Fiduciary Risk Management

Fiduciaries may be personally liable for plan losses if their actions do not meet the standard of care provided under ERISA. However, fiduciaries can limit their liability in certain situations.

We assist plan sponsors by recommending plan appropriate solutions for minimizing fiduciary exposure, including

- Increasing the plan’s fidelity bond

- Acquiring fiduciary insurance

- Introducing optional fiduciary service providers to support the selection, monitoring & reporting of plan appropriate investments, such as 3(21) and investment fiduciaries

- Implementing a prudent process for decision-making and documentation

- Providing fiduciary education for the plan’s fiduciaries and administrators

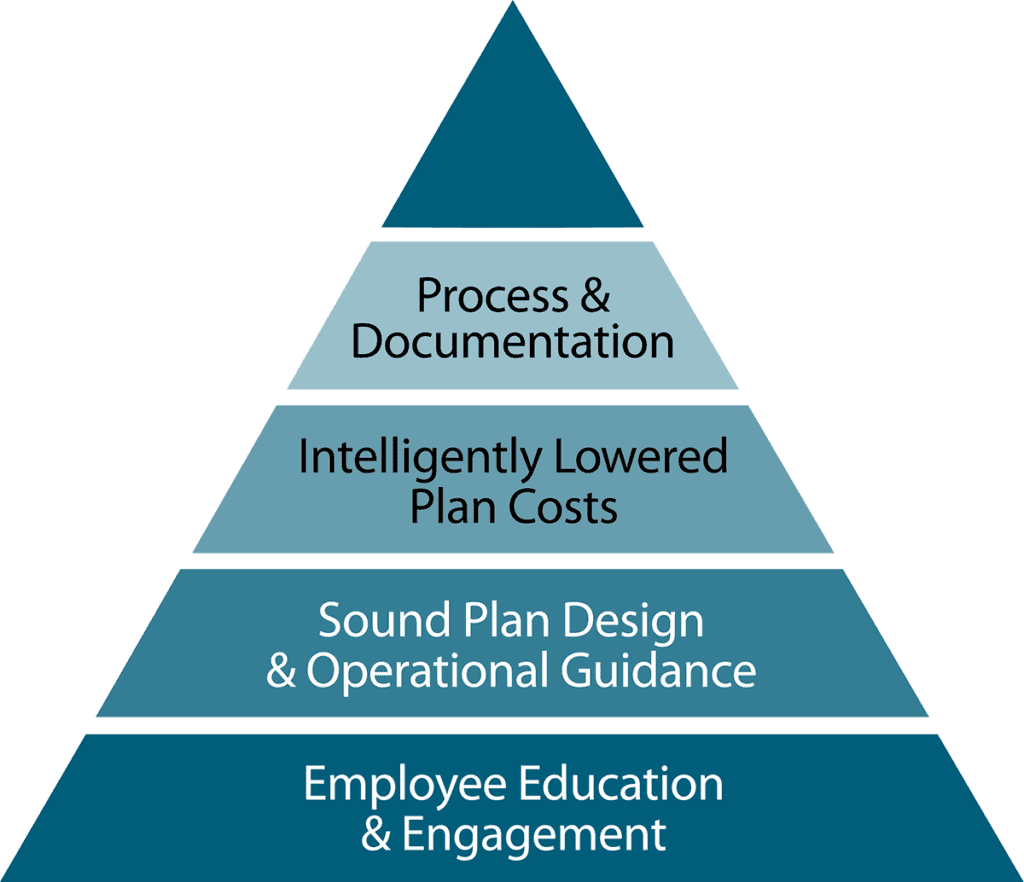

Fiduciary Risk Management goes beyond the investments.

Reducing fiduciary liability exposure involves the operation of the plan as much as it does the investment oversight.

Our fiduciary protection encompasses provider fee and service benchmarking and participant education/one-on-one guidance services to provide maximum support to the plan fiduciaries in managing their obligations.

Our client onboarding includes complete plan document, plan design, and plan operations reviews to aim to protect plan fiduciaries from further missteps.