The U.S. Banking Crisis – Is It Over? Or Was It Even a Thing?

Key Points – The U.S. Banking Crisis – Is It Over? Or Was It Even a Thing?

- Looking Back at the Big Three Bank Failures

- But What Has Happened Since Those Three Bank Failures?

- Is This Really a U.S. Banking Crisis That People Are Making It Out to Be?

- It Might Not Look Like a U.S. Banking Crisis Now, But More Bank Mismanagement Could Change That

- 10 Minutes to Read

Questions Surrounding the U.S. “Banking Crisis”

With all the turmoil we’ve seen so far in 2023, you could be forgiven for not remembering that three U.S. banks failed in a single week back in March. That caused fear on a global scale that the financial system was on the verge of collapse. For a full month and a half, every financial media outlet had story after story about the “banking crisis” that were filled with dire predictions.

You also had all the usual suspects telling you to buy gold and silver (from them) to protect yourself from the coming collapse. And, of course, they were urging you to subscribe to their newsletters too. While they were all panicking, I wrote an article titled, What’s Going on with Bank Failures? in which I suggested that there was no need for panic. I suggested for everyone to do their own research on their bank and pointed out that the three banks that had failed were all exposed to unhedged risks brought on by poor management and questionable business practices, making the likelihood of a full-on banking crisis unlikely. And here we are today.

Is the U.S. Banking Crisis Over? … Did It Happen in the First Place?

If you Google banking crisis, many of articles and videos that pop up are from March to mid-May. There has been a remarkable drop-off in activity on that subject. So, what does that mean? Is it over? Was the U.S. “banking crisis” ever even really a thing? Are there banks out there on the verge of collapse as we speak? Well, it depends on who you ask.

I’ve spent a lot of time getting into the weeds on this topic. So today, I’m going to attempt to bring you what I think are the most important things to know where the banking system is concerned to allow you to decide for yourself if there is/was a real banking crisis and whether or it’s over if there was. There are convincing arguments on both sides. The reality is that we won’t know for a while who is correct and who is mistaken. So, without further ado, let’s dig in.

For the purposes of this discussion, we should review the basics of how banks make money to have an informed opinion about the current health of banks, and the potential for the onset of a banking crisis. As always, knowledge is power. Specifically, power to discern truth, ignore speculation, and regulate emotion.

Understanding Return on Assets

When you deposit your money in the bank, your deposit becomes a liability and an asset to the bank. It’s a liability because they owe you the money back when you request it, in addition to the interest they must pay you (if they do) while your money is on deposit. It’s an asset because they can use your money to issue credit cards or to lend it to other people to buy vehicles, houses, and the like at an interest rate higher than what they are paying you. The difference in the interest rate they pay you as a depositor and the interest rate they collect on these loans is the profit they get to keep. It’s one of the key metrics to show how well or poorly banks are doing. It’s known as Return on Assets (ROA).

The typical ROA for most banks is in the 1% range. Some are higher and some are lower depending on the type of business the bank is in and their cost of acquiring assets.

