Mortgage Rates and Interest Rates on the Rise

Key Points – Mortgage Rates and Interest Rates on the Rise

- The NASDAQ 100 Enters Bear Market Territory

- If/When Could We Go into a Recession

- Assessing Where the Fed Funds Rate Could Be by Year’s End

- Pressure on the Bond Market

- Looking at the 30-Year Mortgage Rate Forecast

- 4 minutes to read | 8 minutes to listen

April showers tend to bring spring May flowers, but in the financial world, the forecast is filled with more market volatility. Dean Barber looks at the latest developments with interest rates, the bond and stock markets, and 30-year mortgage rates.

Get a Complimentary Consultation Subscribe on YouTube

What Can We Expect Next with Rising Mortgage and Interest Rates?

As we’re recording this on April 27, I want to reflect on the wild ride that we’ve had so far this year. I’m going to talk about what’s going on with interest rates, the 10-year treasury, and the inverted yield curve that I talked about in March. I’m also going to talk about 30-year mortgage rates and the stock market in our Monthly Economic Update.

First, A Look a Year-to-Date Market Performances

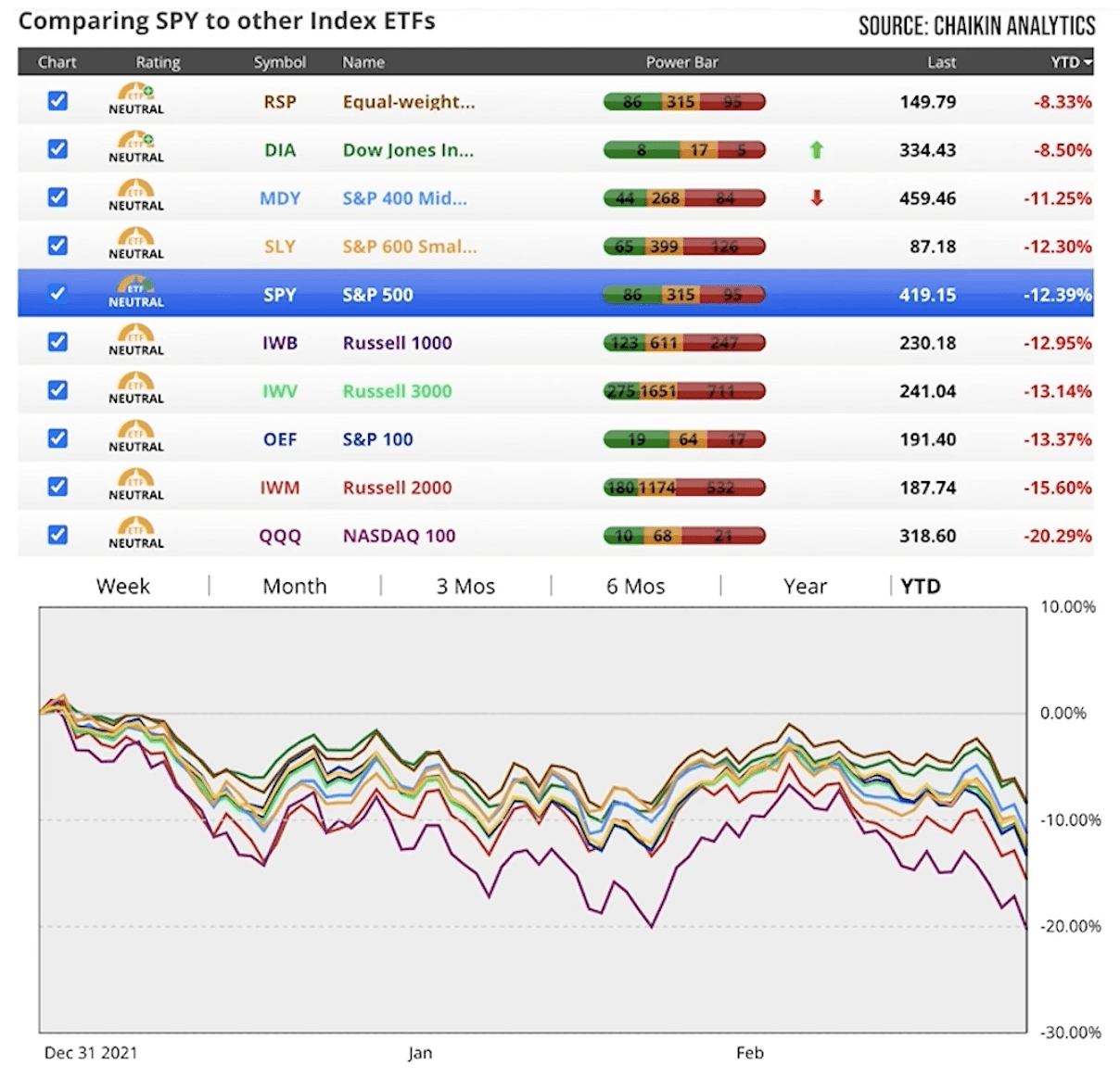

Let’s start with a year-to-date look in Figure 1 on what’s happening with the major indexes.

