Q3 2023 Quarterly Market Update

Key Points – Q3 2023 Quarterly Market Update

- Q3 Typically Isn’t a Time for Thriving Markets

- Interest Rates to Remain Higher for Longer

- Can the Fed Still Engineer a Soft Landing?

- Fighting Off Inflation in Retirement

- 5 Minutes to Read | 16 Minutes to Watch

What Happened in Q3 2023?

We’re moving along at a brisk pace to begin Q4. However, we want to take some time to review the key things that happened in Q3 2023. Let’s hear from Dean Barber, Ken Osiwala, and Bud Kasper, CFP® to learn their main takeaways from the third quarter during our Q3 2023 Quarterly Market Update. They’ll also give their outlook for the remainder of Q4.

Q3 2023 Wasn’t a Great Time of Stocks or Bonds

Q3 2023 was quite a wild ride. For starters, Q3 2023 wasn’t very friendly for stocks or bonds. There were indications in the first half of the year for some promise in the markets following a rough 2022, but Q3 2023 certainly didn’t indicate that we were in a recovery phase.

There was a point in September where the Dow Jones Industrial Average went negative on a year-to-date basis. It’s back into positive territory to begin October, though.

“August and September are typically rough months in the market. September has had a negative average monthly return for the past 50 years. So, it’s not out of turn for Q3 to be a struggling quarter.” – Ken Osiwala

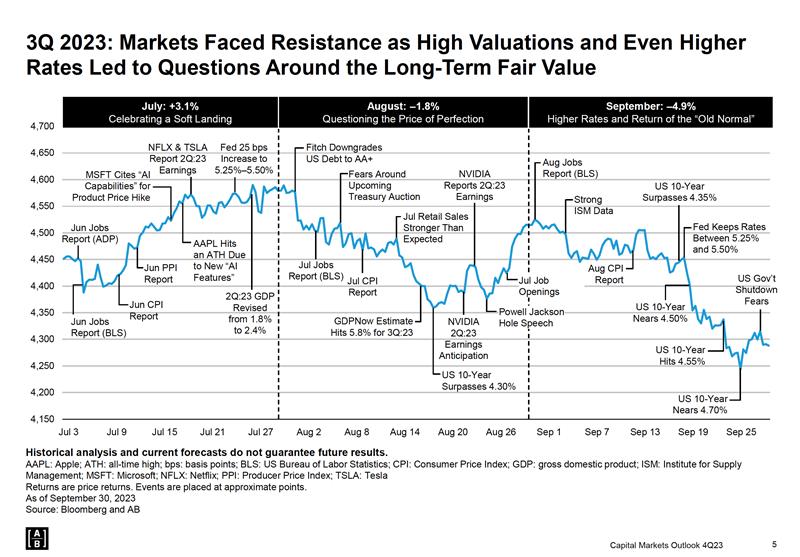

Let’s look at Figure 1 to understand some of the positive and negative things that drove the markets in Q3 2023.

Interest Rates to Remain Elevated for the Foreseeable Future

What the Fed has been doing for the past year-and-a-half or so now with rapidly increasing interest rates has driven the stock and bond markets crazy. The last interest rate hike by the Fed came in July with a 0.25% hike. That raised the Fed funds rate range to 5.25%-5.5%. As you can see in Figure 1, that’s when the markets started to fall apart again. We also saw a sharp increase in the 10-year treasury yield.

Then, in August, Fitch downgraded U.S. debt to AA+. The markets had a significant drop immediately after that. The mid-August estimate for Q3 2023 GDP was 5.8% and the U.S. 10-year treasury surpassed 4.3% right around that same time. The 10-year treasury was the highest that it’s been since before the Great Recession—going over 4.8%. It has since declined to about 4.58%.

“We’ve heard from the Fed that they’re going to keep interest rates elevated for the foreseeable future. Can the Fed engineer a soft landing? Where do we go from here?” – Dean Barber

A Disinflationary Environment

The Fed’s goal is to get inflation back down to its 2% target rate. But could doing so throw us into a recession next year? The only way we’ll know is when we get into next year.

What we’re seeing right now is a disinflationary environment. The inflation fears are still there, but they’re easing. Inflation wholesale prices rose by 0.5% in September (multiply that by 12, and it’s 6% per year). Is inflation still going to be a threat or is the Fed going to need to raise rates even higher?

The bond market seemed to take that in stride, as the yield on the 10-year treasury is still dropping. But in September alone, the bond aggregate lost more than 3%, putting it into negative territory once again after losing more than 13% in 2022. They’re down about 1.7%, 1.8% in 2023, but that gives us very attractive yields on fixed income.

