What Millionaires Do in Times of Economic Uncertainty

Key Points – What Millionaires Do in Times of Economic Uncertainty

- Breaking Down Some Statistics from Northwestern Mutual’s 2023 Planning & Progress Study

- Factors That Go into How Much You Need to Retire

- Millionaires Plan for Times of Economic Uncertainty … Hopefully You Do as Well

- The Key to Combatting Financial Insecurity

- 4 Minutes to Read | 24 Minutes to Watch

What Do Millionaires Do in Times of Economic Uncertainty?

Have you been negatively impacted by the economic uncertainty we’ve experienced over the past couple of years? If so, how? It’s not a fun conversation to have, but it’s a necessary one. Not having a conversation about it at all can only increase the anxiety of economic uncertainty, which is why it’s so critical to plan for economic uncertainty. We’re going to discuss what millionaires do in times of economic uncertainty to illustrate the importance of planning for it.

Logan DeGraeve, CFP® and Chris Rett, CFP® are going to dive into three specific things that millionaires do in times of economic uncertainty. Those things are:

- Plan for Market Volatility

- Work with a Team of Financial Professionals

- Continuously Monitor Their Financial Plan and Update It as Necessary

But first, let’s ask Chris what he would do if he had a $1 million and wasn’t a CFP® Professional.

“I would first call a financial advisor or CPA. If I have $1 million, I need to know what to do with it. I need to know what the tax implications of my investments are and how to invest.” – Chris Rett, CFP®

It’s important to understand that if you have $1 million in a traditional 401(k), you don’t actually have $1 million. That money is tax-deferred, meaning that it hasn’t been taxed yet. So, make sure to keep that in mind throughout this article and as you’re approaching and going through retirement.

How Much Do You Need to Retire?

