Your First Year of Retirement: Here Are 4 Things You Can Expect

Key Points – Your First Year of Retirement: Here Are 4 Things You Can Expect

- What Retirees Can Expect in Their First Year of Retirement

- How Retirement Can Be Emotional

- Financial Consideration as You Venture into Retirement

- 13 Minutes to Read | 24 Minutes to Watch

The Year We’ve All Been Waiting for

Have you worked and worked and worked for so many while saving for retirement? Well, saving for retirement is only one component of retirement planning. You need to build a forward-looking financial plan that includes quite a few things that an ordinary retirement calculator won’t account for. Without a financial plan, you won’t have the clarity to know that you have enough money to get to and through retirement and achieve your retirement goals in the process.

Have you thought about your retirement goals? So many people get caught up in trying to save as much as possible and haven’t thought about what they want their retirement to look like. Your retirement goals are obviously part of what will make your plan unique. But there are several things that many people will experience in retirement that we want to prepare you for. Modern Wealth Management Managing Directors Dean Barber and Ken Osiwala are going to review four things that you can expect in your first year in retirement to help you in your retirement planning process.

Dean and Ken Have Helped Hundreds of People Plan for Their First Year of Retirement

Dean began his career in 1987 and Ken followed suit not too long after that in 1990. During their respective 30-plus year careers, they’ve witnessed and helped hundreds of people transition into retirement. There is a lot of planning that goes into that so that people won’t be blindsided by something in their first year of retirement or soon after. Let’s dive give a quick rundown of the four things that they want you to be aware of during your first year of retirement before they further explain each one.

The 4 Things You Can Expect in Your First Year of Retirement

- Retirement Won’t Feel Like Vacation, but Every Day Is a Saturday

- It’s Going to Be Emotional, Both Good and Bad

- Your Spending May Be Surprising without a Budget, But Shouldn’t Live Like You’re Broke

- You’ll Be Anxious without a Plan; With a Plan You’ll Have Confidence, Freedom, and Time

1. Retirement Won’t Feel Like Vacation, but Every Day Is a Saturday

Dean actually envisions that every day will feel like a Friday night in retirement, but hopefully you get the point. As Ken has been helping people plan for their first year of retirement and beyond, most of his clients have looked back on their working years and found it hard to believe that they had time to do much else. Part of the reason for that is because of how busy they suddenly get with things that they’ve been wanting to do instead of working.

Your first six months of retirement may feel like a vacation because everything feels so new to you and there’s a lot of excitement. But then you’re going to start realizing what hobbies and other things that you really want to do in retirement.

“In that first year of retirement, I see a lot of people step back and say, ‘What do I really want to do?’ Some people have their hobbies already lined out. They know exactly what they’re going to do. But for a lot of people that spend all their time working, they need to find that hobby.” – Dean Barber

What Do You and Your Spouse Want to Do in Retirement?

At Modern Wealth Management, one of the greatest attributes of our Guided Retirement System is a prioritization exercise that our CFP® Professionals will take people through. We need to find out what’s important to you before we can really start building out your financial plan. So, it’s our goal to find out what you and your spouse want to do in retirement well before your first year of retirement.

A perfect example would be when one of our CFP® Professionals talks to a couple and one spouse looks at the other and says, “I never knew you wanted to do that.” It’s because they never had a conversation about what they really wanted to do.

“About a year or two ago, I was sitting down with a client and his wife. She said that she wanted to go back and learn how to play the violin again. She used to play it when she was a child and wanted to play it in church and so on. The husband didn’t even know that his wife’s little dream existed. That was something that she wanted to put down on their list of things that she wanted to get done.” – Ken Osiwala

A Vacation During the First Year of Retirement Isn’t Really a Vacation, It’s Life

There’s another reason why Dean said that retirement won’t feel like a vacation during your first year of retirement (or afterward). That’s because it’s a permanent vacation. You don’t need to go back to work afterward. Let’s say that you’re still working and you take a two-week vacation. It can take you two to three days to unwind from that. And even two to three days before you go back to work, your mind can start racing with all the things you need to do when you get back.

