5 Retirement Planning Tasks for a Better 2022

Key Points – 5 Retirement Planning Tasks for a Better 2022

- A Quick Recap of 2021

- Increasing Your 401(k) Contributions and Then Rebalancing

- Adjusting Your Tax Withholding

- Consider Refinancing Your Mortgage and Shopping Your Property and Casualty Insurance Policies

- Other Things to Think About in 2022

- 19 minutes to read

A Quick Recap of 2021

Dean Barber: Thanks so much to those who join us on America’s Wealth Management Show. I’m your host, Dean Barber, along with Bud Kasper. We’re going to talk about five retirement planning tasks for a better 2022. But first, let’s just have a brief conversation about what happened in 2021. Last year was the better years in the stock market that we’ve seen in a long time. Of course, that was right on the heels of 2020, which wound up being a solid year for the stock market as well.

The S&P 100, the S&P 500, and the NASDAQ composites were right around 27% total return for 2021. The small-cap came in on the tail end at about 13% and the Dow Jones Industrial Average was around 18%. There were solid numbers across the board.

Bud Kasper: The bond market did hurt returns this year, but that’s to be expected after coming off the emergence of COVID when bonds were the greatest place to be in the world. As we move into this new year, though, let’s look at what the Federal Reserve has on its plate. I think we’ll see three rate increases this year with the first one coming in late spring. We’ll see what happens, but nonetheless, bonds are going to be challenged again this year. Finding safety inside the portfolios will be challenging.

Dean Barber: Our theme for January is getting organized. This is a great time to get organized because everybody’s favorite time of year is coming right up and that’s tax time. We’re going to start getting all our 1099s, W-2s, and dividend and interest statements and gathering information. That brings us to Item No. 1 of our five retirement planning tasks for a better 2022, which is increasing your 401(k) contributions.

For those of you that are still working, this is a great time. Usually people get their raises toward the end of the year. You know what your new salaries are going to be. Let’s take a part of that and increase those 401(k) contributions.

1. Increase Your 401(k) Contributions

If you enroll in your company’s retirement plan, you’ve already taken a big step toward having a more secure retirement. For 2022, the contribution limit for employees in a 401(k) plan is $20,500. If you’re a worker over the age of 50, you’re allowed an additional $6,500 in savings (called a catch-up contribution), potentially bringing your annual contribution limit to $27,000. Vanguard released data in 2020 on how Americans save for retirement and found that of its customers, “only 13% of participants saved the statutory maximum…”

Even if you cannot save the maximum allowable amount in your 401(k) plan, a good habit is to increase your contributions over time. Some plans have an automatic contribution escalation feature, meaning every January, they will automatically deduct an incremental percentage from your paycheck and save it to your 401(k) account. Even if your plan does not offer this feature, you can manually adjust your savings at the start of each year.

An additional savings of 1% of your paycheck may not seem like it would make a big difference, but the more time you have until you retire, the more significant the impact will be. Chances are you probably will not notice the reduction in your take-home pay very much, if at all.

Sacrifice and Saving Go Hand in Hand

Bud Kasper: There needs to be some sacrifice when it comes to saving. Some more than others, but absolutely. Keep the future in mind and maxing out those, especially if you’re over 50 and get that extra $6,500 you can contribute.

Our CPAs were so busy at the end of the year with Roth conversions. I think we’ve done an incredible job of getting that message out to our clients that this is a good way of getting Uncle Sam out of your life by moving money out of a traditional IRA and going over to a Roth IRA. You must pay the tax, but that’s the last tax you’ll pay on that money. That’s significant.

Our CPAs were so busy at the end of last year. Now they’re going to have a little bit of reprieve and then it’s back in action to get ready for tax time. Tax consequence and comprehensive financial planning is a critical way of getting long-term success.

Roth or Traditional?

Dean Barber: I’m glad Bud brought that up. When you take a step back and think about increasing your 401(k) contributions, it’s also a good idea assess where you’re putting your money into that 401(k). Does your 401(k) offer the option for a Roth contribution? If they do, you should figure out whether to add to the Roth or Traditional portion of your 401(k).

