Lumber, Commodities, and Inflation Fears

Key Points – Lumber, Commodities, and Inflation Fears

- Lumber Industry Expert Explanation

- Agricultural Commodity Trends

- Quelling Fears of Runaway Inflation

- 7 minute read

Lumber, Commodities, and Inflation Fears

In my last article, I discussed the dislocation between the supply chain and final demand brought on by pandemic lockdowns and the underestimation of the American consumer. I noted that the dislocation caused a dramatic increase in the prices of commodities of all kinds, especially lumber. I expressed that these inflationary pressures would likely be transitory and not the runaway inflation that some financial media speculated.

If recent events are any indication, and I believe they are, we may already be seeing the end of this inflationary trend and the beginning of a return to more normal prices. I’m going to focus a lot on lumber in this article. However, I am also discussing the big three agricultural commodities we farm in the Midwest: corn, wheat, and soybeans.

Industry Experts on Supply & Demand Anomaly

You’ve heard me explain why the dislocation in lumber supply and demand expectations got so bad. So now, I’ll share the perspective of a lumber industry expert and insider. I ran across an article from March 31st of this year on www.probuilder.com. It was written by a gentleman named Sean Tighe, SVP of purchasing for Lumbermen’s Merchandising Corporation (LMC), based in Wayne, Pa. He started at LMC in 1994 as a lumber buyer and has traded every lumber species in North America. You can read his entire article here if you want. I’ll share the pertinent pieces, but it’s well worth the 10-minute read. The story’s first sentence alludes to just how crazy things have gotten since the beginning of last year. Sean opens this way.

“Those of us in the lumber and building materials (LBM) industry can recall moments when we’ve uttered, “I’ve never seen anything like this,” when referring to a particular market dynamic. I can say with confidence that the market conditions of 2020 and early 2021 are examples of a supply chain and pricing environment most of us have truly never encountered.”

Disruption and Inflation No One Predicted

When industry insiders are caught off guard by something, you can bet everyone else was too. If the supply chain disruption were only in lumber, that would be one thing, but it’s not. It’s everywhere. Try to buy a new pickup, or boat, or appliances. You might find something, but it is not likely to be what you would choose under different circumstances. And the shortages are all caused by basically the same thing that happened in the lumber industry; a severe underestimation of near-term demand. Here’s what happened in lumber, according to Sean.

“In January and February of 2020, the price of lumber and panels began to fall due to an expectation within the LBM industry of waning demand and that inventories were sufficient.”

“A month later, in March 2020, COVID-19 threw a wrench into everything, causing uncertainty across all industries. Notably and reasonably, LBM manufacturers across North America took cues from the declining prices and slowing demand of the previous two months. They determined that those factors would continue for the foreseeable future as the pandemic shut down or slowed construction activity.”

“What they didn’t factor, and could not have foreseen, was that homeowners now forced to work from home began an incredible surge in repair and remodeling projects to create at-home workspaces or extend and improve outdoor living spaces—a dynamic that set the stage for an unexpected boom in demand for a variety of LBM products.”

Sudden Surge in Demand for Single-Family Dwellings

He goes on in the article to bring up the other shoe that no one saw dropping in 2020, which was the mass exodus from multi-family housing to single-family dwellings with more space and privacy.

Price Spikes Cause Inflation Fear

These events all conspired together to cause the most violent price spike in lumber we’ve ever seen. And again, lumber is just a proxy for almost every commodity imaginable. They were all affected. These price spikes have caused countless people to speculate about the prospect of runaway inflation coming permanently to the shores of the U.S. and setting up a very unwelcome and costly camp in our stores and wallets.

I would be stretching the truth if I told you that the possibility never crossed my mind. I’ve given that thought more space in my head than it deserves. Yet, it’s easy to understand why people get so worked up about this, especially when you see the meteoric price inflation in charts, rather than just hearing numbers on a news report or wincing at the thought of paying $8.52 for a 2 X 4 at Home Depot that was $2 last year.

