Mega Backdoor Roth Before Retirement

Key Points – Mega Backdoor Roth Before Retirement

- Potentially Saving More to Your Roth IRA and/or Roth 401(k)

- Reviewing the Roth IRA Income Limits

- The Difference Between Doing a Backdoor Roth IRA and a Mega Backdoor Roth IRA

- 5-Minute Read

What Is a Mega Backdoor Roth?

We’ve published a lot of content about Roth IRAs and how they can be an effective tax savings vehicle. But have you heard of a backdoor Roth or a mega backdoor Roth? They might sound like they’re special types of Roth IRA accounts, but they’re actually strategies that high income earners use to get more money into Roth accounts.

There are annual Roth contribution limits and income limits to make Roth IRA contributions. Utilizing a backdoor Roth or a mega backdoor Roth can potentially serve as loopholes to make Roth contributions if your Modified Adjusted Gross Income exceeds the income limits. We’ll share what those income limits (and contribution limits) are after explaining the difference between the two strategies.

Schedule a Meeting Get the Retirement Plan Checklist

Backdoor Roth vs. Mega Backdoor Roth

With a backdoor Roth, you’re contributing funds that have previously been taxed into a traditional IRA as a non-deductible contribution. If you’ve already funded an IRA with deductible contributions or rollover of pre-tax funds, the funds you’ve previously contributed may impact your taxes. After you make that non-deductible IRA contribution, you would then roll the funds over to a Roth IRA via a Roth conversion.

While there are income limits for making Roth IRA contributions, there aren’t any for after-tax non-deductible IRA contributions as long as you or your spouse have enough earned income. There aren’t Roth conversion income limits or limits on how much you can convert either. You will still need to pay tax on the conversion for earnings or the pro-rata portion of pre-tax dollars in the IRA, but Roth IRA earnings grow tax-free and they’ll also come out tax-free under certain conditions.

If you have pre-tax dollars in any IRAs, doing the backdoor Roth conversion may not make sense now because of the pro-rata rules. However, it could still be a viable option for making a larger backdoor Roth conversion before retirement if you do some planning.

Mega Backdoor Roth

Now let’s break down the mega backdoor Roth IRA process. The mega backdoor Roth involves after-tax 401(k) contributions that are immediately rolled over through an in-plan rollover (conversion) into a Roth 401(k) account. We want to be clear here. This involves an after-tax 401(k) contribution, not a pre-tax contribution or Roth 401(k) contribution. You’ll need to check and see if your 401(k) plan provider allows after-tax contributions and for in-plan Roth conversions, which are also referred to as in-plan rollovers.

The Main Reason to Consider Doing a Mega Backdoor Roth

If your MAGI is above the Roth IRA contribution income limits, in addition to the higher contribution amounts available in the 401(k) versus the IRA contribution limits, you might want to consider doing a mega backdoor Roth. Additionally, you could still do backdoor Roth conversion, allowing even more money to accumulate in Roth accounts.

Let’s review the Roth IRA contribution income limits and Roth IRA contribution limits for 2024. If you’re a single tax filer and want to make a full Roth IRA contribution in 2024, your MAGI needs to be below $146,000. You can still make a partial contribution if your MAGI is between $146,000-$161,000.

If you’re married and filing jointly, your MAGI needs to be under $230,000 in 2024. The phase-out range to make a partial Roth IRA contribution is $230,000-$240,000. If your MAGI is above those thresholds, that could be a reason to consider doing a mega backdoor Roth if your 401(k) plan provider allows post-tax contributions and in-plan Roth conversions.

