Are You Fully Covered?

Understanding Property & Casualty Insurance

In this webinar, Darren Newell, Insurance Advisor, breaks down the intricacies of property and casualty insurance to address the question, “Are you fully covered?” The intention of the Are You Fully Covered? is to help people understand property and casualty insurance. What you need, and, just as important, what you don’t need in coverage.

Complimentary Consultation Share this Video

Darren Newell | (913) 275-2446

If you have questions about your insurance coverage and want to know if you’re fully covered, we can help. Give us a call at 913-393-1000 or schedule a complimentary below to get started today.

Video Transcript:

Hi, my name is Darren Newell, the property and casualty advisor here at Modern Wealth Management. Today, we will go in-depth with auto home and umbrella and give you some pointers and things to look at your current policies to discover if you are fully covered.

Your Home

We’re going to start first on the home, really probably protecting your largest asset.

Understanding Home Coverage

Coverage a is dwelling, the actual structure of the home. Coverage B is other structures, anything that is not attached to the house, like a shed, pool, or anything like that. Covered C is personal property. Coverage D is loss of use, and coverage E is personal liability.

Coverage A: Dwelling

Like I said, Coverage A is anything in the home attached structures such as garages.

The average cost of construction per square foot in Johnson County or the Kansas City area today is anywhere from 160 to $200 per square foot.

This can go up depending on the type of materials that you use inside your home. But for basis, we’d like to think around 160 to $200 per square feet, the average new home in America is 2687 square feet.

According to this study, the same home would cost about $400,000. To rebuild, this can go up as high as $300 per square foot.

Factors determine the value of this home. Greater materials used.

There are usually five different types of grades that we use today, economy, standard, above average, custom, and premium. When you’re talking about those types of grades, the economy will be anywhere from $140 to $150 per square foot.

Builders grade anywhere from $150 to $170 per square foot. And above and beyond up to about $300 per square foot.

Coverage B: Other Structures

Coverage B includes sheds, outbuildings, and fences on most policies. Typically, Coverage B is about 10% of coverage A. Now, this can go up and down. Take a look in your backyard. What is out there that is not attached to your home?

Standard policies automatically give 10%. Some insurance companies can increase or decrease that depending. Take a look at their coverage. If you’re up above 10%, or you’re at 10%, and you don’t have anything other than perhaps a privacy fence that maybe cost about $5,000 – perhaps that $40,000 in coverage is something you don’t need.

Coverage C: Personal Property

Personal property coverage is anywhere from 50% to 70% of Coverage A. If you want to figure out anything of your personal property, if you turn your house upside down, whatever fell out is your personal property.

When we’re talking about personal property, please take inventory of everything in your home. I recommend doing this about every year, taking a camera that you can upload onto a cloud or a zip drive, walking into every single room, opening up every single drawer, and taking pictures.

I promise you if there ever was a fire and you lose everything, you’re not going to be able to go back and remember. It also helps you when you’re talking to your insurance adjuster to show them what you do have and what you did not have because when you start replacing things, they’re going to question that.

So, it’s always great to have pictures of everything. I promise you. I couldn’t tell you every single t-shirt that I have in my closet, so I highly recommend doing this.

HO-3’s & the Most Common Perils

Standard homeowner policies are called HO-3 and include coverages on listed perils regarding personal belongings, some of the most common perils when I say perils are things that cause losses.

Typically, the most significant home claim is lightning or fire and then obviously wind hail or damage, damage caused by aircraft explosions, smoke damage, riots or civil disturbance theft, and vandalism in damage caused by vehicles.

Continuing our list, we have falling objects, volcanic eruptions, damage from snow, ice, sleet, water damage, water, heater cracking, tearing and burning, damage from electric current, and freezing pipes.

Actual Cash Value

When we talk about replacing those items, there are two things on your policy, especially in your home, that I want you to take a look at. The first is ACV, which means actual cash value, and then there is RCV, which is replacement cost value.

With ACV, for example, if you had a ten-year-old TV, there’s depreciation on that TV. If your policy’s actual cash value of that $5,000 TV back in 2010 might only be worth $1,000.

Now, so you want to make sure that your policy has replacement cost value. It does not cost a lot to increase your home premium to get replacement cost value.

Exceptions to Coverage Limits

Exceptions the coverage limits, certain high-value objects will not be reimbursed completely – for example, jewelry coverage. Say you own $20,000 jewelry, but standard insurance policies only cover up to the standard amount, such as $5,000.