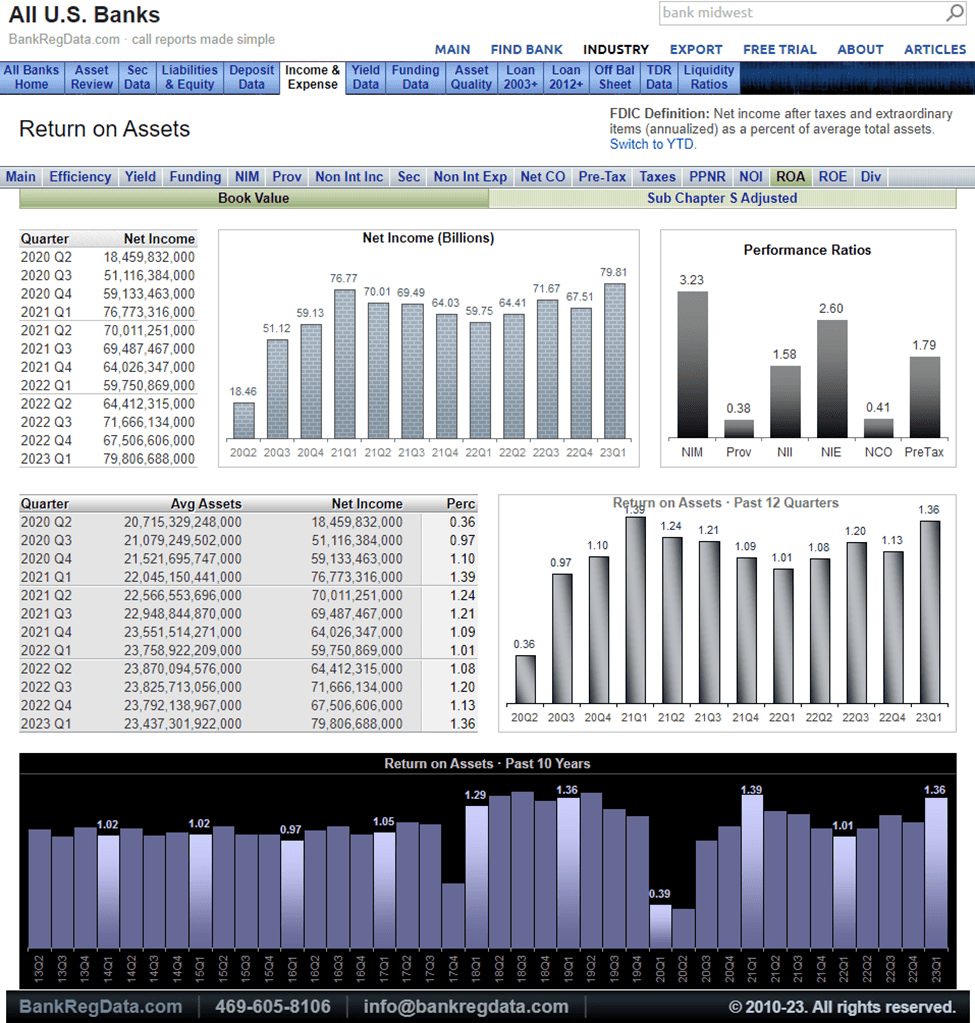

FIGURE 1 shows that the ROA for all U.S. banks in the first quarter of 2023 was 1.36%. That level of ROA has only been exceeded three times over the last 10 years. The highest was just a fraction higher at 1.39% in the first quarter of 2021. So, at the present time, banks appear to be doing quite well.

FIGURE 1 – 2023 Q1 ROA for all U.S. Banks – BankRegData

Fractional Reserve Banking

The thing we need to keep in mind is that we have what is known as a Fractional Reserve Banking system, which means that banks are usually only required to keep a small amount of the money they take in on deposits, say 5% or so. However, in March 2020, the Federal Reserve lowered the reserve requirements for all banking institutions to zero.

Instead of requiring banks to keep reserves on hand, they established a specific interest rate that they would pay banks on their reserve deposits, the IORB rate. They did this to create liquidity and encourage lending to households and businesses. The rate that banks are paid on reserve balances at that point was 0.15% and banks were happy to lend money freely. The current rate is now 5.15%, which means banks don’t need to take on nearly as much risk to get a return on their reserves.

So, the policy designed to create liquidity and encourage lending, due to the rise in the Fed funds rate over the last 15 months, is now discouraging those activities…on purpose. An influx of money in the system is one of the things that helped bring about the inflation we’ve all experienced. And reducing the supply of money with higher interest rates has helped to bring that inflation under control.

The Real Possibility of a Recession

Theoretically, the higher rates on reserves that banks can get should make them much more diligent when it comes to making loans to consumers and businesses, requiring better credit and more collateral. That should lead to higher quality debt at higher rates, which will ultimately make the banks more profitable in the long run. Theoretically. But what if the pendulum swings too far in one direction?

What if the lack of cheap money in the system causes the economy to slow all the way into recession? It’s a very real possibility. That’s why I say that there are merits to some of the fears for the banking industry. I don’t think it’s a foregone conclusion, but it’s worth keeping in mind as we continue this discussion.

Why the So-Called U.S. Banking Crisis Is Being Overblown

The U.S. banking crisis of 2023 as it’s been labeled has so far been contained to three banks who were grossly negligent in their businesses. Silicon Valley Bank, like First Republic Bank, catered to start up technology companies in California, who were in large part unprofitable and being infused with large sums of venture capital. First Republic had a loan-to-deposit ratio of 111%, meaning they loaned more money than they had.

Neither bank had any hedges against interest rate risk. And as interest rates rose, the value of the long-term treasuries they held as reserves fell dramatically. As they struggled to remain solvent, they were met with huge redemption requests by their depositors. Silicon Valley Bank had $42 billion withdrawn in a single day.

