Good Market Performances to Begin 2022

Key Points – Good Market Performances to Begin 2022

- A Year in Review of Good Market Performances

- How Those Good Market Performances Are Carrying Over to 2022

- A Lot to Be Encouraged About Despite COVID Cases and Inflation Climbing

- 3-minute read | 6 minutes to watch

We had the Delta variant, the Omicron variant, and all kinds of crazy things happening in 2021. Nevertheless, Dean Barber is excited to review a solid year in the markets for 2021 and highlight how 2022 is already offering good market performances.

Get a Complimentary Consultation Subscribe on YouTube

2022 Brings Good Market Performances

Happy new year to everyone! 2021 was one heck of a year across the market. We are off to a solid start with good market performances in 2022 as well. First, let’s look back at what happened last year within the different indices.

A Stellar Santa Clause Rally

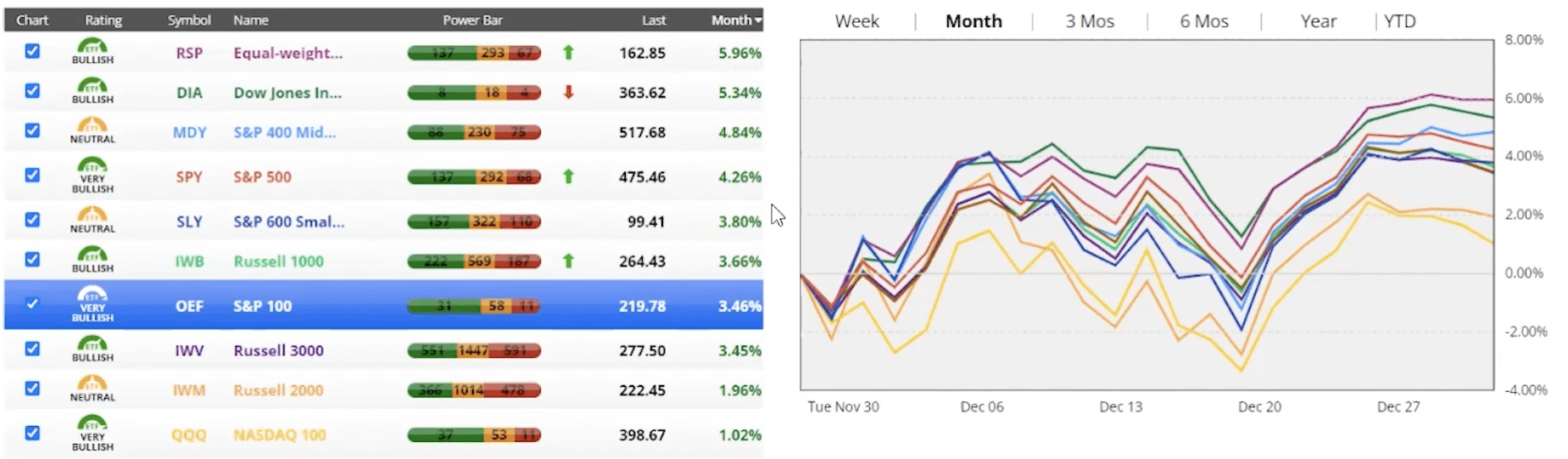

We’ll start off by looking at the last month. As you can see below in Figure 1, the best performing indice was the RSP Equal Weight, which was up by 5.96%. The Dow Jones Industrial Average was in second place, up by 5.34%. We had positive numbers across the board in December.

FIGURE 1 | December Market Performances | Chaikin Analytics

Most of that came after December 20. We had a little bit of a Santa Clause rally that has leaked into this year. The worst performing sector in December was the NASDAQ 100, which was up 1.02%.

