Mortgage Applications Hit 22-Year Low

Key Points – Mortgage Applications Hit 22-Year Low

- It Looked Like Mortgage Applications Were on the Rise Just a Month Ago … Now Mortgage Applications Have Hit a 22-Year Low

- The Median Price of a Home Now Sits at $423,000

- More Than 20% of Listings Experience Price Drop Over Past Four Weeks

- Where Will Interest Rates on 30-Year Mortgages Go from Here?

- 3 Minutes to Read

Remember How Just a Month Ago That It Looked Like Mortgage Applications Were Back on the Rise?

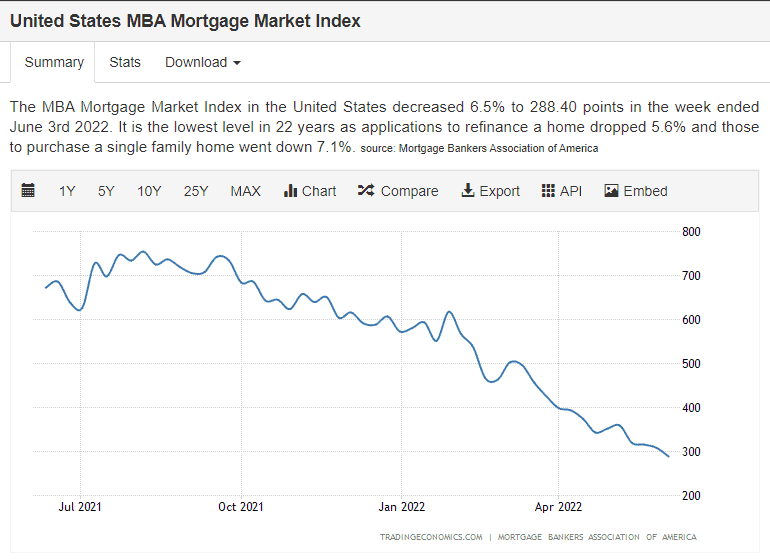

In mid-May, I wrote an article titled, When a Housing Market Shortage Becomes a Surplus. If you haven’t read it yet, I believe it’s worth your time. At the time, it appeared that mortgage purchase applications were back on the rise. However, that trend was short lived. Mortgage applications have subsequently hit a 22-year low.

It appears that the rising cost of a 30-year mortgage, along with the fact that the median price of a home is now $423,000, has begun the process of demand destruction in earnest. Buyers are walking away from deals and the supply surplus I wrote about may well be on its way.

How We Could Soon See a Shortage of Buyers and Surplus of Homes

When the 1.8 million residential units now under construction become available for sale, will there still be buyers? If the mortgage market index is any indication, there may be a huge shortage of buyers and a surplus of homes.

FIGURE 1 | United States MBA Mortgage Market Index | Mortgage Bankers Association of America

This drop in mortgage purchases is having a direct effect on the housing market, as you can see in below in Figure 2.

