Active Versus Passive Management

Key Points – Active Versus Passive Management

- Defining Active Management and Passive Management

- The History of the Active vs. Passive Management Debate

- The Cyclical Nature of Investing Disciplines

- 6 Minutes to Read

Defining Active vs Passive Management

Back in the 1600s, the Dutch East India Company was looking to raise capital to further global trading activity between the Dutch Republic and nations of Asia.1 They began issuing shares, available for purchase by citizens, that were then allowed to be bought and sold in secondary markets. Trading activity in these secondary markets became so prevalent that eventually the first stock market exchange was created in Amsterdam.2

Over the years, markets have evolved rapidly from these physical locations of trade to electronic exchanges that have made investing accessible to a broader audience. As the exchanges have changed, so have the strategies that investors have access to. In today’s world, investors will often encounter competing investment strategies known as “active” and “passive” investing. Let’s break down what those mean to help you understand active vs. passive management.

Schedule a Meeting Get the Retirement Plan Checklist

Active Management

Active management is when a manager uses their perceived skill, research, intuition, experience, and analysis to pick securities they believe will outperform a benchmark; usually, a market index of similar securities. Active portfolio managers must dedicate resources to monitoring company fundamentals, economic shifts, geopolitical regimes, and market trends. This requires a larger, time-intensive team effort, which often means higher expense ratios to offset internal costs. Active management is often associated with mutual fund vehicles or similar investment fund structures.

Passive Management

Passive management is when a manager attempts to create a portfolio that mirrors a market index or benchmark. Exposure to passive investing is commonly achieved via index funds. Index funds are investment vehicles that seek to replicate an underlying index, such as the S&P 500.

Passive investment managers are not seeking outperformance. They strive to deliver a product that provides market return at lower cost than active management, given that they are not leveraging additional resources for excess return. Passive management is often associated with exchange traded funds or ETFs.

More History of the Active vs Passive Management Debate

To help illustrate where the active vs. passive management debate stands today, let’s review how it’s evolved over the past 30-plus years.

The active vs. passive management debate has been with us for a long time, going back almost to the issuance of the first ETF in the U.S. in 1993.3 When they were first issued, ETFs were used almost exclusively by institutional investors to execute sophisticated trading strategies. However, it wasn’t long until financial advisors and individual investors took to them as well.

Broad acceptance came slowly, though, as it took until 2003 for the ETF market to hit $200 billion.4 2007 was the peak year for ETF creation and saw the introduction of 270 ETFs.5 Then, on December 9, 2010, 17 years after the first ETF debuted, ETFs reached their first trillion dollars in assets.6 According to Schwab’s Q3 2010 Investor Snapshot, the ETF assets that Schwab custodied at that time were growing exponentially.7 Those ETF assets had grown 14% in the previous quarter, eclipsing $100 billion.

That $1 trillion in ETFs paled in comparison to the $11.5 trillion in mutual funds in October 2010, though.8 However, Nasdaq, Inc. shared that there were “incipient signs” that ETFs were stealing market share from mutual funds, such as Blackrock purchasing iShares and Guggenheim acquiring Claymore Group.9,10 The active vs. passive management battle was officially on.

Active Versus Passive Management: The Day they Became Equal

Now, let’s fast forward a little bit with the active vs. passive management debate. In August 2019, passive assets under management (AUM) for U.S. equities grew to $4.27 trillion to overtake active AUM ($4.25 trillion) for the first time.11

Institutional Investor’s Julie Segal noted a few reasons why passive management had catch up to active management in the U.S. stock fund realm, namely that active managers were being challenged by the fee pressure of passive assets.12 She asserted that investors lost faith in the financial industry in general and in active managers’ abilities to protect them from deep market routs and that their “tastes seemed to permanently change.”

