Target Date Funds: What You Need to Know

Key Points – Target Date Funds: What You Need to Know

- There Are Pros and Cons of Target Date Funds

- Asset Allocation Is a Critical Component of Target Date Funds

- Target Date Funds Aren’t Static

- Understanding Target Date Fund Glide Paths

- 8 Minutes to Read

What Are Target Date Funds?

According to a Morningstar 2023 report, total target date fund assets hit an all-time high of $3.27 trillion in 2021.1 But when market performances drastically tumbled in 2022, the flaws of target date funds became very apparent, as total TDFs fell to $2.81 trillion by the end of 2022. While they have since rebounded, the past few years have highlighted some pros and cons of target date funds.

We caught up with LSA Portfolio Analytics President and CFO Brad Kasper to provide his keen insight on TDFs. He defines target date funds as a type of mutual fund that is managed by professionals to simplify retirement investing for individuals who may not have the expertise or time to actively manage their portfolios.

“They offer a straightforward investment strategy that gradually shifts asset allocations as an investor approaches a predetermined retirement date.” – Brad Kasper

Target date funds tend to target age 65 because it’s considered to be a traditional age for retirement. However, that isn’t the case for all TDFs. Brad will help explain why that is later in this article.

While they offer a straightforward investment strategy, there are still other important factors about target date funds that you should know so that you can have more confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things you love. Let’s review some key considerations about target date funds.

1. Knowing the Risks of the Target Date Fund You’re in

What’s your preferred mixture of stocks and bonds in your portfolio that gives you ideal asset allocation? Your answer to that question will likely be different than that of your friend, coworker, or family member. That’s because everyone has different comfort levels when it comes to investment risk exposure.

Brad shares that target date funds typically begin with a higher allocation to equities (stocks) in the early years to maximize growth potential. As the target retirement date approaches, the fund gradually lessens exposure to stocks and increases bonds to reduce volatility and protect capital.

“The fund manager’s objective is to maintain an appropriate balance of risk and return throughout the investment horizon. Target Date Funds automatically adjust the asset allocation over time, periodically rebalancing the portfolio to maintain the target risk profile.” – Brad Kasper

When Do You Plan to Retire?