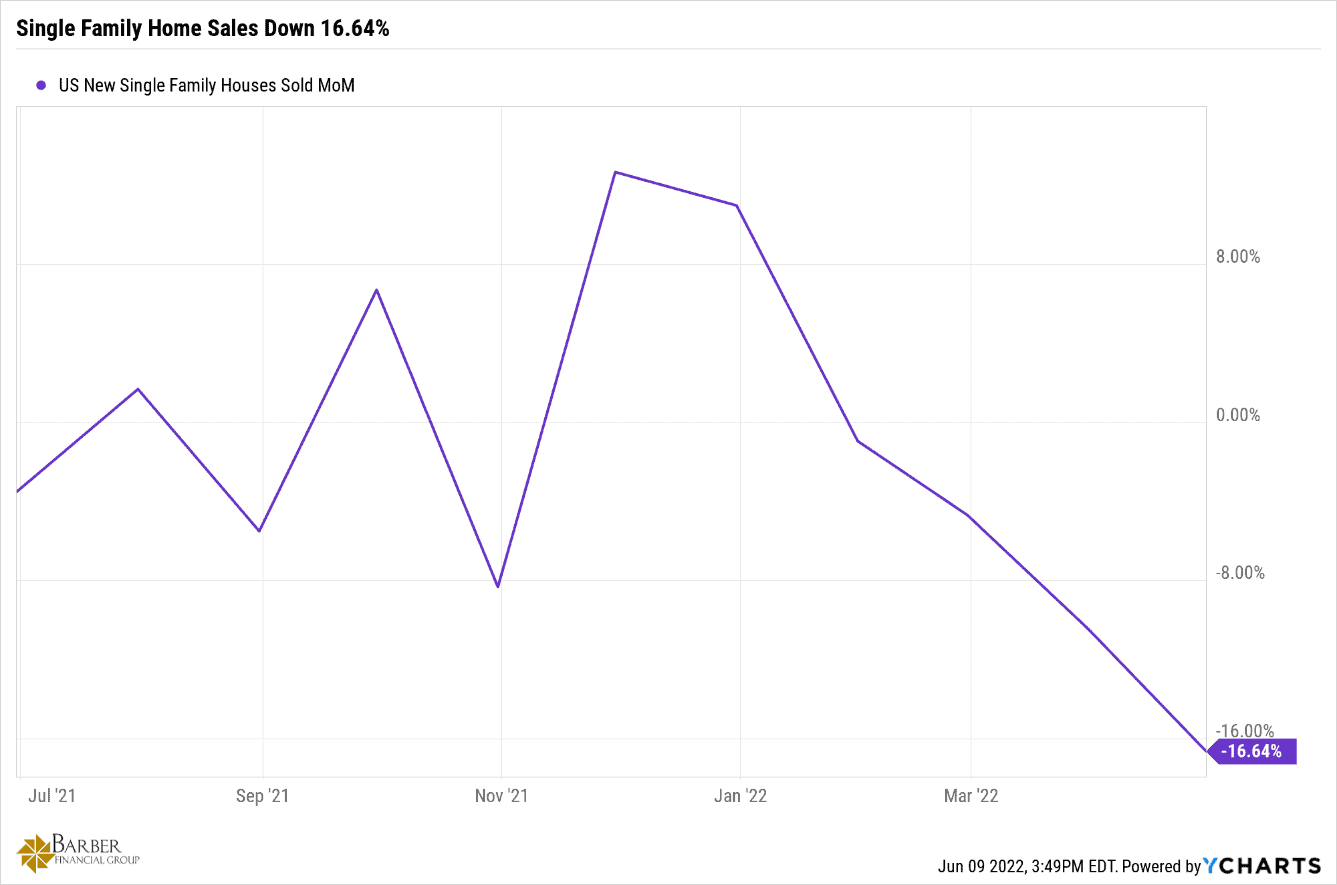

FIGURE 2 | Single Family Home Sales Down 16.64% | YCharts

Single family home sales are down 16.64%. This is unusual at the beginning of the busiest season for home buying. In fact, there were fewer sales than there were in the beginning of the pandemic in 2020.

