Defining True Wealth with Ken Osiwala

START PLANNING Subscribe on YouTube

Defining True Wealth with Ken Osiwala Show Notes

What is the true definition of true wealth? It’s been a hot topic lately on America’s Wealth Management Show with Dean Barber and Bud Kasper. Today, Ken Osiwala joins Dean on the The Guided Retirement Show to give his definition of true wealth on and explain how a lot of people define true wealth differently.

In this podcast interview, you’ll learn:

- The definitions of financial wealth, health wealth, time wealth, and social wealth.

- There’s more to defining wealth than how much money you have.

- You have a mindset change when you enter retirement.

- The importance of family financial planning.

Ken’s Definition of Wealth

But before Ken define true wealth, how do you define true wealth? Ask yourself now and then ask yourself after listening to the podcast and reading this article and see if you have a different answer.

Ken points out that Wall Street teaches people to define wealth as how much money you have. What does your net worth look like? What does your income look like? But Ken says there is much more to wealth than your money.

“When you really look at life, wealth has nothing to do with how much money you have. The money is a tool, but it isn’t necessarily your wealth. That’s the way I really look at it.” – Ken Osiwala

What Did Charles Schwab’s 2023 Modern Wealth Survey Say About True Wealth

We’re going to dive much, much deeper into Ken’s definition of true wealth because everyone at Modern Wealth shares his sentiments on that. But there’s a survey that was recently done by Charles Schwab that makes us think that a lot of people might not grasp or be thinking along the same lines of Ken when it comes to true wealth.

Schwab surveyed a 1,000 people between the ages 21 of 75. After running the numbers of those people surveyed, they found that you need $2.2 million to be considered wealthy. Forty-eight percent of them said they feel wealthy. It was really different for different generations.

Defining True Wealth Across Different Generations

According to those in Gen Z that were surveyed, $414,000 is what you need to feel wealthy. The millennials in the survey said $531,000. The Gen-Xers $410,000 and the Baby Boomers said $692,000. So, this survey was really all over the board with how people feel about “true wealth.”

The Millionaire Next Door

Dean and Ken found the survey to be very interesting. They’ve had clients with $2 million, $3 million, $4 million, or even $5 million-plus who have told them that they don’t feel like they’re truly wealthy or that they’ve always wanted to have more than what they have. Ken really thinks that backs up his definition of true wealth.

“I have a lot of clients that say, ‘I’ve always wanted to have $2 million, but I’m 65 and only have a million. What do I do?’ They think they’re falling short.” – Ken Osiwala

Dean agrees. He thinks it’s interesting because there are a lot of people who he classifies as “the millionaires next door” that don’t feel wealthy because they didn’t accumulate their wealth by having a gigantic income. They accumulated their wealth by working hard, living below their means, and saving part of everything that they made.

“Over time they’ve accumulated $1 million, $2 million, $3 million, but never lived a lavish lifestyle. Most of them never had the $1 million income. They’re the average American that just saved hard and was responsible.” – Dean Barber

Getting Stuck in a Saving Mindset

Living below your means can be a blessing and a curse because when you move into the distribution phase of life, a lot of people feel like they can’t spend money because that’s the way they’ve lived their whole life. They’ve always been saving and are still saving when they move into the distribution phase of life.

“That’s kind of scary in a way because that’s what you traded your life for. People have all those working years to move into the distribution phase of life and then don’t even want to spend my money. They just still want to save it. That’s really what comes across a lot of people’s minds.” – Ken Osiwala

Going from a Working Mindset to a Retirement Mindset

There’s a big change in mindset when you move into that distribution phase of your life as well. Dean has been working with a couple who is in their mid-60s. They have accumulated about $4 million and were never really high earners. They just always saved into their 401(k) as much as they possibly could. Then, they saved more outside of that.

The husband of the couple just lost his mother and just inherited $3 million from his mother. So, they have around $7 million and they’re in their mid-60s, but the wife of the couple still is nervous about retiring. She was nervous about retiring because she knows how much her paycheck is every month.

“When we went through the planning process and I showed them how much they could spend each month, she was blown away. She was like, ‘Why am I still working?’ She didn’t have to work. I had been telling her that for a long time even before they inherited the money. She admitted that she was scared, so I asked her why she was scared. She said, ‘I don’t know who I am outside of work. People rely on me at work. I have a purpose.’ So, they have a lot of money, but think back to what Ken said about money not completely defining true wealth.” – Dean Barber

What Are the Things That Are Important to You?

Again, our money is just a tool to allow us to do the things that we find wealthy in life. So, things like spending time with your family, creating living memories and experiences—things like that. That’s true wealth.

