Are You Overspending or Underspending?

Key Points – Are You Overspending or Underspending?

- Could You Be Overspending or Underspending and Not Realize It?

- Setting Up a Spending Plan for Retirement

- Reviewing Data from BlackRock’s 2023 Study, To Spend or Not to Spend?

- 7 Minutes to Read | 23 Minutes to Watch

How Do You Know If You’re Overspending or Underspending?

Are you overspending and don’t even realize it? Or are you underspending and living well below your means? And whether you’re overspending or underspending, how are you supposed to be able to tell?

If you haven’t built a spending plan (AKA, a budget), it’s very difficult to keep track of how much you’re spending. We’ve met with many people who were under the assumption that once they retire, they won’t need a budget anymore. That couldn’t be further from the truth.

Making a budget for retirement might not seem like fun, which is why we like to call it a spending plan. And think about the clarity that you’ll receive in knowing whether you’re overspending, underspending, or spending efficiently. That clarity can breed confidence that you’re doing the right things with your money. That con can then create freedom from financial stress, which can give you more time to do the things you love.

Figuring Out If You’re Overspending or Underspending as You’re Heading into Retirement

It’s important to us at Modern Wealth that you have more confidence, freedom, and time, especially you’re approaching and going through retirement. As you enter retirement, some of your basic spending (such as your mortgage and groceries) will stay the same. But what are you going to do during the week now that you’re no longer working?

If you’re passionate about volunteer work, that’s not going to be an added expense in retirement. But if you want to travel a lot more, that needs to be planned for. The same goes for things like health insurance, whether you’re getting it from the marketplace if you’re retiring pre-65 or if you’re retiring at 65 or later and become Medicare eligible. Your needs, wants, and wishes are going to change as you go through retirement, so you need to have an up-to-date spending plan that lets you know whether you might be overspending or underspending.

To Spend or Not to Spend?

Everyone’s spending plan is going to look different because everyone has different needs, wants, and wishes. As you’re building out or reviewing your spending plan, we want to share some data from a December 2023 BlackRock study that’s titled, To Spend or Not to Spend?1 BlackRock teamed up with the Employee Benefit Research Institute for the study, and what they found was rather interesting. We’re going to review their six main takeaways to help educate you about key considerations with figuring out whether you may be overspending or underspending.

- Retirees Prefer to Keep Their Assets Untouched

- Retirees More Often Plan to Spend Consistently – Increasing with Age

- Retirees Retain Their Accumulation Mindset

- Retirees with Pension Income Are the Least Likely to Spend Down Because They Don’t Need to

- Men and Women Approach Finances in Retirement Differently, and Mostly for Good Reason

- More Recent Retirees Are Less Optimistic

1. Retirees Prefer to Keep Their Assets Untouched

For this study, BlackRock surveyed more than 1,500 retirees that had been fully retired for a minimum of five years. Each retiree they surveyed was between 60 and 80 years old and had investable assets ranging from $200,000 to $2.5 million.