Signature Bank in New York City specialized in private real estate, private equity, and cryptocurrency, and had been under investigation by the justice department for its failure to recognize the unlawful activities of FTX, the cryptocurrency exchange. They were placed in FDIC receivership 48 hours after the failure of SVB.

A Stupidity Crisis

This is not the stuff of a banking crisis, rather a stupidity crisis in my opinion. No one except the regulators investigating Signature Bank and the people running the banks themselves had any idea things were going bad at these banks.

In February, Forbes published their 14th annual list of America’s Best Banks. That list ranks the top 100 banks in the country by several criteria, including total assets, return on equity, non-performing assets percentage, and revenue growth. Shockingly, or perhaps not, all three of the banks that failed the next month were on that list. What that means for the rest of the banks on that list, I don’t know. However, bad actors hide their bad actions, no matter what the industry. So, let’s just hope the other 97% are above board.

What Could Lead to a Real U.S. Banking Crisis?

Assuming that most banks are abiding by the rules, and I think that’s a safe assumption, what could trigger a real banking crisis? There are several things.

Remember, banks make their money by making loans on commercial real estate, private real estate, revolving loans, student loans, and vehicle loans, just to name a few.

How the Commercial Real Estate Landscape Has Changed

Commercial real estate can make up 25-33% of a bank’s loan portfolio. That’s especially the case regional banks, which have a more difficult time balancing their loan portfolios. In 2020, the commercial real estate landscape changed, perhaps permanently.

Working in a physical office has become a choice rather than a necessity for many people. Working from home has become common place. And now empty commercial buildings, many having never been occupied after completion, dot the landscape. Someone holds the debt used to build those buildings.

So, what if they can’t sell it to a new owner? What if the bank needs to write off that debt? What if a lot of banks have the same issue at the same time? And what if having to write off that debt causes the banks to simultaneously report losses to their shareholders and depositors, who make the decision to sell the bank’s stock and withdraw their money from the bank in a short window of time? THAT would look a lot like a real banking crisis. And, in my opinion, it maybe the biggest risk that the banking sector faces.

The Root Issues in Residential Real Estate

Residential real estate may be another area where banks could find themselves in a bit of a pickle. Home values have skyrocketed since 2020 and some banks have unfortunately made a lot of the same types of silly mortgage loans they made in the lead up to the last housing crisis, which started in 2005 and brought on the Great Financial Crisis of 2007-2009.

Back then, I would have never thought that banks would once again be making zero down loans or worse, loaning more than the home appraised for. But they are…or at least were. When home values fall, and they will fall, those who took out a zero down or over value loan will find themselves getting calls from the bank to come up with cash since they no longer have any equity in the home or are upside down. If they can’t, they’ll face foreclosure. Then, the banks will need to sell the homes they loaned money on at a loss since they are no longer worth what they loaned. Don’t get me wrong because we’re not there yet. But that kind of a scenario would be an actual U.S. banking crisis…again.

A Rough Ride for Automobile Loans

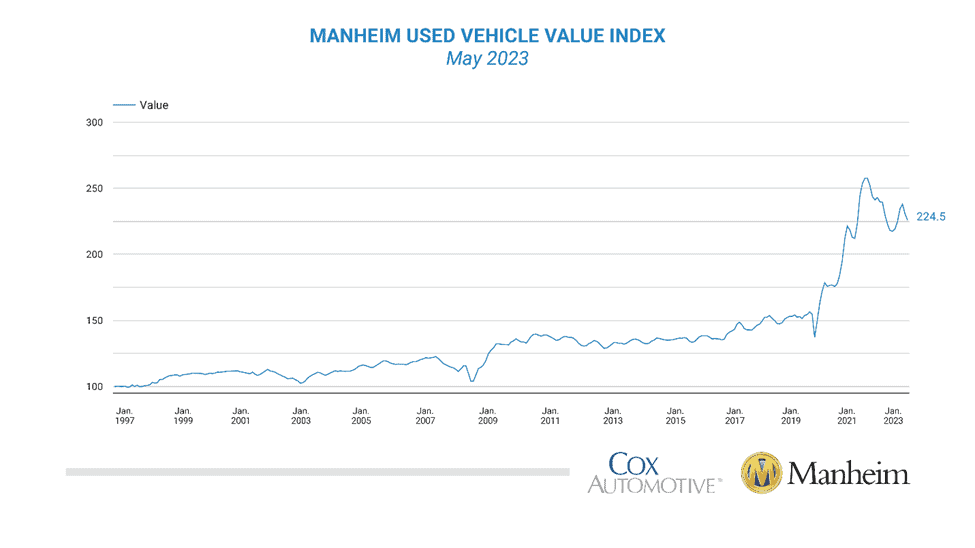

While it’s on a smaller scale, automobile loans may be in for a rough ride, which is still an issue that could put pressure on banks. Just as home prices rose in the last three years, so did the prices for used vehicles. In fact, they have risen by over 40% since 2020, as supply chain issues made finding a new vehicle difficult. Now, those prices are beginning to fall dramatically.