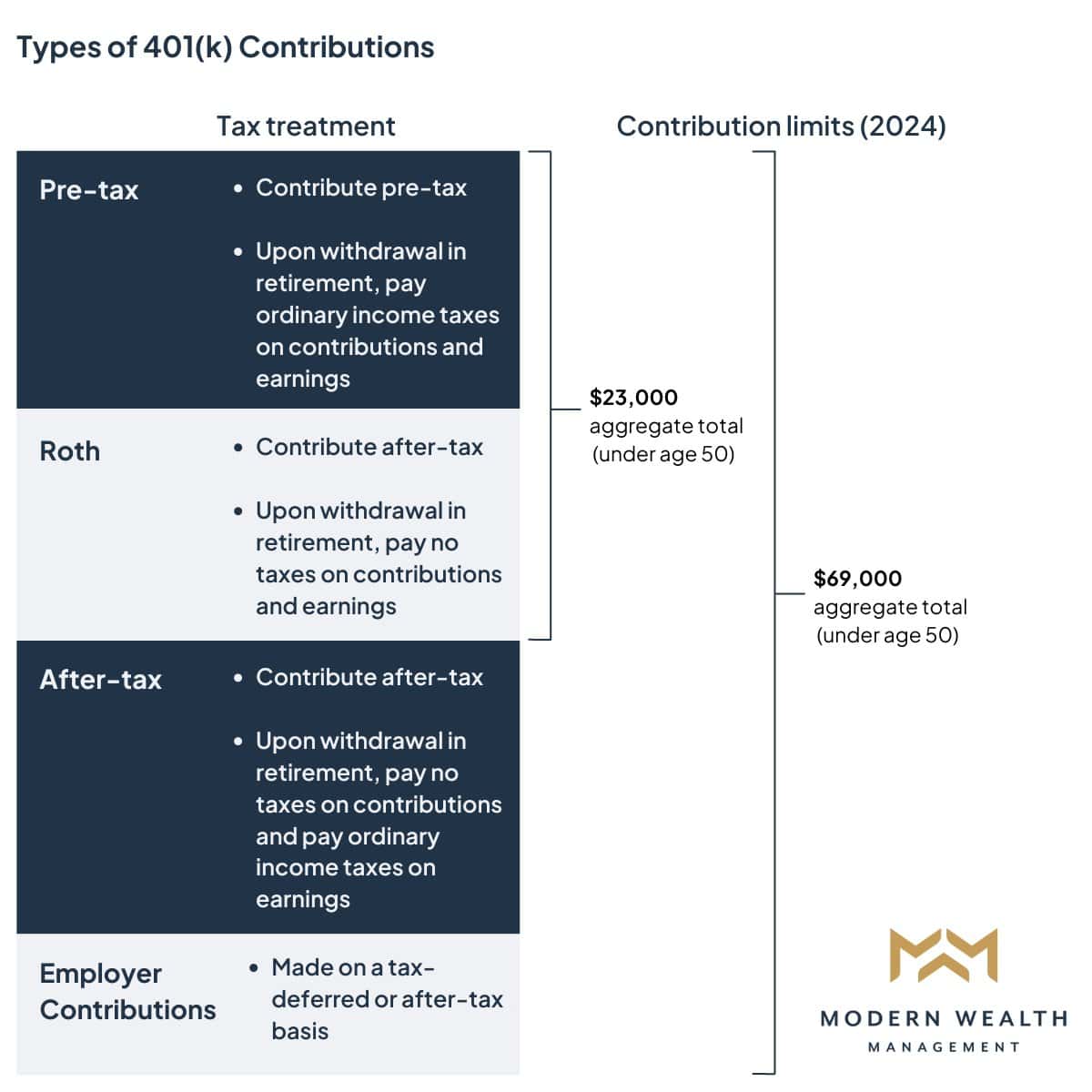

In 2024, the most you can contribute using only pre-tax and/or Roth contributions is $23,000. If you’re 50 or older, that total can increase to $30,500 if you make a catch-up contribution. When factoring in after-tax contributions as well, you can potentially contribute up to $69,000 a year if you’re under age 50. See Figure 1, below, for a breakdown of the different types of 401(k) contributions.

FIGURE 1 – Types of 401(k) Contributions

Important Note About After-Tax Contributions in 401(k) Plans

If after-tax contributions are allowed in your 401(k) plan, this feature must pass annual compliance testing. A passing result is unlikely unless favorable conditions exist, which requires enough non-highly compensated employees to contribute more than the standard IRS limit of $23,000. If compliance testing fails, then participants who did make after-tax contributions will have their deposits removed from the plan. This is one reason why after-tax contribution features aren’t commonly found in 401(k) plans.

Taking Advantage of Catch-up Contributions

If you’re 50 or older, you have an opportunity to contribute even more than $69,000 a year. That’s because people 50 or older are eligible to make an annual catch-up contribution of up to $7,500 in 2024. The potential aggregate total would then bump up to $76,500. If you want to learn more about the power of catch-up contributions, check out this episode of America’s Wealth Management Show with Dean Barber and Matt Kasper, CFP®, AIF®.