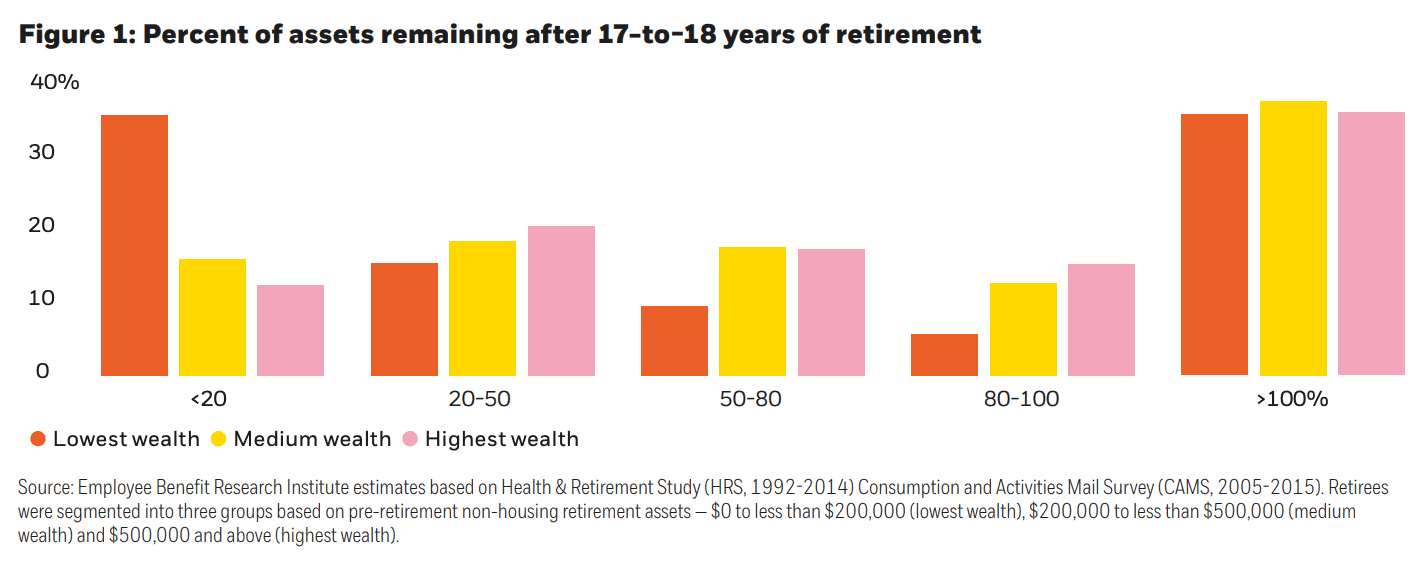

BlackRock and the EBRI’s research indicated that most of the retirees in the survey—regardless of their financial wealth—still had at least 80% of their pre-retirement savings after nearly 20 years of retirement. On top of that, one third of the surveyed retirees also managed to grow their assets over that time. See Figure 1, below, for more context on how the responses of the retirees varied based on their financial wealth.

Why Could So Many Retirees Potentially Be Underspending?

The main takeaway that BlackRock had from the survey was the alarming number of retirees that prefer to keep their assets untouched. Only 25% percent of the retirees in the survey said that they think they’ll need to spend down principal to live how they want to live in retirement.

That would seem to indicate that mitigating financial stress is more important to them rather than having the retirement of their dreams. They’re potentially in the category of underspending. However, since we don’t know each retiree’s unique situation, we can’t say that with certainty.

They could have substantial health care costs that are on the horizon for themselves or their partner. Or they could be intentionally spending below their means because they want to leave a big legacy to their children/grandchildren and/or charity. Again, everyone’s situation is different. If you don’t have a spending plan that shows you how much you’re spending now and how much you’re expecting to spend in the future, you could be mitigating financial stress, but you could also be missing out on your retirement dreams when you don’t have to be.

As you’re planning to get to and through retirement, make sure to download a copy of our Retirement Plan Checklist. It addresses key financial planning considerations, such as creating a spending plan, and gauges your retirement readiness. Download your copy below.

2. Retirees More Often Plan to Spend Consistently – Increasing with Age

That leads us right into our BlackRock’s second takeaway from the survey. Forty-three percent of the surveyed retirees said that they intend to spend consistently in retirement. That very well could be because they’re worried about overspending in retirement.

However, think about how you might set up your spending in retirement. If you do want to travel the world in retirement, it makes sense to do as much of that traveling as possible while you’re still healthy and spry. We like to think of retirement in three stages: your go-go, slow-go, and no-go years.

By front-loading your spending in retirement, you can make the most of those go-go years. During your slow-go years, you’ll hopefully still be healthy, but might not get around as well to travel much. Therefore, you might consider cutting your spending during that stage before ramping it back up to cover health care expenses during the no-go years.

There were only one in six of the retirees in the survey had that line of thinking, though. Taking it one step further, 25% of the retirees in the survey said they didn’t have a spending plan. Those are the people that could very well be underspending or overspending without even knowing it.

3. Retirees Retain Their Accumulation Mindset

It can be very easy for retirees to remain stuck in a save-save-save mindset. The shift from saving to spending can even difficult for retirees who have spending plans.

BlackRock found that fewer than 20% of the retirees surveyed set asset-level goals by the time they were five years into retirement. More than 50% of the retirees that did have asset-level goals wanted to grow their assets. That shows that they maybe worried about overspending. For those who did plan to spend down their assets, BlackRock shared that many of them wanted to keep their assets above a certain threshold.

