Rules on Gifting Money to Family

Key Points – Rules on Gifting Money to Family

- Gifting to Your Children and Grandchildren

- The Misconceptions Surrounding the Rules on Gifting Money to Family

- The Gift Tax Limitation and Estate Tax Exemption for 2023

- Creating Portability and Using Irrevocable Trusts

- 7 Minutes to Read | 12 Minutes to Watch

What Are the Rules on Gifting Money to Family?

How do wealth transfer and gifting affect your taxes? What are some strategies that you can use to transfer wealth to the next generation as tax efficiently as possible? Director of Tax Corey Hulstein answers those questions and review rules on gifting money to family on the Modern Wealth Management Educational Series.

Giving Money with Warm Hands or Cold Hands

One of the most popular questions that Corey gets as a CPA is, “How should I be gifting my money to the next generation?” Is it best for them to gift their money today or should they just leave their money to the next generation whenever they pass? There are several different ways you can go about transferring wealth.

“One of the things we talk about with clients quite often is whether they want to give away their money with warm hands or cold hands. Not to sound dark, but when giving away money during your lifetime, utilizing things like the gift limitations per year, you can really see the value of the gifts you’ve made to your heirs while you’re still living.” – Corey Hulstein

Gift Tax Limitation

The first thing we really want to dig in to with rules on gifting to family members is the gift tax limitation. The IRS dictates that we can give up to $17,000 to any other individual in 2023 before any other type of tax filing is required. There are a few misconceptions about that, though.

Gifting to Your Children

If you’re married with one child, you and your spouse can gift $17,000 apiece to your child. Therefore, you can collectively transfer up to $34,000 to your child. In that scenario, there’s still no gift tax return that would need to be filed for 2023.

Here’s another spinoff from that example. What if their child has grown up and is married? They can collectively gift $34,000 to their child and $34,000 to their child’s spouse to gift $68,000 overall.

“Another thing to note here is that these gift tax limitations per year scale with inflation. We’ve seen these numbers climbing thanks to the higher inflation rates that we’ve had. If you’re reading this article well after we published it in May 2023, make sure to check the updated numbers for each annual gift tax inclusion.” – Corey Hulstein

Gifting to Your Grandchildren

This wealth transfer concept also rings for grandparents as they’re gifting to the third generation. Are you a grandparent and have grandchildren who have recently graduated or about to graduate from college? Maybe you can help get them started with a down payment on a house.

Giving More Than $17,000 in 2023

It’s also important to know with the rules on gifting money to family is that the $17,000 gift tax limitation applies to the person that’s giving the gift AND the person that’s receiving it. There’s no filing requirement as long as the dollar amount is under $17,000.

But what happens if you give more than $17,000 to an individual in 2023? Will there be a tax ramification of doing so, and if so, what is it?

“In a lot of my field, the answer is maybe. It looks at your estate tax limits. Estate tax limits refer to all the assets you own at the individual level. This includes your house, invested assets, cash in your bank account, etc. Everything that you own, the fair market value gets lumped into the estate valuation.” – Corey Hulstein

Estate Tax Limitation for 2023

For 2023, that estate tax limitation is quite high relative to where we’ve been in the past. The estate tax limitation for 2023 is $12.92 million per person before there’s any type of tax consequence for wealth transfer. So, it’s $25.84 million if you’re married filing jointly. Anything over those amounts that’s transferred to the next generation will result in some taxation.

“That taxation does get pretty steep pretty quickly with the top tax rate being at 40%. So, what if we give more than $17,000 in any given year? Now, you need to file a gift tax return that’s filed on Form 706. This form asks how much you have given to any individual during the current tax year.” – Corey Hulstein

A $100,000 Gift Example

Let’s say you gave Child No. 1 $100,000 as a down payment for their home. Out of that $100,000, you’ll need to file Form 706 for the gift tax return. That $100,000 will be fully reported on the return. You back off the $17,000 exclusion for 2023. That leaves $83,000 that will be applied toward your wealth tax exemption on the date that you pass. That $83,000 will carry on with you even as the estate tax exemption moves up or down due to legislation.

Therefore, when you pass away, that $12.92 million moves down to just more than $12.8 million due to the $83,000 that you had to apply in 2023. For most individuals, this estate tax limitation isn’t very applicable. A $25.84 million fair market value of assets for a married filing jointly couple isn’t attainable for most of the general public.

“A lot of these misconceptions with rules on gifting money to family really don’t apply for today’s purposes. However, this $12.92 million exemption that’s in place today will likely be changing in the future as well.” – Corey Hulstein

Estate Tax Exemptions May Fall in 2026

Due to the sunsetting of the Tax Cuts and Jobs Act that we expect to happen in 2026, these estate limitations will move down. We’re currently projecting that these estate tax exemptions will shift down from $12.92 million to $5.49 million in 2026 at the individual level since it’s sunsetting back to 2017. That’s $10.98 million for married filing jointly couples before any type of estate tax would be expected.

