How to Calculate Your Pension in 3 Steps

Key Points – How to Calculate Your Pension in 3 Steps

- Understanding Your Pension

- Preparing for the Race

- Understanding the Reality of Investing

- Questions About Pensions

- 9 Minutes to Read

The Rare Feat of Retiring with a Pension

Pensions as an employee benefit have been on the decline,1 but they still serve as an impactful retirement income source for those that have them. According to the U.S. Bureau of Labor Statistics, only 15% of private industry workers had access to a defined benefit plan in March 2023.2 That compares to 83% back in 1980.3 So, if you’re one of the lucky ones who has that option, we want to make sure that you’re prepared to make the right decision and how to calculate your pension.

One thing that we’ve found alarming from 2023 BLS data was that only 11% of private industry workers participate in a defined benefit plan. That means that nearly one third of those who were eligible to participate in one chose not to.

Defined Benefit Plans vs. Defined Contribution Plans

Before we break down how to calculate your pension, it’s important to understand the difference between defined benefit plans and defined contribution plans. With defined benefit plans, your company is tasked with funding the plan and making sound decisions with investing the money. The responsibility is on your employer to have enough funds to give each retiree a defined benefit—a set monthly amount—for the rest of their life.

Now, let’s compare that to defined contribution plans (ex: 401(k)s, 403(b)s, 457(b)s). Your employer lets you decide you much you want to put into the plan, up to a certain amount. While many companies have the option to match your contribution, defined contribution plans have no guaranteed benefit for the rest of your life. This is why we said that the 15% of people who have the option of defined benefit plans are the lucky ones.

How Do the Olympics Relate with How to Calculate Your Pension?

In the spirit of 2024 being an Olympic year, we’re going to discuss a track and field event to help illustrate how to calculate the tradeoffs of your pension versus a lump sum option.

Sydney McLaughlin-Levrone is the world record holder in the 400-meter hurdles with a time of 51.41, which she ran at the USA Outdoor Track and Field Championships in 2022. That mark broke her own world record from the 2021 Olympics in Tokyo, when she clocked in at 51.46 seconds.

If McLaughlin-Levrone were competing in the 100-meter hurdle, she would have to overcome hurdles standing 33 inches tall. However, fortunately, the 400-meter hurdle stands at 30 inches tall, allowing the sprinter some relief in height while going four times the distance.

While three inches may not seem like a big difference, it’s a 10% increase in height. For every 10 hurdles, this would add 30 inches or, in this case, one extra hurdle!

Understanding Your Pension to Run the Race of Retirement

When we think about your pension, clearly the height of the hurdle (your pension payment) and the longer the distance (your longevity) are key to understanding the pain and pressure a lump sum decision would have to last to overcome the certainty of your pension. Let’s grab the starting blocks, as we review three steps for how to calculate your pension payments.

Step One for How to Calculate Your Pension: Get Ready!

Preparing for the Race

Hurdle rate = value of the pension payment x 12 ÷ value of the lump sum

For example, if you have a $500,000 lump sum payment versus a $2,500/month or $30,000/year pension, your hurdle rate would be 6%.

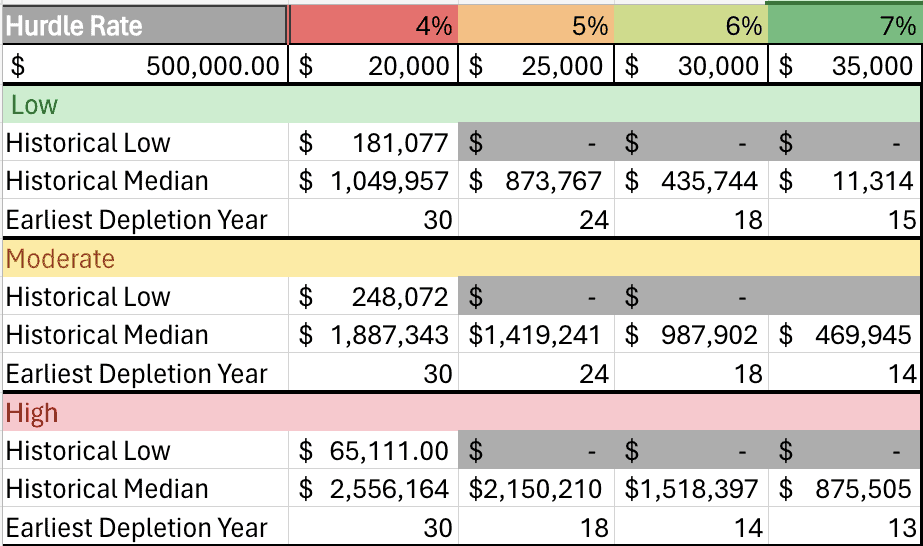

The internal rate of return you would need to generate to reproduce the same pension payments over your lifetime. Let’s define multiple hurdle rates for the same $500,000 lump sum and later identify the tradeoffs between the rates in Figure 2 below:

Next, you need to determine how much time it would take for the pension payments to break even with the lump sum and assume no return in the stock market but secured in a cash position. Unfortunately, lifespan is not in our control. It’s understandable to have reservations on life expectancy and missed opportunities by starting a pension payment.