The concern of outliving your money is a very real fear. As you’re creating and reviewing your spending plan for retirement, make sure that you’re planning for unexpected expenses so that that fear doesn’t turn into a reality.

4. Retirees with Pension Income Are the Least Likely to Spend Down Because They Don’t Need to

How people think and feel about money is something that we try to gauge when first meeting with prospective clients. That certainly came to mind when reading BlackRock’s fourth key finding. They noticed that there was a big contrast in both spending and confidence in financial well-being between retirees who did and didn’t have defined benefit pension plans.

While pensions are becoming less prevalent,2 they can still be a very impactful source of retirement income for those that have them. Still, only 25% of the retirees in the survey that had pensions said that they would spend down their retirement savings to cover expenses. Meanwhile, 55% of retirees in the survey who didn’t have pensions indicated that they would utilize retirement savings to offset expenses. The concern of overspending seems apparent again with this key finding.

5. Men and Women Approach Finances in Retirement Differently, and Mostly for Good Reason

Staying on the topic of fear of overspending, BlackRock also found that men were more likely than women to spend consistently during retirement. Forty-eight percent of men shared they were more likely to spend consistently in retirement compared to 38% of women.

There are a few possible reasons behind those numbers. One, women tend to nearly six years longer than men on average.3 And two, the gender pay gap hasn’t closed much in recent years, as U.S. women still only earned 82 cents for every $1 earned by U.S. men in 2022.4 While those are legitimate concerns for women to have when it comes to overspending, it’s still important for them to have a spending plan that can give them a higher level of clarity on how much they can comfortably spend throughout retirement.

6. More Recent Retirees Are Less Optimistic

Along with looking at differences among retirees between men and women, BlackRock also wanted to assess how likely retirees were to spend based on their age. They found that people who have retired within the past decade are less optimistic about their ability to spend in retirement. Many of them cited future health concerns and potential investment loss as their main financial stress factors.

Americans are also carrying more and more debt, especially those in Gen X who are planning for retirement.5 It’s important to understand that there is good debt and bad debt. Make sure you know the difference between them as you’re developing a spending plan for retirement.

So, Are You Overspending or Underspending?

Hopefully, you found the data we shared from BlackRock to be informative so that you have an idea on why others might be overspending or underspending. The main takeaway here, though, is that it’s critical to have a spending plan that considers your current and future needs, wants, and wishes. This is all about your unique situation, not the people in the BlackRock survey.

If you have questions about building a spending plan or are trying to figure out if you might be overspending or underspending, start a conversation with our team below.

Think of a spending plan as having a permission slip to do the things you want to do in retirement. We’re ready to help you develop a spending plan so that you can enter and go through retirement with more confidence, freedom, and time.

Articles

- Setting Up a Spending Plan for Retirement

- Family Financial Planning with Matt Kasper, CFP®, AIF®

- Charitable Giving in Retirement

- Nonfinancial Life Planning with Bruce Godke

- When Is It Time to Stop Saving for Retirement?

- The Difference Between Good Debt and Bad Debt with Logan DeGraeve, CFP®, AIF®

Past Shows

- 7 Overlooked Budget Items in Retirement

- How to Spend When You First Retire

- Health Care Costs During Retirement

- Your Retirement Lifestyle: What Do You Want Your Retirement to Look Like

- Financial Stress: How Do You Deal with It?

- Creating a Game Plan for Retirement

- Longevity Risk in Retirement and How to Plan for It

- Unexpected Expenses and How to Plan for Them

- What Is Financial Well-Being?

- Pension Plans: Defined Benefit Plans vs. Defined Contribution Plans

- Retirement Savings by Age

- Retiring with Debt: What’s OK?

Downloads

Other Sources

[1] https://www.blackrock.com/us/individual/insights/retirement/spending-and-investing-in-retirement

[2] https://www.ssa.gov/policy/docs/ssb/v69n3/v69n3p1.html#

[3] https://www.cdc.gov/nchs/fastats/life-expectancy.htm

[4] https://www.pewresearch.org/social-trends/2023/03/01/the-enduring-grip-of-the-gender-pay-gap/

[5] https://www.businessinsider.com/personal-finance/average-american-debt

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.