Financial Infidelity and Its Potential Impact

Key Points – Financial Infidelity and Its Potential Impact

- Breaking Down Statistics for a 2023 Bankrate Survey on Financial Infidelity

- Forms of Financial Infidelity

- The Potential Ramifications of Lying to Your Partner About Money

- 3-Minute Read | 23-Minute Watch

What Is Financial Infidelity?

Talking about money with your significant other can sometimes be uncomfortable. If you have a fight with your partner about spending money, what actions do you take after the fight? Do you work toward getting on the same page as your partner or secretly keep spending how you’ve been spending and lie about it? If you’re doing the latter, that’s financial infidelity. Financial infidelity can have significant ramifications, especially if it goes on for a long time and the truth about your actions is uncovered.

Schedule a Meeting Get the Retirement Plan Checklist

Financial Infidelity by the Numbers

Hopefully any fights you’ve had with your significant other about money have ended up being beneficial and you’ve both avoided financial infidelity. However, there are potentially other couples that you may know who have fallen into the trap of financial infidelity. Let’s review some statistics from a December 2023 Bankrate survey to see how prevalent financial infidelity is in the United States.1 Bankrate teamed up with YouGov Plc to administer the survey. More than 2,200 U.S. adults were surveyed, and about half of them had a significant other.

According to the survey, 42% of U.S. adults say that they’ve kept a financial secret from their partner. Twenty-eight percent of the people surveyed said they think that keeping money-related secrets from your significant other is just as immoral as cheating on them. Here’s a breakdown of the most common forms of financial infidelity according to the Bankrate survey:

- 30%: Spending more money than your significant other would be OK with.

- 23%: Accruing debt behind your partner’s back.

- 19%: Having a secret savings account.

- 18%: Having a secret credit card.

- 17%: Not telling your partner about a checking account.

Why Do People Lie to Their Significant Other About Money?

Along with there being various forms of financial infidelity, there are various reasons why people commit it. The three most common reasons according to the Bankrate survey are:

- 37%: Craving financial privacy/wanting to control their own monetary situation.

- 33%: Not wanting to talk about money with their partner.

- 28%: Being embarrassed about their personal wealth management tendencies.

What Generation Is Most Likely to Practice Financial Infidelity?