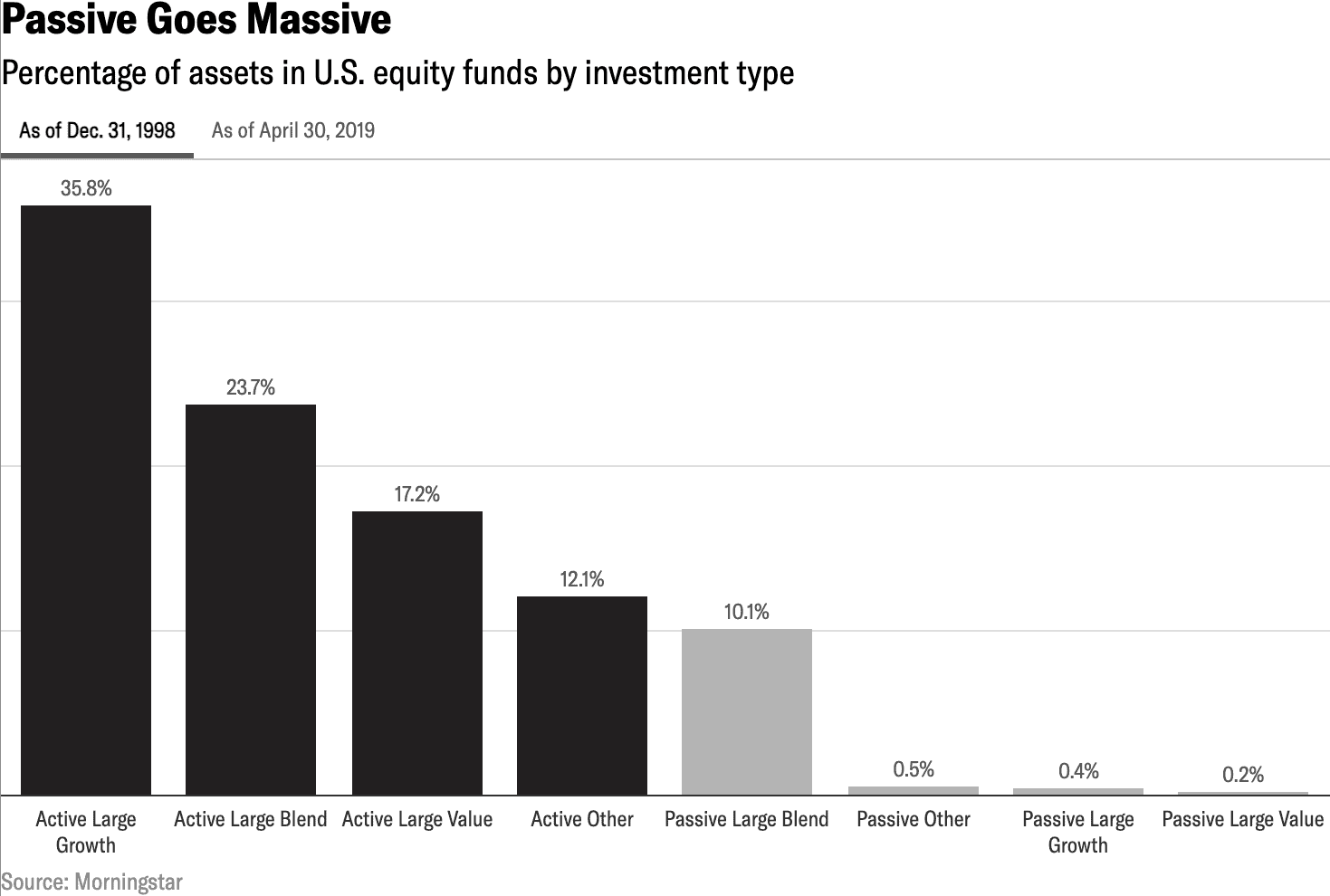

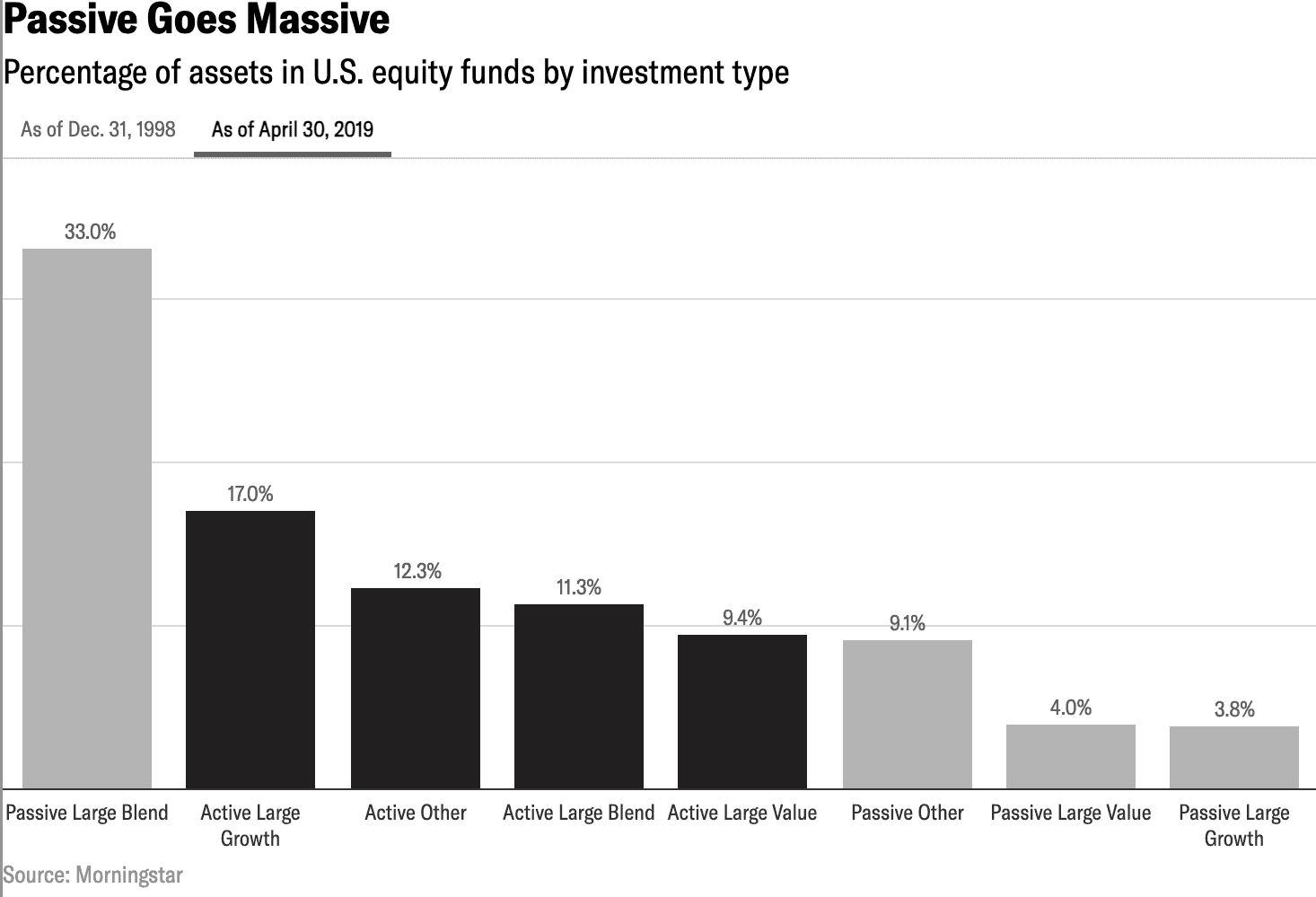

Segal’s article contained a compelling infographic (see Figures 1 and 2 below). The switch from active to passive management over the 20 years from December 31, 1998, to April 30, 2019, was clear.

FIGURE 1 – Passive Goes Massive 1998 – Morningstar/Institutional Investor

FIGURE 2 – Passive Goes Massive 2019 – Morningstar/Institutional Investor

In 1998, 35.8% of assets in U.S. equity funds were in actively managed large growth mutual funds. By 2019, that number had dwindled to 17% while passively managed ETFs accounted for 33% of all the large–blend investment assets.

Active vs. Passive Management: Cyclical Nature and Fickle Investors

In Daniel Goldman’s article, Active Investing Is Dead, Long Live Active Investing, from 2019, he notes the cyclical nature of investing disciplines and that active vs. passive management is a debate that’ll likely last longer than most think possible.13

Goldman cited a white paper published by Hartford Funds that lays out how cyclical active and passive investing can be.14 One is never king for long. The Hartford Funds white paper, which was last updated in February 2025, active management outperformed passive management nine out of 10 times from 2000-2009. But that was preceded by passive outperforming active 1994-1998. Figure 3 also shows that passive outperformed active from 2014-2024 except for 2022.