The only way to get the correct answer on that is by going through and completing a comprehensive financial plan. We use our Guided Retirement System™ to determine that, but the answer is going to be kind of a riddle because you need to know what your tax rate is. What do we anticipate the tax rate is going to be in the future when you’re taking the money out? What is the effect of tax deductions that you’re getting now versus getting tax-free or taxable income in the future?

Put that into the financial planning program to get the correct answer on where you should be saving inside that 401(k) and increase those contributions now. Let’s make that something that happens.

Maximum 401(k) Contributions for 2022

For 2022, your 401(k) plan allows you to contribute up to $20,500. If you’re over 50, you can add an additional $6,500 bringing your maximum contribution limit to $27,000.

Start looking at what you have going into your 401(k) plan and increase those contributions. Once you know that you have that contribution increased and want to find out should you be doing traditional or Roth, this is where one of our CERTIFIED FINANCIAL PLANNER™ Professionals can help you. We can visit with you by phone, do a virtual meeting, or meet in person.

I also encourage you to check out our 401(k) Survival Guide and our Retiring with $1 Million video. The video does a great job of showing you the power of some financial planning techniques and how much of a difference that can make in your future.

2. Rebalance Your 401(k)

That brings us right into our second of five retirement planning tasks for a better 2022, which is rebalancing your investments. I think it’s our number one challenge. Rebalancing your investments is critical right now.

If you had a large amount of stock market investments in your account in 2020, you may have felt like you were on a roller coaster ride. Suppose you aren’t using a target-date fund and not regularly rebalancing your investments. In that case, your current investment allocation could look a lot different than it did when you initially chose those investments.