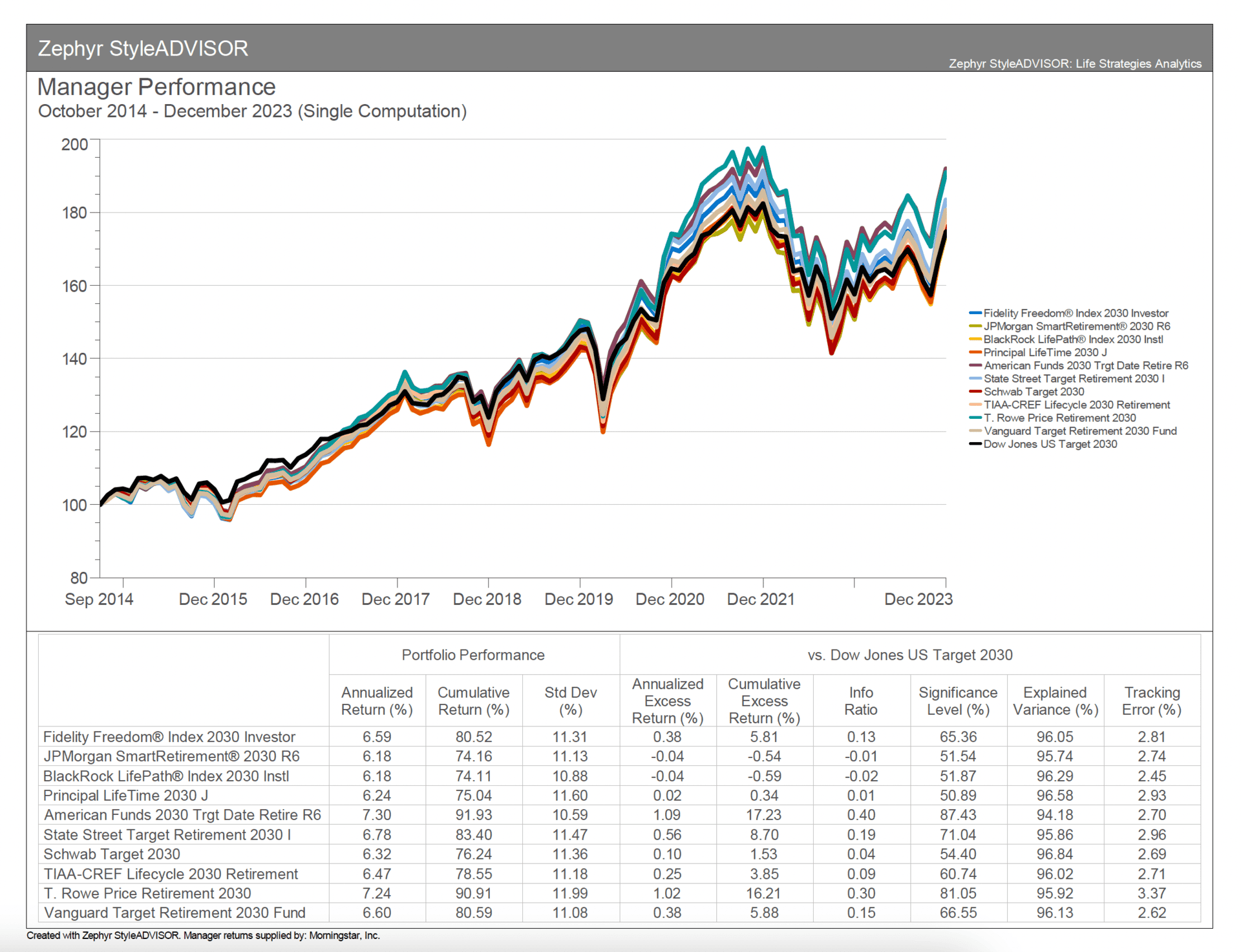

Your investment horizon is going to coincide with when you want to retire. For example, let’s say that you’ll turn 59 in 2024 and plan to retire in 2030 at 65. Figure 1, below, shows how several different 2030 target date funds have performed over the past decade. Before you look at Figure 1, though, it’s imperative to understand that past performance does not guarantee future results.

FIGURE 1 – 2030 TDFs – Zephyr StyleADVISOR/Morningstar

Figure 1 backs up the data from the opening paragraph with how total target date fund assets peaked in 2021 before sharply falling off in 2022. While 2023 was a year of recovery—albeit amid some heightened volatility—what if you had planned to retire in 2022 rather than 2030? This is why it’s critical to understand the risks of the TDF that you’re in.

There’s no doubt that it’s a definite perk of TDFs to have professionals actively manage it. But nevertheless, the investor still carries the responsibility of keeping tabs on it to know how much risk they’re subjecting themselves to at any point in time, especially as they’re approaching retirement.

2. TDFs Are Essentially a Fund of Funds

Another important thing to know about TDFs is that they are essentially funds comprised of funds. One of the biggest drawbacks of target date funds is that they provide limited customization.

“They may not suit investors with unique financial goals, risk tolerances, or preferences. Customization options within target date funds are limited compared to building a personalized portfolio.” – Brad Kasper

Also, Brad notes that TDFs oftentimes have higher expense ratios compared to passive index funds or ETFs. Investors should consider the impact of fees on their returns. And again, the asset allocation in your friend’s portfolio might not work for you even if you’re planning to retire at the same time. Target date funds will assume that everyone with the same target date has identical risk tolerance and financial situations, but that clearly isn’t the case. That’s an inherent risk of TDFs.

3. Most Employer Plans Legally Default into a Target Date Fund

The next point we want to share about target date funds is that most 401(k) and 403(b) plans legally default into them.2 The only way to get away from them is to go in and change your allocation.

According to a study from the Investment Company Institute and Employee Benefit Research Institute, 86% of 401(k) plan participants included TDFs in their investment lineup as of December 31, 2020.3 That just goes to show how popular target date funds are, and why it’s critical to understand how they work.

