Retirement Withdrawal Strategy: You Need a Plan

Key Points – Retirement Withdrawal Strategy: You Need a Plan

- Determining Your Retirement Withdrawal Strategy Starts with a Financial Plan

- Your Retirement Withdrawal Strategy Includes Your Asset Allocation, Asset Location, and Tax Allocation

- What to Consider When Claiming Social Security

- Working with a CFP® Professional to Better Understand Your Retirement Withdrawal Strategy

- 14 Minutes to Read | 23 Minutes to Listen

Retirement Withdrawal Strategy: You Need a Plan

There are many factors when considering when and from which accounts to make withdrawals from in retirement, such as sequence of return risk, Required Minimum Distributions, and tax implications. Navigating the dynamics of retirement planning is what Dean Barber, Logan DeGraeve, and the rest of our team do every day. Dean and Logan will elaborate on that and explain why having a retirement withdrawal strategy when you’re in or approaching retirement is critical on America’s Wealth Management Show.

A Dream Retirement Withdrawal Strategy

What if we were in an era where you could buy a 30-year treasury that pays 9%. It would be very simple since you would just put all your money in that 30-year treasury. You could take a 7% withdrawal stream and your account would grow by 2% every year. Wouldn’t that be nice?

Well, it would be. But clearly that isn’t the reality we’re in right now. A lot of people are coming off a year in which they lost 15-16% in their portfolio. Years like 2022 when a dream retirement withdrawal strategy isn’t in the cards make having a financial plan that much more important.

The Dangers of Lacking Financial Awareness in Fantasy Land

Thinking about that dream retirement withdrawal strategy made Dean think back on a scenario he had with a client way back in 1992. She retired in 1982 and put 100% of her money in a 10-year CD that was paying 14.4%. She was using 100% of the income from the CD on top of their Social Security to support her style.

In 1992, that CD matured and they wanted to give her 4.5%. Suddenly, her income on her investments was going to decline by 75%. That’s not even bringing in the projected increase in cost of living over the prior 10-year period into the equation. So, even if you’re in a dream scenario with your retirement withdrawal strategy, it’s not going to be plain and simple.

“That’s reinvestment risk. Let’s talk more about the reality of today with having lost around 15-16% last year. Maybe you’re not on Social Security yet and don’t have a pension, so you’re planning to spend 5-6% of your portfolio. Well, you just spent considerably more than that with losing 15-16%. You now need to level set in 2023 and determine where you’re at. That can be a pretty ugly situation for someone who just retired and is withdrawing from their portfolio for the first time.” – Logan DeGraeve

The 60-40 portfolio: 2021 vs. 2022

If you do a quick Google search for “balanced asset allocation,” the first result that pops up suggests that it’s 60% stocks and 40% bonds. So, let’s look at how someone who stayed in a 60-40 asset allocation would’ve fared in 2021 and 2022. In 2021, a 60-40 portfolio did exceptionally well. But for 2022, not so much.

Someone with a 60-40 portfolio that retired in 2021 would’ve been making way more than the 5% than they needed to withdraw. What if they were talking to their friend who was getting ready to retire in December 2021 about having a 60-40 portfolio and how simple it was for them? Well, the friend’s results would have been dramatically different because the S&P 500 was down 18% and the bond aggregate was down 17%.

“That buddy that just retired (in 2022) is more susceptible to this risk because they just retired. Hopefully they’ve set up a retirement withdrawal strategy if they’ve done planning, but if they haven’t, they’re in trouble. If you look at that 60-40 portfolio in January 2023, what are you going to spend from? The S&P 500 that’s down 18% or the bond aggregate that’s down 14% or whatever it is. You need to sell something at a large loss, and that’s not great.” – Logan DeGraeve

Having Multiple Years of Safe Money

That’s why you need to have at least two years of income in a very, very safe spot in your portfolio. Having a dynamic retirement withdrawal strategy is critical.

Let’s say that you have $2 million and it’s all in an IRA. In that account, you need to have that proper allocation and retirement withdrawal strategy. If you were taking 5% per year, you would want to take $120,000 and multiply it by two to get your two years of safe income. That $240,000 needs to be in a safe space because you know you’re going to take it out of your account over those two years.