Rebalancing Example

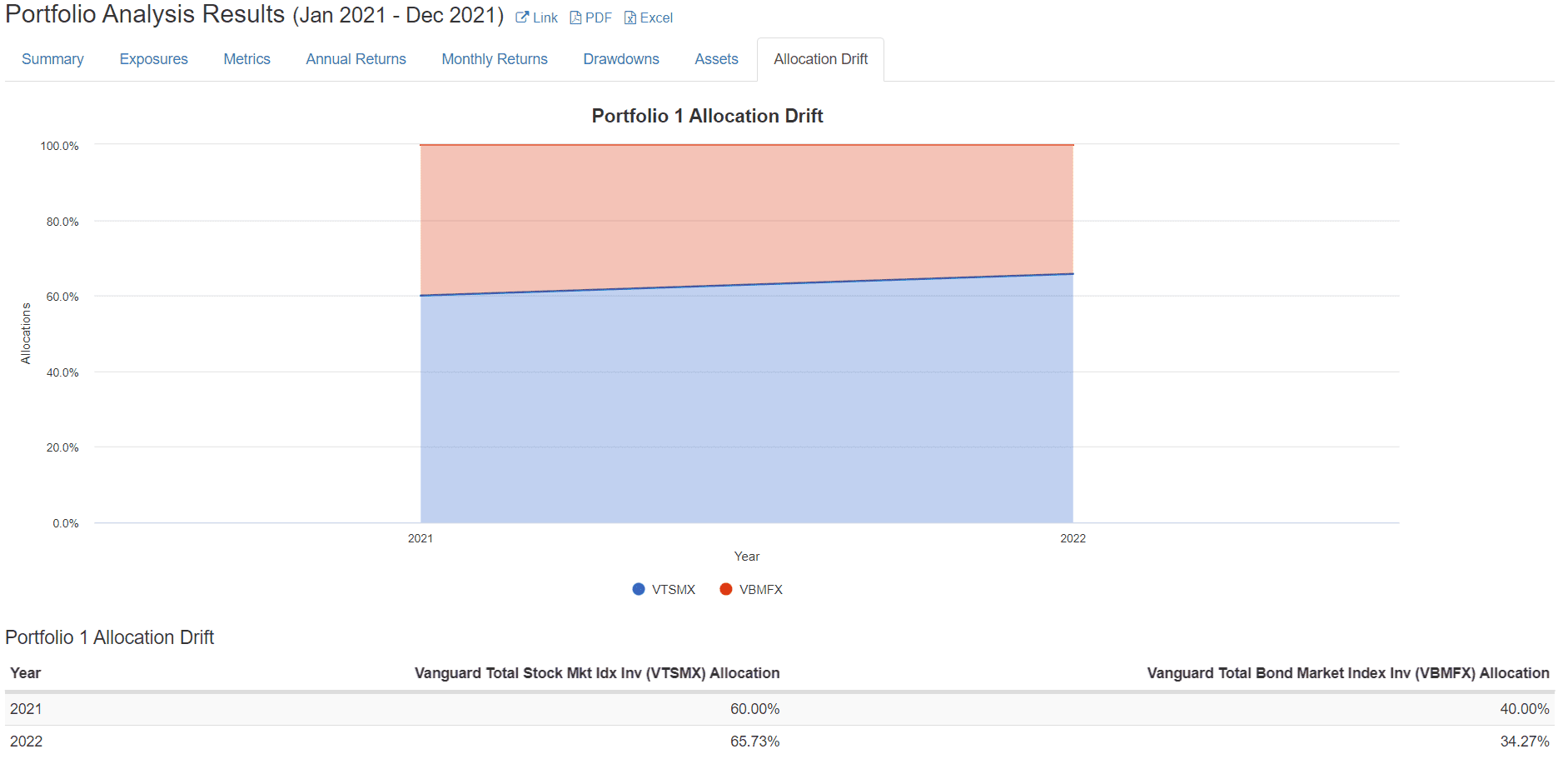

For example, let’s imagine you rebalanced your account on January 1, 2021, so you have a mix of 60% stocks (we’ll use the Vanguard Total Stock Market mutual fund as a proxy) and 40% bonds (using the Vanguard Total Bond Market mutual fund as a proxy) and have not rebalanced since.

You’re making a monthly contribution of $1,500 over that time, with exactly 60% going to the stock fund and 40% to the bond fund. However, with the wild ride in stocks, you look at your statement today to find almost 66% of your account is invested in stocks! That’s a drift of almost 10% of your original allocation).

(Source: portfoliovisualizer.com)

This could become an issue the next time the stock market declines, as you may experience a sharper drop than you expected. It’s good practice to rebalance your 401(k) regularly. As your stock investments have greater long-term returns than your more conservative bond investments, consider shifting some of those gains over to the bonds. Conversely, if you find that it’s time to rebalance and the stock market is in a period of decline, you’d shift money from your more stable investments into the underperforming investments. This can be difficult to do in practice, as it’s mentally tough to sell something that’s doing well to buy something that isn’t. As long as your overall investment strategy aligns with the overall financial plan you have, rebalancing can be a useful technique.

Why You Should Consider Rebalancing

A lot of people are saying their bonds didn’t do anything last year and were a drag on their portfolio. So now they’re hearing us talk about rebalancing and selling what they’ve got in equities and putting it over into a piece that’s not doing very well. What’s your strategy right now, Bud?

Bud Kasper: I’m not sure I have the answer, but bonds are a drag until they aren’t. And that’s going to be based upon events that are taking place. The biggest issue that’s facing us right now is inflation. You want to have your portfolio keeping up with inflation. Traditional bonds aren’t going to provide that unless we have a calamity. That would change the direction of the Federal Reserve suggesting instead of having three increases that they don’t do anything.

For most people who are looking at rebalancing, you should be taking your profits and redistributing money among other types of investments. But as I said before, this is a challenging year because traditionally we’d go back into the bond market and then move forward from there. This year, you’re going to have to be much more selective and think about how to counter a fall in the stock market if that were to happen.

We’re Happy to Help You with Rebalancing

Dean Barber: No question about it. We can’t just look at the total bond market index and say, ‘That’s going to be our space.'” We’ve got to look at other parts of the bond market. We’re happy to visit with you about our ideas behind the fixed income area.

When you’re going through and rebalancing, which is the right thing to do, what are the alternatives on the bond side of how you should be rebalancing? Getting that right and making sure that you’ve always got that safety component with inside of your investments—whether they’re inside your 401(k), IRA, or taxable accounts—doing that properly is a key component to controlling risk. Is there anything else you want to talk about on rebalancing, Bud?

Bud Kasper: No. Except for the fact that it needs to be addressed. Don’t just put this off and say, “I’m going to let this run. It’s made me so much money over the last 24 months.” You can’t take that approach either.

Dean Barber: You definitely can’t. That’s what we call greed. Our two strongest emotions are fear and greed, but we don’t want to let those drive our investing decisions.