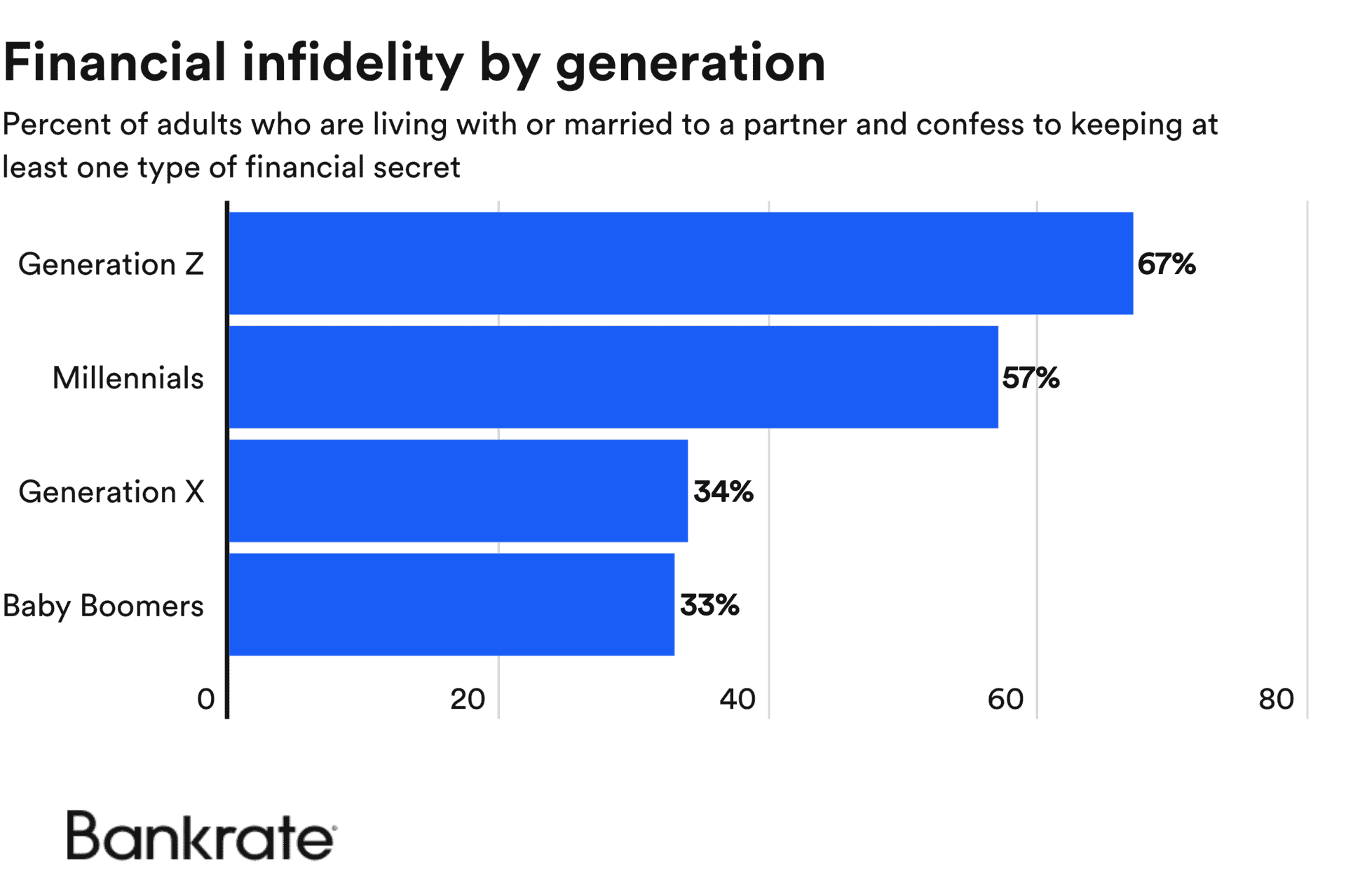

Our team at Modern Wealth focuses a lot on helping people build generational wealth. That can be very challenging, though, when financial infidelity is taking place. Bankrate’s survey shows that older couples are much less likely to commit financial infidelity than younger couples.

FIGURE 1 – Financial Infidelity by Generation – Bankrate

Financial Infidelity and Divorce

Why do you think financial infidelity is so much more of an issue for younger generations? There could be several factors. Remember the second statistic that we shared from the Bankrate survey: 28% of the people surveyed said they think that keeping money-related secrets from your partner is just as immoral as cheating on them. Financial infidelity can be a slippery slope—potentially resulting in divorce.

There are also situations in which other factors could lead to divorce and financial infidelity might not be unearthed until the divorce proceedings. Financial infidelity could influence division of property, spousal support, child support, and legal fees.2

We’ve shared in several articles, podcasts, and videos that taxes and healthcare are two of the leading wealth-eroding factors in retirement. Divorce can quickly erode someone’s wealth as well, especially if a former partner has evidence that their ex committed financial infidelity.

Preventing Financial Infidelity

We don’t want to see anyone become a victim of financial infidelity. That’s why we encourage couples to have open and honest conversations about money as they’re approaching and going through retirement. Don’t avoid those difficult conversations—we can attempt to help you reach a common ground.

It’s important to identify the forms of financial stress that are impacting you and your partner and plan for them by building a financial plan and working with a team of professionals. As you work toward building a unified financial future with your partner, make sure to download a copy of our Retirement Plan Checklist. It consists of 30 yes-or-no questions that gauge your retirement readiness and age-and date-based timelines of important retirement planning considerations.

Open and Honest Conversations

If you have a significant other, it’s critical to remember that retirement planning and wealth management doesn’t just revolve around your goals. Your partner’s goals need to be at the forefront as well. Getting on the same page as your partner about financial and life goals can be very difficult if there isn’t on-going communication. Opening the door to money-related conversations can sometimes be the hardest part, and we’re here to help you with that. If you have any questions about building a goals-based financial plan that’s been stress tested against various forms of risk, start a conversation with our team below.

The top priority of our team is to put our clients’ interests ahead of our own. We want to give you more confidence to make informed decisions with your money, freedom from financial stress, and time to spend doing the things you love.

Financial Infidelity | Watch Guide

00:00 – What Is Financial Infidelity?

03:03 – Financial Infidelity By the Numbers

10:46 – Financial Infidelity By Generation

14:34 – Divorce

16:27 – Preventing Financial Infidelity

Resources Mentioned in This Article

- Talking to Your Spouse About Money

- How to Build Generational Wealth

- 6 Wealth Destroying Factors

- Taxes on Retirement Income

- Healthcare Costs During Retirement

- Couples Retirement Planning

- Financial Stress: How Do You Deal with It?

- Components of a Complete Financial Plan with Logan DeGraeve, CFP®, AIF®

- Why You Need a Financial Planning Team with Jason Gordo

- Don’t Retire without Doing These Things First

- Short-Term, Mid-Term, and Long-Term Financial Goals

- Stress Testing Your Financial Plan

- 7 Money Management Tips to Consider

Downloads

Other Sources

[1] https://www.bankrate.com/credit-cards/news/financial-infidelity-survey/

Investment advisory services offered through Modern Wealth Management, Inc., a Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management a Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.