Strategies for Wealth Transfer Over the Exemption

Again, the tax implications of wealth transfer very much depend on the level of assets that you’re transferring today. For most households, these exemptions will plenty satisfy any type of wealth transfer for general population today. For any estates over $25.84 million today or that will be $10.98 million in 2026, it might make sense to utilize some financial planning to shelter those assets from the estate tax.

Creating Portability

The first strategy is crucial for any household that is getting close to that $25.84 million or $10.98 million threshold. Unfortunately, we know that life happens and that both spouses don’t usually pass away at the same time or within the same tax year. One crucial step when one taxpayer passes away is to also file Form 706 in the year of passing.

“By filing Form 706, it creates a term called portability. That’s when one spouse passes away and that estate tax exemption isn’t utilized because the assets are held jointly between the two spouses. If you don’t file Form 706 and the assets transfer from one spouse to the other, that estate tax exemption would be lost. In today’s dollars, that $12.92 million goes away. When the second spouse passes away, there’s only $12.92 million remaining on the estate tax exemption. Those numbers for 2026 drop significantly. It’s important that you file Form 706 to create that portability between spouses.” – Corey Hulstein

So, when one spouse passes away, you should look into filing Form 706 even though there isn’t a true wealth transfer event in that year. That way you create the portability event and have that exemption built up for whenever the second spouse passes away.

Using Irrevocable Trusts

As we continue to review rules on gifting money to family, let’s look at another strategy that we can use any households where the estate tax is applicable. You can utilize a couple of different vehicles, namely irrevocable trusts, to shelter your assets from the estate tax. With an irrevocable trust, once you put the assets into the trust, you lose control of those assets. They’re no longer a part of the estate formula. You also can’t tap back into those assets during your lifetime.

“With irrevocable trusts, you’re trying to give money to the next generation upon your passing while still fully committing to what the trust says today. There aren’t a lot of modifications that can be made throughout the rest of your lifetime. Additionally, an irrevocable trust will require an annual tax return for the trust each year. Irrevocable trusts are a very complicated issue in tax law. Always make sure to work with a professional when establishing the trust and to meet the annual filing requirements. You also need to work with a professional to make sure that the irrevocable trust is something that makes sense within your financial plan and work with a tax expert to make sure all the I’s are dotted and T’s are crossed upon completion of the trust.” – Corey Hulstein

What Kind of Irrevocable Trust Will Meet Your Goals?

The goal of the irrevocable trust is to take some of the assets that are over the $25.84 million exclusion and shelter them from the estate tax. You lose control of the assets, but they transfer to the next generation without being included as part of that estate limit.

When looking at irrevocable trusts, know that there are many variations of irrevocable trusts that can meet your objectives. It depends on where your assets are going and who inherits them. You’ll want to consider a variety of irrevocable trusts to meet your goals of the money you’re leaving behind to the next generation.

Working with a Professional to Fully Understand the Rules on Gifting Money to Family

If you’re thinking about giving large gifts to family members or are battling estate tax exemptions, you need to work with a professional before taking action. Make sure that it makes sense within the financial plan and that everyone is on the same page about how your plan will come to fruition. If you have any questions about the rules on gifting money to family, our CFP® Professionals are all ears. You can meet in person, virtually, or by phone with one of our CFP® Professionals by clicking the “See Our Schedule” button below.

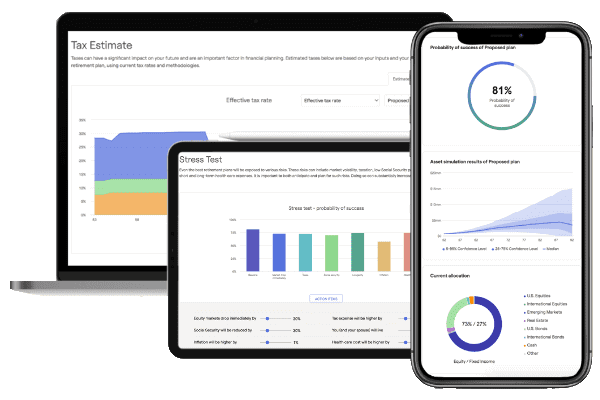

If you need a little bit of time before meeting with a professional, we have another way that you can start building your plan and understand how these rules of gifting family will apply to you. Take our industry-leading financial planning tool for a spin today to begin getting a clearer picture of your financial future. Just click the “Start Planning” button below to build a plan that gets you to and through retirement.

Whether you partially complete your plan or have questions after completing it, our CFP® Professionals will still be available to answer your questions. We hope that this article on the rules on gifting money to family has helped illustrate the importance of having a financial plan.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.