FIGURE 2 – May 2023 Manheim Used Vehicle Value Index – Manheim

Just as the banks made silly loans on mortgages, some were making what can only be described as subprime loans on vehicles that were severely overpriced to people with dubious abilities to repay the loans, like the vehicles were just going to keep increasing in value. Those misguided choices may well come back to bite both the lenders and the people who took out the loans. And with nearly $2 trillion in outstanding loans, that’s no small problem to deal with if repossessions and a flooded vehicle market become a contagion.

Think about it. How fast will the value of a depreciating asset like a vehicle come down from a 40% premium to its actual value, when the market is flooded with available inventory? That may be a reality in the not-too-distant future, if this video came across has any truth to it.

It’s a lengthy video, but if you’re so inclined, you might want to watch it.

I don’t want to keep beating the horse here. I just wanted to let you know that there are things in the banking sector that we’re watching which could cause problems so that you don’t think what I’m going to tell you next is too pollyannish.

The Banking Sector’s Biggest Risk

In my opinion, the biggest risk to the banking sector is the herd mentality that takes over when things like the possibility of a U.S. “banking crisis” get plastered in the news 24/7. The media were predicting a ton of money would pour out of smaller banks and into larger banks, causing the smaller banks to fail. That did not happen in any real sense thankfully.

Only about $100 billion moved in the three months following the failure of SVB. That’s a drop in the bucket of the $4 trillion in deposit accounts currently. That tells me two things. People used their heads rather than panicking and that the banking sector is healthier than the fear mongers would have you believe.

How Does the 2023 U.S. “Banking Crisis” to the Great Financial Crisis?

The attempt to equate the failures of the three banks this year with the Great Financial Crisis is quite flawed. I agree with what Mike Gitlin, who is global head of Capital Group’s fixed income, had to say on Bloomberg Television. Most banks, especially the larger banks, are in good shape at this point.

The issues have been with a few banks that, in the words of Kevin O’Leary, were under “idiot management.” In his interview with Fox Business’s Stewart Varney, he stressed the proper response to banks being managed by idiots was to let them fail. He pointed out that there are people running some of these banks that have no business being in banking. That’s true. And just like in life, it only takes a few idiots to ruin it for everybody else. It’s a good interview, so I recommend that you check it out.

Final Takeaways on the So-Called U.S. Banking Crisis

Is there a U.S. “banking crisis” right now? The short answer now is no. March certainly held the makings of one, but it didn’t materialize for the reasons that I’ve already pointed out. However, lacking the assistance of a functioning crystal ball, I can’t say for certain that there won’t be one at some point.

Just like Forbes didn’t see the three failed banks on its list because they were unaware that there were idiots at the helm of those institutions, we can’t know how many more idiot managers there are in the world of banking. We can only pray that the number is a small fraction of the total.

Continue Doing Your Own Research on Your Bank

As I said in my article in March, do your own research on your bank. Know who you are entrusting with your money. Use the information I’ve included in this article as a good place to start your research.

And Don’t Shy Away from Consulting Financial Professionals

Whether we’re in a time of crisis or not, the only way to truly know you’re OK is by having a comprehensive financial plan. It’s our goal at Modern Wealth to help people have more confidence, freedom, and time in retirement. That all starts with a financial plan. So, if you don’t have a plan or feel like your plan is lacking, let’s change that.

You can begin to see how the many components of a financial plan come together by using our industry-leading financial planning tool. There’s no cost or obligation to using it, so why wait in getting started on building your very own plan? To begin building your plan from the comfort of your own home, click the “Start Planning” button below.

And as always, our Modern Wealth team is here to answer your financial planning questions. You have the option to schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. We can meet with you in person, virtually, or by phone. I hope you have a wonderful rest of your week. And if I don’t talk to you between now and the Fourth of July, have a fun and safe Fourth!

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.