Other examples include music instruments, certain electronics, and cash. To get the full value, you’ll need to purchase an endorsement from the insurance company to increase the limits on those objects.

Additional Living Expenses

This is when you have to move out of your home because it’s being repaired due to a kitchen fire or a tornado. Say you usually spend about $300 on groceries per month. Let’s say that you moved out, and you can no longer cook at home.

So you have to eat out every single day. So now your expenses go up to $500. That $300 that you usually spent, they’re not going to reimburse, but they will reimburse you for the extra $200 that you spend going out to eat every single week.

They also include hotel or rental home charges, food utility expenses, and additional car mileage. So if you’re driving, typically from your home five miles to work, but now you’ve been displaced 10 miles, those additional five extra miles will be reimbursed to you based on your homeowner’s policy.

Personal Liability Insurance Coverage

This one is important. Personal liability coverage provides a defense if you’re sued and pays damages to injured persons up to the limit of liability. This includes damages to property and medical payments.

I highly recommend that your homeowner’s policy has at least $300,000 in liability limits on this is a very litigious society. Anyone walking in your yard, anyone walking up to your doorstep, if they slip and fall, you are going to be held liable for that. But what happens if the injury damages extend the limits of liability?

For example, if you have $100,000 in liability, and the damages or injury goes above that, the remaining balance is out of your pocket. How can you protect the money that you’ve worked so hard for?

The Umbrella Policy

The umbrella policy where this comes in protecting your family assets is a top priority, so people have insurance. Personal umbrella insurance is a type of insurance designed to add extra liability to coverages above and beyond other insurance policies for auto and homeowners insurance.

It’s meant to protect you from potentially devastating liability claims or judgments. Personal umbrella coverages come into play when underlying limits are met. So, for example, in your home, if you exceed that $100,000 and you have an umbrella policy of $1,000,000, anything above and beyond that $100,000, another $1,000,000 kicks in.