FIGURE 1 | Comparing SPY to Other Index ETFs | Chaikin Analytics

The best performing index year to date is the RSP, which is the S&P 500 equal weight. It’s -8.33%. The S&P 500 is -12.39%, while the NASDAQ 100 is the worst performing index year to date at -20.29%. At its low point, the NASDAQ 100 has been much down as much as 23% from its all-time high on November 22, 2021.

There isn’t any index that has gone unscathed so far this year. Many of the indexes in Figure 1 are also eclipsing or going below the low point that was set back in late January.

Signals of a Bear Market

A lot of times when you’re heading into a potential bear market, one of the things that you’ll notice is that you’ll get lower highs and lower lows. When you start getting lower highs and lower lows with all the volatility out there, that means there’s still downward pressure on what’s happening in the markets. The question becomes, what is causing this downward pressure?

Well, last month, we talked about the inverted yield curve. The two-year treasury was yielding higher than the 10-year treasury. Every time since the 1970s that that has occurred, a recession has also occurred within six to 18 months. I don’t believe that we’re heading for a recession this year, but nobody has a crystal ball. There’s no way to know for sure.

To meet the definition of a recession, the economy needs to have negative GDP for back-to-back quarters. Right now, we’re not seeing the threat of negative GDP. We’re seeing a deceleration of the growth in the economy. We’re still seeing growth. The forecasts are still slowing growth through 2023, yet on a decelerating timeframe.

The issue is, what is the Federal Reserve doing? It’s been all over the news that the Federal Reserve raised rates by 0.25%. They’re projected to raise rates by another 2.25% to 2.5% by the end of the year. That would send the Fed funds overnight rate up to 2.5% to 2.75% by year’s end.

Being Aware of Your Bond Market Holdings

That has wreaked havoc with the bond markets. At one point this year, the bond aggregate was down about 9%. It’s still around that number. Even some of your mortgage-back securities and senior-secured debt are trading slightly negative this year. That’s because of the pressure that has been put on bonds. I would encourage you to talk to your advisor so you can understand what is happening in the fixed income market.

Generally, the bond market is a stay-rich investment while the stock market is supposed to be a get-rich investment. But from time to time when you see that interest rates are doing what they’re doing, you need to take a second look at the bond market. You need to understand what happens if you hold those bonds, bond ETFs, or bond funds for a long period.

Once you understand that, it can give you a little bit more comfort on why bonds are still a critical part of your portfolio. During times like this, it’s important to know that you can be more dynamic and don’t have to hold the same thing through all market cycles.

