown.

FIGURE 1 – Demographic Breakdown of Expectations of the Wealthy – Knight Frank Next Gen Survey

Different Generations Have Different Wealth Planning Expectations

Knight Frank’s findings were in line with the data in Northwestern Mutual’s 2024 Planning and Progress Study when it comes to younger generations being more confident about growing their wealth.3 Northwestern Mutual found that the average age that Americans start saving for retirement is 31. However, the average age for Baby Boomers was 37 and the average age for Gen Z was 22.

With starting to save for retirement at a much earlier age, it makes sense why younger generations are more confident about increasing their wealth in 2024 and retiring at an earlier age. However, in each year that Northwestern Mutual has conducted its planning and progress study, the average amount that people say they’ll need to retire at 65 has drastically increased.

All Self-Made Millionaires Aren’t Made the Same

As we’ve mentioned so many times, though, in our articles, podcasts, and other content, the amount you need to retire depends on so many different variables. The Northwestern Mutual and Knight Frank studies didn’t specify anything about the goals (financial and nonfinancial), risk tolerance, health, asset allocation, or tax allocation for the individuals that they surveyed. How much you need to retire and how much you need your money to grow each year depends on your unique situation. It’s not as simple as plugging numbers into a retirement calculator.

So, how are you supposed to know if you’ve saved enough to retire? The six habits of self-made millionaires that we’re going to review can help you answer that. And the same goes with our Retirement Plan Checklist. This white paper includes 30 yes-or-no questions that gauge your retirement readiness and age-and date-based timelines of critical financial planning considerations. Download a copy of the Retirement Plan Checklist below.

6 Habits of Self-Made Millionaires

1. Work with a Team of Professionals That Works on Their Behalf

Many people will hire a financial advisor, tax professional, estate planning attorney, investment manager, and various insurance specialists, and have individual relationships with them. It’s important to have those professionals working for you, but that’s only half the battle.

It’s critical to have all those professionals working together in a coordinated effort for you. Many self-made millionaires not only have that scenario; they’ve come to expect it.

At Modern Wealth, we have CFP® Professionals, CPAs, CFAs, estate planning specialists, and insurance specialists that work together and have a collective mindset of putting your needs, wants, and wishes first. If you’ve hired all those professionals but they aren’t regularly communicating with each other, there are key financial planning opportunities that can be missed. We’ll give an example of that in the second habit of self-made millionaires, which is…

2. Utilize a Forward-Looking Tax Plan

Our tax team has been extremely busy the past few weeks with Tax Day coming up on April 15. But one thing that many of our tax team members enjoy is that they’re not solely focused on tax compliance. Our tax team members spend much of their time working alongside our CFP® Professionals—reviewing financial plans for tax planning opportunities. Again, that close working relationship between CFP® Professionals and CPAs is something that many self-made millionaires expect.

As our CPAs review financial plans for tax planning opportunities, they’re looking at your current tax rate and your projected future tax rate. One tax planning opportunity that our CPAs have been looking for a lot lately are Roth conversions. With a Roth conversion, you’re converting funds from your traditional IRA into a Roth IRA.

If you decide to do a Roth conversion, you’re required to pay tax on the funds you’re converting because they haven’t been taxed yet. However, all the Roth IRA earnings from that point on and the distribution of those funds will be tax-free.

The reason that now is a popular time to do Roth conversions is because the tax rates of the Tax Cuts and Jobs Act are scheduled to sunset after December 31, 2025.4 Our current tax rates from the TCJA are lower than the tax rates from 2017. By doing Roth conversions before 2026, you have an opportunity to do them at a discount with paying tax on the conversion at today’s lower rates.

It’s important to understand that Roth conversions could be a great planning opportunity for some but have adverse consequences for others. To learn more about the pros and cons of Roth conversions, download our Roth Conversion Case Studies white paper.

3. Understand the Importance of Building Generational Wealth

Many self-made millionaires don’t just contribute/convert to Roth funds so they can become self-made millionaires. They also do it to create generational wealth when they pass on those tax-free funds to their beneficiaries.

There was another Roth-related legacy planning opportunity that just became available in 2024. One provision of the SECURE Act 2.0, which was signed into law in December 2022, made it possible for 529 plan to be rolled over to a Roth IRA (tax-free and penalty-free) under certain conditions.5 So, if your children or grandchildren suddenly don’t need the financially support for educational expenses that a 529 plan offers, they can roll those funds over to a Roth IRA and benefit from those tax-free dollars.

And, of course, having an estate plan is critical to building generational wealth. Whether you’re a self-made millionaire or just starting to save for retirement, you need to have an estate plan that includes the following:

- Last Will and Testament

- Revocable Living Trust

- Beneficiary Designations

- Advance Healthcare Directive: Living Will and Medical Power of Attorney

- Financial Power of Attorney

At Modern Wealth, we recommend to our clients to review their estate plan with us every other year and after big life events. Make sure that your loved ones are all on the same page about what they’re inheriting from you (or vice versa) so there are no surprises if either of you pass away or become incapacitated.

4. Control What They Can Control (and Plan for What They Can’t)

There are a lot of things that you can control as a self-made millionaire (or aspiring self-made millionaire). You can choose whether to contribute to a Roth or traditional 401(k), what you want your distribution strategy to look like, when to claim Social Security, etc.

But there are also several things that are out of your control when it comes to financial planning. You can’t control things like market volatility, inflation, interest rates, and tax rate hikes. However, as we mentioned in second habit of self-made millionaires with potentially higher tax rates looming, you can plan for them.

This is where stress testing your financial plan is key. When interest rates, inflation, market volatility, and tax rates are all low, it can be easy to not plan for them. But when they’re at high levels and you don’t plan for them, they can derail your retirement. So, as you’re building your financial plan, see if your plan can withstand past periods of high inflation, high interest rates, high tax rates, heightened market volatility, etc.