Buyers Get Priced Out of the Housing Market

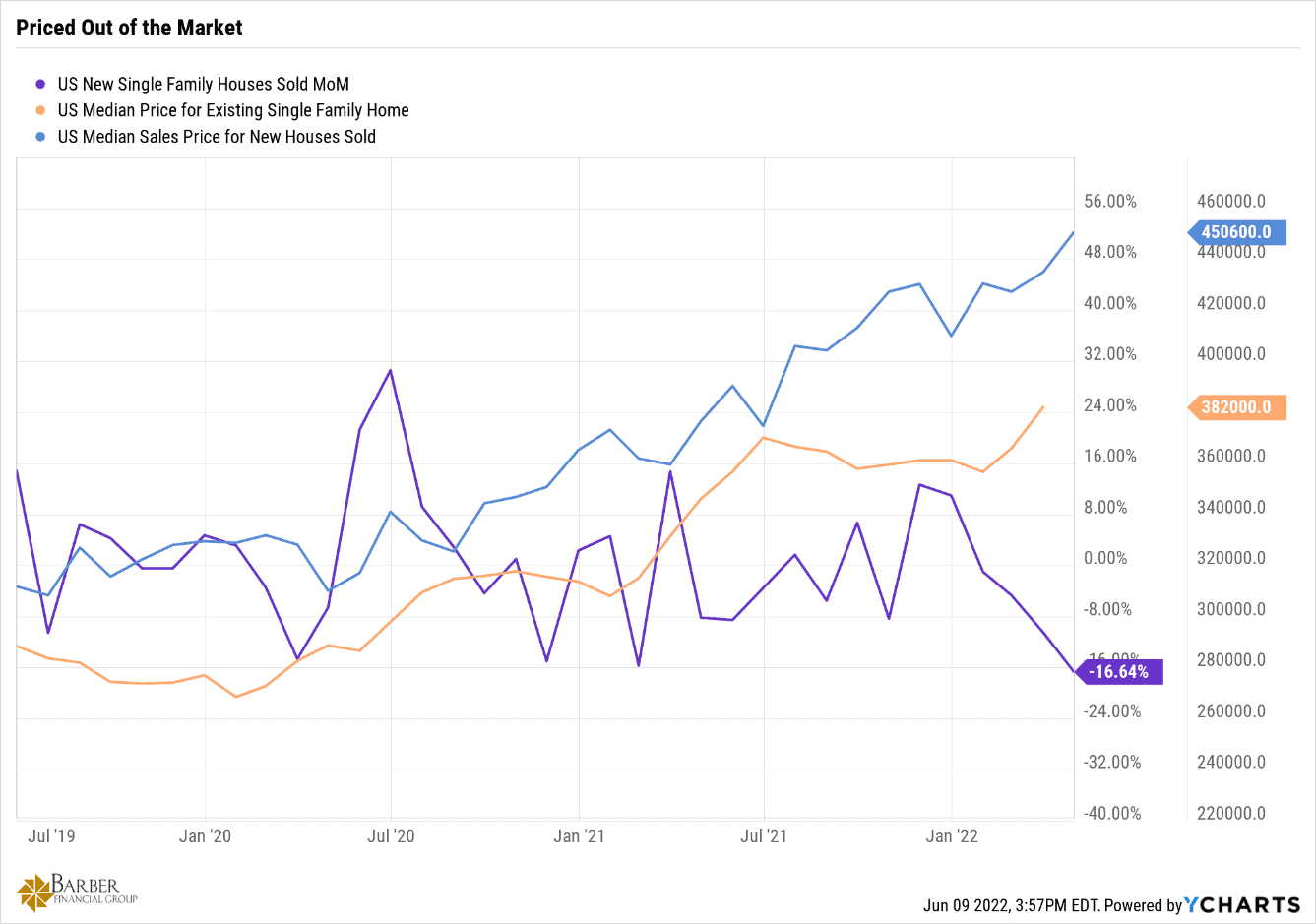

Below in Figure 3, you’ll see that skyrocketing prices are taking their toll on the housing market, as buyers are getting priced out of the market.

FIGURE 3 | Priced Out of the Market | YCharts

With interest rates on 30-year mortgages north of 5%, the average mortgage payment is now $2,428. That’s a full $1,000 higher than it was just two years ago and 42.1% higher than this time last year. That means that fewer people can afford to buy in this market, and many more are simply choosing to wait till things get better. It’s no wonder why mortgage applications hit a 22-year low.

Low Buyer Demand Leads to Sellers Lowering Asking Price

The slowdown in buyer demand is causing sellers to lower their asking price. Over the last four weeks, 21% of listings had a price drop. This trend may well build on itself as sellers lower their price to be competitive with the other houses being sold in their area who have already lowered their price. Meanwhile, the buyers sit on the sidelines and wait and see how low prices will go before jumping back in to make their purchase. Lather, rinse, repeat.

This virtuous cycle will continue until buyers are lured back into the market at a certain price point. We don’t know what the level will be, but when this bubble started inflating, the median price of a home was roughly $250,000. Today, the median price is around $423,000. So, the reentry point will more than likely be somewhere in between those two.

How the Pressure on the Housing Market Could Intensify

The other unknown is where the interest rates on 30-year mortgages go. If the economy falls into a recession during this season of interest rate hikes by the Federal Reserve, it’s almost a given that they will either stop raising rates or cut them again to restart the economy. If they don’t, the pressure on the housing market will likely intensify.

Either way, the current narrative of a shortage of homes is going to be shown to be incorrect…and sooner rather than later. If you have any questions about how we’ve reached the point of mortgage applications reaching a 22-year low and where we could go from here, you can schedule a complimentary consultation or 20-minute “ask anything” session with one of our CERTIFIED FINANCIAL PLANNER™ professionals. Whether it’s in person, virtually, or by phone, we’re happy to meet with you to get your questions answered.

Schedule Complimentary Consultation

Select the office you would like to meet with. We can meet in person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Lenexa Office Lee’s Summit Office North Kansas City Office

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.