The One Big Beautiful Bill Act: What You Need to Know

Key Points – The One Big Beautiful Bill Act: What You Need to Know

- Tax Cuts and Jobs Act Tax Rates Permanently Extended

- Temporary and Permanent Tax Provisions in the One Big Beautiful Bill Act

- What Spending Was Cut to Offset the New Tax Provisions?

- Other Spending Priorities within the Bill

- How the One Big Beautiful Bill Act Could Affect Your Financial Plan

- 6-Minute Read

Main Takeaways from the One Big Beautiful Bill Act

The One Big Beautiful Bill Act became law on July 4 after narrowly passing through the House and Senate.1 There was a lot to unpack in the new bill, as it was nearly 1,000 pages long. The provisions of the One Big Beautiful Bill Act cover important financial planning components such as taxes, health care, and much more. Let’s review some of the main points and how it could impact your financial plan.

Schedule a Meeting Get the Retirement Plan Checklist

Tax Cuts and Jobs Act (TCJA) Tax Rates Permanently Extended

First, let’s dive into the tax provisions within the One Big Beautiful Bill Act. Prior to the One Big Beautiful Bill being signed into law, the Tax Cuts and Jobs Act was scheduled to sunset after December 31, 2025.

The One Big Beautiful Bill Act permanently extended the tax rates from the Tax Cuts and Jobs Act. That means that tax rates will remain at 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Tax rates were set to revert to 10%, 15%, 25%, 28%, 33%, 35%, and 39.6% if the TCJA sunset took place. Tax Foundation projects that a sunset of current tax rates would’ve resulted in a potential tax increase for 62% of taxpayers.2

Standard Deduction Increases

The TCJA nearly doubled the standard deduction in 2018. The One Big Beautiful Bill Act increased the standard deduction thresholds to $15,750 for single filers and $31,500 for joint filers for 2025, and they will be indexed annually for inflation.3

SALT Deduction Increases

The TCJA also implemented a $10,000 SALT (state and local tax) cap for all tax filers. The One Big Beautiful Bill Act lifted the SALT cap to $40,000 for 2025.4 While the SALT cap will temporarily increase by 1% per year, it will go back to $10,000 in 2030. There’s also a phase-out limit for the SALT cap that will impact high-income earners (those with MAGI exceeding $500,000).

Estate and Gift Tax Exemption to Go Up in 2026

The TCJA also nearly doubled the federal estate tax exemption when it became law. It stands at $13.99 million in 2025 (that amount can be double for couples making joint gifts). The One Big Beautiful Bill Act will permanently raise the federal estate tax exemption to $15 million beginning in 2026.5

Other TJCA Tax Provisions That Will Become Permanent

There are a few other tax provisions from the TCJA that the One Big Beautiful Bill Act permanently extended. They include:

- The mortgage interest deduction will remain at $375,000 for single filers and $750,000 for joint filers. There are select mortgage insurance premiums other could potentially qualify for a deduction.

- The Child Tax Credit doubled when the TCJA became law. It will increase to $2,200 for 2025 and be indexed for inflation.

- Personal exemption elimination becomes permanent.

- Increased Alternative Minimum Tax exemption and income phaseout thresholds become permanent. The phaseout levels begin at $500,000 for single filers and $1 million for joint filers and will be indexed for inflation.

Other Temporary Tax Provisions

There are also several tax provisions in the One Big Beautiful Bill that are temporary.6 They include:

- An “above-the-line” type of deduction that will reduce adjusted gross income for those who are 65 and older through 2028.7 Single filers who are 65 and older will see an additional $6,000 tax break, and it’s $12,000 for joint filers. There’s a caveat to that, though. Seniors that have at least $75,000 in Modified Adjusted Gross ($150,000 for joint filers) will be phased out of the additional tax break.

- No taxes on tips or overtime through 2028.8 There’s a $25,000 cap on taxes on tipped income. The cap on overtime income is $12,500 for single filers and $25,000 for joint filers. An income phaseout for this deduction starts at $150,000 for single filers and $300,000 for joint filers.

- Deductible interest on auto loans through 2028.9 You may be eligible for up to a $10,000 deduction of auto loan interest if you purchase your vehicle in the U.S. and it was U.S. made. Single filers must have $100,000 or less of MAGI and joint filers must have less than $200,000 to qualify for the deduction.