Finishing Strong in the Fourth Quarter

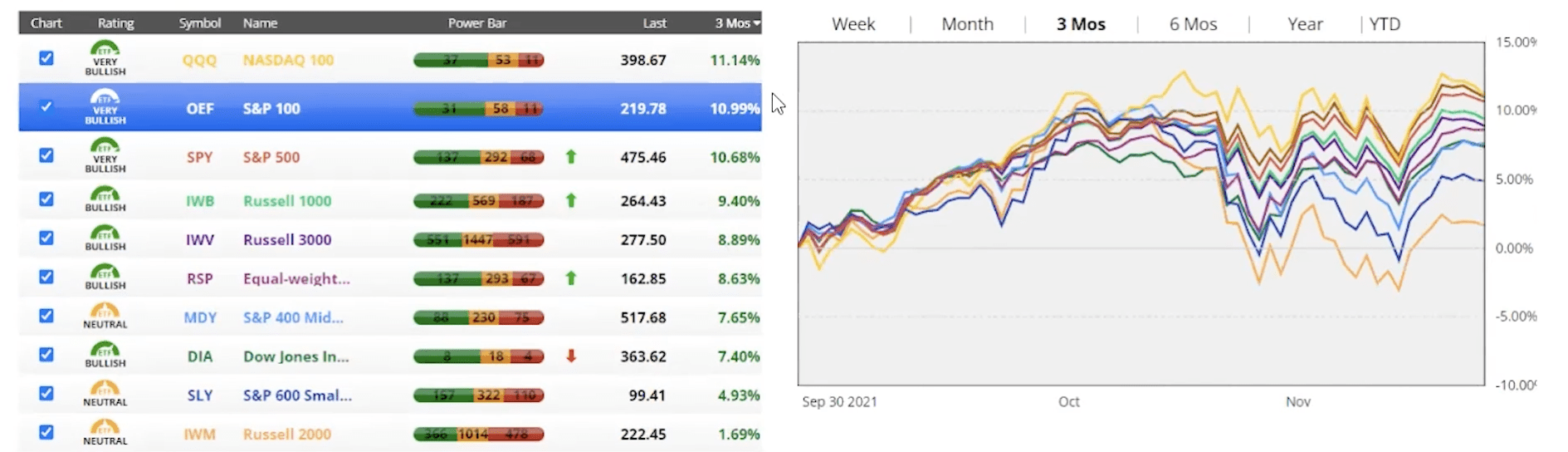

Now, let’s look at the last three months of 2021 in Figure 2. Everything is still in positive territory. There was some choppiness in November and December. The NASDAQ 100 was the best performing sector in the fourth quarter even though it was the worst performing sector in December. In the last three months, it was up 11.14%.

FIGURE 2 | 2021 Q4 Market Performances | Chaikin Analytics

The NASDAQ 100 was followed by S&P 100 and S&P 500, as they were up 10.99% and 10.68%, respectively. Our lowest performer for that period was the Russell 2000, up just 1.69%.