Identifying if someone lives five, 10, 15, 20, 25, or 30 years in retirement will help you understand what we gain or lose depending on our pension election. Based on someone with a pension payment option of $20,000 (our lowest hurdle rate of 4%) versus a lump sum payment of $500,000 would have to live 25 years just to break even. Yikes!

If your retirement only lasted five years, you risk losing 80%. That’s $400,000 of what you would have as a legacy from the lump sum. Twenty years into retirement, you would have missed out on 20% of the value of the lump sum ($100,000).

Alternatively…

Now, let’s shift gears. What if your pension payment has a 7% hurdle rate at $35,000/year? You now meet the break-even point in 14.3 years, and in 30 years, you would have received $1,050,000. All without the risk of the stock market and over double the lump sum amount.

In Figure 3, below, you’ll see the four hurdle rates and the pension payment deficit or surplus versus the lump sum over multiple time horizons.

FIGURE 3

Step Two for How to Calculate Your Pension: Get Set!

Understanding the Reality of Investing

Our next step for how to calculate your pension is understanding the reality of investing the lump sum versus the pension. This analysis will take the same four hurdle rates and only use historical returns that have taken place. Let’s quickly explain the facts for this analysis.

- Time horizon: 30 years

- Number of rolling periods: 68

- A rolling period is identifying how many 30-year sequences of history can we calculate: For example, a rolling period is 1993-2023, then 1992-2022. We’ll go all the way back to 1926-1956.

- Three investment risk levels: low risk 40% stocks/60% bonds; moderate risk 60%/40%; high risk 80%/20%

- Fee: 1% (fees will vary by investment election and guidance provided)

- Effective tax rate: 20% (taxes will vary by individual or family)

- NOTE: We did not include inflation to keep this analysis apples to apples of a fixed pension payment versus a lump sum. One fact to understand this analysis does identify the pressure of your Required Minimum Distribution (RMD)—an unfortunate truth for a lump sum.

What Are the Results?

The probability of success of the lump sum covering the hurdle of pension payments over 30 years is calculated in Figure 4 below.

FIGURE 4

The 4% and 5% hurdle results are all satisfactory, surprising for a low risk and 4%, 5%, and 6% for moderate risk and high risk. And at 5%, high risk experienced 98% success. That means that only one of the 68 rolling periods failed.

The three rolling periods that failed were 1928-1958, 1929-1959, and 1930-1960. Starting your lump sum and going into the Great Depression was the only sequence of time to fall short of meeting the guarantee of the pension payment.

Raising the Bar

Moving on to a taller hurdle, low risk moves to caution at 6% and into a hazard (very low confidence) at 7%. Moderate risk and high risk remain satisfactory through 6% and move to warning and caution at 7%. Concluding once our hurdle rate crosses 6%, you need to know confidence begins to drop, and your tolerance of investment risk is a major factor.

Risk-averse investors need to be aware that the taller the hurdle, the more risk you may need. That is what we define as risk capacity, not risk tolerance.

The Fear of Running Out of Money

Once again, the results show in Figure 4 may appear to be favoring the lump sum and even taking on more risk, but let’s not lose sight of the earliest depletion years. The 7% hurdle rate with a high-risk portfolio has the caution flag for a reason.

While high risk outperformed the pension payments 85% of the time, high risk also experienced a rolling period with the earliest depletion year of 13 years. That means you ran out of money in Year 13, leaving nothing for the remaining 17 years of your 30-year retirement.

That’s the fear you face when the lump sum is up against a high hurdle rate and taking on a high level of investment risk combined with market uncertainty.

Now, let’s review the 4% hurdle below in Figure 5. All risk levels are satisfactory with a 100% success. We want you to be aware of your potential loss of legacy going forward with pension payments.

FIGURE 5

The historical low is the worst 30-year rolling period experienced at each risk level. Out of the 68 rolling periods, the number one losing period that experienced the worst 30-year sequence of return still had $181,077 left at the low-risk investor. The moderate-risk investor and high-risk investor had $248,072 and $65,111, respectively.

The historical median—the average rolling period—for the low-risk investor ended with $1,049,957. Meanwhile, the moderate-risk investor ended with $1,887,343, and the high-risk investor ended with an incredible $2,556,164.

Not only did you cover the pension, but you also left a strong legacy. The fields left blank in Figure 5 identifies their historical low. That means you ran out of money in those worst-case sequences.

Step Three for How to Calculate Your Pension: Go!

It’s Implementation Time

Implementation is the third step for how to calculate your pension. But unfortunately, we must come to a hard Forrest Gump-style stop. Determining the best pension option goes well beyond identifying a hurdle rate and understanding historical probabilities.