3. Adjust Your Tax Withholding

Let’s move on now to our third item for retirement planning tasks for a better 2022. This is a good time to adjust your tax withholdings.

Each year when you file your tax return, do you expect to get a large refund? Most people that are filing their tax return get an average refund of $2,725. While it might seem like a pleasant surprise to get a check like that in the mail, these tax filers have been loaning the IRS their hard-earned money and not getting any interest on that loan! With a bit of planning done properly at the beginning of the year, you may be able to increase your monthly take-home pay.

You could use that money throughout the year to save more for future expenses, pay down debt, or purchase things you’d find some enjoyment from. If you regularly receive a large refund from the IRS (or, if you usually write a large check when you file your tax return), you might consider making adjustments to your tax withholdings throughout the year. Or if you’re still working and are a W-2 employee (you get a W-2 form each January used to report your earnings from work), you can use the IRS Form W-4 to increase or decrease your withholdings from each pay period.

And if you’re a single tax filer with a single job, the form is straight-forward enough. If you are a married tax filer or have multiple jobs, the IRS provides a tax withholding estimator, which will help you calculate the amount you should instruct your employer to withhold from your paycheck.

Finding Your Probability for Success

Bud Kasper: Even 1% makes a difference when you’re trying to compound that over the years. With the Guided Retirement System™, we can show what your probability of success is. That success is going to be based on the person, not what we’re talking about in terms of what their anticipation is and the amount of income that they’re going to need to live on. It’s better that you find out now so you can adjust earlier.

That’s why we’re making the comments about maximizing your 401(k) contribution. Even though it might make sense to do the pre-tax contribution in the long run, I don’t think that pays off most people when they reach retirement age. Therefore, I prefer doing the Roth option if it’s available. Most plans do have a Roth option now.

Why Give the IRS Your Money with No Interest?

Dean Barber: Most of them do. Bud is right. I can’t think of any that I’ve run into recently that do not have the Roth option. Let’s talk about this adjusting your tax withholding thing because a lot of people like getting that refund. To me, it’s like you’re giving the IRS or the government your money all year long with no interest. You should be using that.

I think that’s one area that people can use a part of what that normal refund is and increase their 401(k) contributions by a portion of that. Then, adjust your withholdings a little bit so you can free up a little cash to take and aside. It requires a little bit of discipline, but you should be in control of that money all year long, not the IRS.

Bud Kasper: Yeah, perfectly stated. If you’re getting money back at the end of the tax season in the spring, you’ve done something wrong. You could be using that money that you let Uncle Sam have for nine months or whatever the case may be and it made that additional contribution to your 401(k). That compounded benefit over the years does magical things when it comes to retirement planning.

Dean Barber: Absolutely. Bud and I are both on the same page when it comes to that. I don’t want a refund. I wouldn’t mind owing just a little bit whenever I get my taxes filed. But last thing I want to do is overpaying throughout the year. That’s exactly what’s happening when you get a refund. That means you overpaid your taxes through the year.

Reap the Benefits of a Forward-Looking Tax Plan

This leads into why forward-looking tax planning is important. You should be sitting down with your CERTIFIED FINANCIAL PLANNER™ Professional and your CPA together and going through these types of things on a regular basis.

We recommend the fall as the time to dive in and do the tax planning. That’s the time of year when we would normally discuss what happened last year and what we anticipate is going to happen this year. Let’s plan for next year and review the adjustments that you need to be make and some strategies that you can employ to help mitigate those taxes for the long-term.

The key is how you plan your savings and income strategies in retirement while you’re working and then to get to retirement so that you can pay as little tax as possible over your lifetime. It’s not looking at it in just an individual year. If you live in the United States and have money or make money, taxes are going to be a fact of your life. That’s why the longer-term strategy is important.

Bud Kasper: Absolutely. Once people understand how a coordinated plan accounts for what the future need is, then you’re going to finally realize the impact that comprehensive planning can do for you.

Dean Barber: One of the greatest tools that we have to get you organized is our Retirement Plan Checklist. It gives you 30 different checklist items, plus a timeline of things that you need to be doing at certain ages and at certain times before and after retirement.