This made Ken think of a story about meeting with one of his clients who worked at a big automotive company. He was in his early 70s and had a few million dollars and a pension, so he had all kinds of financial backing behind him as the woman Dean was talking to. He had people that relied on him at work and talked about this big legacy that he had with the young guys that he was mentoring and bringing up through the channels.

“When we got into a deep discussion about what he really valued and what he really loved in life, it wasn’t that. He told me what he really valued in life. It was his family—his kids and his grandkids. So, I asked him if he was putting his work with these young guys that were starting out in the company ahead of them. He sat back in his chair and said, ‘I think you’re right.’ He sent Kyle Akers and I a letter the next day said that no one had ever shared that thought with him like we did. And he said he was going to retire.” – Ken Osiwala

Things That Money Can’t Buy and That Death Can’t Take Away

Ken and Kyle helped him discover what the true wealth was. Ken also said something else about true wealth a few years ago that has stuck with Dean ever since. He said that true wealth is defined by things that money can’t buy and things that death can’t take away. That can get emotional if you really think about it.

Comparing the Process of Building a Financial Plan to Building a House

What do you value in life? When you start to think about that, that’s where the financial plan should start. It is designed from that starting point. Think about building a financial plan like you would think about building a house.

When you’re sitting down in front of the architect, the architect asks you what you want. Do you want a one-story home, two-story home, or even bigger? Do you want a walk-out basement? What about the feel of the house? Do you want it to be modern or traditional?

After you describe what you want in your dream house to the architect, they’ll take that information and come back with a rendering. The rendering usually features a little bit of what you’re looking for, but it’s not exactly what you want. So, you describe it a little bit more in your next meeting with the architect. You might have two or three of these meetings with his architect. Then, the architect will come up with a blueprint that looks exactly like your dream house.

“That’s where you need to start thinking about true wealth and what it really means to you. That’s the critical part that I think our organization does a great job of. We have these early discussions with people and don’t even get into finances.” – Ken Osiwala

Couples Retirement Planning

The problem is that most people won’t have those discussions with financial professionals and will just use an online retirement calculator. Those online retirement calculators leave out so many things—including what’s important to you. And your plan isn’t just about you either. What about your spouse or significant other? You need to incorporate their needs, wants, and wishes as well.

“What’s important in your life? You need to reflect on that with your spouse because oftentimes those discussions don’t happen. You live your life together, but when’s the last time you really talked about what’s truly important to you and listen to what’s truly important to your spouse? If you’re going to go into retirement together and be together 24/7, you need to figure out the things that are important to both of you and what you want your lives to look like.” – Dean Barber

What You Can Miss with DIY Financial Planning

Unfortunately, many couples wait until they’re retired to have that discussion if they have it at all. And if you wait a few years into the distribution phase to have that discussion, it’s even harder to have. If you’re not retired yet, it’s great to have that discussion before retirement so you can start working on it.

Not only do you want to make sure that you’re putting enough money into your plan, but you want to make sure that the life part of the financial plan is in line with the financial part of it. They are two completely different things, and they need to mesh.

“The scariest thing is if you’re doing it on your own, it’s almost like you need to have a person to guide you. We have hundreds of these conversations with couples each year and have done it for years. If you try to do this on your own, that can still be OK, but how do you how do you go a little deeper on that particular subject with your spouse? I’ve been married 35 years. It’s not the easiest thing to do on your own to have that deep discussion. I don’t want to call it a mediator, but you need somebody to lead you.” – Ken Osiwala

Just to Clarify, Dean and Ken Are Financial Advisors, Not Marriage Counselors

Dean has had a few clients tell him that he’s the best marriage counselor they’ve ever had. He’s not so sure about that, but he thoroughly enjoys bringing people clarity by helping them discover what’s important to them and defining what true wealth is all about.

Your Investments Are the Engine That Drives Your Plan

Dean and Ken have sat in on several meetings where one spouse learns something new about the other spouse. And some of those couples have been married for 30 or 40 years. The discovery process is where the true wealth really is defined. It’s not in your in the value of your investments. Yes, you need to have some money to drive that. It’s the tool.

“If you were to list off the five most important things in your life, money isn’t going to be one of the top two or three. It’s going to be your family. Maybe it’s your faith or your health. All that is enhanced with the tool of your finances.” – Ken Osiwala

It’s sometimes hard for Dean and Ken to explain exactly what they do as financial advisors. When they tells people that he’s a financial advisor, a lot of people immediately think that they sell investments or life insurance. It’s hard to explain what a good financial advisor does without sitting down with them to tell them about yourself and what’s important to you.