But in that first year of retirement, you don’t need to worry about going back to work. You don’t need to be in a hurry to get back. The emotional feeling that comes into play is figuring out your next trip or what you’re going to do next in retirement.

“I just had a conversation with one of my clients in Michigan who has a second home in Florida. He and his spouse drive down there for the winter. If they take three, four, or five days to drive down there and they have all these different stops as part of their as part of their trip. They’re just not trying to get there as soon as possible like they were when they were working and only had so much time off. They take four or five days just to hang out and do their thing.” – Ken Osiwala

2. It’s Going to Be Emotional, Both Good and Bad

That brings us to No. 2 on our list of things that you can expect during your first year of retirement. The first year of your retirement is going to be emotional, both good and bad. Whenever people head into retirement, they oftentimes need to rediscover their identity.

When you’re working, how do you answer when someone asks you to tell them about yourself. You’ll probably say a few things about your family and things like that, but so many people are so entrenched in their career that their career is what defines them. Is that the case for you? Hopefully, that isn’t the case. But in that first year of retirement, your career is no longer your identity. You need to find out what’s important to you again. That can be emotional.

Overcoming the Loneliness One Can Feel in Retirement

Think about this. During your career, let’s say that you get up at 6 a.m. every day and have been doing so for 30-40 years. In your first year of retirement, chances are that you’re still going to get up at 6 a.m. or very close to it even if you try to sleep in. What’s life going to look like for the rest of the day once you don’t have to go to work?

“There’s another emotion that comes in that first year of retirement and it’s loneliness. At work, you had the camaraderie of all your teammates and fellow employees and maybe had a lot of things in common and things to do with them. When you exit the workforce, you start to slowly lose touch with those individuals and those friendships fade. So, it’s important that you have something to engage yourself in where there are other people. Whether it’s activities or groups, your church, a charity, or something like that, getting involved in something like that in that first year of retirement can really help with that loneliness factor.” – Dean Barber

We don’t need to look back that long ago to 2020 (and 2021 for some people) where COVID put everyone in that scenario. Some people might have thought that working from home every day was great at the onset of the pandemic, but a lot of people started to miss the in-person interaction with their coworkers. Make sure that you don’t find yourself in a similar lonely situation by having things to do and people to spend time with in your first year of retirement.

Spending Time with the People You Really Care About

Speaking of which, who are those people that you really care about and how can you spend time with them in your first year of retirement? You have a lot more time that you can spend with your family if they’re local. And if they’re not local, you still have more time to plan a trip to see them.

“You can take a trip and go to the city where your children and grandchildren live. You can do the things you want to do in that first year of retirement and spend time with them at the same time. It’s not like you need to move in with them or stay at their house for several days. You can start to be present for your grandkids’ activities. I hear people talk more about family time being what they really want to get out of that first year of retirement and that it feels good to have the time to spend with the people they care about.” – Dean Barber

Getting Reacquainted with Your Spouse

As we mentioned earlier, our prioritization exercise is designed to find out the most important things to you AND your spouse. During your working years, you spend a large portion of your day at work rather than when your spouse. That changes when you and your spouse are retired.

There may be an adjustment period. It may be something that you’ve been looking forward to spending with spending all this time with your spouse. But it may be that your spouse and you are saying, “How are we going to do this?” You need to have that conversation. That’s especially true if one spouse has been a stay-at-home spouse and the other wasn’t.

“Three or four years ago, I went through a tough and stressful week. I went home and told my wife that I was thinking about retirement. She looked at me and said, ‘Don’t even think about it. You will ruin my life.’ She’s the type of person who can sit around, read a book, listen to a podcast, fiddle with her plants, and all those other different things. I’m the type of person who needs to be on the go. I need to have something to do. You really need to understand that. There could be some relationship successes or there could also be some relationship stress.” – Dean Barber

All in the Family

The same thing can apply with your kids and grandkids because you very well might be spending more time with them. Sometimes it’s not always perfect like a lot of people think.

