What Is Going on with Interest Rates?

Key Points – What Is Going on with Interest Rates?

- Around Every Corner You Turn, Inflation Is There

- What Is the Federal Reserve’s Plan to Fight Inflation?

- How Many Interest Rate Increases Can We Expect?

- How Will Potential Interest Rate Hikes Impact You?

- 8 Minutes to Read

Absorbing the Sticker Shock

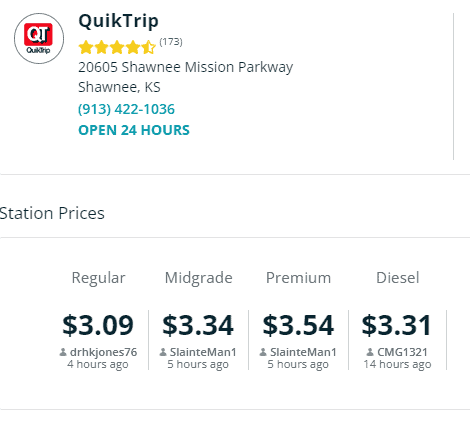

Anyone who has recently visited a grocery store, a gas station, or home improvement store is painfully aware that things have gotten a lot more expensive than they were just 12 months ago. A LOT more expensive. In the Kansas City area, the price of a gallon of gasoline is about $3.20. Twelve months ago, it was less than $2.00 a gallon.

FIGURE 1 | Kansas City Area Gas Prices | QuikTrip

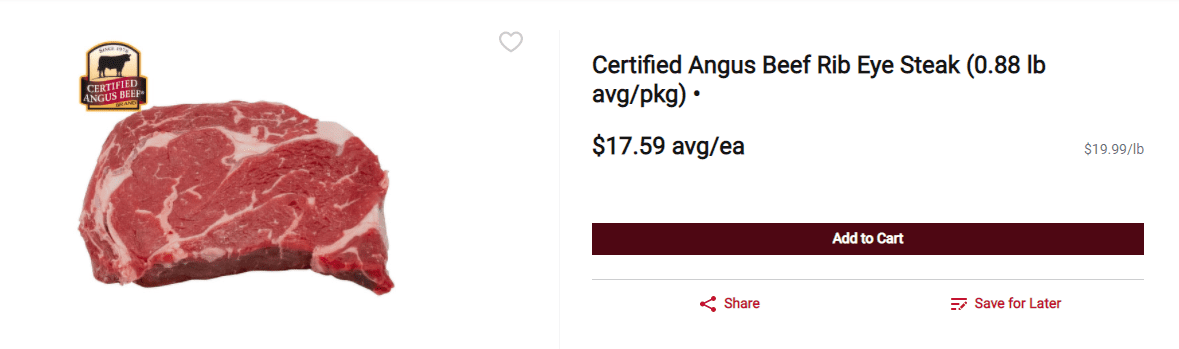

I went to my local grocery store to pick up some steaks for dinner last week and had to apply for a loan to buy the ribeyes, which were over $20 a pound! An 8-foot 2×4 at your local home improvement store will cost you almost $7. Just 12 months ago, that 2×4 was less than $3. Everywhere you turn, you’re met with sticker shock!

FIGURE 2 | Ribeye Prices | Certified Angus Beef

FIGURE 3 | 2×4 Prices | The Home Depot

How Inflation Is Measured

This, of course, is the phenomenon we refer to as inflation. The government measures it using several methods, which they lovingly apply an alphabet soup name to. Those names include PPI, CPI, CPI-U, CPI-E, and C-CPI-U.

Basically, they are measuring the prices that businesses pay for inputs and the prices that consumers of different groups pay for a basket of consumable goods and services. The basket of goods includes basic food and beverages, such as cereal, milk, and coffee. It also includes housing costs, bedroom furniture, apparel, transportation expenses, medical care costs, recreational expenses, toys, and museum admission costs. Education and communication expenses are included in the basket’s contents, and the government also includes other random items such as tobacco, haircuts, and funerals.

The Federal Reserve’s Fine Line

These measurements are calculated monthly and are used by the Federal Reserve to determine monetary policy to achieve their “dual mandate” of full employment and price stability while maintaining moderate interest rates. The Fed aims to keep annual inflation at around 2%. They start getting uneasy when it goes too far above that since it begins to affect price stability.

Historically, they have tried to steer the economy with monetary policy by raising and lowering the Fed Funds rate. They inject or remove liquidity in the financial system based on which direction or speed they’re trying to get the economy to go.

When things are too slow economically, they’ll lower rates and add liquidity to increase the incentive to borrow and spend because it’s inexpensive to do so, thereby creating economic activity. Conversely, if the economy is “over heated” and prices are rising faster than they would like, they will remove liquidity and raise the Fed Funds rate. Doing so effectively makes money harder to come by and more expensive to borrow and spend. In turn, that discourages unwanted economic activity.