There Aren’t Do-Overs in Retirement

We don’t even talk about money until you’ve identified what you want life to look like in retirement. That would be like building a house before you’ve defined the blueprint. It’s tough to do that. You would end up making a lot of mistakes because nobody is perfect.

When you sit down and think about your life as you’re nearing retirement, it’s important to realize that you’ve only got one shot. You can’t do 70 over again. By the time you’re done with 70, you’re 71. You don’t get to relive 70. When you’re going through it, you want to make sure you’re making the most of retirement.

The Clarity Dean and Ken Receive as Financial Advisors

When Ken and Dean are guiding people to and through retirement, their goal is to help give people more clarity and confidence in their financial life. They’re passionate about helping people define true wealth. But after the early stages of Ken and Dean’s respective careers, they started to gain some clarity and confidence as well from the trust that their clients were giving them.

Ken and Dean Often Think About What’s Important to Them As Well

Ken has been in the business since 1990. In the beginning of his career, he just was more focused on getting enough clients so he could make a living and be successful. But eventually, he had an aha moment that his clients actually liked him and that he was doing a good job. He was proud of the value he was bringing to them and was focused on putting their needs before his own.

“There’s way more to it than accumulating money, asset allocation, and even tax planning. All those things are extremely important, but the most important part is connecting your life and your finances. That’s the art and science of retirement.” – Ken Osiwala

For Dean, he had a similar realization in 2003 or 2004 when he was in the middle of building a business. He was working six days a week, 10 hours a day and going as hard and fast as he could. It dawned on him that he needed a business coach. He needed somebody that could teach him how to be more efficient so he could get more things done in a day.

Family Matters

In the very first meeting he had with that coach, she asked him where he thought he would be in five years and in 10 years. Dean started going through all these details about building a business and eventually she stopped him. She wanted to know what he wanted his life to look like in five to 10 years. writing all this stuff down about business and I start going.

Dean has five kids and realized that in five years from that time, only three of them were going to be at home. Within 10 years, they were all going to be gone.

“I didn’t know their teachers’ names. I was missing their sporting events. When I thought about that, I start crying literally. I was missing the most important thing. It was that realization that caused me to stop thinking about how much money somebody has and really focus on how someone is spending their life.” – Dean Barber

So, how are you living your life? Are you living your one best life? Are you doing the things that are important or are you just chasing the dollar? Dean changed his entire way of thinking when it came to working with his clients after he thought about those questions on a personal level.

Being the Dad and Not Just the Dad

It was around that same stage of life that Ken realized that his family really hadn’t had a true family vacation. He has three children, and his oldest daughter was entering high school. So, Ken decided that they were always going to spend spring break as a family.

“That was one of the instances that it started for me. It was something as simple as that. Then, I just kept building upon that. What can I do better here? What can I do better there as far as making that impact? Speaking about being a dad, do you want to be the dad or do you want to be the dad? I wanted to be the dad.” – Ken Osiwala

What Do You Want Your Retirement to Look Like?

Ken has a similarly-framed question for you. Do you want to have a retirement or do you want to have a real retirement? A real retirement is fulfilling and might include you leaving a legacy. What do you want your legacy to look like?

Communicating What’s Important to You to Your Family

Thinking about what you want your legacy to look like can be very emotional. Some people can be so passionate about leaving a legacy for their children and/or grandchildren that they won’t spend much in retirement. And they might feel insecure about how much they have and not even communicate that with their family.

Dean and his family are firm believers in family financial planning. That’s kind of a different way of saying that you’re transparent about estate planning with your family. Dean has annual family meetings with his family where they take a destination vacation and as part of the vacation, they review their respective estate plans so that everyone is aware of who will be inheriting what in the event someone passes away. Some clients will also bring their families into our offices or have their advisors join a family meeting virtually.

“There have been adult children say that they don’t really care about the money. Some of them will say, ‘Mom, dad, go spend it. I’m going to be fine. Go enjoy your life. Quit worrying about me. I’m in my 50s now.’” – Dean Barber

Creating a Game Plan to Win the Big Game

If you’ve never thought about true wealth from this perspective, you need to take time to do it. You’re not going to learn about true wealth on some website and figure it out in five minutes. To define true wealth, you need to sit down with an expert and go through what we’ve talked about.

Let’s go through one more example to help define true wealth. Think about a professional athlete. They might be a phenomenal player, but they still might sometimes struggle with thinking about what the defense (or offense) is going to do. That’s why they have a coach. Multiple coaches, in fact. They see what the player is missing and see an opportunity. The coach will see a special talent or a different move.

