Are We in a Recession?

Key Points – Are We in a Recession?

- Some Economists Are Already Saying We Are in a Recession

- What Are Some of the Indicators of a Recession?

- Taking Risk Off During This Bear Market

- Is This a Cyclical or Secular Bear Market?

- Looking Back at the Last Three Years of Bond Performances

- 6 Minutes to Read | 10 Minutes to Watch

The Question of the Day: Are We in a Recession?

We’re officially in a bear market. June has been horrific across the board. Dean Barber shares what’s going on with interest rates, how that’s impacting bonds, and asks the burning question, “Are we in a recession?” in June’s Monthly Economic Update.

Some Economists Are Saying We Are in a Recession, but It’s Hard to Tell Right Now

Boy, has it been a crazy ride in June. As I record this, it is June the 29. We have major indices down across the board. We have many people asking, “Are We in Recession?” A lot of people are saying that we are in a recession, but we don’t know that for sure.

I don’t necessarily think that we are in a recession but do think that there is the possibility that a recession comes in the next 12 to 18 months. I think it will be a shallow recession. But recessions are hard to predict. It’s hard to predict exactly what’s going to happen with the market.

Communication with Your Financial Advisor Is Critical Right Now

As I go through today’s Monthly Economic Update, I would encourage you to keep the lines of communication open with your financial advisor at Modern Wealth Management. If you feel like you have more risk in your portfolio than what you can tolerate, we have ways to de-risk the portfolios and reduce the volatility. We’re happy to talk to you about how we’ve done that.

June Market Performances

We’ve made a lot of changes to a lot of our portfolios. We haven’t changed every portfolio, but we have made a lot of changes. So, let’s dive right in and look at Figure 1 to see what has happened in June.

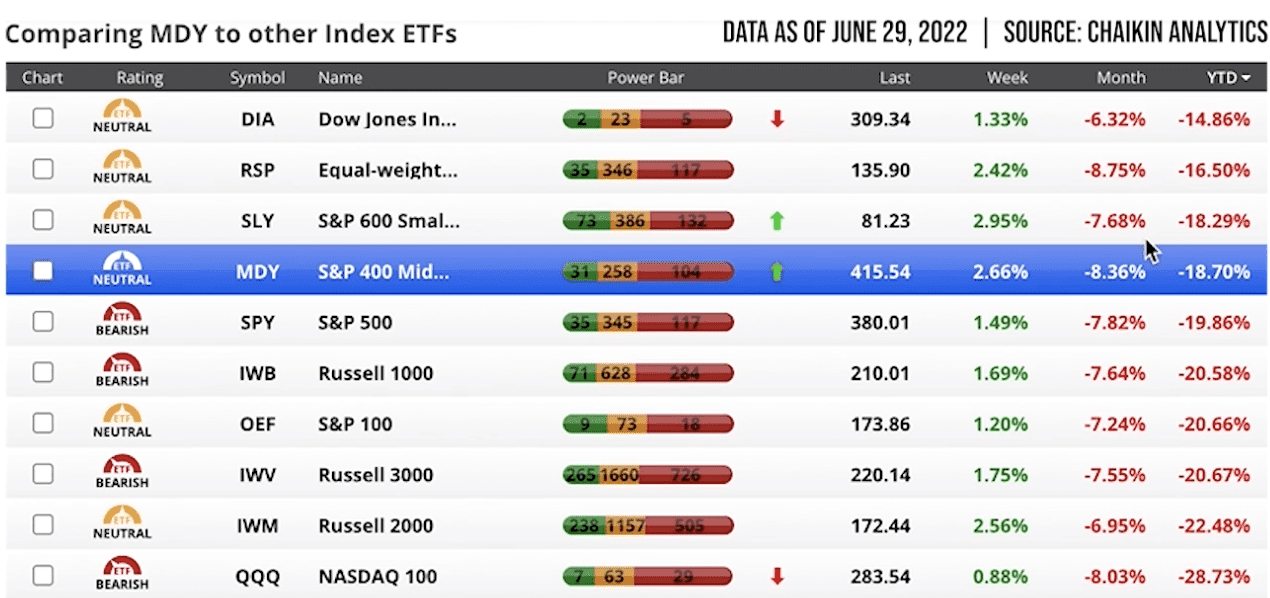

FIGURE 1 – June Market Performances – Chaikin Analytics

Just about every major index is down somewhere between 6.32% (Dow Jones Industrial Average) to 8.75% (RSP Equal-Weighted). One thing I want to point out is that the rating on all the major indices listed, four are now reading a bearish signal. The other six are reading a neutral signal.