A Mega Backdoor Roth Case Study

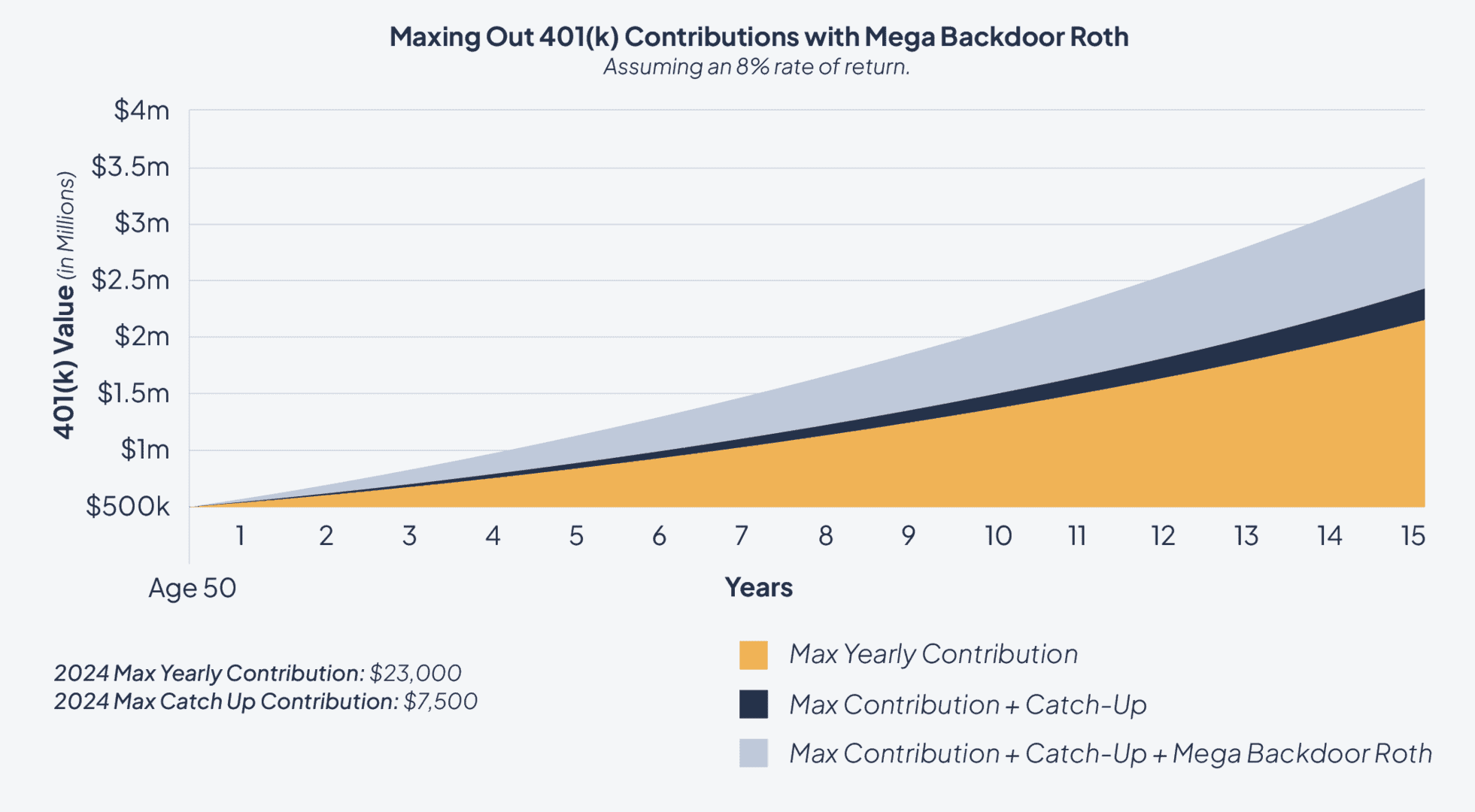

Now that we’ve reviewed the contribution limits, let’s run through a case study that illustrates the long-term impact of doing a mega backdoor Roth IRA. In this case study, there are three people who are 50 years old and have $500,000 in their 401(k) with an 8% average rate of return—Max Moore, Chris Catchings, and Becky Baxter.

FIGURE 2 – Maxing Out 401(k) Contributions with Mega Backdoor Roth

Max Moore: Maximum Annual 401(k) Contributions, But No Catch-ups or Mega Backdoor Roth

Max plans to make maximum annual contributions to his 401(k) but is unaware that he’s eligible to make catch-up contributions and about the opportunity to do a mega backdoor Roth. Still, if Max makes maximum contributions over 10 years, his savings are projected to grow to $1,412,653.44 by the time he’s 60. And if he makes maximum contributions until he’s 65, his savings are projected to reach $2,210,583.18.

Chris Catchings: Maximum Annual 401(k) Contributions with Catch-ups, But No Mega Backdoor Roth

Chris intends to make maximum annual contributions to his 401(k) and do full catch-up contributions. However, he’s also unaware of the opportunity to do a mega backdoor Roth. By making maximum contributions with catch-ups over 10 years, Chris projects to increase his savings to $1,521,302.65. If he were to do this until age 65, Chris projects to have $2,414,224.03 in savings.