Then, you build your asset allocation on the other 90% of the money to allow that to grow. You can ignore those short-term market fluctuations since you have that two years of safe money. And that other 90% doesn’t all need to be built in the same way. Logan suggests breaking it out further to a mid-term, core strategy. You can still have a long-term bucket of money. Investing doesn’t need to be boring in retirement, but you need that safe space that you can go to.

“It doesn’t mean that you need to have a bunch of separate accounts either. You can manage it all within an individual account.” – Dean Barber

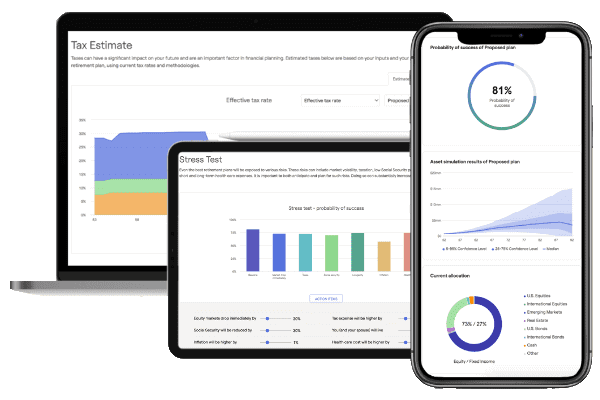

Stress Testing Your Financial Plan

This brings us to stress testing your financial plan. We’re looking at history to tell us if your plan could survive various economic cycles, especially long-term downward periods (years like 2022 are a good example).

We don’t have a crystal ball to know what the rest of 2023 could have in store and know when this downward period could end. However, we can look at times like the Dot-Com Bubble and Great Recession to see if your plan can withstand long-term painful periods like those. Is your plan still on track to do everything that you want to do? We need to make sure that we’re managing around that.

We also want you to be aware of another resource that we have that can help you determine if you’re in a good position to retire. Please review our Retirement Plan Checklist that has 30 yes-or-no questions that gauges your retirement readiness as well as date-and age-based timelines of things to consider leading up to and during retirement. Download your copy below!

Download: Retirement Plan Checklist

Bonds Are a Stay-Rich Investment, Right?

There have been a lot of people who have wanted to rush to bonds when stocks get hit hard, but we aren’t used to seeing stocks and bonds both do so poorly like they did in 2022. Bonds are a stay-rich investment over a long period, but that’s obviously not much help right now when people need it. That’s why we’ve been looking at alternatives to the bond aggregate.

“For example, let’s look at what’s happened with Silicon Valley Bank. They owned U.S. treasuries with an average duration of a little more than seven years. Was that still a stay-rich investment? Absolutely it was. It just so happens that you need to understand a term called mark to market, which is what bonds do every day. If interest rates rise, that bond gets marked to the market and it goes lower as far its net asset value. Eventually, it comes back to par with whatever you put in, but they didn’t have time to let it mature. That’s why they went belly up.” – Dean Barber

Income Strategy

If you think about this and think about a retirement withdrawal strategy, for someone who has one IRA, it’s not that complicated. At the end of the day, you can look at some tax planning, but we want tax diversification. That means that you have your money spread out within tax-free, tax-deferred, and taxable accounts. We can sit down with someone and—maybe in conjunction with Social Security—can figure out how much you’re going to take from each bucket.

“For our clients, we do something called an income strategy so they can see month by month what source or bucket their money is coming from. That’s where the magic is made.” – Logan DeGraeve

Two Different Retirement Withdrawal Strategies

So, there are really two retirement withdrawal strategies. It’s not just a retirement withdrawal strategy from an asset allocation perspective. It’s also a retirement withdrawal strategy from a tax allocation perspective. For people that did nothing but pour money into their 401(k) throughout their career and didn’t save anywhere else, they don’t have the luxury of tax allocation and which bucket to pull from.