Trying to Find the Rates That Are Just Right

It’s really the monetary policy equivalent of the story of Goldilocks and the Three Bears. The Federal Reserve Board is Goldilocks. While rummaging around the cabin, they try to find that bowl of porridge that is just the right temperature, the perfect chair that the bottom won’t fall out of, and the bed that is just right to take a nap in. They might find it, but as you know in the story, the bears come back in from their walk in the woods and cause Goldilocks to jump out the window.

How Many Interest Rate Increases Can We Expect?

The Federal Reserve recently began to address the inflationary pressures affecting our economy. They indicated that they will likely begin increasing the Fed Funds rate beginning in March. Speculation in the financial markets as to how many rate increases they may make this year range from one to seven. That’s quite a wide range of estimates.

The consensus seems to be four at this point, which would take the Fed Funds rate from its current level of zero up to 1% by year’s end. Should they effect the high end of the estimate and raise interest rates seven times this year, the Fed Funds rate will go from zero to 1.75-2.0% by year’s end. As you will see in a moment, that may be the chair that the bottom drops out of.

Tightening the Money Supply

At the same time as they are going to be raising interest rates, they are also going to begin tightening the money supply by reducing their bond buying activity by $15 billion a month. That will likely last for 10 months until the monthly bond buying program reaches zero. That means less available money to borrow and higher costs to borrow what is available.

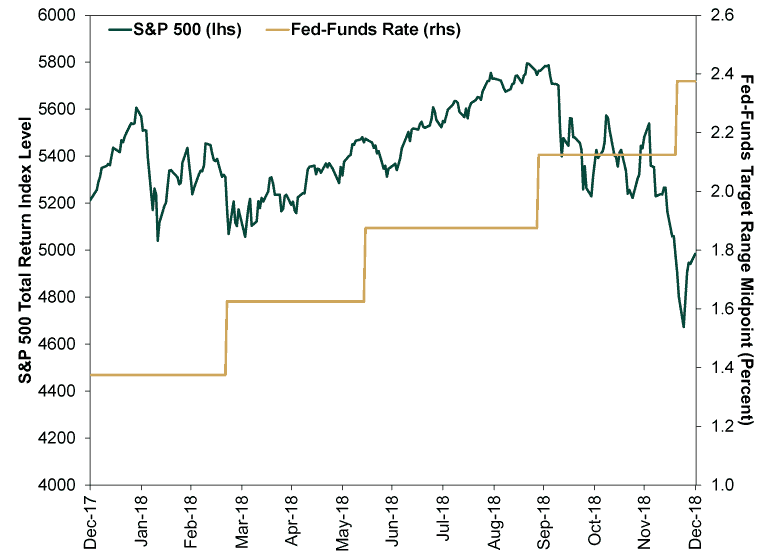

This will hopefully slow the growth of prices without upsetting the markets. The thing about the markets is that they don’t care about interest rates…until they do. And when they do, that’s when the bottom falls out of the chair Goldilocks is sitting in. Look what happened the last time, just five years ago.

Why Interest Rates Matter

The Fed began raising rates from zero in early 2016 and was stepping them up each quarter by 0.25%. At 1.25% in early 2018, the markets indicated that they were beginning to give way. When the Fed got to 2% in September 2018, the bottom fell out of the chair.

Not shown below in Figure 4 is that they were doing the same thing then that they are planning to do now. They’re removing liquidity while raising rates.

FIGURE 4 | Fed Funds Target Range Midpoint vs. S&P 500 Total Return Index Level | nxtmine