Historically High Prices

So, let’s take a look. The following charts are from Trading Economics. They have a wealth of information available to anyone interested in taking a deep dive into all things economic. If you are so inclined, check it out. You can spend HOURS there! And, to the spouses of those who are so inclined, my apologies. Just check the computer room before filing a missing person’s report because they are probably there.

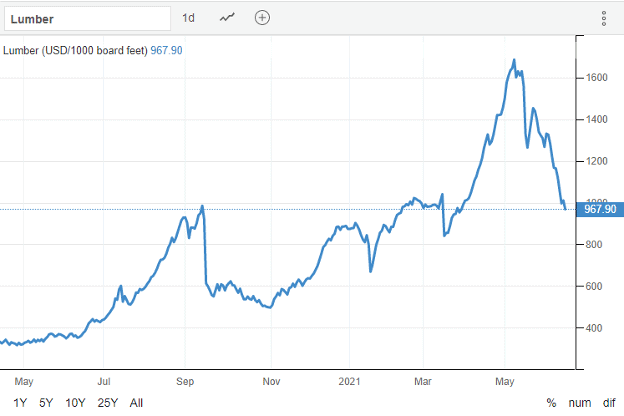

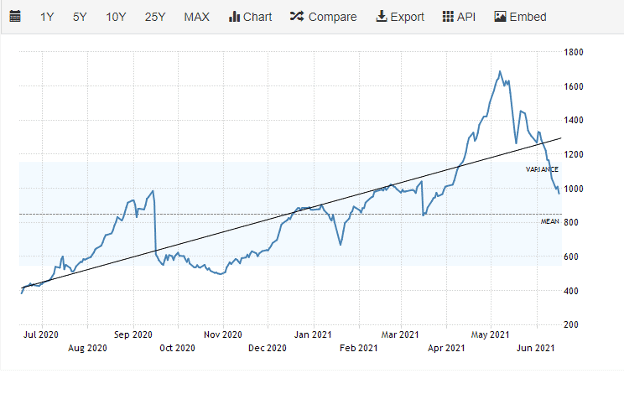

Figure 1 | Source: Trading Economics

As you can see above in Figure 1, lumber went from less than $400 per 1000 board feet a year ago to its peak on May 7th of nearly $1700 per 1000 board feet in less than 12 months. That kind of increase in lumber prices has never happened before, ever. The cost of lumber quadrupling caused people to believe that we were in for runaway hyperinflation like that of Venezuela or the Weimar Republic of Germany in the early 1920s. Mercifully, the run-up is over, and prices are coming back down.

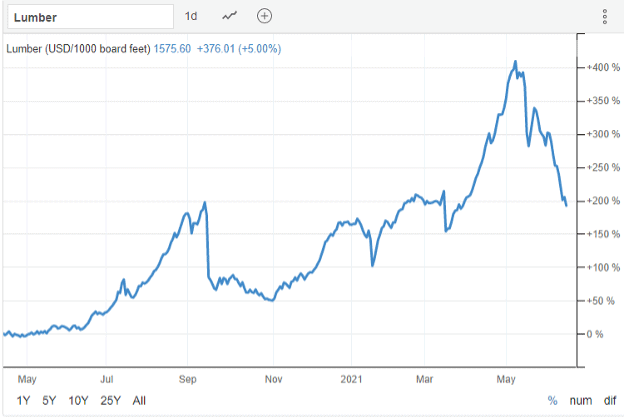

Figure 2 | Source: Trading Economics

Figure 2 shows the actual percentage of increase in lumber prices over the same timeframe. The increase was more than 400%. It’s key to remember that even though prices of anything can rise exponentially as a percentage of their starting price, they can only fall by 100% before they get to zero. As of June 6, 2021, lumber prices have fallen over 40% from their recent peak and now set about 175% above where they were 12 months ago. Forecasters from BMO expect the prices to crash further, calling for another 60% drop from where we are today, by the end of next year or sooner, which would put the price somewhere in the $400 per 1000 board feet range. You know, normal.