Out of the Dow Jones Industrial Average’s 30 stocks, 23 are neutral, five are bearish, and two are bullish. If we go to the S&P 500, it has a bearish rating right now and you can see why. There are 117 of the 500 stocks in the S&P 500 that are bearish, while only 35 are bullish. The other 345 are neutral.

Year-to-Date Market Performances

Things are down across the board. Year to date, the best performing index is the Dow Jones Industrial Average. It’s down 14.86%, which is still a lot. But the Nasdaq composite is the worst of all, down -28.73%. I want to focus on the Nasdaq composite because I think it will allow me to tell the story of what we see happening in bear markets.

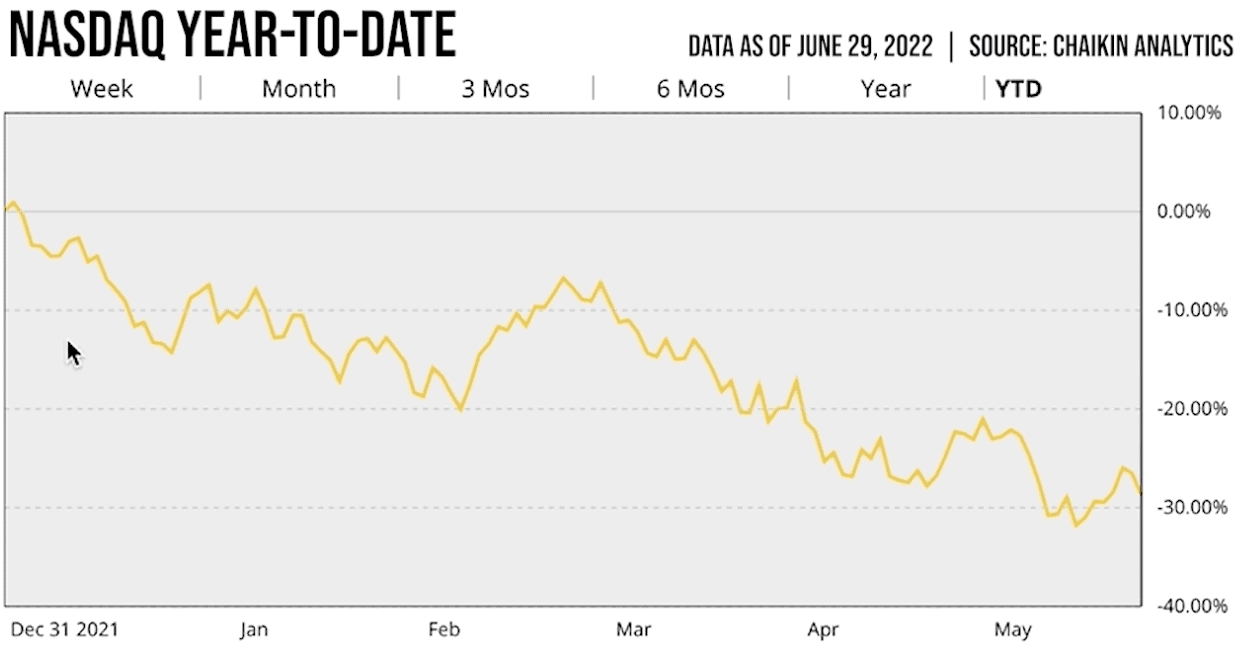

FIGURE 2 – NASDAQ Year-to-Date – Chaikin Analytics

If we look above at Figure 2, which is a year-to-date chart of the Nasdaq, it’s down 18.7%. It’s a steady downward trend, but you have these little run-ups. In early February, the Nasdaq was down a lot, but then there was a good run-up for about a month or so. Then, it started coming back down.

This is very typical of a bear market. It’s one of the clear signs. I could go through a lot of the major indices and you’d see exactly the same thing. What you typically see in a bear market is not a straight line down. It’s a very jagged line down that leads to lower lows and lower highs on the rebounds.

Are We in a Cyclical or Secular Bear Market?