A Year in Review

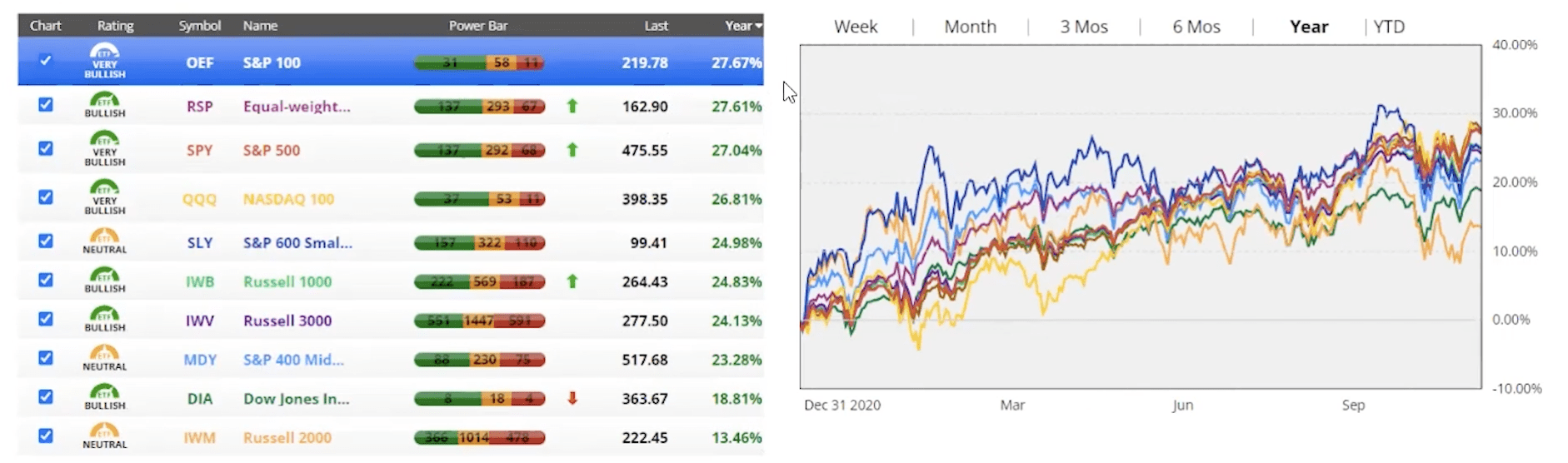

Doing a full year in review in Figure 3, we had three indices that were up more than 27%—the S&P 100, RSP Equal Weight, and S&P 500. The NASDAQ 100 wasn’t too far behind with being up 26.81%. The Dow Jones Industrial Average and Russell 2000 round things out, as they were up 18.81% and 13.46%, respectively.

FIGURE 3 | 2021 Market Performances | Chaikin Analytics

What Will 2022 Bring?

As you can see, we had great returns across the board within the indices. I think the question right now is what 2022 will usher in for us. We’re right in the throws of a record number of COVID-19 positive cases with the Omicron variant. Inflation is running very, very hot. The Federal Reserve is looking to raise interest rates this year. I believe that they’ll be done tapering and with all their bond purchases by summertime. I think the first rate hike is likely to come sometime in June.

That is going to push our yields on treasuries a little bit higher. As I’ve said over the last couple months, we should see the 10-year treasury finish 2022 under 2%. I think it’s going to be choppy as we start the year. The real question as we begin the first quarter is how we respond to the Omicron variant, what hospitalizations start to look like, and whether we start to see any additional closings, shutdowns, or more restrictions put in place.

Economy Looks Good Despite COVID Pressures

As we all saw over the holiday period, travel really got into a major bind. I hope that you weren’t caught in long airport lines or had any cancelled flights. We all know that COVID-19 can disrupt a lot of different things. However, let’s step away from COVID for just a minute and understand that by and large our economy is looking good. Corporate profits and unemployment are looking good. There are all kinds of things that we should be excited about for 2022 good market performances.

I’m not going to go as far as to make a prediction on what I think the stock market is going to finish at this year, but I do believe that it’s going to be choppier than 2021. But right now, we’re looking at positive returns in the high single to low double digits. I don’t think we’ll see anything near what we saw in 2021, but we could always get a surprise on that. Let’s hope that we do and look for some positive things to happen.

Begin the New Year with a Conversation with Your Financial Advisor

We do know that we’ll need to be a little bit more nimble in the fixed income sector. We probably don’t want to be holding treasuries or high-quality corporates currently. Talk with your financial advisor about your bond holdings and positions and things that we’re doing to protect that fixed income space.

I want to wish everyone a very happy new year. I’ll be back with another Monthly Economic Update at the end of January. If you have questions about how 2022 is shaping up with the projected good market performances, you are more than welcome to start a conversation with us even if you aren’t a Modern Wealth Management client. You can schedule a complimentary consultation below or call us at (913) 393-1000. We’re here to help you live your one best financial life.

Dean Barber Founder & CEO

Schedule Complimentary Consultation

Select the office you would like to meet with. We can meet in person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Lenexa Office Lee’s Summit Office North Kansas City Office

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.