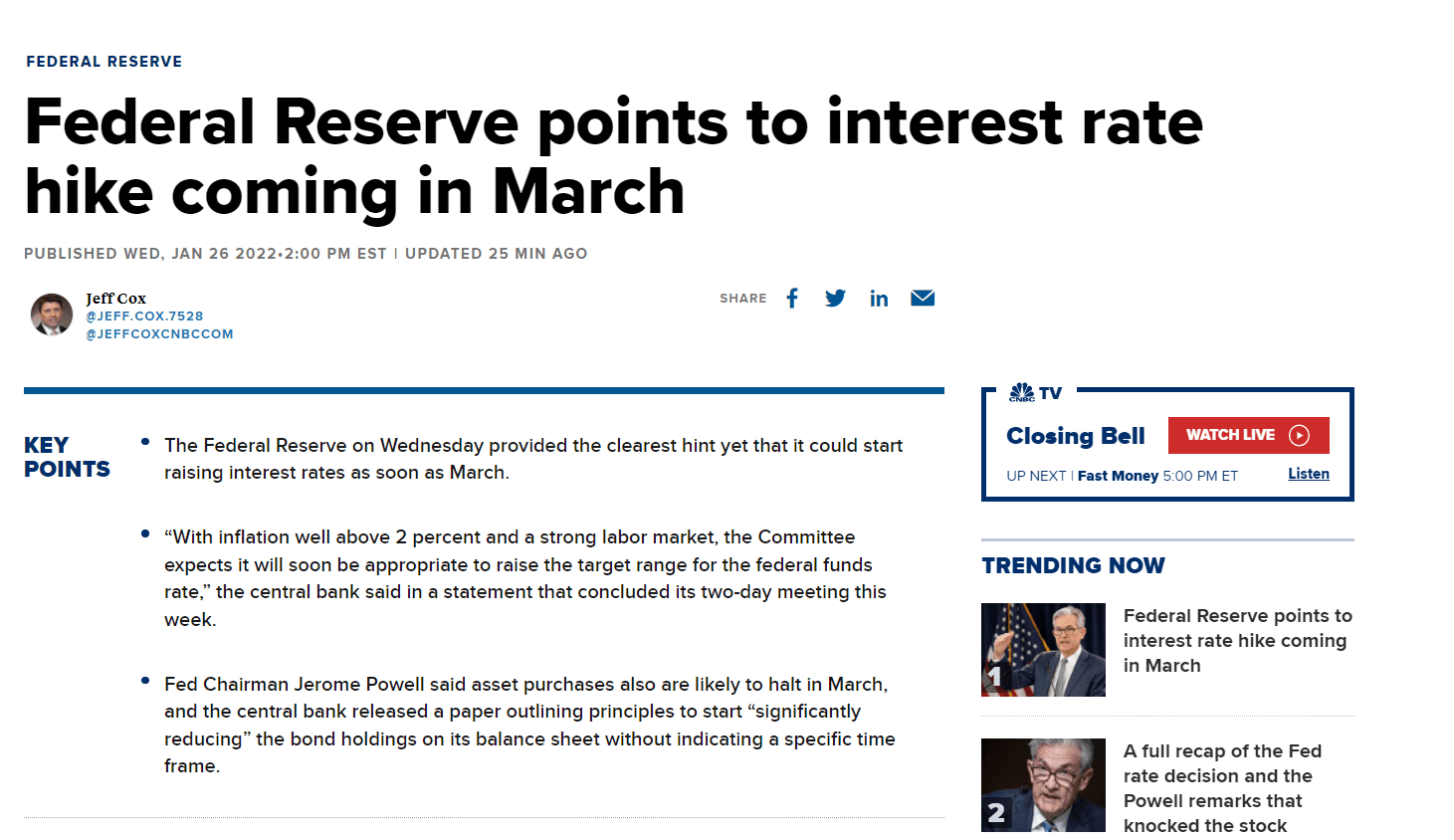

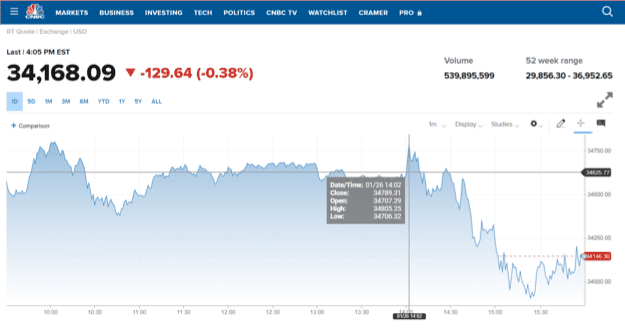

In anticipation of writing this article, I watched CNBC after the last meeting when Jerome Powell was set to address the press with the results of the latest Federal Reserve meeting on January 26. I took the following screenshots from the CNBC website just so that you could see the things that we get to see daily. The markets react instantly to news relating to interest rates, even if it’s only temporary most of the time.

FIGURE 5 | Federal Reserve Points to Interest Rate Hike Coming in March | CNBC

FIGURE 6 | Market Reaction to Possible Interest Rate Hikes | CNBC

The markets’ immediate hissy fit reaction, illustrated above in Figure 6, was only to the MENTION of the possibility that rates are going up, not the actual economic effects that those rate hikes will undoubtedly cause. So, if someone tells you interest rates don’t matter, show them these two charts. Because at some point, they do matter.

What Higher Rates Mean for You

Higher interest rates and less available money won’t just affect the stock market or the broader economy. They will also affect individuals in a very real way. The largest purchase most people make in their lives is their home, and that is going to get a bit more difficult and costly to do.