What is your plan’s probability of success after doing that stress testing? Will you be OK or will you likely need to adjust your spending at some point in retirement? This is why it’s crucial to create a spending plan for retirement as a part of the retirement planning process.

5. Start Saving Early for Retirement

As we outlined when referencing the Northwestern Mutual study, when you start saving for retirement matters. If you’re working and you’re not saving to your employer-sponsored retirement plan, why not? It might sound like we’re stating the obvious, but by saving early for retirement, you can increase your chances of retiring earlier, leave a larger legacy, and/or spend more in retirement.

Being discipline with saving isn’t easy, but just remember that retirement planning is all about playing the long game. It’s crucial to keep that discipline when it comes to wealth management if you’re trying to become a self-made millionaire. And speaking of managing your emotions, that leads us to our last habit of self-made millionaires. Drum roll, please.

6. They’re Fearful When Others Are Greedy and Greedy When Others Are Fearful

If you think of people who are extremely wealthy, Warren Buffett might be someone who comes to mind. After all, he has a $369 billion portfolio.6 Buffett had a memorable quote that some of our Modern Wealth team members think about often.

“Be fearful when others are greedy and greedy when others are fearful.7” – Warren Buffett

Buffett said that during the Great Recession as emotions for many investors were running high. Do you know why it can be easier for self-made millionaires not to make knee-jerk reactions during market downturns? It’s because they’ve likely planned for the possibility of a severe market downturn by stress testing their financial plan. It all starts with building a financial plan that takes you to and through retirement.

Working with a Team of Professionals to Build a Personalized Financial Plan

Let’s circle back to the first habit of self-made millionaires as we wrap up this article. You need to have a team of professionals that’s working for you to build you a personalized financial plan. Along with helping you practice these habits of self-made millionaires, we want you to have a plan that can give you more confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things you love. Start a conversation with our team below to begin seeing what that personalized financial plan will look like for you.

Self-made millionaires aren’t made overnight (unless you happen to win the lottery or a game show like Who Wants to Be a Millionaire?). And even if you end up being that lucky, you unfortunately won’t be getting all of the winnings because that money hasn’t been taxed yet.8 In-depth planning—which should be done with a team of professionals—is critical to becoming a self-made millionaire. Whether you’re a self-made millionaire or are trying to become one, our team is ready to assist you with your wealth management needs.

6 Habits of Self-Made Millionaires: Watch Guide

00:00 – Introduction

02:48 – The Six Habits

04:02 – 1. Start Saving Early

05:45 – 2. Understanding Fear and Greed

07:20 – 3. Controlling What You Can, Planning for What You Can’t

08:43 – 4. Forward-Looking Tax Planning

11:58 – 5. Building Generational Wealth

18:47 – 6. Working With a Team of Professionals

21:29 – What We Learned Today

Articles

- How Much Do I Need to Retire?

- Nonfinancial Life Planning with Bruce Godke

- Have I Saved Enough to Retire?

- Don’t Retire without Doing These Things First

- Why You Need a Financial Planning Team with Jason Gordo

- The CFP® Professional and CPA Relationship with Logan DeGraeve, CFP®, AIF® and Corey Hulstein, CPA

- Components of a Complete Financial Plan with Logan DeGraeve, CFP®, AIF®

- Tax Planning Strategies with Marty James, CPA, PFS

- What If We Go Back to Old Tax Rates?

- Tax Rates Sunset in 2026 and Why That Matters

- How to Build Generational Wealth

- Family Financial Planning with Matt Kasper, CFP®, AIF®

- Understanding the SECURE Act 2.0 with Ed Slott, CPA

- Revisiting Roth vs. Traditional with Bud Kasper, CFP®, AIF® and Corey Hulstein, CPA

- Maximizing Social Security Benefits

- What Is a Monte Carlo Simulation?

- Setting Up a Spending Plan for Retirement

- Starting the Retirement Planning Process

- Can I Retire Early? Becoming Financially Independent

- The Great Recession’s History Remains Relevant

Past Shows

- Retirement Savings by Age

- 5 Factors More Important Than Rate of Return

- Health Care Costs During Retirement

- Understanding Retirement Asset Allocation

- Asset Allocation vs. Tax Allocation

- 9 Items Retirement Calculators Miss (That Our Tool Doesn’t)

- Financial Planning Considerations

- What Is Financial Planning?

- 9 Tax Filing Errors to Avoid

- Roth Conversion Rules

- Converting to a Roth IRA: What Are the Pros and Cons?

- How Does a Roth IRA Grow?

- 529 Rollover to a Roth IRA – What You Need to Know

- 5 Estate Planning Documents That Everyone Needs

- 4 Retirement Risks That Are Out of Your Control

- 5 Long-Term Strategies for a Better Retirement

- Reviewing Rebalancing Strategies

- 10 Ways to Fight Inflation in Retirement

- The Effect of Rising Interest Rates on the Economy

- How to Spend When You First Retire

Downloads

Other Sources

[1] https://www.imdb.com/title/tt0211178/

[2] https://www.knightfrank.com/wealthreport

[3] https://news.northwesternmutual.com/planning-and-progress-study-2024

[4] https://taxfoundation.org/blog/tcja-expiring-means-for-you/

[5] https://www.savingforcollege.com/article/roll-over-529-plan-funds-to-a-roth-ira

[6] https://finance.yahoo.com/news/almost-half-warren-buffetts-369-083500243.html

[7] https://finance.yahoo.com/news/warren-buffett-says-simple-rule-180552807.html

[8] https://www.nerdwallet.com/article/taxes/pay-taxes-game-show-winnings

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.