Creating Tax Diversification

Let’s say that someone has created some tax diversification. They might have some money in a traditional IRA, Roth IRA, taxable account, and maybe some investment real estate. They’re going to have Social Security and maybe a pension.

So, when we’re creating a retirement withdrawal strategy for that person, you’re not just looking at their investments. You’re looking at all their sources of income. Where does it make the most sense from a tax perspective to take the income you need and deposit it into your checking account so that you can live the life you want to live.

Also, a lot of people don’t know that couples that are married filing jointly can have a 0% capital gains rate on a lot of taxable income. What you own in these buckets from an investment standpoint matters too.

“I met with a gentleman who had a big trust account, an after-tax account. He had corporate bonds in there. I asked him why he had corporate bonds in that account and not in his IRA. He was in a 32% tax bracket. His tax equivalent yield was hardly anything. I told him to look at municipal bonds and his tax equivalent yield. Your tax equivalent yield is the interest you make that you don’t need to pay taxes on. It’s critical to pay attention to this so that you’re not leaving money on the table.” – Logan DeGraeve

The Third Dynamic to a Retirement Withdrawal Strategy

That brings in a third dynamic to your retirement withdrawal strategy, which is asset location. So, you have asset allocation, asset location, and tax allocation. All three of those need to be married together to determine your retirement withdrawal strategy.

Don’t Forget About Social Security

And you can’t stop there because the other source of income that almost every American will have is Social Security. When should you turn on your Social Security benefits? How does it mix with the other sources of income? And how does that look on your tax return? Those are all three critical questions to think about.

“Social Security is taxed differently than any other source of income. It looks at your provisional income. People will start living off Social Security in retirement and think it’s great with having low taxes. But then what happens? Required Minimum Distributions begin from your IRAs. Your Social Security could suddenly be as much as 85% taxable.” – Logan DeGraeve

There’s a lot to consider when claiming Social Security. Although it’s tempting to claim it right away when you turn 62, what Logan just shared and what we’re about to share shows that it’s not that simple. We also took a deep dive into what all needs to be considered when claiming Social Security in our Social Security Decisions Guide, so make sure to download your copy below.

Download: Social Security Decisions Guide

Provisional Income and Phantom Capital Gains

But let’s take a step back for a minute. When talking about taxable accounts, we mentioned municipal bonds. Another thing that can mess things up is when you own mutual funds in a taxable account. They kick off capital gains distributions.

If it’s a real capital gains distribution from money that you really made, that’s fine. But if it’s a phantom capital gain, that can spell trouble. It’s something that a lot of people don’t understand until it hits them. And by the time it does, it’s too late. The phantom capital gain is something that’s written into the tax code that every mutual fund must distribute 90% of any capital gains that are realized in that fund during a given year to their shareholders.

“For example, let’s say this mutual fund bought Apple stock a couple of decades ago at $5 a share. They decided that Apple stock had become too big of a part of the asset allocation within that mutual fund and sold it at $160 a share. All that gain up until the time they sold it pushed up the price of the mutual fund. It becomes a realized gain inside that fund on the day they sold it. So, all that realized gain needs to be distributed and then becomes taxable to the holder of the mutual fund.” – Dean Barber

If you bought that mutual fund in the example Dean shared and only owned it for a year, you really didn’t participate in the long-term growth of Apple. However, you’re still going to be stuck with the tax consequences of what that mutual fund manager made during that year.

Paying Attention to Capital Gain Distributions Announcements

The issue with that is that it can throw a big wrench into things when you’re doing long-term tax planning. The phantom capital gains could result in $50,000-$75,000 of income that you weren’t expecting. But if you didn’t know that, it’s because you weren’t paying attention.

Why’s that? It’s because the mutual fund companies will announce their estimated capital gain distributions about five to six weeks before you make the distributions. That way you can look at it and figure out what you should do. Maybe you should sell a fund and trade it for something similar that won’t have those capital gain distributions? If you sell it, will you have less of a gain and less of a tax liability? Is there something else in your portfolio that you can sell to offset that potential capital gain. That requires some planning.