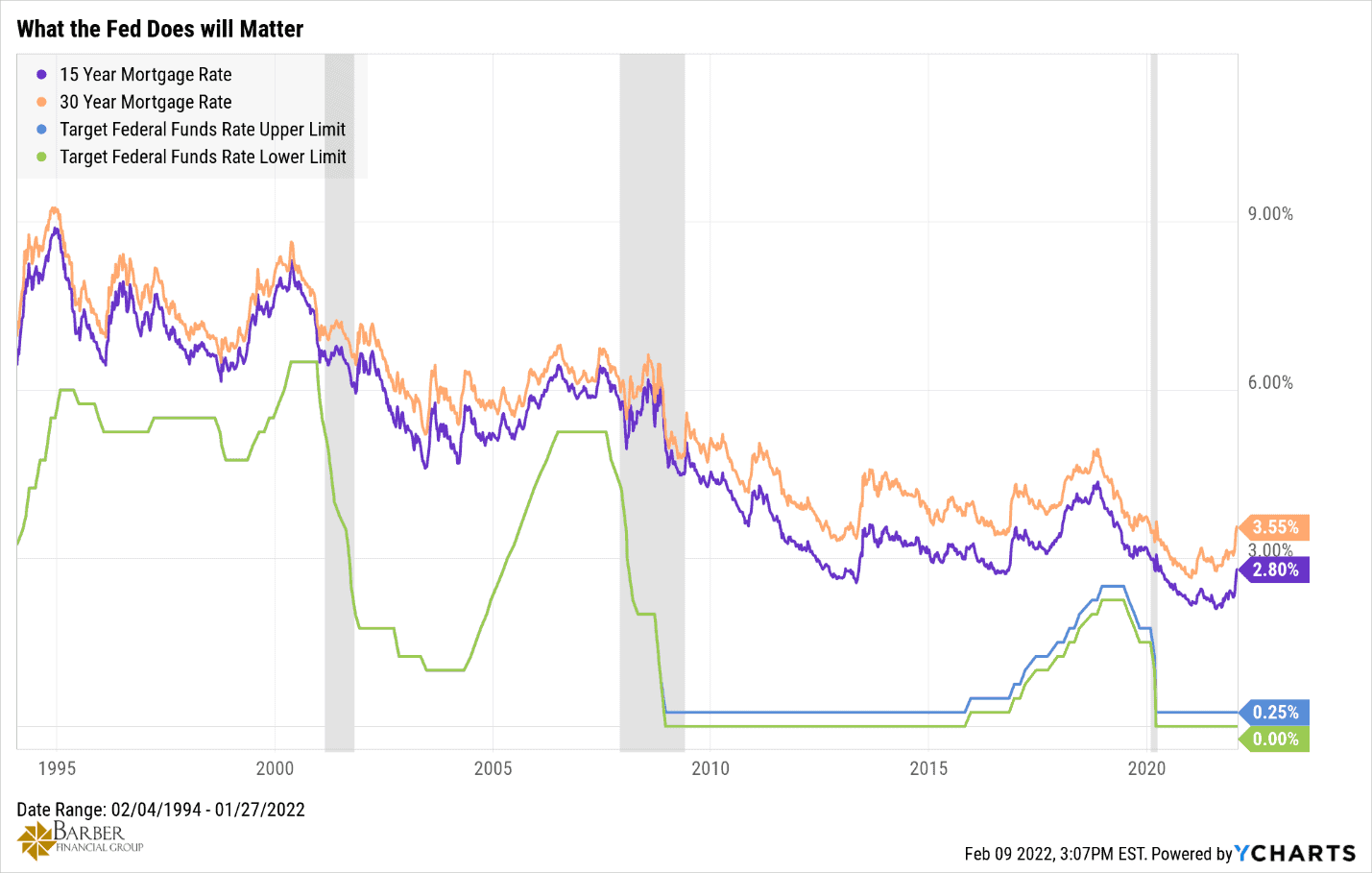

The Fed Funds rate (and discussions surrounding it) cause mortgage rates to move. In this case, it’s higher movement in conjunction with the Fed Funds rate. Less available money will mean that lending standards will likely get more stringent so that good money isn’t put at risk by being lent to less-than-qualified buyers. Higher interest rates will mean that fewer buyers are qualified for a loan on a given property.