“Sometimes I get into some conversations with clients and it’s not exactly the way that they thought it would be with seeing their kids/grandkids more often and their kids/grandkids don’t necessarily have the time. Maybe they were more active than they thought they would be.” – Ken Osiwala

3. Your Spending May Be Surprising without a Budget, But Shouldn’t Live Like You’re Broke

Let’s move on to the third thing that you can expect in the first year of retirement. Your spending may surprise you without a budget, but it shouldn’t cause you to live like you’re broke. This is the money part. We always talk about how money in and of itself is never the goal. Money is how you pay for the things that you want to do.

During your working life, you really can have clarity on the income that’s coming in. You know how much is being withheld for your 401(k), You know how much your health insurance is. And you know how much is going to be deposited after taxes. All that is taken care of. You know your monthly deposits into my checking account and what you’re allowed to spend.

But when you get into retirement, it all gets kind of fuzzy, if you don’t have a budget. You could wind up either overspending or—just as bad— you could underspend because you don’t know what a safe dollar amount is for you to spend.

“I think it depends upon what type of person you are, too. I’ve learned that some people just get it. They understand what their spending is going to be like after retirement and they’ve worked for it. And then there are other people that don’t.” – Ken Osiwala

Setting Up a Spending Plan for Retirement

If you’re one of those people that can never save enough money, you might struggle more with retirement than the person who is a little bit more carefree in life. When that type of person moves into retirement, they can struggle with it a little bit more, especially if they don’t have a spending plan. They’re so worried about it because all they’ve ever been doing is accumulating more and more assets to be successful.

But suddenly like a light switch goes on and off and they’re not accumulating. They’re in the distribution phase where it’s time to start using what they’ve saved. That’s a huge psychological shift.

“I always say that in retirement, you save by not spending everything that your money makes. That’s how you save in retirement. It’s not like your right pocket is producing the income and you take all the income out of your right pocket and whatever you don’t spend, you put it in your left pocket. You don’t have to do that anymore. It’s all about making sure that you’re not spending more than what your money makes. And there could be tradeoffs. Those tradeoffs should be discussed prior to retirement.” – Dean Barber

Confidence, Freedom, and Time in Retirement

A lot of times in that first year of retirement, people are really excited about traveling. Maybe they’ve budgeted in $10,000, $15,000, $20,000 each year for travel for the first 15 years of their retirement. After that, they might not have the health or energy to do the type of traveling that they want to do in those early years.

“When you’re about spending another $10,000-$20,000 for travel, you might be asking yourself, can we really do that? I see people go on these trips and they try to do things cheap when they don’t need to. If you’ve built it into your overall plan, it’ll give you that confidence and freedom to enjoy the time that you have.” – Dean Barber

If you think about it, you traded your life to get what you have. Your life is the most valuable thing you have, so you traded life to accumulate assets so you can go out and spend them and use them and enjoy and enhance your life into retirement.

“I always think about it this way. You spent your entire life working for money. Now it’s time for your money to work for you. It’s a different mindset. That first year of retirement is difficult for people to develop the mindset of not working for your money anymore. Your money is working for you.” – Dean Barber

4. You’ll Be Anxious without a Plan; With a Plan You’ll Have Confidence, Freedom, and Time

That brings us to our fourth thing to expect in the first year of retirement. You’ll be anxious without a plan. But like we just mentioned, you’ll have confidence, freedom, and time in retirement if you do have a plan. Your plan is really a permission slip that allows you to do the things that you want to do in retirement.

You Can’t Set It and Forget It with Your Financial Plan

Your financial plan is an ongoing process. You don’t just build it and then you’re done. You need to update it as your life and the world changes.