4. Target Date Funds Aren’t Static

We touched on this as a part of point No. 1, but it’s worth reiterating that target date funds aren’t static. Let’s go through another quick hypothetical example. Let’s say that you’re turning 25 in 2025 and plan to retire at 65 in 2065.

Someone with a 2065 target date fund will obviously have a much longer investment horizon at this point than someone with a 2030 target date fund. The longer your investment horizon, the higher percentage of equities you’ll have in your target date fund. That will gradually shift to become more conservative and shift to bonds the closer you get to 2065, reducing exposure to investment risk.

“As the retirement date approaches, the target date fund typically reaches its most conservative allocation, with a higher emphasis on bonds and cash equivalents. In the post-retirement phase, target date funds may continue to adjust their allocation, although the primary objective remains capital preservation and providing income.” – Brad Kasper

5. Glide Paths: “To vs. “Through”

To this point, we’ve given a few hypothetical examples of people using target date funds that take them up to age 65. But that isn’t the only approach to take when managing the asset allocation of a TDF as investors approach and reach their retirement date. There’s also an approach that manages the investor’s asset allocation beyond their retirement date, taking them through retirement. Let’s examine the “to” and “through” target date fund glide paths.

“To” Glide Path

We’ll start with the “to” glide path approach. It focuses on managing the target date fund’s asset allocation up to when the investor retires. For TDFs with a “to” glide path, the fund’s asset allocation becomes static or levels off after the investor retires.

“This means that once the investor reaches their target retirement date, the asset allocation remains relatively stable with a higher proportion of fixed-income investments, such as bonds and cash equivalents, to minimize risk. The emphasis is on capital preservation and generating income during retirement.” – Brad Kasper

“Through” Glide Path

Now, let’s shift gears to the “through” glide path approach. It extends the management of asset allocation beyond the investor’s retirement date. The “through” glide path allows the fund to evolve and adjust its asset allocation following the investor’s retirement.

“This approach recognizes that many retirees will continue to rely on their investments for income and capital appreciation during their retirement years. The asset allocation remains dynamic, with a more significant allocation to equities and other growth assets, even after the target retirement date, to potentially keep pace with inflation and provide long-term growth.” – Brad Kasper

So, the main difference between the two glide paths is how the asset allocation is managed following the investor’s retirement.

Assessing Different Target Date Strategies

Let’s circle back to assessing how target date funds performed in 2022 as we begin to wrap up this article. That year demonstrated the importance of adapting to a changing investment landscape. Since it wasn’t a great year for traditional stocks and bonds, many investors sought a more diversified approach by incorporating a broader spectrum of growth and defensive assets.

In many instances that diversified approach included defensive equities, equity and bond diversifiers, inflation-resilient real assets such as real estate and commodities, and Treasury Inflation-Protected Securities (TIPS).

“This diversification across various market segments helped cushion losses in 2022, outperforming simple-allocated target date strategies,” Brad Kasper

As bond yields were rising in 2022, diversification of asset exposure became that much more important. Dean Barber always likes to say that stocks are a get-rich investment while bonds are a stay-rich investment, but that simply wasn’t the case for bonds in 2022. Again, that was a particularly rude awakening for those who were near or entering retirement. That timeframe is oftentimes when an investor counts on bonds as a refuge of retirement income that can last well into their retirement.

Inflation’s Impact

We just mentioned TIPS being a popular addition to portfolio in 2022, as year-over-year inflation hit 9.1% in June of that year.4 That was the highest mark since 1981.5 The high inflationary environment posed a major threat in 2022, hence another reason why TIPS and other inflation-sensitive assets were critical components of target date strategies at that time. According to AllianceBernstein, well-diversified target date strategies allocated nearly 20% to TIPS and real estate near retirement.6

“While no single investment strategy is infallible, a diversified target date approach offers the potential to weather different market conditions. It may underperform in certain environments, such as a prolonged bull market, but its primary goal is to build assets over the long term, which requires navigating market ups and downs.” – Brad Kasper

The Rise of Target Date Funds

It took about 15 years for target date funds to become a popular investment strategy after they were created in 1994.7 But the growth of TDFs since the end of the Great Recession has been remarkable. They eclipsed $1 trillion in assets under management in 2017.7 And remember that we shared that the target date funds assets under management (AUM) reached $3.27 trillion by the end of 2021.