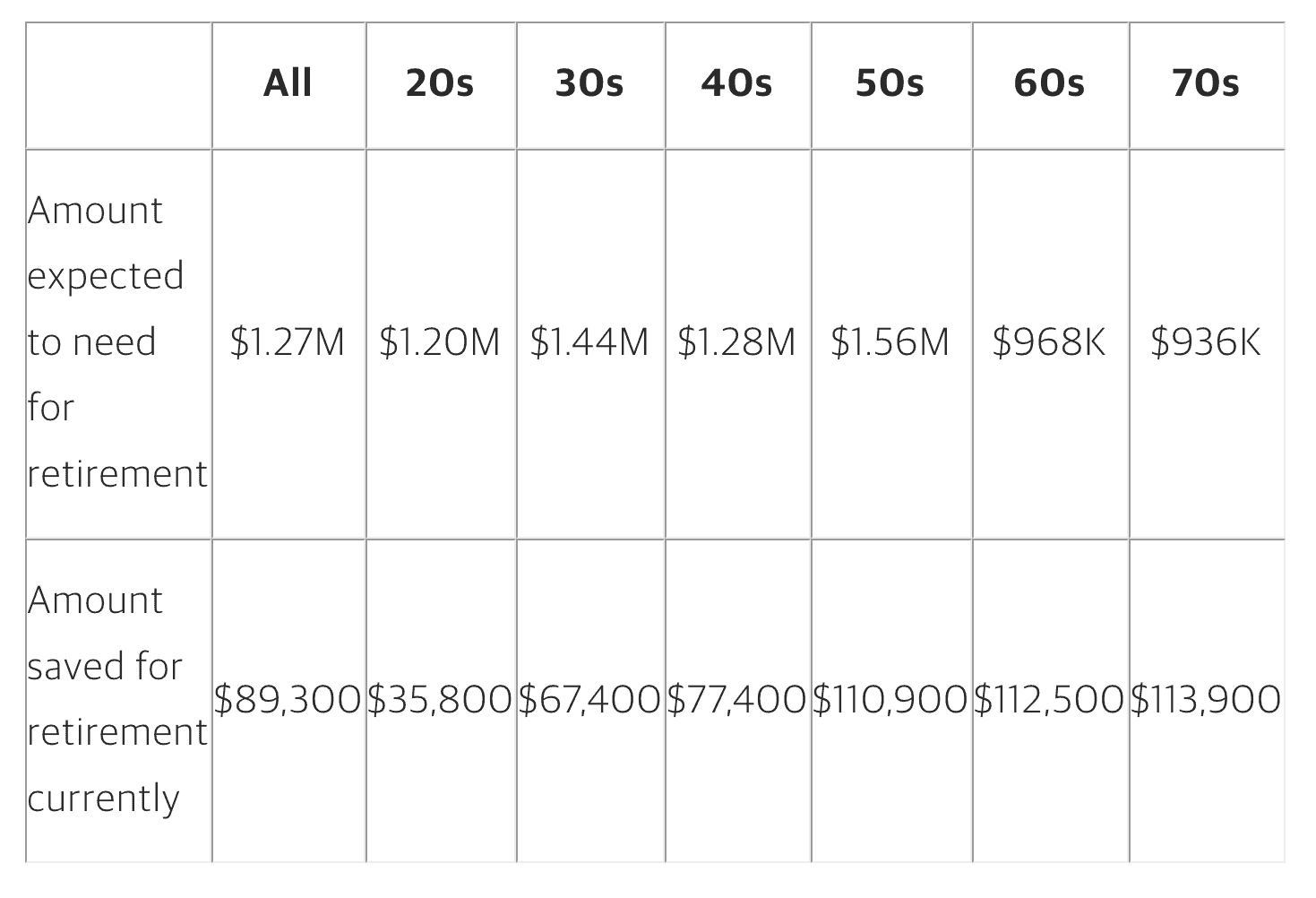

We want to set the stage for this discussion on what millionaires do in times of economic uncertainty by looking at some statistics from Northwestern Mutual’s 2023 Planning & Progress Study. According to the study, Americans think that they need to amass $1.27 million to retire without financial stress. That number jumps all the way up to $1.56 million for people in their 50s.

“In your 50s, retirement starts to become a little more real. At 50, life starts to slow down a little bit. You start saving and think, ‘Oh my gosh. Retirement could feasibly be within 10 years.'” – Chris Rett, CFP®

In their same study from 2022, the average expected amount needed for retirement was $1.25 million. Given the high inflationary, high interest rate environment we’ve been in, the increase from $1.25 million to $1.27 million is hardly a surprise.

Creating a Spending Plan for Retirement

But just because that study says that Americans feels they need $1.27 million to comfortably retire doesn’t mean that’s how much YOU need to retire.

“There are some people that only need $50,000 net a year in retirement and there are some people that can’t retire on that. The amount that you need to save is going to be dependent on what you want to do.” – Logan DeGraeve, CFP®

How much you need to retire depends on your unique retirement goals and lifestyle. And what are your current vs. expected expenses? What do we need to account for throughout the life of your retirement? A lot of people don’t like the word “budget.” It doesn’t need to be something you live within, but it’s critical for people of all ages to outline their planned expenses. We like to refer to it as creating a spending plan.

It’s also important to plan for unexpected expenses. What if you need a new car, have urgent home repairs, or have significant health care expenses? Those things also need to be considered as you’re creating a spending plan. That leads us right into three things that millionaires likely do in times of economic uncertainty.

1. What Millionaires Do in Times of Economic Uncertainty: Plan for Market Volatility

Northwestern Mutual’s research found that only 52% of Americans have a forward-looking financial plan that stress tests for the possibility of a market downturn, heightened inflation, etc. That percentage goes up to 84% when segmenting it to the wealthiest Americans.

“Wealthy people hold themselves to an exceptionally high standard when it comes to managing their finances,” Aditi Javeri Gokhale, Northwestern Mutual Chief Strategy Officer and Head of Institutional Investments

Almost exactly two years ago, Dean Barber and Bud Kasper had a thorough conversation on America’s Wealth Management Show about how to plan for uncertainty in retirement. Let’s revisit seven yes-or-no questions that Dean asked about retirement risks that you can and can’t control to illustrate that economic uncertainty is something that you can plan for.

“Can you control inflation?

No.

Can you control what tax rates are going to do?

No.

Can you control how much you’re going to pay in taxes?

Yes.

Can you control how you’ve predicted inflation into your future?

Yes.

Can you control the markets?

No.

Can you control interest rates?

No.

Here’s the biggest question. Can you control how those things will be handled so that you can give yourself the highest probability of the proper outcome in the future? The answer is absolutely, unequivocally, yes.” – Dean Barber

You don’t need to reinvent the wheel during the financial planning process. Look at what the wealthy are doing and copy what they’re doing. That starts with having a plan. It’s not a coincidence that the wealthy are wealthy because they plan for it.

2. What Millionaires Do in Times of Economic Uncertainty: Work with a Team of Financial Professionals

Notice that the second and third questions that Dean asked there were tied directly to taxes. Taxes and health care are typically the two biggest wealth-eroding factors in retirement. Do you think that one financial advisor can effectively plan for your all your financial planning needs—cash flow management, tax planning, risk management, estate planning, etc.? That’s a lot to ask of one person.