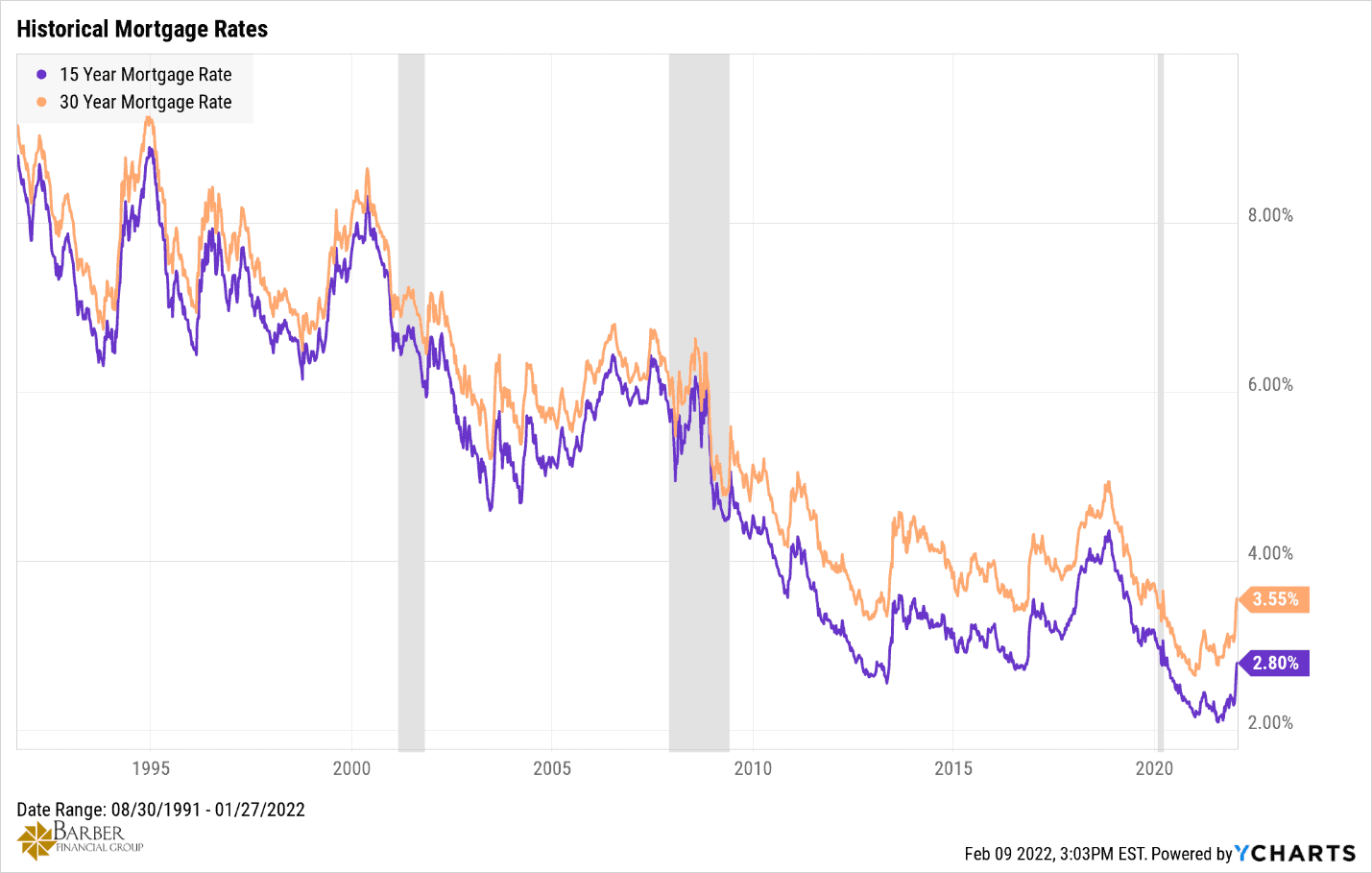

Figure 7, below, highlights the last 30-plus years of 15-and 30-year fixed rate mortgages. Note that it wasn’t that long ago (14 years) that a 6% mortgage was common. It’s also interesting to think that rates have been so far below that level long for enough that there are potential home buyers in the market today who have never seen a mortgage rate higher than 4%…yet.

FIGURE 7 | Historical Mortgage Rates | YCharts

Then, below in Figure 8, you can see the correlation between the Fed Funds rate and the interest rates charged on 15-and 30-year mortgages. It is indeed a very strong correlation. Note, too, that even though the Fed Funds rate hasn’t been raised yet, that the mortgage rates have jumped considerably since January 26.