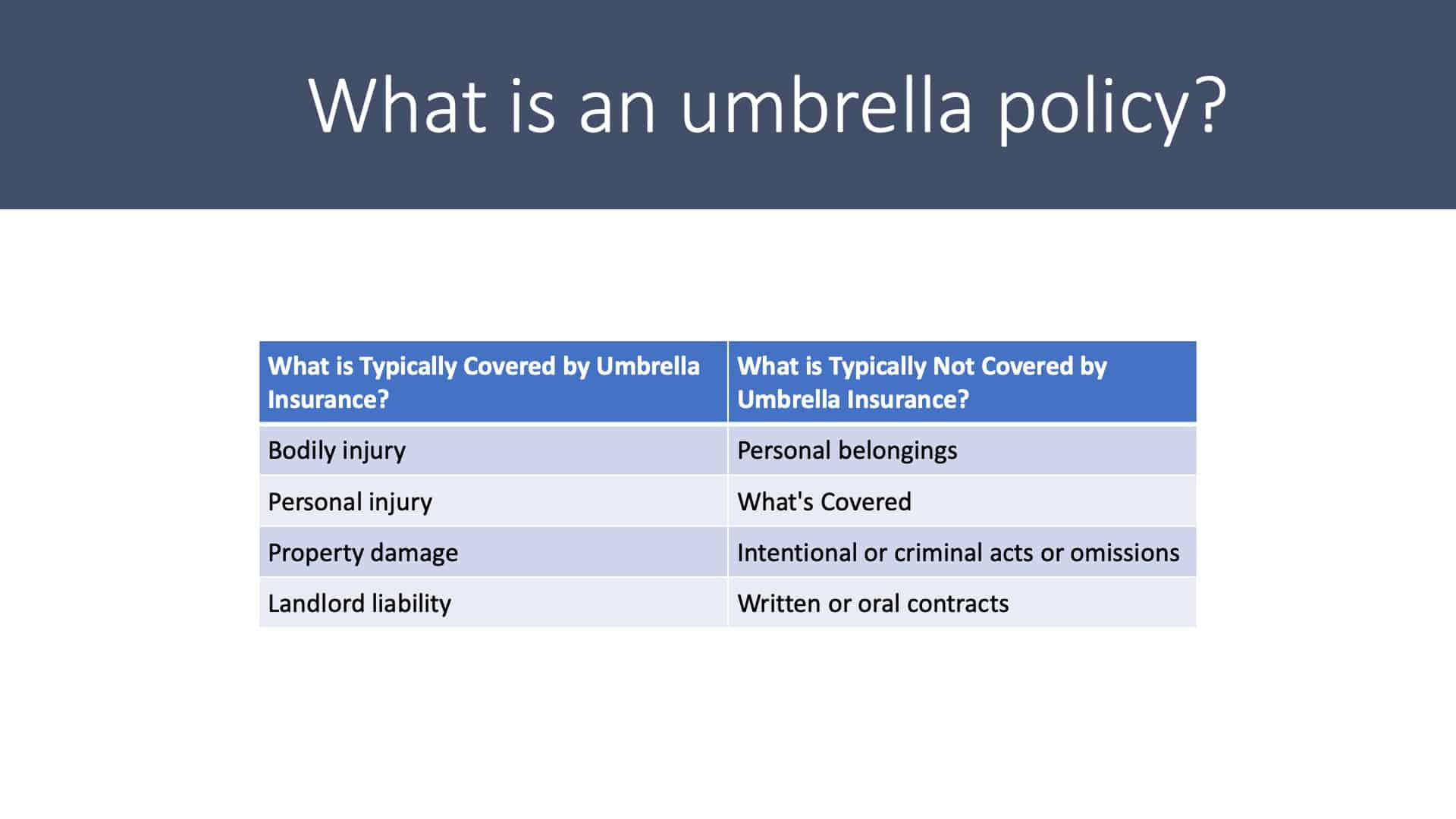

What is Covered in an Umbrella Policy?

Typical things covered by an umbrella policy are bodily injury, personal injury, property damage, and landlord liability. Things that are not covered our personal belongings what’s covered on your policy already intentional or criminal acts or omission, written or oral contracts.

A great example of an umbrella policy and action your fault in a car accident that injures another driver. Your regular car insurance may cover other drivers up to the policy limits of $250,000. But what if the limit is not met to cover the other driver’s medical bills?

Again, you may be legally responsible for damages beyond that $250,000 that your car insurance covers. Imagine the other driver is a surgeon and the injury you cause results, and he cannot work for six months. He sues you for $1,000,000 to cover the six months he was away from work. This umbrella policy is going to kick in.

What is covered by a personal umbrella policy?

Like we said before, your personal property. While personal umbrella insurance covers expenses, you’re held responsible for damage to someone else’s property but will not cover the damage to your property.

Persona Umbrella Policy Increments

Personal umbrella policies are available in $1,000,000 increments, from $1 million up to $5 million. While umbrella policy is not required, it may offer increased protection in the unfortunate event of an accident.

The great thing about umbrella policies is typically today. They’re about $175 up to $250 for a household of two drivers. Now, if you have youthful drivers, they’re going to go up just a little bit more. If you have a pool, trampoline, or other exposures with greater risk, that’s all going to go up a little bit more.

But you should expect anywhere from $175 to $250 a year, which is very, very minimal when you’re thinking about the coverage of an additional million dollars to take care of you to take care of your assets.

For example, if you’re still working, if you have 20 years left and don’t have an umbrella policy, you exceed those limits. They can come after you for lost wages and any assets you may already have to pay those damages. So this is just an extra added protection for you to protect your assets.

Auto Liability Coverage

Now on to auto insurance liability coverage. Auto liability coverage is mandatory in most states, and it has two components. Like I said before,

bodily injury liability property damage liability limits are recommended, although you can go as low as 25/50/50. So again, that 25 is $25,000 per person up to $50,000 for everyone in the car, and that in the last $50,000 is for property damage. You cannot get an umbrella, most likely for anything less than 250 502 50 with most carriers.

Uninsured & Underinsured Motorist Coverage

If an uninsured or uninsured motorist hits you, make sure your policy has this on it today, one in four drivers are driving without insurance. To buy a car, you have to have insurance. But typically, most people only pay month to month on their insurance. So they pay for one month of insurance. Now they have a car, and no one else checks again, and they’re driving out without insurance. It’s very important to have this.

Comprehensive and Collision Coverage

The difference between comprehensive and collision comprehensive is when you hit something other than a vehicle, for example, a deer. Collision is when you hit a car under deductibles. If you’re a good driver, the typical average deductible is $500.

For comp and collision, I highly recommend going to $1000, if not $2,000. To lower your rates. If you haven’t had an accident in the last 10 or 15 years, it’s better to bet on yourself and have a higher deductible than pay an additional $100 a year for the next ten years. You’re going to make that money up.

To reduce your premium, it’s better to self insure as much as you possibly can. That’s why I recommend a little bit higher deductible. If you have an accident, and it’s $1,000 repair on a scratch bumper, and your deductible is $500, they’re going to give you $500.