Well, the ultra-wealthy expect their financial advisor to work with their CPA, CFA, attorney, and insurance specialists. Think about all the constant communication that needs to happen between those professionals to get the best results for the client. There’s a lot that can get lost in translation.

That’s why we’ve built a full-service wealth management firm at Modern Wealth. Our team of professionals firmly believes that the millionaire next door should get the same financial planning experience that the ultra-wealthy have come to expect.

“There are multiple facets with financial planning, especially when you get into retirement because there are a lot of moving pieces. Your team needs to work together and understand what the end goal is.” – Chris Rett, CFP®

3. What Millionaires Do in Times of Economic Uncertainty: Continuously Monitor Their Financial Plan and Update It as Necessary

Things can instantly change in times of economic uncertainty. So, building your plan with a team of financial professionals isn’t enough. You need to review your plan with them at least once or twice a year because of how much can change. There can be changes in the markets, tax code, your retirement goals—the list goes on.

Think of it as a financial checkup. It’s not any different than going to the doctor for a checkup. Instead of a checkup on your health, you’re doing a checkup on the various components of your financial life.

“Just because you clean out your car one time doesn’t mean that you never need to clean it out again. It’s important to monitor your financial plan. Are you on track?” – Chris Rett, CFP®

Going Through the Retirement Planning Process with Your Spouse

It might sound obvious, but it’s important to go through the retirement planning process with your spouse as well. Your spouse’s wants, needs, and wishes need to be incorporated into your plan too. What are their goals for retirement? Whether you’re starting the retirement planning process or are trying to fine tune your financial plan, take some time to review our Retirement Plan Checklist with your spouse. It consists of 30 yes-or-no questions and an age-based timeline that cover a variety of key retirement considerations. Download your copy below!

It All Starts with a Financial Plan

Of course, if you don’t have a financial plan, that’s where it all starts. That was the baseline for all three things on our list of what millionaires do in times of economic uncertainty. If you don’t have a plan and/or have concerns about if your plan can get you to and through retirement, we want to share more with you about our team approach to financial planning.

“It always starts with the plan. Like Ben Franklin said, ‘failing to plan is planning to fail.’” – Chris Rett, CFP®

We welcome you and your spouse to schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. Again, the process begins with defining your retirement goals and lifestyle. We want to get a better understanding of who you are and what you need your money to do for you instead of jumping right in and asking about your investments.

You can meet with us in person, virtually, or by phone—it’s whatever is easiest for you. We hope that what we’ve shared about what millionaires do in times of economic uncertainty has helped you to understand that it’s critical for everyone to have a forward-looking financial plan.

What Millionaires Do in Times of Economic Uncertainty | Watch Guide

00:00 – Introductions

01:00 – What Would Chris Do with $1 Million?

01:45 – How Much Do You Need to Retire?

06:31 – What Are Millionaires Doing?

07:17 – 1) Failing to Plan is Planning to Fail

11:48 – 2) Build a Financial Planning Team

17:07 – 3) Continuously Monitoring & Adjusting the Plan

19:40 – What We Learned Today

Articles

- Retiring with $1 Million

- Tax Efficient Investing with Stephen Tuckwood

- Revisiting Roth vs. Traditional with Bud Kasper and Corey Hulstein

- How Much Do I Need to Retire?

- Setting Up a Spending Plan for Retirement

- Rising Long-Term Care Costs

- Making a Big Purchase in Retirement

- Monetary Policy Tools: The Fed’s Latest Actions with Brad Kasper

- Components of a Complete Financial Plan with Logan DeGraeve

- What Is a Monte Carlo Simulation?

- Taxes on Retirement Income

- How to Mitigate Inflation on Health Care Costs

- Don’t Miss Out on Your Money: Redefining Risk Management

- Why You Need a Financial Planning Team with Jason Gordo

- Talking with Your Spouse About Money

Past Shows

- Staying Calm Amid Economic Uncertainty

- Planning for Uncertainty in Retirement

- Your Retirement Lifestyle: What Do You Want Your Retirement to Look Like?

- Unexpected Expenses and How to Plan for Them

- Stress Testing Your Financial Plan

- 4 Retirement Risks That Are Out of Your Control

- Retirement Cash Flow: What You Need to Know

- What Is Tax Planning?

- Couples Financial Planning: What You Need to Know

- Getting Ready for Retirement: Don’t Retire without Doing These Things First

Downloads

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.