4. Consider Refinancing Your Mortgage

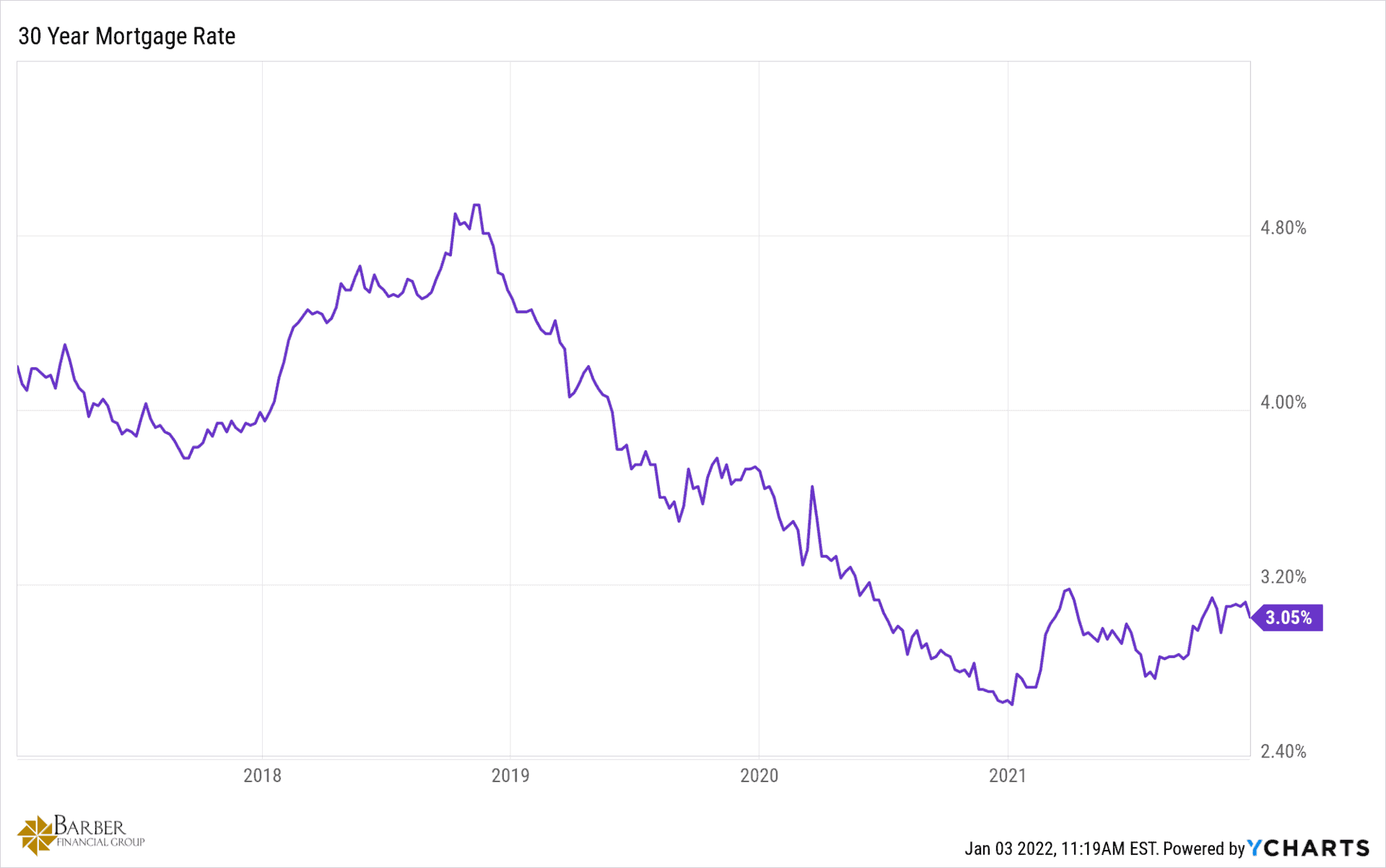

Moving on to the fourth of our five retirement planning tasks for a better 2022, we still need to consider refinancing your mortgage. For the better part of a decade, we’ve heard that you should refinance your mortgage to take advantage of lower rates. After all, they are bound to go up one of these days. (Right?!) For now, though, rates have kept dropping.