“Half the time, coaches haven’t even been professional athletes themselves. But they know how to see the overall picture.” – Ken Osiwala

That’s also the way Ken, Dean, or our other financial advisors’ mindsets when meeting with our clients and prospective clients. It’s the same thing with our CPAs, estate planning specialists, risk management specialists, and investment specialists. We come together as a team to serve our clients.

Until we know what’s important in a person’s life, we can’t discuss what your money should do. That’s really where I think it all begins. This is the most important part of the financial plan. If this isn’t done right, everything else comes in after this. You might have somebody that can manage your money, but that’s just a piece of it.

There’s More to Life Than Money

Dean and Ken both belong to a nationwide CEO group called Vistage. There was a speaker at their Vistage group who was talking about living a fulfilling life. It focused a lot on what Ken and Dean have talked about.

“He went through a survey that was similar to what Schwab did, but it only surveyed people who were in hospice, and it asked them about their regrets. Not one person said, ‘I wish I had more money in my bank account right now.’” – Dean Barber

Other regrets included not working at the job that they really wanted to work at and not spending the time that they wanted to with their kids or grandkids. It was all personal things that would have fulfilled their life more.

“We’ve seen so many times where people have the financial wherewithal to do everything that they want to do but didn’t know what until they went through the planning process. Once they get through that planning process, they’ve identified with their financial advisor what’s important to them and how much their desired lifestyle going to cost them. Then, the plan validates if they can or can’t do all those things. Maybe there’s a trade off. But in most cases, people can do all the things that are important to them.” – Dean Barber

Giving with Warm Hands

If leaving a legacy is a big part of your plan, there’s one more thing we want you to consider as we finishing defining true wealth. You can always leave a legacy by leaving money behind you your children, grandchildren, or favorite charities. But you can give with warm hands too, meaning that you can start gifting money and watch your family members enjoy it (or better yet, maybe you go on a trip with them and enjoy it with them) or your favorite charities benefit from it.

Doing that can really bring the meaning of true wealth to your life. However, if you don’t have a plan that gives you clarity that you can give with warm hands, how else are you going to know that you can do so and confidently get to and through retirement.

Discussing True Wealth with Our Financial Advisors

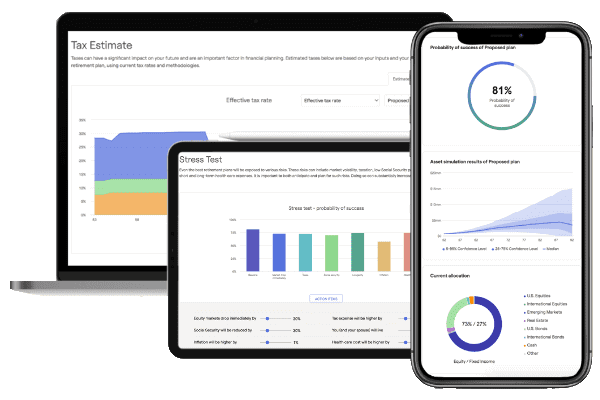

We hope that this discussion has helped you to better understand how to go about defining true wealth. Now, it’s time for you to really understand it on a personal level by building a financial plan and working with a team of professionals. One of the things you’ll see from using our financial planning tool is that you need to define your retirement goals. Start building your goals-based plan by clicking the “Start Planning” button below.

We’ll review your plan to help you see where you’re at, but better yet, have a conversation with one of our CFP® Professionals to begin learning what true wealth means to you on a personal level. You can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. We can meet with you in person, virtually, or by phone. It’s our goal to build you a plan that helps bring you more confidence, freedom, and time leading up to and through retirement.

Resources Mentioned in This Article

- What Is Wealth? 4 Types of Wealth

- Retiring with $1 Million

- 8 Tips on Saving for Retirement

- Optimizing Your 401(k) for Retirement with Drew Jones

- Rules for Inherited IRA Distributions – What Are the Latest Changes?

- Starting the Retirement Planning Process

- Your Retirement Lifestyle: What Do You Want Your Retirement to Look Like?

- Family Financial Planning with Matt Kasper

- The Guided Retirement System

- Couples Retirement Planning: What You Need to Know

- DIY Retirement Planning: What Can Be Overlooked?

- 9 Items That Retirement Calculators Miss (That Our Tool Doesn’t)

- Asset Allocation vs. Tax Allocation

- What Is Tax Planning?

- Meet Modern Wealth Management

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC, does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.