Retirement Planning with Modern Wealth Management

Who We Are

Consider us your go-to team for all things related to wealth management. We provide a range of services such as financial planning for retirement, tax planning, risk management, and estate planning. Our team is comprised of knowledgeable experts who have your back by sharing essential and personalized retirement advice.

Confidence, Freedom, and Time

A financial plan is key to giving you more confidence, freedom, and time as you’re approaching and going through retirement. We’re all about giving you the confidence, freedom, and time to make your dreams happen.

Staying on Track

Download our Retirement Plan Checklist to get started and see where you’re at on your retirement and financial planning journey.

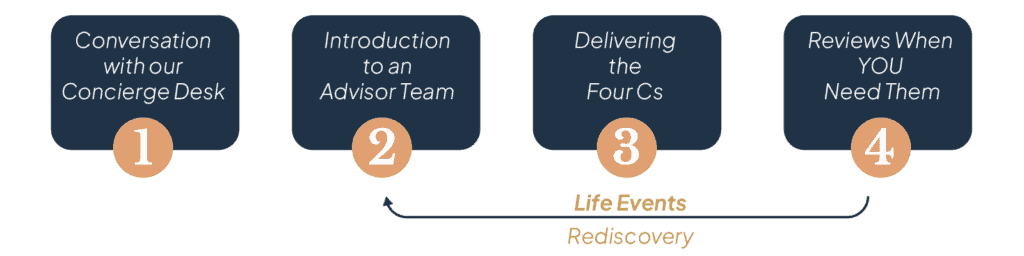

What Is Our Process?

1. Conversation with Our Concierge Desk

A member of our concierge desk will reach out to you to learn more about your situation and determine if we can help. While we’re more than happy to address your questions about Modern Wealth, the focus of the conversation will be about your unique situation.

Once you’re ready to start the retirement planning process, schedule a conversation with our concierge desk.

2. Introduction to an Advisor Team

Before you meet with one of our advisor teams, they’ll review all the information you provided to our concierge desk. This is simply a get-to-know-you meeting to determine if we should work together. We’ll share some retirement and financial advice tailored to your situation. If you’re ready to move forward at that point, great! If not, you’re welcome to schedule additional meetings.

3. Delivering Service

If you decide to become a client, your advisor team will schedule another meeting with you to begin working on your financial plan. As our centralized financial planning, centralized tax planning and preparation, and centralized investment management teams collaborate to build your plan, they’ll keep your specific needs, wants, and wishes top of mind. Let’s figure out how to get your retirement funds to work for you in the most tax-efficient way possible.

4. Reviews When YOU Need Them

Your goals and other life circumstances will change over time, which means your financial plan will need to be continuously updated. That’s why we’ll have review meetings (typically at least once a year) with you to discuss your financial plan, retirement income, tax situation, and goals. We’ll typically meet with you every other year about your insurance and estate planning needs.

Get Your Copy

Our Retirement Plan Checklist includes 30 items to gauge your retirement readiness.

- Investments

- Taxes

- Risk Management

- Social Security

- Estate Planning

Also included is an age-based timeline of events. Prioritize your retirement planning based on key decisions to make at these ages:

- 50, 55, 59.5, 60, 62, 65, 66 – 67, 70, & 73+