Becky Baxter: Maximum Annual 401(k) Contributions with Catch-ups and Mega Backdoor Roth

Becky is the only one of three who knows about the mega backdoor Roth and plans to use it as a potential strategy. She also intends to make maximum annual contributions to her 401(k), including full catch-up contributions. By age 60, Becky projects to accumulate $2,079,035.31 in savings. If she were to continue utilizing the same strategy until age 65, Becky projects to have $3,459.580.42 in savings.

Who Should Consider Doing a Mega Backdoor Roth and Why?

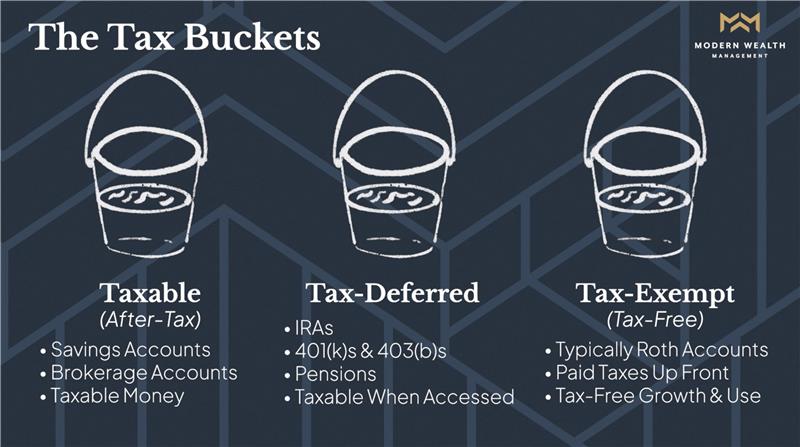

A brokerage account is also a savings vehicle that people sometimes use if they have excess cash flow. However, a brokerage account is an after-tax account. Don’t assume that if you exceed the Roth IRA income limits that you can’t get money into a Roth account. Doing a mega backdoor Roth presents an opportunity to capture tax-free growth prior to retirement and create tax diversification. Many plans allow you access pre-59½ to your after-tax contributions even if they have been converted to the Roth account.

FIGURE 3 – The Tax Buckets

Doing a Mega Backdoor Roth at Lower Tax Rates

Remember that a traditional 401(k) and IRAs are tax-deferred assets. That means that you won’t pay any tax on that money until you take it out of the account. If you have most of your retirement savings in tax-deferred accounts and aren’t planning to take the money out in 2024 or 2025, it’s important to realize that you might be paying more tax on your withdrawals. That’s because the tax rates outlined in the Tax Cuts and Jobs are scheduled to sunset after 2025.1 If that happens, the current tax rates would revert to the higher rates from 2017.

Many retirees and near-retirees have been doing Roth conversions in an effort to potentially lower their long-term tax burden. Our advisors and CPAs have realized that backdoor Roths and mega backdoor Roths are much lesser-known strategies than Roth conversions, but they could be very effective strategies depending on your situation.

Building Generational Wealth

When considering whether to do backdoor Roths or mega backdoor Roths, remember that the decision isn’t all about you if leaving a legacy is important to you. The tax-free growth of Roth IRAs can potentially make a big impact with building generational wealth.

Do You Have Questions About Mega Backdoor Roths and Backdoor Roths?

We can’t stress enough that this all depends on your situation. Let’s circle back to the case study we went through. We stated that each person was 50 years old with $500,000 saved in a 401(k), but we didn’t say anything about their goals, family situation, plans for retirement, health situation, etc. All that and more needs to be considered before doing a mega backdoor Roth or backdoor Roth.

As you’re considering whether these strategies could make sense for you, start a conversation with our team below so we can potentially share some additional insight.

One of our priorities at Modern Wealth is to help give people more confidence to make the right decisions with their money. That’s why we publish educational content like this to help people make important decisions about their financial future. We look forward to talking with you more about your financial and life goals and how we might be able to help you accomplish them.

Resources Mentioned in This Article

- How Does a Roth IRA Grow?

- What Is a Backdoor Roth IRA?

- 2024 401(k) and IRA Contribution Limits

- 5 Tax Secrets Retirees Need to Know

- How to Maximize In-Plan Roth Conversions in 401(k) Plans

- Roth Conversion Decisions for 2024

- Catch-Up Contributions for Your Retirement Plan

- Retirement Cash Flow: What You Need to Know

- 5 Long-Term Strategies for a Better Retirement

- Revisiting Roth vs. Traditional with Bud Kasper, CFP®, AIF®, and Corey Hulstein, CPA

- Tax Rates Sunset in 2026 and Why That Matters

- How to Build Generational Wealth

- The Great Wealth Transfer Has Arrived

Downloads

Other Sources

[1] https://taxfoundation.org/blog/tcja-expiring-means-for-you/

Investment advisory services offered through Modern Wealth Management, Inc., a Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management a Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.