“My point would be that if you want to own things like that, own it in an IRA or Roth IRA. That way you won’t need to worry about it. It can kick off any capital gain distributions it wants and you won’t need to pay taxes on it. That’s another reason why you need to look at what you own and why you own it.” – Logan DeGraeve

Your Roth IRA should be drastically more aggressive than the short-term bucket that you’re spending today and tomorrow. That’s the money that you’re wanting to grow tax-free for the rest of your life. If you’re going to pre-pay some taxes, why not try to get the most bang for your buck?

A Complex Calculation

Let’s circle back to discuss provisional income and Social Security a little bit more. It is a bit of a complex calculation. But let’s start with the basic fact that Social Security was designed to be a tax-free source of income. And if all you have is Social Security, it is a tax-free source of income. For your Social Security to become taxable, you need to take all sources of taxable income plus any tax-exempt income coming from municipal bonds and then you add 50% of your Social Security check.

If you’re married filing jointly and that exceeds $32,000, then up to 50% of your Social Security becomes taxable. If that number exceeds $44,000, up to 85% of your Social Security becomes taxable.

“One of the things that we can do with our financial planning tool—our Guided Retirement System—is that we can show a mocked up tax return that’s done year by year. If you want to fast forward to that year that they’re going to need to start taking RMDs, we can show on that tax return what your RMD would be, what that did to your Social Security and your capital gains or dividends that were tax-free because you exceeded a certain limit. We’ll show you the total impact on your taxes. When you see that and how large that number can be, what it does to the rest of your income, and how much it causes you to pay in taxes, it becomes an easier conversation about the steps to take to mitigate that tax in the future.” – Dean Barber

It’s Pivotal to Have a Financial Plan

Dean and Logan believe that more than 90% of people don’t do that level of planning. There are a lot of people that we meet with for the first time that want us to jump right into fixing their taxes. Well, we’ll start looking for tax planning opportunities, but we first need to learn a little bit about you, your goals, and how you think and feel about money—among other things. You need to start by building a financial plan. Then, we can really do that forward-looking tax planning as part of the comprehensive financial plan.

“My favorite thing is when someone comes to me and says that they’re on Social Security but doesn’t need the money. I ask them why they’re on Social Security then. It’s usually just because they’ve paid into it and they want their money. They need to do planning around it.” – Logan DeGraeve

Dean says that the reason why more than 90% of people don’t do that level of planning is because we live in a “society with a drive-thru mentality.” What he means by that is that everyone wants things to be simple, easy, and inexpensive. They just want the quickest solutions to solve their problems and don’t want to take the time to work with a CFP® Professional. For a CFP® Professional to have an intelligent conversation with a CPA on what someone’s tax strategy is going to be, they need to do two, three, or maybe four hours of work of learning about the client.

“It’s not simple. It’s not easy. There isn’t a five-minute plan online that’s going to give you these answers.” – Dean Barber

Your CFP® Professional and CPA Need to Work Together

One thing to be aware of is that many CPAs don’t focus on tax planning. They focus strictly on tax compliance. It’s critical for your CPA to work alongside your CFP® Professional to build and review your plan from a tax perspective. We not only want to improve your situation for this year, but for several years down the road.

“Here’s the thing that a lot of people don’t understand. A lot of people think that tax planning is only for the ultra-wealthy. They might be concerned about only having $1 million or $1.5 million and think it doesn’t apply to them. But nothing could be further from the truth. These strategies really start to work when someone has $500,000 of investments. Obviously, the more money you have, the more impactful these strategies are going to be. The strategies that we employ for the average millionaire next door can make a significant and profound difference in the amount of taxes they pay.” – Dean Barber

Understanding All Three Dynamics of Your Retirement Withdrawal Strategy

That’s why when we’re talking about your retirement withdrawal strategy, you need to have all three parts of it. You need asset location, asset allocation, and tax allocation. We started out talking about the asset location and asset allocation parts of the retirement withdrawal strategy. But the tax allocation and which account you take from when and how much can have a far bigger impact.