Now insurance is for the big things. I highly recommend that you insure for a little bit higher and pay for the small things. And use the insurance when you are in a collision, or you have a big claim on your house.

Because if you have smaller claims, if you have two or three over a year, your insurance will go up. For example, I had an insured the other day with a $50 windshield claim and had a $1,600 claim on a scratch bumper. So those are two claims in one year. His premium went up $600.

That accident in the state of Kansas is going to stay on for three years. In the state of Missouri, it’s going to stay on for five years. So he’s going to pay $1,800 more than what he was paying over the next three years when all he got back with six $600 from his $1,600 accident.

So if you have the opportunity, and you have the means, do not make small claims such as that because you’re going to pay for that over the next three or five years.

Medical Payment Coverage

If you’re a passenger injured in an accident, medical payment coverage may help pay for the cost associated with the injuries. Coverage costs may include hospital visits, surgeries, x rays, and more. This is probably one of the least used incidents in insurance.

I like to keep those load $1,000 because most people do have insurance, and they’re going to use their insurance other than use your car insurance for those coverages, but that $1,000 would pay for their deductible. So it’s a good way to look at it.

Other Types of Auto Insurance Coverage

Another insurance coverage is rental reimbursement coverage, highly recommend that you typically see $30 a day up to $900. That’s going to cover you for about a month. We hope gap coverage is for leasing a car. New car replacement coverage is for if you have a lien on your vehicle and you want to get the same kind and quality just like before replacement cost value versus actual cash value.

Most policies in auto are all actual cash value on cars. However, some do offer this new replacement car coverage. It is something to consider towing and labor cost coverage, glass coverage, ridesharing coverage, if your Lyft or an Uber, and sound system coverage.

Tips to Avoid Higher Rates on Your Home & Auto Insurance Premiums

In most cases, please call your agent before you call the insurance company. I say this because if you don’t know if you need to make a claim or not, and you do not receive any money back from your insurance company, they still send an adjuster out that still counts as a claim.

For example, I haven’t had an insured that thought that they had hail damage on their home, they called out their insurance adjuster, and they didn’t have enough damage on their home, only about $1,500 worth to make a claim.

So now that claim that they didn’t take any money for will be on the record for the next five years. That’s the same in Missouri and Kansas. So that’s why I say to call your agent. We have roofers who have relationships with us, home Builders that will come out and make an assessment and decide together for us if we need to make a claim or not.

We want to keep those claims off your record. So please give your agent a call before calling the insurance company to come out and send an adjuster.

What About Towing?

Remove towing from your policy if possible and get AAA. AAA has roadside assistance, and when you call AAA to come out and do that, it’s not a claim on your insurance. If you call your insurance company for roadside assistance, that is automatically a claim.

Again, it stays on your record for quite some time, and your rates are going to go up. We only want claims on your insurance record that are deemed unnecessary. Typically AAA costs about $85 to $125 per household to have roadside assistance.

Windshield Coverage

I also highly recommend that remove glass coverage from your policy for chips. But take a look at your auto as well find out what kind of glasses in that. For example, there are Mercedes and Audis in some Volvos with computer chips inside their windows, which I recommend actually having glass coverage.

But if it’s just a normal window, without sensors in it, then remove it. If at all possible, stay away from companies like Safelite, find a local person. Safelite spends a lot of money on advertising, and how they pay for that advertising is through overcharging on your windows. There are great smaller companies in town that will charge about $35 per chip. And the average window to replace is anywhere from $250 to $300.

Avoid Making Small Claims

Again, you’re self-insuring yourself as much as you possibly can to mitigate those more minor claims.

So you can use insurance when it’s needed to keep your premiums down when it’s not. I’d like to thank you for joining us today at Barbara financial,

we want to invite you to give me a call whenever you’d like to have a free assessment of your current coverages.

This is a no-hassle, no-obligation assessment. By no means do we want to take any business. We want to make sure that you’re fully insured; we will, if you’d like, give you a free quote to compare prices as well.

But first and foremost, we want to make sure you’re fully covered. That way, if there ever is an accident, you’re not paying money that shouldn’t come out of pocket. If you have an incident where your liability limits are hit, maybe you should have an umbrella because the last thing we want is to again, have you spent any money out of pocket that you shouldn’t have.

If you have any questions or comments, please leave them there, and we’ll get back to you as soon as possible.

Schedule Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.