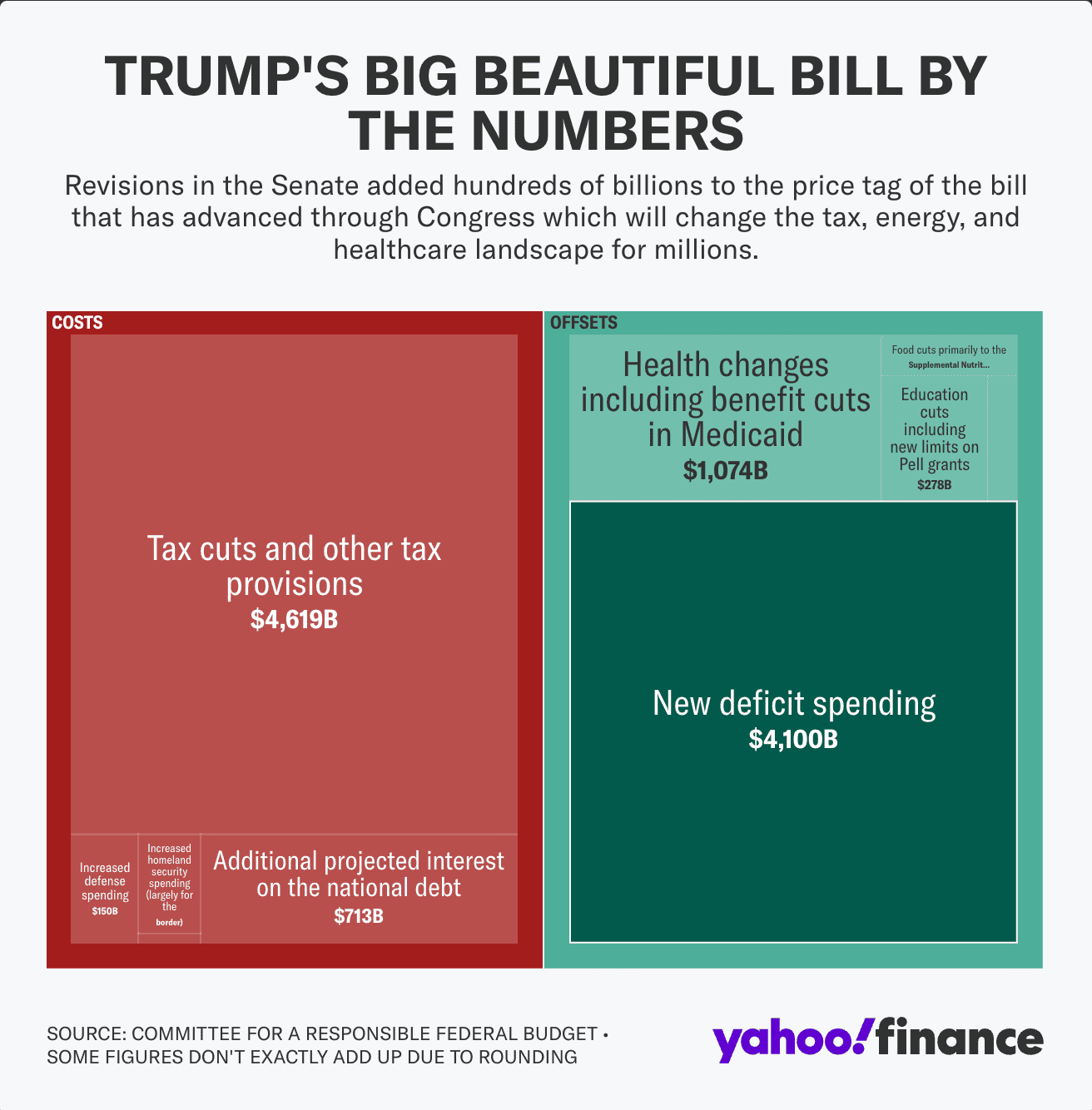

How Will These Tax Provisions Be Funded?

We talk all the time about how retirement planning is a series of trade-offs. The same thing applies to the One Big Beautiful Bill Act. To pay for all the tax provisions we just listed, there will be spending cuts to programs such as Medicaid and SNAP (Supplemental Nutrition Assistance Program).10

The Congressional Budget Office and KFF project that an additional 17 million Americans could become uninsured due to cuts to Medicaid and adjustments to the Affordable Care Act. from the One Big Beautiful Bill Act.12 The CBO also projects that an additional 3 million Americans would no longer be eligible for food stamps from SNAP.13

While the One Big Beautiful Bill Act included several spending cuts, it also drastically increased spending for entities like the Department of Homeland Security.14 The DHS is due to receive an additional $165 billion over the next 10 years to increase border security and crack down illegal immigration.