FIGURE 8 | What the Fed Does Will Matter | YCharts

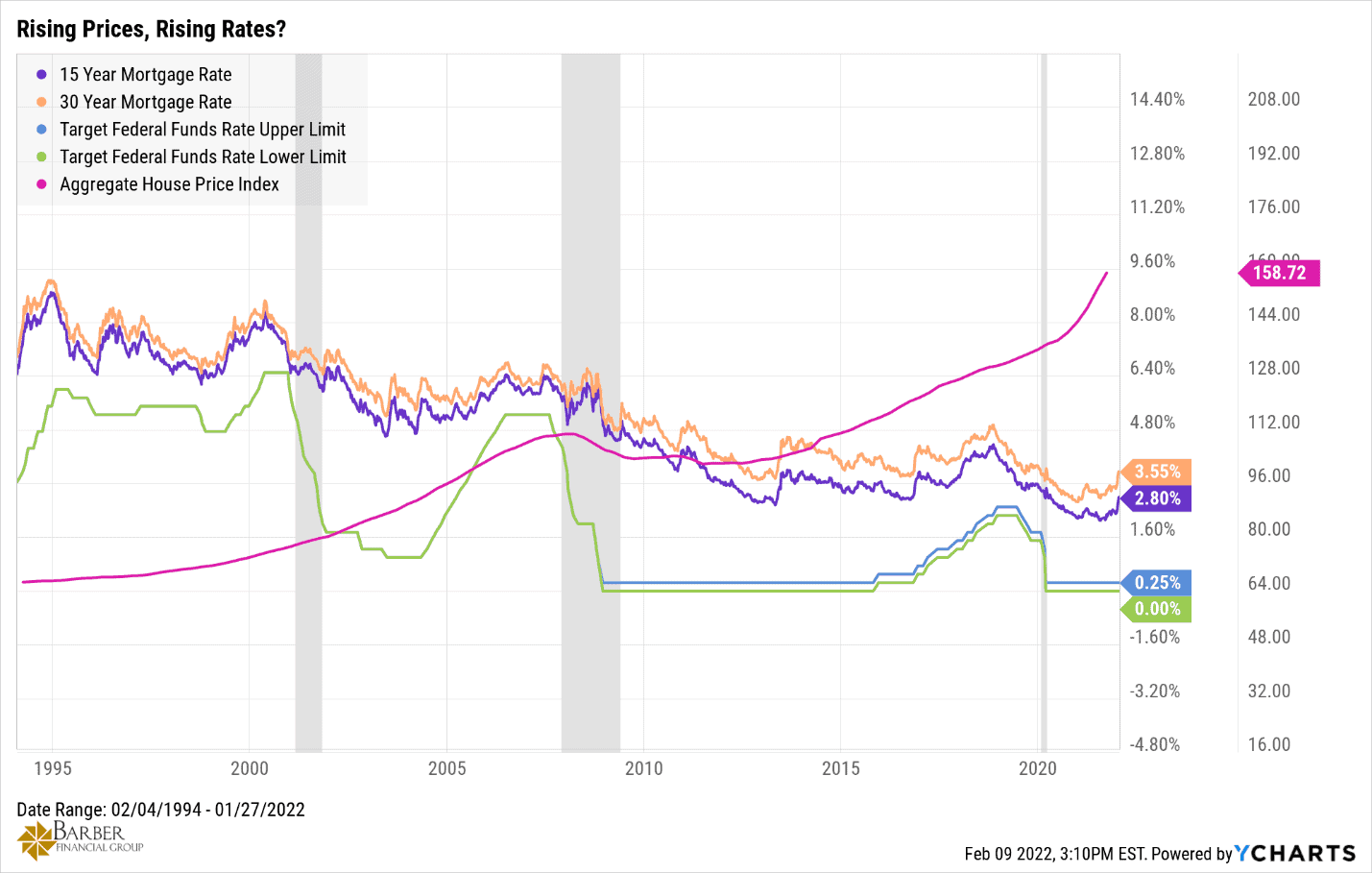

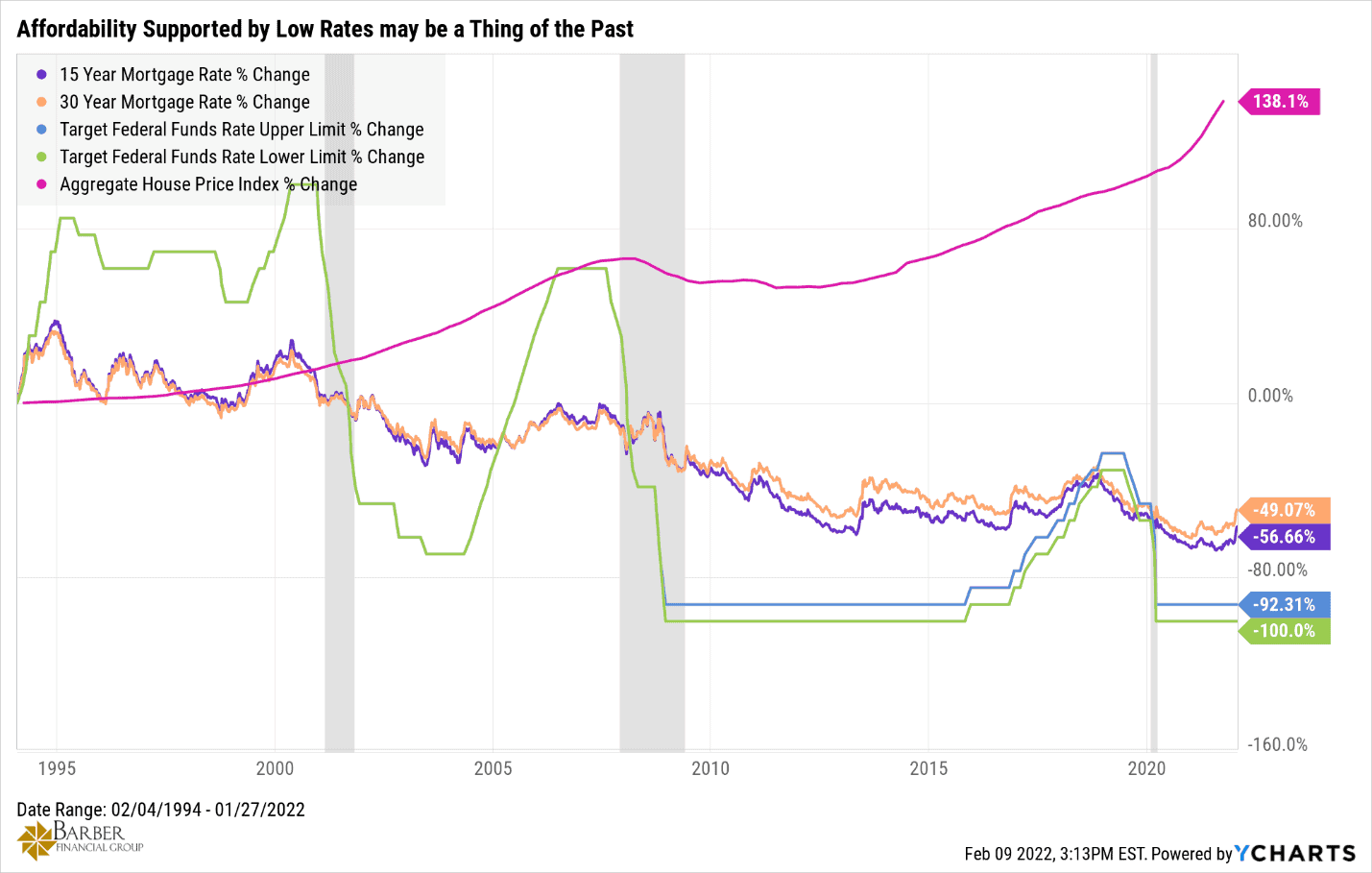

One Bad Home Prices Recipe

When you couple rising interest rates with the rapid increase in home prices that we’ve seen over the past couple of years, you get a recipe for falling home sales and eventually stagnant or falling home prices. The demand is destroyed by virtue of moving the affordability bar so high that it disqualifies many potential buyers.

The average home price today is $330,000 and rising at an almost 20 percent per year pace. We can do some math to see how rising rates might affect some potential buyers. The principal and interest payments on a $330,000 loan at current rates are as follows:

- 15-year fixed at 2.8% is $2,247 per month

- 30-year fixed at 3.55% is $1,491 per month

If either of these go back to where they were in 2007-2009 at 6%+/-, the numbers are substantially different. The 15-year is now $2,785 per month and the 30-year is $1,979. That’s a difference of $538 a month on the 15-year and $488 dollars on the 30-year. Those numbers are great enough to make that $330,000 house unaffordable for some buyers when it may have been affordable just days, weeks, or months ago.

In fact, it’s not a secret that the very low interest rates we have today are one of the main reasons that prices have escalated as quickly as they have while remaining relatively affordable to most buyers. Let the rates go up and that will change quickly. Check out Figures 9 and 10 below.

FIGURE 9 | Rising Prices, Rising Rates? | YCharts

FIGURE 10 | Affordability Supported by Low Rates May Be a Thing of the Past | YCharts