The question that we need to ask ourselves is, are we in a cyclical or a secular bear market? The difference between the two is that a cyclical bear market is typically short lived, much like what we saw happen with the COVID-19 virus back in March 2020. We had a bear market that was very quick. Then, we had a bull market that roared right out of the bottom of that bear market, starting in April 2020.

A cyclical bear market will typically be 12, 15, 18 months in nature. A secular bear market would be one that lasts for years. So go back and think about from the Dot-Com Bubble all the way through the end of 2008 and into early 2009. Through that period, you could argue that we were in a long-term secular bear market with a good bull run that came from 2003 up through 2007.

So, we don’t know where we’re at right now. There are more questions than answers. Are we in a recession? Is this a secular or cyclical bear market? Bear markets are very hard to predict. But within those bear markets, there is opportunity that is created. We continue to be vigilant and look at what is happening with the overall economy in the markets.

The Federal Reserve’s Big Dilemma

The biggest problem that we believe the markets are facing today is the Federal Reserve. We’re in a position where we haven’t been since the late 1970s, early 1980s, when we had high inflation and a stagnating economy. We find ourselves in that exact same position today, a stagnating economy and high inflation.

Put an End to Inflation or Go into a Recession?

The Fed needs to make a choice. Do they act and act swiftly and kill inflation and most likely causing the economy to go into a recession? Or do they maintain an easy monetary policy, allowing inflation to roar and even put in stimulus?

I think the Fed knows, and most people know instinctively, that an easy monetary policy at this point would allow inflation to continue to run rampant. That would do far more damage to the average American than a shallow recession. Until the Fed puts an end to this inflation, people will likely keep asking, “Are we in a recession?”

I think we’ll see continued tightening from the Federal Reserve and potentially a shrinking of the money supply to tamp down inflation and get back to a more normal cycle. We are getting back to a more normal monetary policy.

Hold on Tight While the Fed Is Tightening

The interest rates on 30-year mortgages have jumped up almost double from where they were a year ago. We anticipate that that’s going to continue to rise. We started to see the increase in housing prices slow. We’ve started to see the number of existing home sales start to slow. There are signs around the globe where you’re starting to see things slow. And it’s not just here in the United States; it is around the world.

So, hold on tight as the Fed continues to do its tightening. Just remember, though, that at the end of every bear market cycle, there is a bull market on the other side. It can create an amazing opportunity for us.