“Your plan should act like a GPS. It’s always making sure that you’re on track because we’re going to have other incidents like COVID. We’re going to have a recession at some point. We’re going to have a rising interest rate environment again and a bad stock market. And we’re going to have unrest in the political and geopolitical environments. All these things are going to change. Without a plan, all these things can come flying at you and can cause you to panic. They can cause you to live like you’re broke when you’re really not.” – Dean Barber

Going Back to the GPS Example

The only way to unwind that possible anxiety would be to stress test some of those things and scenarios. If a health care issue happened, are you going to be OK? Do you know where you would get an extra $6,000 from if you have a dental procedure or something along those lines? Sometimes, people just won’t know that the financial plan can handle that and that it’s OK.

“Again, it’s like a financial GPS system. You don’t know that there’s an accident down the road when you’re on your way down to Florida from Michigan. But if you have a GPS, it’s going to tell you to get off. Well, you didn’t know you were going to have a tooth problem either and didn’t know it was going to be a $6,000 curveball thrown at you. You know what? That shouldn’t derail your retirement.” – Ken Osiwala

A financial plan will account for those types of things can. That’s where a CFP® Professional that’s working with a team of CPAs and other professionals—like estate and insurance specialists—can guide you to and through retirement. That’s how we operate at Modern Wealth Management. We want to build you a plan that gives you confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things that you love.

A Couple More Things to Expect in Your First Year of Retirement

There are a couple more things that we want to share really quick about your first year of retirement. You need to understand that taxes are different in retirement and that different types of income are taxed in different ways. Oftentimes, they don’t play nice together.

Social Security is going to be taxed different than your pension. Your IRA distributions are going to be taxed different than your dividends on equities or fixed income. They’re going to be taxed different than the interest on your checking account or your savings account.

“All these different things and the different sources of income that a person has have different ways that they are taxed. Some can cause others to be taxed at a higher rate. If you don’t have a plan that includes a CPA that’s working with the CFP® Professional to really dial in where should you be spending your money from, that’s where the anxiousness comes in. Sometimes, people will live blissfully ignorant of the fact that they can control their taxes in retirement. They wind up overpaying their taxes because they just didn’t understand that they can control taxes in retirement unlike any other time during their lifetime.” – Dean Barber

Building a Plan That Gives You Confidence, Freedom, and Time

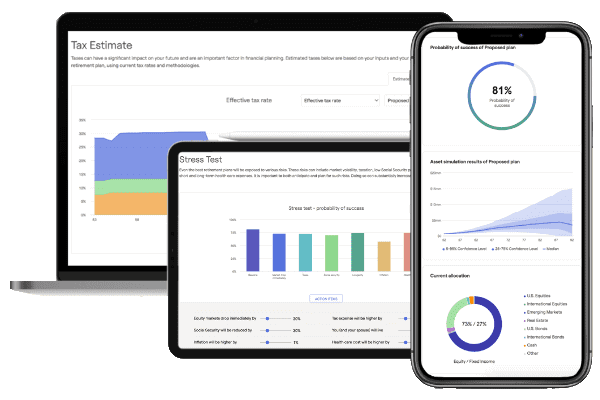

Dean and Ken could keep rattling off a few more things to expect in your first year of retirement, but what they shared are a few of the main things that you need to keep in mind. We don’t want you to be one of the people who is anxious because you don’t have a financial plan. That’s why we’re letting you use our industry-leading financial planning tool at no cost or obligation so you can build a plan that gives you confidence, freedom, and time in your first year of retirement and beyond. It’s the same tool that our CFP® Professionals use with our clients. You can use it from the comfort of your own home by clicking the “Start Planning” button below.

Getting to and Through Retirement

One of the most difficult aspects of retirement planning is knowing where to start. That’s a big reason why we’re welcoming you to schedule a meeting with one of our CFP® Professionals to ask any questions that you may have about retirement. By clicking the “See Our Schedule” button below, you can meet with us for in person, virtually, or by phone for a 20-minute “ask anything” session or complimentary consultation.

So, we’ll ask the question again. Have you worked and worked and worked for so many while saving for retirement? It’s critical to understand that your money starts working for you in retirement. Make sure that you have a financial plan that takes you to and through retirement. A financial plan can make a world of difference for you, especially in the first year of retirement.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.