In fact, banks have been inundated with homeowners looking to refinance their mortgages to lower rates. The amount of refinanced loans as a percentage of the total amount of new mortgages is as high as it has been since early 2013. If you haven’t looked into refinancing your home mortgage in a few years, it may be worth looking into. However, just because you may be able to lower your monthly payment by a couple hundred dollars, keep in mind, there will be closing costs associated with your new loan, which may push your break-even point out a few years.

A History of 30-Year Mortgage Rates

Let’s look back to late 2018 when we had the 30-year mortgage right around 5%. Going back even further into the early to mid-1980s, mortgage rates were double digits. Back then, we would’ve said that a 5% mortgage rate would be amazing. Before COVID hit in January 2020, mortgage rates were at about 3.8%. Once COVID did hit, we got all the way down to about 2.7% in January 2021.

Today, those 30-year mortgage rates are at 3.05%. I would argue that anybody who has a mortgage rate higher than 3.05% to seriously consider refinancing that mortgage.

Bud Kasper: That’s just money in your pocket. The phenomena that we’ve had at the housing market with people bidding and competing against each other and the turnover in real estate has been absolutely off the charts.

Rising Interest Rates on the Horizon

That is all related to these low interest rates that have been perpetrated by the Federal Reserve. They’re going to raise rates this year. I don’t think there’s any doubt about that. And that’s going to be counter to inflation.

Remember, low interest rates are dictating how much house people can buy. In many cases, people are buying much larger and expensive homes, but the price to pay on that, meaning the mortgage rate itself, is low enough that they all get away with it.

Dean and I also remember that no more than a decade ago that people were buying real estate hand over fist. That ended up being a catastrophe when we saw value start to drop. That’s the other side of the picture associated with this, but the interest rates are still low and housing will probably still continue to do pretty well.

Not All Debt Is Bad Debt

Dean Barber: Let’s talk about this idea of refinancing if you are nearing retirement or in retirement. The thing is that there’s a lot of people that are of the opinion that any kind of debt is bad debt. I don’t happen to be a person who believes that. I believe that there’s good debt and I believe there’s bad debt.

I’ll share a quick story about a client of mine who’s 72 years old. He and his wife are in the process of refinancing. In fact, they did it last year. He was asking for my guidance and counsel on whether he and his wife should refinance. They’re at about a 4% interest rate currently, so getting that interest rate down below 3% when they did the original refinance was a big deal.

He wanted to take this to a 15-year mortgage. In doing so, it was going to cut into his spending a little bit. I said, “Why would you do that? What’s the hurry to pay this thing off if you’re going to be under 3% on the mortgage? Let it go for 30 years. When you pass on, I know your children are not going to keep the house. If there’s a little debt on it, big deal. What we’re concerned about is your ability to do the things that you want to do throughout retirement.”

In that scenario, it comes all to cash flow. What is the free cash flow that an individual household can have to do the things that they wanted to do? If you encumber yourself with a heavier payment because you’re trying to pay something off quickly when interest rates are this low, I just don’t think that make much sense.

Controlling Your Cash Flow

Bud Kasper: It doesn’t. That was good advice Dean gave to that gentleman. Take the lowest rate and if you want to pay it off, then pay it off. I’d rather do it that way at a low rate and know that if I don’t want to pay it off, I go back to the 3% in the example that Dean was using.

Control your cash flow yourself. If you have surplus money at the end of the month or the quarter and think it would be a good opportunity to pay down more of your mortgage, that’s fine. But don’t do it while your mortgage rate is at 4%. Do it while the rate is at 3%. That was good advice.

Dean Barber: This individual has enough money that he could just pay the house off anyway. But when we look at the scenario of his underlying investments and the average return that he’s achieving over the last decade, it means he’s achieving far more than a 3% mortgage interest is being charged. So, why would you take an investment position and sell it to pay that off when you can refinance and use somebody else’s money? We call it other people’s money.

The 10-year treasury today is around 1.65%. Think about its position. How much money would you want to borrow to go do with it whatever you wanted to do at 1.65%? If you could borrow as much money as you wanted at 1.65%, would you say you don’t want it or ask for as much as you can to take it, invest it, and earn a lot more than 1.65%?

Bud Kasper: That’s right. Of course, there’s the rub associated with where to go and how much risk there is to take with that. But on a pure, fundamental mathematical position, Dean is right. That’s inexpensive money to secure for yourself.