“Over the past decade, demand for traditional target date strategies surged due to favorable market conditions. This period was characterized by a remarkable bull market in stocks, occasionally punctuated by volatility, which was effectively balanced by the negative correlation of bonds.” – Brad Kasper

A Diversified Approach Is Critical

That being said, the performances of target date funds in 2022—especially ones with broad stocks and nominal bonds—can’t be ignored. 2022 highlighted how important it is to consider more diversified asset allocations.

“As we transition to a new investment regime marked by converging risks, plan sponsors should critically evaluate target date designs. Incorporating diversified exposures beyond broad stocks and nominal bonds, as well as defenses against inflation, can represent significant steps forward in preparing participants to achieve their savings and income goals throughout the glide path phases.” – Brad Kasper

Brad encourages investors to remain vigilant and open to adapting their target date strategies in response to evolving market conditions, as there is no guarantee that the favorable climate of the past decade will be repeated in the years to come.

Have Any Questions?

We appreciate Brad for sharing his insight and always enjoy having him as a guest on The Guided Retirement Show. Whether you participate in a target date fund or not, ask yourself these questions.

- Are target date funds worth it?

- Are they right for me?

- Which one do I choose?

- How do I make the right choice?

That’s a lot to think about, but there’s one thing in common with answering each question. It’s important to talk to a team of professionals as you determine that investment strategy that helps you achieve your needs, wants, and wishes as you approach and go through retirement.

There’s More to Retirement Planning Than Your Investments

It’s also critical to remember that your investment portfolio and a financial plan aren’t one in the same. Your investment portfolio needs to be a part of your financial plan, which also includes a forward-looking tax plan and estate plan as well as risk management strategies and retirement planning goals that are unique to you. Our Retirement Plan Checklist demonstrates that retirement planning involves so much more than your investments. Download your copy below to gauge your retirement readiness.

If you have any questions about target date funds, our Retirement Plan Checklist, or anything else concerning your plans to get to and through retirement, start a conversation with our team below.

We want to stress that when it comes to specific investments, it’s critical to understand that past performance does not guarantee future results. We hope that you found this article to be educational. It’s our goal to help you make informed decisions so that you more confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things you love.

Resources Mentioned in This Article

- 2022 Was Unusual for Bonds, Tough on Stocks

- Proper Portfolio Construction with Stephen Tuckwood, CFA

- Asset Allocation vs. Tax Allocation

- 7 Wealth Protection Tactics

- Financial Stress: How Do You Deal with It?

- Your Retirement Lifestyle: What Do You Want Your Retirement to Look Like?

- Investment Risk in 2023 with Garrett Waters

- Reviewing Rebalancing Strategies

- Retiring Before 65: What You Need to Consider

- Active vs. Passive Management

- How Bonds Fit into a Financial Plan

- The Great Recession’s History Remains Relevant

- Why You Need a Financial Planning Team

- Components of a Complete Financial Plan with Logan DeGraeve

- What Is Tax Planning?

- 5 Estate Planning Documents That Everyone Needs

- Don’t Miss Out on Your Money: Redefining Risk Management

- Nonfinancial Life Planning with Bruce Godke

- Reviewing Your Retirement Checklist

- Don’t Retire without Doing These Things First

- Retirement Plan Checklist

Other Sources

[1] https://www.morningstar.com/lp/tdf-landscape

[3] https://www.ici.org/news-release/22-news-ebri-ici-401k

[4] https://www.usinflationcalculator.com/inflation/current-inflation-rates/

[5] https://www.usinflationcalculator.com/inflation/historical-inflation-rates/

[7] https://www.ici.org/system/files/2021-09/per27-07.pdf

[8] https://www.mutualfunds.com/retirement-channel/history-target-date-funds/</a&gt;

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.