Looking at the 30-Year Mortgage Rate Forecast

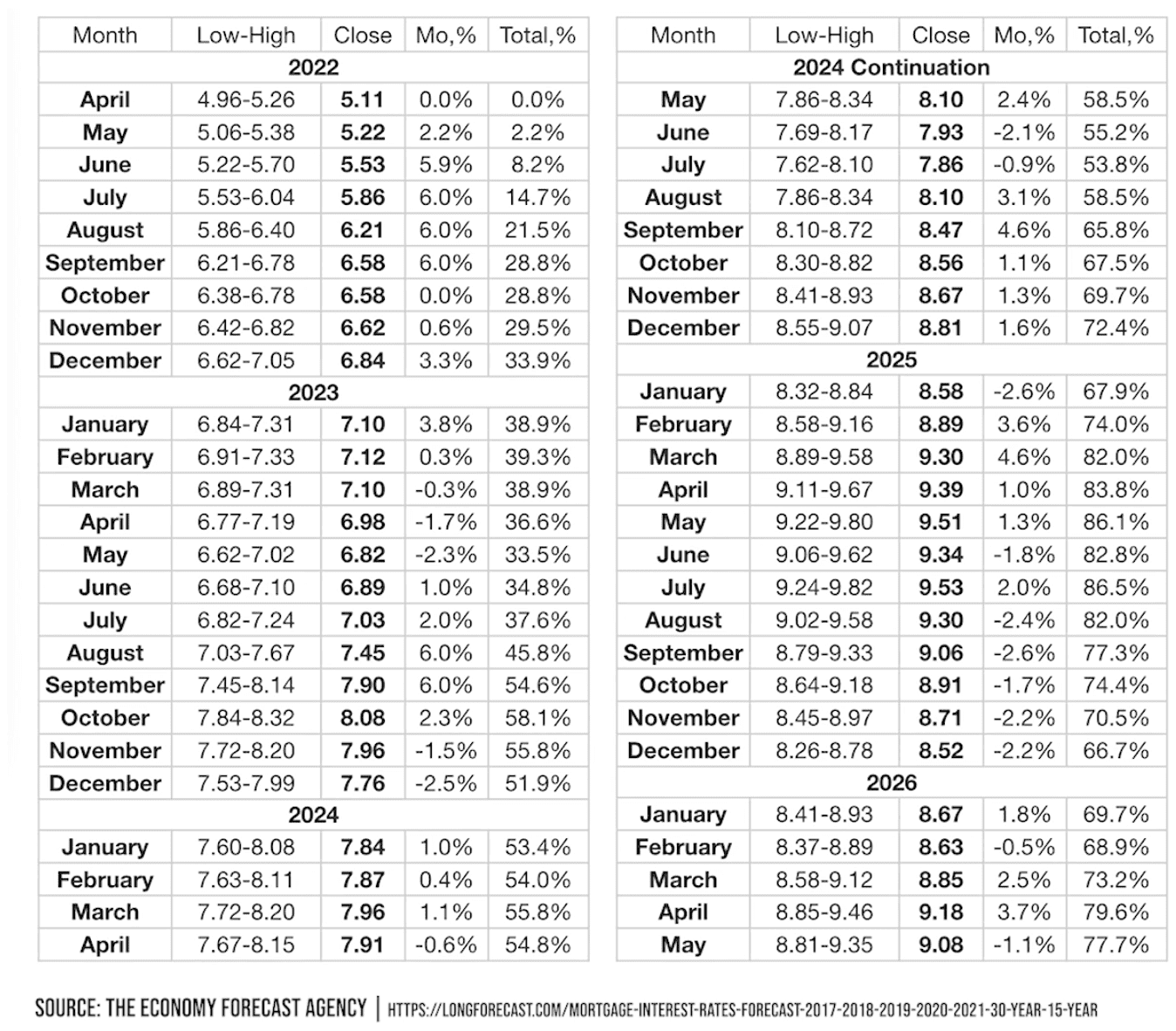

Speaking of interest rates, I want to talk about the 30-year mortgage rates. Let’s look at this in Figure 2.

FIGURE 2 | 30-Year Mortgage Forecast | The Economy Forecast Agency

The 30-year mortgage rate is already 2% higher than it was at its low point last year. In Figure 2, we’re looking at what The Economy Forecast Agency’s forecast is for 30-year mortgage rates. In April, they were looking at mortgage rates to be around 5.11%. Well, it’s around 5.2% to 5.3% depending on what lender you go to.

They project that to continue increasing through the end of the year. Their projection for the 30-year mortgage by the end of the year is in the range of 6.62% to 7.05%. The median of that would be 6.84%. That projected increase goes through next year with a median of 7.76% in December 2023.

If we look ahead to 2024, they’re forecasting 30-year mortgage rates at 8.81% by December 2024. They’re projected to peak at 9.53% in July 2025 before beginning to flatten or decline.

Obviously, this is a long-range forecast with what 30-year mortgage rates are projected to do. It wouldn’t surprise me to see those 30-year mortgages in the 6% to 6.5% range by the end of the year. It could even be the 6.84% that they’re forecasting.

This Is Different than the Housing Market of 2008

One thing is for certain is that this will slow the housing market a lot. A lot of people aren’t cash buyers. These higher interest rates will cause mortgage payments to be much higher than what they’ve been in the past. At the same time, there’s a lot of demand.

We’re not looking at a scenario like what we saw in 2008 where we had speculation and a lot of bad loans. There were a lot of subprime loans and interest-only loans. People were borrowing 100% to 120% of the value of the home.

We have a shortage of homes on the market right now. That has fueled the home prices along with the low interest rate environment. Home prices have increased very rapidly. Only time will tell, but I think what these rising interest rates will greatly slow the increase in housing prices. It could start to cause housing prices to stagnate and potentially decline over the next 18-24 months.

As Volatility Continues, We’re Here to Help

All that being said, we do anticipate that the volatility will continue. We also think that there is a very good possibility that the equity indexes finish the year in positive territory. We’ll keep a close eye on things.

We encourage communication between you and our financial planners at Modern Wealth Management. If you’re not a client, you can schedule a 20-minute ask anything session or a complimentary consultation with one of our CERTIFIED FINANCIAL PLANNER™ professionals. You can meet with us in person, by phone, or virtually. With that, I want to thank you for joining me for our Monthly Economic Update.

Schedule a Conversation

Click below to select the office you would like to meet with and check the calendar. We can meet in person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your conversation.

Get a Complimentary Consultation

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.