Dean Barber: This is one of those times when I’d like to be the government. Let me borrow that money. But really you can think about it in a similar format when you’re thinking about refinancing your mortgage. So, take a look at that and see if that makes any sense.

5. Shop Your Property and Casualty Insurance Policies

Finally, our fifth retirement planning task for a better 2022 is shopping or reviewing all your property casualty insurances. Reviewing your property casualty insurance at least every other year is a great idea.

Even if you won’t always need to make a change to your existing coverage, it’s a good idea to be comparing rates on your property and casualty insurance policies every two or three years. Darren Newell, an insurance advisor, suggests that if you are working with an insurance broker, they should be shopping for you every year if the rates on your current coverage jump by 8% or more. An independent insurance agent may be able to take a lot of the work off your shoulders. If you feel inclined to work without an agent, remember that you’ll need to not only be on the lookout for the best rate but make sure that the coverage you are paying for will be adequate to insure your property.

Getting a Checkup

It’s like going to the doctor and getting a checkup. Look and see what else is out there. Are there any other companies that could give you better rates? Do you have the exact right coverage? Are you overpaying? Do you have too little coverage? Reviewing that just makes sense from a good risk management of perspective.

Bud Kasper: Absolutely. We sometimes lock in these things and forget about them because we feel like we covered ourselves with having some insurance in case something screwy happens. What if a guy delivering some sort of a gift to your front door falls and breaks his neck or whatever. You need to be covered with that. It’s a necessary part of life to be covered from that perspective. But once again, are you overpaying for what the benefit is in terms of the coverage?

Dean Barber: I like to go through it at least every couple of years just to make sure that I’m not getting gouged and that I’ve got what I need.

A Quick Review of the 5 Retirement Planning Tasks for a Better 2022

Before we touch on a few other things to think about in 2022, let’s review the five retirement planning tasks for a better 2022.

Number one, increase those 401(k) contributions. You can get up to $27,000 if you’re over 50. If you’re under 50, your maximum contribution limit is $20,500. Determine whether you should be going into the Roth or the traditional portion of that.

Number two is rebalancing that 401(k) plan. It’s probably out of whack right now due to the out performance of the stock market and the under performance of the bond market.

Number three is adjusting your tax withholding. Number four is to consider refinancing your mortgage. That’s still very attractive with rates around 3.05%. Finally, number five is making sure that you’ve got the right coverage when it comes to property casualty insurance.

Other Things to Think About in 2022

As I mentioned earlier, I believe we’re off to a good start in the markets this year. It’s a good start for the Dow Jones Industrial Average and the stocks that are inside that. The S&P 500 is trailing a little bit behind the Dow Jones Industrial Average so far this year. The NASDAQ composite, the tech heavy NASDAQ, seems to be the one that is really trailing those indices right now. What do you make of that?

Technology Will Continue to Thrive

You read around the financial circles and see it’s this fear of interest rates going up or the over-heating economy is going to hurt the technology stocks. Bud and I think that technology is not going anywhere. The best technology companies are going to continue being global leaders and have amazing profit margins. I think they should be a part of somebody’s portfolio.

Bud Kasper: I totally agree. We have clients positioned in that sector as well. There was a nice Santa Claus rally at the end of the year. We predicted that back in September. It was purely guesswork, but nonetheless, it did come through. I think what everybody’s asking now, and this is such a legitimate question, is whether the portfolio they had on December 31, 2021, will be good in 2022.

You better really think hard about repositioning your assets as we move forward. It doesn’t have to be radical. Remember what just happened this past week. Apple went over $3 trillion of valuation, which is unbelievable. You look at Apple, and then Microsoft and Amazon, which are over $2 trillion, and it’s incredible what these American companies have done.

Dean Barber: Did you know that Warren Buffet said that his Apple position made him $120 billion, making it his best idea ever?

Bud Kasper: Is that right? I wonder how long he had to think about that.

Dean Barber: $120 billion is his profit on the positions that he has in Apple stock.