FIGURE 3 – No Clear Winner in Active vs. Passive Large-Cap Funds – Morningstar and Hartford Funds

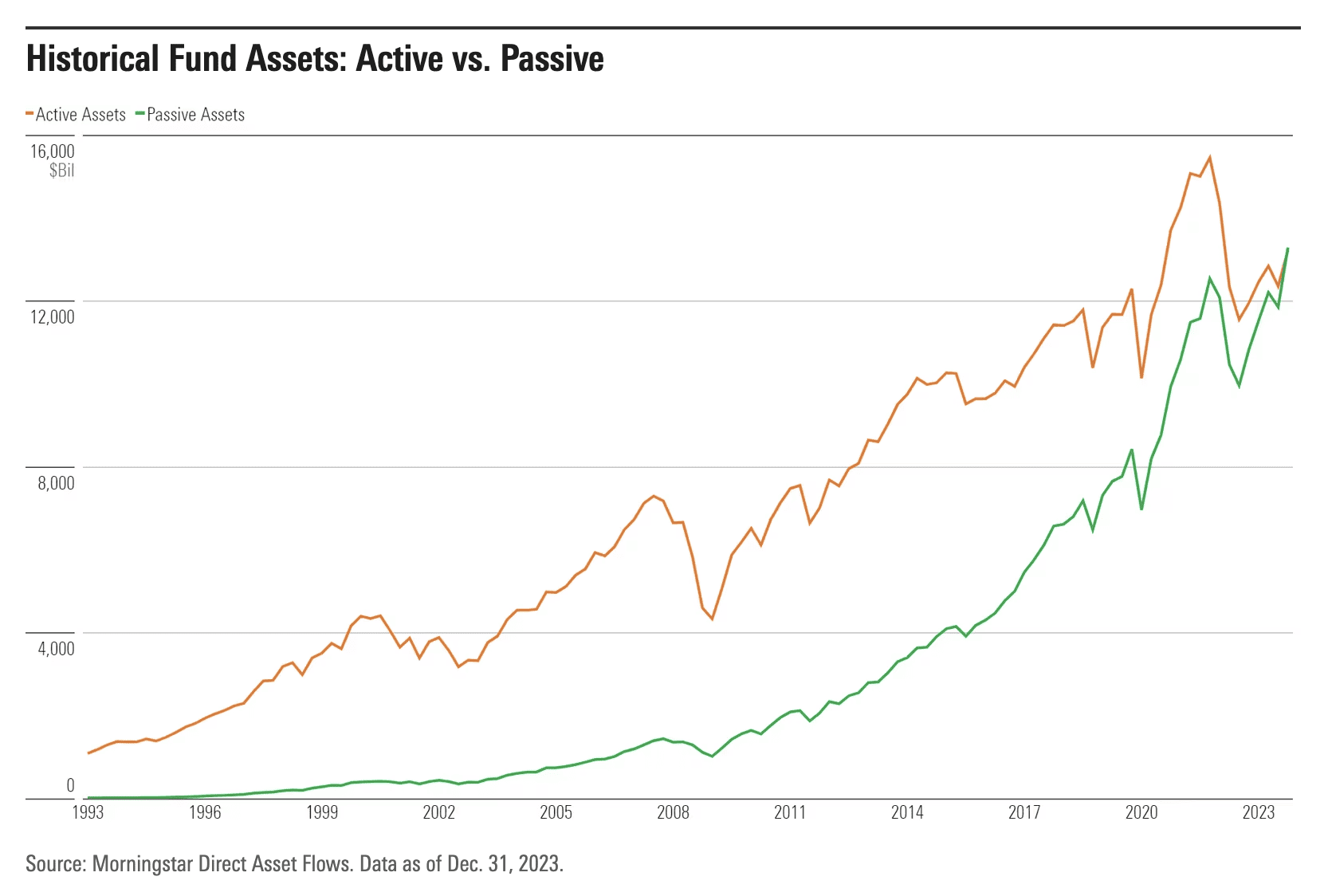

The active vs. passive management debate made a lot of headlines to begin 2024, as passive AUM for all asset classes finally edged active AUM, $13.29 trillion to $13.23 trillion at the end of 2023.15

FIGURE 4 – Historical Fund Assets: Active vs. Passive – Morningstar16

Where’s the Active vs. Passive Management Debate in 2025?

While Figures 3 and 4 may seem to illustrate that passive management has all the momentum in the active vs. passive management debate, it’s still not that simple. Look at the market volatility we’ve experienced in 2025.

Taking a passive approach may have seemed like a no-brainer on February 19, 2025, when the S&P 500 reached an all-time high, but by April 8 — one day before President Trump’s reciprocal tariffs were set to go into effect — the S&P 500 had lost about 19%.17 On April 9, Trump issued a 90-day pause on many of those reciprocal tariffs, and the S&P 500 in turn gained about 9%.