“It’s making lemonade out of lemons if you can capture it. We’ve been able to do that.” – Bud Kasper, CFP®

Reverting to the Mean with Inflation

The other concerning thing is that inflation in the U.S. isn’t the only problem. Inflation has been a worldwide problem. It’s hitting companies all over the place, which is going to increase labor costs. That impacts everyone.

“We’ve all been in the business for 30-plus years and haven’t seen inflation like this in years. It feels like it’s a catch-up from years past. It’s almost like we’re reverting to the mean with inflation.” – Ken Osiwala

Dean’s family has seen an example of this recently. One of Dean’s adult children has been looking into buying a new car. His wife was looking at the interest rates on them and noticed that they were 8.0%-8.5%. She told Dean to call a credit union for better rates, but Dean had some unpleasant news for her. Their rates aren’t lower.

Interest rates are higher. 30-year mortgages are also around 8%. Dean’s wife acknowledged that she had gotten used to interest rates being so low for so long.

“It’s been 15 years that we’ve been in this abnormal interest rate environment. We’re now back to a more normal interest rate environment.” – Dean Barber

Dean’s story made Ken think back to when he got married and him and his wife closed on the first house. He thought they had a great interest rate at 10%.

“I thought I hit a home run with the bases loaded when I locked in at a 30-year, 10% interest rate. That was the normal for a long time. I think the new normal is going to be higher interest rates.” – Ken Osiwala

Incorporating Inflation into Your Financial Plan

Dean, Bud, and Ken didn’t used the real inflation rate as an inflation factor with their clients’ financial plans when it was around 2% or so for as long as it was. Our advisors at Modern Wealth use the 30-or 40-year average inflation rate, which has been closer to 4%.

“The scary thing that we might see in the short-term is companies that are less hesitant to invest more money because they don’t know where inflation is going. They don’t know what kind of investment to make in their own futures. It might be a drag on economic growth.” – Ken Osiwala

If we’re back to a more normal interest rate environment, we need to be students of the historical markets. We had interest rates in this range through the 1980s, 1990s, and early 2000s and markets thrived up until the Great Recession. Having abnormally low interest rates for about 15 years after that is making it hard for people to realize that we’re back to a more normal interest rate environment. It’s not necessarily a dangerous thing.

Implications of the Hamas-Israel Conflict

Along with breaking down Q3 2023, Ken, Bud, and Dean want to look at what could be in store for the rest of 2023 and beginning of 2024. Dean doesn’t think inflation is at the center of uncertainty that’s going to drive the markets crazy. It’s the Hamas attack on Israel and ongoing conflict there. Where does that go, and does it start to involve other countries?

“What does that do to the energy supply and fuel prices? Looking here domestically with our strategic petroleum reserve being depleted by 44%, we’re at historic lows. We haven’t seen these lows since the early 1970s.” – Dean Barber

Since the Hamas attack on Israel, we’ve seen energy prices up and the equity markets have been higher, which is surprising a lot of people. It’s important to take a step back and ask ourselves if we’re in a healthy economic position. Remember that the American consumer drives around 70% of the GDP.

“I think the overlying answer to that is yes. Equity valuations are elevated a little bit, but they’re more fairly valued now than they were at the end of July. Inflationary pressures could come back due to increased energy costs.” – Dean Barber

What Else Could Be in Store for Q4?

Bud believes that we could see a mild increase in the stock market and stabilization in the bond market because he doesn’t think the Fed can move much more.

“If that happens, we could get back to an environment where the returns that we expect to capture from the markets will be more sustainable.” – Bud Kasper, CFP®

Bud, Ken, and Dean are all hopeful that the situations in Israel and Ukraine will improve sooner rather than later. Both situations are hard to dictate in terms of how they’ll impact the economy.

“The danger is if Iran and Syria get involved because that then brings in the United States and Russia. This could turn into a global conflict. What are the chances of it being contained?” – Dean Barber

We’ll continue to keep a close eye on the markets and plan accordingly as we get further into Q4 2023 and head into 2024. If you have any questions about what Bud, Ken, and Dean covered in their Q3 2023 Quarterly Market Update, let us know. To ask us your questions about Q3 2023 and how to build or update your plan for your unique situation, schedule a conversation with one of our CFP® Professionals below.

You have the option of scheduling a 20-minute “ask anything” session or complimentary consultation. It can be in person, virtually, or by phone. We wish you nothing but the best for the remainder of 2023 and hope to see you soon.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.