Technology Is a Constant Disruptor

Bud Kasper: Yeah. And Berkshire Hathaway, of course. The one thing that I like about technology is that it’s a constant disruptor. What I mean by that is there are so many things being brought forth in technology that are life-changing events. Technology sectors will always be attractive. That doesn’t mean that you can’t have sectors such as technology that can get overvalued from time to time, but the proof in the pudding is where the earnings are.

Also, look at dividend-paying stocks and what the Dow Jones did this past week. It showed some incredible strength in comparison to the S&P 500 and the NASDAQ, which would tell you that maybe the old fundamental companies that are in the Dow might be representing a client’s best interest as we move forward and start to move away from some of the more go-go type of investments that we’ve had in the past. I don’t have an answer for that, but I think it’s something worth looking at.

The Dow Is on the Rise Right Now

Dean Barber: The Dow underperformed the S&P and NASDAQ by about 8% in 2021, but that started to turn around in December. The Dow was among the best performers, up about 5%. On the other hand, the NASDAQ was up about 1% and the S&P was up about 2.5% to 3%. We’re seeing that come out into the first part of this year.

For the first time in a long time, when we look at the sectors that are moving the best, the Dow Jones Industrial Average comes up there. Bud is right that it’s time to maybe rethink things a little bit and do some repositioning. In fact, we added the Dow 30 component to many of our portfolios on January 1. We think that it is going to provide some extra support moving forward.

Investing Needs to Be Dynamic

When you think about investing, it needs to be dynamic. Not only does it need to be dynamic, but it needs to be tailored to a person’s individual situation. Bud and I know that when we’re taking somebody through our financial planning process, our Guided Retirement System™, we don’t first ask how much risk you want to take.

We want to figure out what a person’s long-term objectives are and the resources needed to meet them. By going through our entire financial planning process, we can come up with what we call your personal return index. That’s the return that you need to make to accomplish all the things financially that you want to accomplish. Then, we can go back and ask the question, how do we achieve that personal return index and do it with the least amount of risk possible?

Don’t Get Complacent with Your Portfolio

You might get lulled into some false sense of security and think these markets are great and whatever happens, the Federal Reserve and government are going to be right there to bail us out. They bailed us of COVID so quickly that it was one of the fastest bear markets and recoveries that we’ve ever seen.

I don’t think that people should be getting complacent right now. We did have a couple of good years. However, what that probably means is that if your goals haven’t changed substantially, you can now reduce some of the risk within your portfolio and still accomplish your financial objectives. That’s a reason to step back and review the overall financial plan to make sure that your portfolio is in line with your long-term objectives.

It’s All About Reducing Unnecessary Risk

Bud Kasper: Simply stated, why take more risk than is necessary to complete your plan? Most people don’t have plans, so that’s not a relevant point until they make one and experience what it’s like. That’s why we share the information that we do and offer complimentary consultations without any obligation. Come in and talk to us and see what the Dickens we are talking about.

We can’t get complacent. Things are always in flux and change, so it’s up to us in the financial business from an investment and planning perspective to understand where the probabilities lie in terms of how we need to reconfigure portfolios moving forward and function around the personal risk score of the clients we represent.

Getting Clarity, Confidence, and Control

Dean Barber: That’s right. When you put that together and when go through the financial planning process, tax planning, and Social Security maximization, it changes the perception of that individual. Suddenly, they have clarity that they haven’t had before, which ultimately gives them confidence in their overall personal financial situation and puts them in control. That’s it: clarity, confidence, and control.

To get that clarity, confidence, and control, I invite you again to look over our Retirement Plan Checklist and the 401(k) Survival Guide. You can also watch our educational videos and sign up for the Modern Wealth Management Educational Series.

We appreciate everyone for joining us on America’s Wealth Management Show. I’m Dean Barber, along with Bud Kasper. Stay healthy, stay safe. We’ll be back with you next week, same time, same place.

Set Up Your Retirement Plan for a Better 2022

2021 was quite the year with many ups and downs. Setting yourself and your retirement plan up for a better year in 2022 is a great way to begin the year. Taking small steps toward securing your financial future is never a bad idea. If you want to talk about the future of your financial life, schedule a complimentary consultation below or give us a call at (913) 393-1000. We’ll discuss your goals and help you find clarity in your financial future.

Schedule Complimentary Consultation

Select the office you would like to meet with. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Lenexa Office Lee’s Summit Office North Kansas City Office

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.