Ben Franklin said, “In this world, nothing is certain except death and taxes.” A close third for your retirement plan is inflation. What happens to your historical probability of success when you include a 3.5% inflation factor? CPI for March 2024 coincidentally came in at 3.48%.4 Let’s look below at Figure 6.

FIGURE 6

Confidence goes out the door starting at 5% for low-risk investors and concern across all risk levels starts at 6%.

Questions About Pensions

Step three for how to calculate your pension covers questions such as:

- Is my pension solvent?

- What are my survivorship options or term options?

- Do I have a cost-of-living adjustment, better known as COLA, to keep up with the inflation?

And planning questions such as:

- How does inflation impact my decision?

- How should I build this income into my tax strategy?

- Does this impact my Social Security timing decision?

- Assuming your pension doesn’t reduce or remove your Social Security options, could the lump sum make my Medicare more expensive.

- How does this impact the future of my RMDs?

- Will my taxes go up because of it?

- And on and on

Gaining More Confidence, Freedom, and Time

I also want to break this down to how to garner more confidence to make the right decisions with your money, freedom from financial stress, and time to spend doing the things you love.

For all you spenders, taking that lump sum may stand out as a green light. Keep in mind the high probabilities are based on a disciplined withdrawal strategy. You would have to avoid big purchases and buyer’s remorse. Remember, a spending discipline is naturally built into your pension. You can spend every cent of your pension without concern. This may help you.

This also holds true for those that tend to protect their assets. Statistically, you are not spending your assets or creating the memories you worked so hard for to get to retirement. Pension payments coming in every month allow you to spend this income freely, knowing you will not outlive your pension or worry about the success or failure of the stock market.

Individuals committed to family legacy need to understand the potential loss of legacy if pension payments are selected.

Do the Analysis

The hurdle rate analysis is critical to gain clarity on the value of your pension versus the lump sum option. Unfortunately, there is not a universal truth. Whether you live 10 or 30 years in retirement, pension payments can eliminate the worry of running out of money.

Of course, if you take the lump sum, you have the potential for growth, enhanced cash flows, and the likelihood of leaving a legacy. Hurdle rates also help with annuity options and even rental income versus selling a home or property. We need a few more facts for the calculation but it’s the same concept.

The way you build confidence in this decision is by designing a complete financial plan around your priorities. With proper guidance from a financial planning team, you can gain control over these difficult financial decisions and understand how to calculate your pension. If you have any questions about these three steps for how to calculate your pension or about how your pension can support you throughout retirement, start a conversation with our team below.

Coming Full Circle with How to Calculate Your Pension

As this article about how to calculate your pension reaches the finish line, let’s bring it full circle. Think about McLaughlin-Levrone again for a second. She’s a world-class athlete, but she doesn’t do it all on her own. She has a coach, agent, personal trainer, and several other professionals who help her to be the best women’s 400-meter hurdler in the world.

Training for the long race to get to and through retirement is no different. It requires a team of professionals—CFP® Professional, CPAs, CFAs, estate planning specialists, and risk management specialists—to help give you the highest probability of success throughout retirement. A pension can help give you a leg up on other retirees, but again, it’s just one potential component of your retirement. Our team is ready to work for you as you approach and go through retirement—helping you gain more confidence, freedom, and time.

Resources Mentioned in This Article

- Pension Plans: Defined Benefit Plans vs. Defined Contribution Plans

- 2024 401(k) and IRA Contribution Limits

- RMD Questions: What Are Required Minimum Distributions?

- 5 Factors More Important Than Rate of Return

- Longevity Risk in Retirement and How to Plan for It

- Market Sentiment and Inflation’s Impact with David Mitchell

- Family Financial Planning with Matt Kasper, CFP®, AIF®

- 10 Ways to Fight Inflation in Retirement

- What Is a Monte Carlo Simulation?

- Social Security Administration Announces 3.2% COLA Increase for 2024

- What Is Tax Planning?

- Retiring Before 62: What You Need to Consider

- Health Care Costs During Retirement

- RMD Strategies Before and After Retirement

- 2024 Tax Brackets: IRS Makes Inflation Adjustments

- 5 Long-Term Strategies for a Better Retirement

- Making BIG Purchases in Retirement

- Setting up a Spending Plan for Retirement

- Reasons People Run Out of Retirement Money

- Retirement Cash Flow: What You Need to Know

- Components of a Complete Financial Plan with Logan DeGraeve, CFP®, AIF®

- Why You Need a Financial Planning Team with Jason Gordo

- Starting the Retirement Planning Process

Downloads

Other Sources

[1] https://www.ssa.gov/policy/docs/ssb/v69n3/v69n3p1.html#

[2] https://www.bls.gov/spotlight/2024/celebrating-50-years-of-protected-retirement-plans/

[3] https://www.forbes.com/advisor/retirement/what-is-a-defined-benefit-plan/

[4] https://www.bls.gov/news.release/cpi.nr0.htm

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.