Let’s Look at Bond Performances

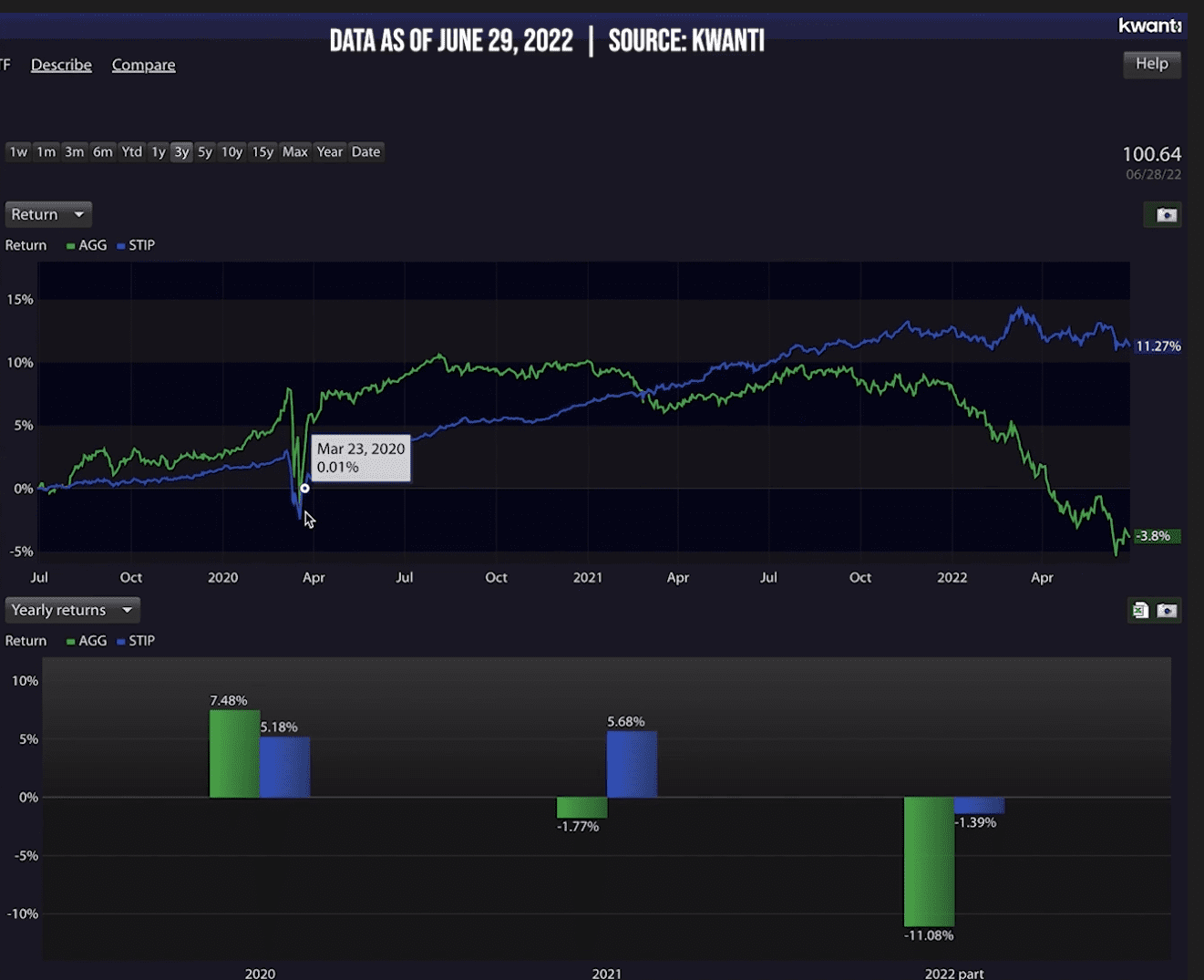

I want to switch gears now and talk just briefly about what’s going on with bonds. Figure 3, below, is a three-year chart comparing AGG to STIP.

FIGURE 3 – Bond Performances – Kwanti

AGG is the core U.S. aggregate bond ETF and STIP is the iShares zero-to-five-year TIPS, which are Treasury Inflation-Protected Securities. If we go back over the last three years, the inflation-protected treasuries lagged behind the AGG for a while there in 2020. But as we’ve come into this year, the STIP has done extremely well relative to the AGG with a total return over the last three years of 11.27%. Meanwhile, there’s a in a total return of a -3.8% over the last three years in AGG.

Something else to be aware of when we’re looking at bonds is the actual yield. The yield on STIP is up to 5.99%, while the yield on the bond AGG is still just 1.96%. In a lot of cases, we have added STIP to the portfolios to try to stabilize what’s going on in the fixed income environment.

Also, in a lot of cases, we still do have some money in the bond aggregate in case we see that Fed gets rates to a point where we really start to see the economy slow. That will allow interest rates to begin to come back down and we can get some good bang for our buck there in AGG through that.

Diversification Is Always Key …

The key on the fixed income side is to have some diversification and not have everything in the bond aggregate. This is a complicated time, something that we haven’t seen since the late 1970s and early 1980s. Myself, all the CFP® professionals, and everybody else at Modern Wealth Management are watching everything very closely. We’re making changes as needed.

… And So Is Regular Communication with Your Financial Advisor

As I stated earlier, it’s critical that you keep an open line of communication with your financial advisor. If you’ve got questions, they’re happy to do quick Zoom meetings and give you an idea of what we’re doing, how it’s looking, what we’re doing to protect, and how it overall affects your financial plan and your ability to do all the things you want to do. We care about your ability to not just get to retirement, but to get through retirement and live the life that you want to live.

If you’re not yet a client of Modern Wealth Management and you’d like to get started from the comfort of your own home, we’re going to make available the ability for you to build your own financial plan using the very same software that our CFP® professionals use here at Modern Wealth Management. Start by clicking the “Start Planning” button below.

A Safe and Happy Holiday Weekend

And with that, I hope that all of you enjoy or did enjoy your Fourth of July weekend depending on when you’re viewing this. I hope everybody has/had a safe and enjoyable time with their family. I’ll be back with you late July, early August. Thanks for watching this edition of the Monthly Economic Update.

Schedule Complimentary Consultation

Select the office you would like to meet with. We can meet in person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Lenexa Office Lee’s Summit Office North Kansas City Office

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.