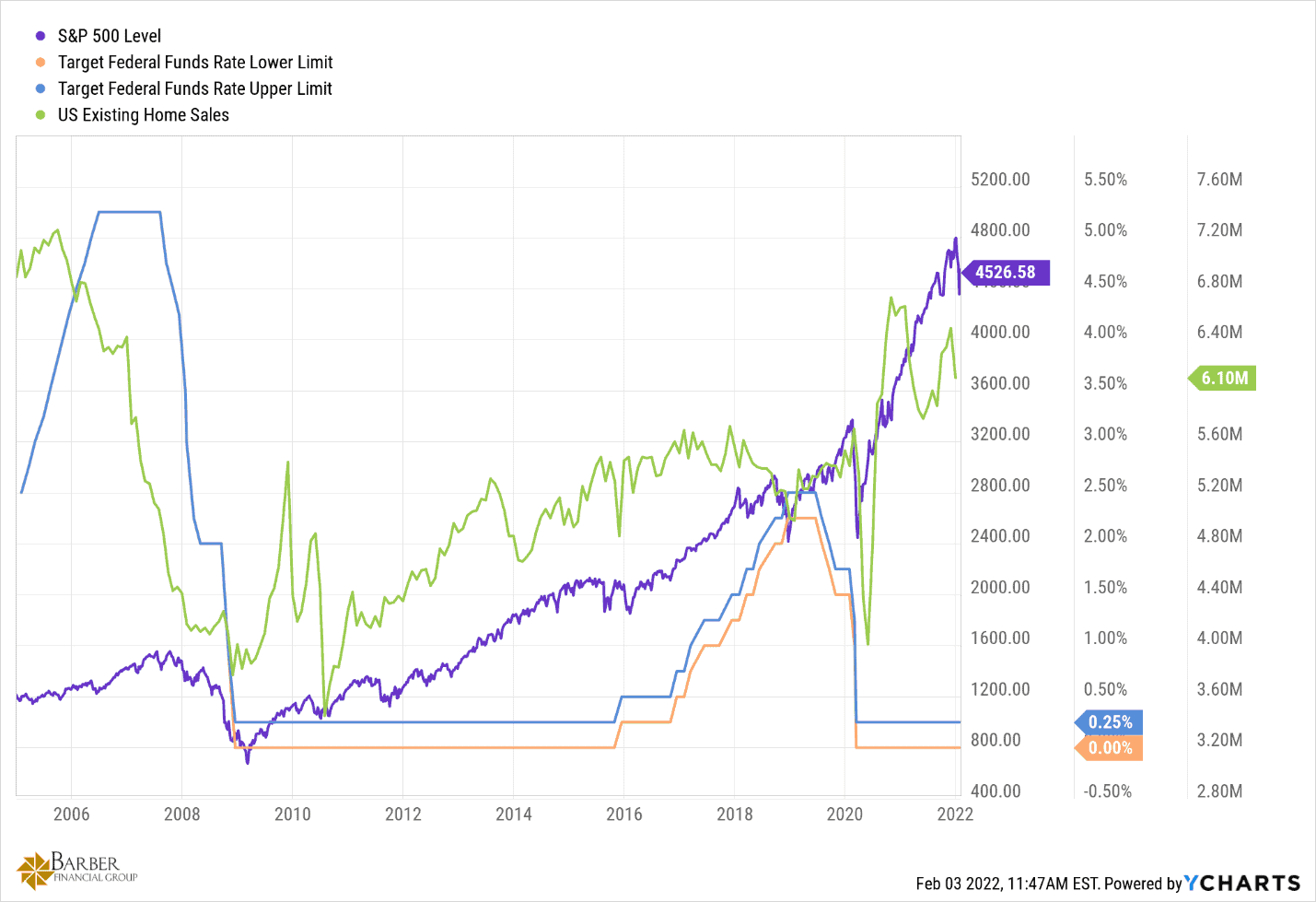

Another Sequel: Higher Interest Rates Lead to Existing Home Sales Plummeting

As you can see below in Figure 11, higher interest rates caused existing home sales to plummet back in 2006 and again in 2018. We’ve seen this movie before, and they didn’t change the ending just for this next showing. This time isn’t, nor will it be different.

FIGURE 11 | Higher Interest Rates Lead to Existing Home Sales Plummeting | YCharts

Is Deflation Possible?

As you may have deduced by now, rising interest rates will have the desired effect in slowing the economy down in all areas. Used cars today are 40% higher than they were just a few months ago. Throw a little tight money policy in the mix and, viola, falling used vehicle prices. The banks aren’t going to want to lend the same way they are today, meaning those cars aren’t going to be nearly as valuable as they’ve been recently. New vehicles, especially luxury trim levels, will be in the same boat.

Add increased supply as the supply chain disruptions heal themselves in the coming months, and inflation may not be the Federal Reserve’s concern any longer. It might lead to the dreaded D word, which they like far less than inflation. Deflation. Yes, I said it. It may not be the most likely outcome from all this, but it absolutely is possible.

The other unspoken reason that the Fed wants/needs to begin to raise the Fed Funds rate is a more self-serving one. Right now, they don’t have room to make policy adjustments when the bears come back from their walk in the woods and start wreaking havoc in the markets. It might not happen tomorrow, next month, or next year, but it’s going to happen.

Enjoy the Low Interest Rates While They Last

The reality is that if there were to be a market meltdown and an economic downturn while rates are already at zero, the Fed would have no room to maneuver. Their only option would be to adopt NEGATIVE interest rates. Nobody wants to think about the results of that.

So, enjoy the low rates while they’re still here. Lock some in if you haven’t already. Those days may be gone for a while before you know it.

Schedule Complimentary Consultation

Select the office you would like to meet with. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Lenexa Office Lee’s Summit Office North Kansas City Office

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.