“You can’t look at anything in your retirement plan within a vacuum. It’s the same thing with Social Security and taxes. It happens so often that people want to start claiming their Social Security, but shouldn’t because they don’t understand that it’s not all about them. It’s about your spouse too. Only the highest benefit if one spouse were to pass away. And if one spouse didn’t work, that can destroy financial plans too. It’s a selfish decision to immediately start claiming Social Security at 62 because you want your money.” – Logan DeGraeve

Being Transparent with Your CFP® Professional

While Logan makes a good point, Dean does point out that there are rare occasions when claiming at 62 could still be the best option for you. Again, you need to build a forward-looking comprehensive financial plan to understand what the best decision will be for you.

“If you’re going to work with a CFP® Professional, you need to be willing to show them everything and share with them exactly what you want to have happen. Once you do that, then you can start to see magic happen. Logan and I have seen it before where someone comes in and we ask them if that’s everything and they say yes. Then, we build the plan and they say that they forgot to tell us about something. That means we need to go back to the drawing board and start all over again.” – Dean Barber

The Bottom Line with Your Retirement Withdrawal Strategy

You need to start working on your retirement withdrawal strategy at least five years prior to retirement. If you haven’t, it’s not too late. Even if you’re in retirement, it’s not too late. But having that retirement withdrawal strategy is critical.

We’re ready to help you with figuring out your retirement withdrawal strategy. We can’t stress enough that it all begins with creating a financial plan. It’s much better to ask questions as you’re preparing for retirement rather than leaving those questions unanswered and having your retirement withdrawal strategy turned upside down in retirement. We can show you what the financial planning process looks like in even greater detail and how to personalize it to your situation during a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals. Just click here to schedule a meeting at no cost or obligation.

And if you’re not quite ready to talk with a financial professional, we have another way to help get you started with building a financial plan and determining your retirement withdrawal strategy. We’re giving you access to use or industry-leading financial planning tool—also at no cost or obligation. It all starts with a financial plan, so start building your plan today by clicking the “Start Planning” button below.

Then, if you have any questions, we’re still happy to meet with you to discuss them. We can meet with you in person, virtually, or by phone depending on what works best for you.

Retirement Withdrawal Strategy: You Need a Plan | Watch Guide

- Introduction: 00:00

- Trip to Fantasy Land vs Reality: 01:15

- 60/40 Portfolio Woes: 03:12

- Banking Crisis Breakdown: 07:20

- Withdrawal Strategies: 08:12

- Social Security Planning: 11:20

- Phantom Capital Gains: 12:07

- Provisional Income: 15:29

- Drive-Thru Mentality: 18:24

- What Most CPAs are Missing: 19:28

- Conclusion: 21:32

Resources Mentioned in this Episode

Articles, Podcasts, Webinars, and Other Videos

- Understanding Sequence of Returns Risk with Bud Kasper

- Considering RMDs Before and After Retirement

- Taxes on Retirement Income

- Maximizing Social Security Benefits with Drew Jones

- Investment Risk in 2023 with Garrett Waters

- Retiring During a Recession

- What Are Tax Buckets?

- Dot-Com Bubble History Remains Relevant

- The Great Recession’s History Remains Relevant

- 2022 Was Unusual for Bonds, Tough on Stocks

- How Bonds Fit into a Financial Plan

- What’s Going on with Bank Failures?

- What Is Tax Diversification?

- Understanding Your Tax Allocation

- Claiming Your Social Security

- Taxes in Retirement with Steven Jarvis

- Considering RMDs Before and After Retirement

- Avoiding Costly Mistakes When Claiming Social Security with Ken Sokol

- The Guided Retirement System

- Tax Planning Strategies with Marty James

Other America’s Wealth Management Show Episodes

- Lost Decades in the Stock Market

- Stress Testing Your Financial Plan

- Interest Rates and Bond Prices

- What Is Tax Planning?

- 8 Tips on Saving for Retirement

- Are Retirement Benefits Taxable?

- 5 Types of Financial Plans

- 9 Items Retirement Calculators Miss (That Our Tool Doesn’t)

Downloads

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.