The S&P 500 essentially churned sideways over next two weeks, but not without heightened volatility, due to the uncertainty about tariffs. The markets then surged during the first half of May, as the U.S. and China struck a trade deal that significantly reduced the tariffs that each country had imposed on each other.18

2025 provides evidence that a case can be made for active management. Working with a team of dedicated professionals can help to define your financial goals, implement a plan to achieve those goals, and help determine the correct asset mix for your portfolio.

The Bottom Line with Active vs. Passive Management

Investor portfolios should be tailored solutions based on long-term financial planning. The discussion on when to include active or passive strategies will be highly dependent on an individual’s key objectives and appetite for risk. There is a time and place for incorporating both investment strategies to potentially help achieve personal financial goals. If you have any questions about what we’ve covered, start a conversation with our team below.

The active vs. passive management debate is important, but there’s so much more to financial planning than your investments. A few factors that are more important than your rate of return include risk, taxes, inflation/interest rates/economic health, time, and a life plan with retirement goals. Think of your investments as the fuel that makes your financial plan run. Each of those components, including investments, is critical to your personalized financial plan.

Our team consists of subject matter experts in investment management, tax, risk management, and estate planning. We have CFAs on our investment management team, including our Director of Investments Stephen Tuckwood, CFA, who has discussed active vs. passive management on a few of our podcasts. Tuck and our investment management team frequently collaborate with our advisors and tax team. Our team is committed to helping people gain more confidence that they’re doing the right things with their money so they can focus on spending time doing the things that they love.

Active Versus Passive Management | Watch Guide

00:00 – Introduction

00:50 – The Difference Between Active and Passive Management

02:31 – Passive Management & Fees

05:31 – Active Management and Risk

09:10 – ETFs and Mutual Funds

12:58 – Active vs. Passive in 2024

16:29 – From an Equity Perspective

22:00 – What We Learned Today

Resources Mentioned in This Article

- Proper Portfolio Construction with Stephen Tuckwood, CFA

- Can I Beat the Market?

- Why You Need a Financial Planning Team

- The S&P 500 Cap-Weighted vs. Equal-Weighted Index

- Navigating Economic Uncertainty: Special Market Update

- Assessing Market Volatility Following April 2 Tariffs

- Trump Pauses Several Reciprocal Tariffs for 90 Days

- Tariff Talk: What to Watch

- Financial Checkup Time: Review These Annual Items

- 5 Factors More Important Than Rate of Return

- 4 Retirement Risks That Are Out of Your Control

- Taxes on Retirement Income

- 10 Ways to Fight Inflation in Retirement

- The Effect of Rising Interest Rates on the Economy

- What Millionaires Do in Times of Economic Uncertainty

- Time Is Your Scarcest Resource in Retirement

- Nonfinancial Life Planning with Bruce Godke

- 5 Types of Financial Plans

- Strategic Investing Through Retirement with Stephen Tuckwood, CFA

- 7 Wealth Protection Tactics

- Your Retirement Lifestyle: What Do You Want Your Retirement to Look Like?

Other Sources

[1] https://www.worldhistory.org/Dutch_East_India_Company/

[2] https://www.worldsfirststockexchange.com/

[3] https://www.marketsmedia.com/the-story-of-the-first-us-etf/

[4] https://finance.yahoo.com/news/etf-beginners-guide-170339563.html

[5] https://www.planadviser.com/2007-a-year-of-records-for-etfs/

[6] https://www.businessinsider.com/december-etf-roundup-1-trillion-and-counting-2011-1

[7] https://www.etftrends.com/wp-content/uploads/2010/12/ETF-Investor-Snapshot-Q3-2010.pdf

[8] https://www.nasdaq.com/articles/us-etf-assets-hit-1-trillion-milestone-2010-12-15

[10] https://www.thinkadvisor.com/2010/10/01/claymore-out-guggenheim-in/

[13] https://blog.politicoid.us/active-investing-is-dead-cea296e6a71e

[14] https://www.hartfordfunds.com/dam/en/docs/pub/whitepapers/WP287.pdf

[15] https://www.cnbc.com/2024/01/18/passive-investing-rules-wall-street-now-topping-actively-managed-assets-in-stock-bond-and-other-funds.html

[16] https://www.morningstar.com/funds/recovery-us-fund-flows-was-weak-2023

[17] https://finance.yahoo.com/quote/%5EGSPC/

[18] https://www.bbc.com/news/articles/czx0ry7kdk5o

Investment advisory services offered through Modern Wealth Management, LLC, a Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management a Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.