The Keys to Unlocking Your Financial Future

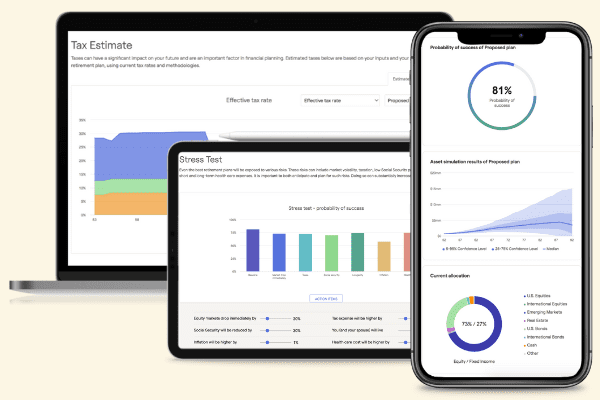

- BUILD your financial plan with planning software

- TEST your portfolio using multi-factored simulations

- REVIEW your probability of reaching retirement success

Tools to Build Your Best Retirement

We combine industry-leading financial planning technology with the insights of CFP® Professionals who specialize in retirement planning.

- Interactive Retirement Planner

- All Your Accounts Sync in One Place

- Probability of Retirement Success Score

- Efficient Tax Distribution Strategies

- Insurance Needs Analysis

- Social Security Optimization

- Asset Allocation Breakdown

- Estate Planning Flow Chart

- Retirement Income and Budgeting Tools

Test the Way You Invest

Stress-test your investment portfolio to determine how it could be affected by changes in several factors:

- Drop in the Equity Markets

- Social Security Reduction

- Rise in Inflation

- Increased Tax Expense

- Longer Life Expectancy

- Higher Health Care Cost

Customized Insights from Retirement Planners

Once completed, our team of CFP® Professionals will contact you if we find opportunities to add value.

Who is Modern Wealth Management?

At Modern Wealth Management, our goal is to reimagine the delivery of financial advice. We are designed to anticipate the needs of Americans at every stage of life by providing a full suite of wealth management services. The Modern Wealth Management team is built with experts specializing in financial planning, tax planning and preparation, risk management, estate planning, and more.

Providing our clients with the confidence that they’re doing the right things with their money, the freedom from financial stress, and the time to spend doing the things they love is what we care about. Confidence, freedom, and time.

Learn more about us and our approach to retirement planning, here.