Other Healthcare Provisions in the One Big Beautiful Bill Act

While the One Big Beautiful Bill Act’s cuts to Medicaid spending are making headlines, there are several other healthcare planning items to take note of. One thing the One Big Beautiful Bill Act didn’t contain was anything regarding the extension of expanded ACA tax credits, which are set to expire after December 31, 2025.15

The version of the One Big Beautiful Bill Act that was passed by the House included 11 different provisions related to Health Savings Accounts (HSAs), but the final bill only included three of them.16 The three HSA provisions in the final bill involve telehealth/remote services, treatment of direct primary care arrangements, and individual market bronze and catastrophic plans:

- Telehealth/Remote Services: This provision permits HSA account owners to utilize HSA funds to pay for telehealth and other remote services.17

- Treatment of DPC Arrangements: DPC plans are also commonly referred to as concierge healthcare plans. This provision allows for DPC fees to be HSA eligible if the fee is less than $150/month for individuals and $300/month for families. Previously, many DPC fees weren’t eligible to be paid for with HSA funds.18

- Individual Market Bronze and Catastrophic Plans: These plans will be treated as HSA-qualified HDHPs under the One Big Beautiful Bill Act. Individuals with these plans will be able to utilize their HSA for out-of-pocket expense19

Educational Provisions in the One Big Beautiful Bill Act

As we begin to wrap up this article on the One Big Beautiful Bill Act, there are a few provisions related to educational costs that we want to call out.

529 Plans Get a Boost

Let’s start by reviewing how the One Big Beautiful Bill Act will expand 529 plans. Prior to the One Big Beautiful Bill Act, there was a $10,000 annual limit that families could withdrawal from a 529 plan for elementary or secondary education. That has increased to a limit of $20,000 per year.20 The list of qualified K-12 qualified expenses has also expanded.

New “Trump Accounts” for Your Children’s/Grandchildren’s Education

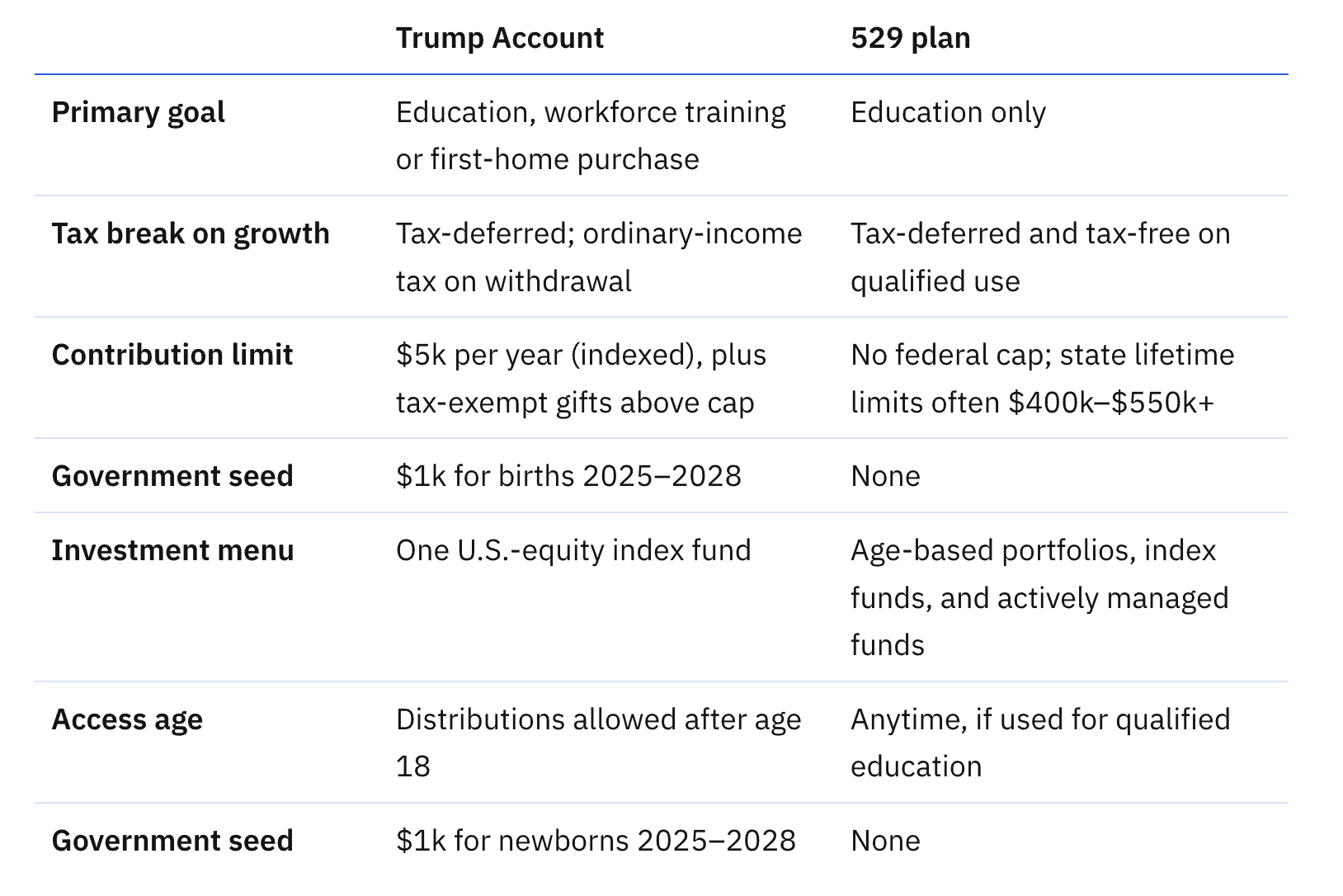

Along with expanding 529 accounts, the One Big Beautiful Bill Act included provisions for “Trump Accounts,” which were created by the Money Accounts for Growth and Advancement program. Here is how those accounts compare and contrast with 529 plans.21

FIGURE 2 – Trump Accounts vs. 529 Plans – Saving for College

While 529 plans and Trump accounts present opportunities to help your children/grandchildren with educational expenses, the One Big Beautiful Bill Act repealed Joe Biden’s student loan forgiveness program. Beginning July 1, 2026, those who take out student loans will only have two repayment options: an updated standard repayment plan or the new Repayment Assistance Plan.22 Additionally, graduate and professional students will have respective annual limits of $20,500 and $50,000 that they can take out in student loans starting on July 1, 2026.

The One Big Thing to Keep in Mind About the One Big Beautiful Bill Act

There are many more provisions within the One Big Beautiful Bill Act, but hopefully this article has helped give you an idea of the bill’s key points. It goes without saying that the One Big Beautiful Bill Act has some politically divisive provisions, but it isn’t our place to provide any political commentary. Our objective is to help you understand how the bill may impact your financial plan.

From tax planning and estate planning to investment planning and healthcare planning, there are many different components of your financial situation that may have been affected by the One Big Beautiful Bill Act. If you have questions about the bill as it relates to your personal circumstances, start a conversation with our team below.

Again, there’s a lot to unpack with this bill. Rather than try to figure it all out on your own, make sure you’re working with a team of financial professionals that will collaborate on your behalf as they revisit your financial plan. Our team is ready to go to work for you and make sure that you have a fluid, forward-looking plan that’s tailored to your unique goals.

Resources Mentioned in This Article

- A Sample Financial Plan

- New Tax Provisions in the One Big Beautiful Bill Act

- What If We Go Back to Old Tax Rates?

- 2025 Tax Brackets: IRS Makes Inflation Adjustments

- What If the Tax Cuts and Jobs Act Isn’t Extended?

- What You Need to Know About Tax Deductions

- The Future of the SALT Deduction Cap

- Estate Tax: How Will My Assets Be Taxed When I Die?

- Estate Tax vs. Inheritance Tax

- Tax Strategies for High-Income Earners

- Financial Stress: How Do You Deal with It?

- Affordable Care Act Subsidies – How to Qualify for Them with Marty James, CPA, PFS

- Tax Advantages of HSAs with Marty James, CPA, PFS

- 529 Plans and Planning for Your Family’s Future

Downloads

Other Sources

[1] https://www.congress.gov/bill/119th-congress/house-bill/1/text

[2, 3] https://taxfoundation.org/research/all/federal/big-beautiful-bill-house-gop-tax-plan/

[4, 6, 7, 8] https://www.fidelity.com/learning-center/personal-finance/one-big-beautiful-bill

[5] https://www.kiplinger.com/taxes/whats-the-new-estate-tax-exemption

[10] https://apnews.com/article/what-is-republican-trump-tax-bill-f65be44e1050431a601320197322551b

[13] https://www.cbo.gov/publication/61534

[16, 17, 18, 19] https://www.kff.org/tracking-the-health-savings-accounts-provisions-in-the-2025-budget-bill/

[21] https://www.savingforcollege.com/article/maga-account-money-accounts-growth-advancement

[22] https://www.cnbc.com/2025/07/10/how-trumps-big-beautiful-bill-will-change-college-financing.html

Investment advisory services offered through Modern Wealth Management, Inc., a Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management a Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.