Lumber Returning to Normal

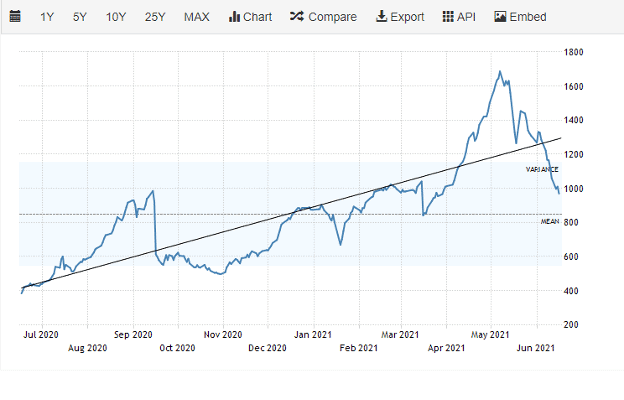

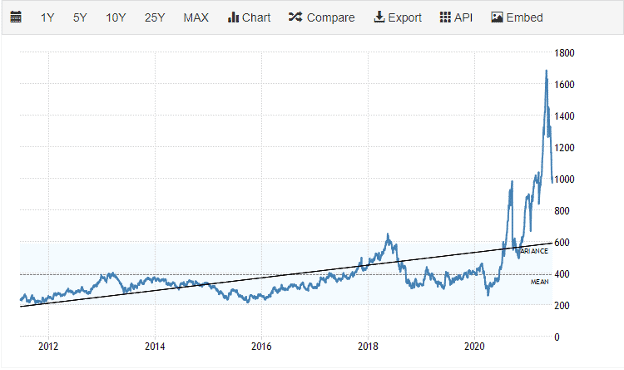

Figure 3 | Source: Trading Economics

Normal. That is what the next couple of charts shows us. The first chart, Figure 3, shows the price trend line for the last 12 months. Prices Crashing through that trend line (which would normally indicate support for prices) confirms a break and that prices are heading lower.

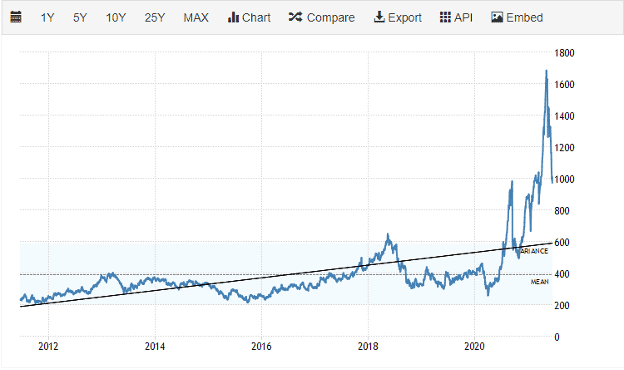

Figure 4 | Source: Trading Economics

In Figure 4, the trend line shows how far prices could fall; looking back over ten years of price history. Look at the trend line in that chart and you’ll see support for lumber prices doesn’t show up until they fall to around $600. That’s the support line based on the recent record highs. However, once the support line breaks, which may be soon, we could very well see prices in the $300 to $400 per 1000 board feed range. Historically, that is where they’ve tended to stay.

Figure 5 | Source: Trading Economics

Figure 6 | Source: Trading Economics

These charts above (Figure 5 and Figure 6) show what the folks at BMO are thinking and illustrate why they think it.

Hoarding Contributes to Price Spike

The Wall Street Journal published an article Turning Hoarders Into Sellers, on June 15th. The article discussed inflated lumber prices and revealed an additional cause for the price spike: hoarding. Of course! First, it was toilet paper, then gasoline, now lumber. I should have known. The author, Ryan Dezember, noted that during the run-up in prices, “wood was hoarded by builders, retailers, and others worried about running out of material during a construction season set into overdrive by low mortgage rates and federal stimulus payments”.

He quotes Mike Wisnefski, former lumber trader and now CEO of MaterialsXchange, an online marketplace, in the article. Mike said, “Everyone was buying more than they needed, there was this fear of lack of availability.” Now, those same people are flooding the market with “shadow inventory” according to Mr. Wisnefski. These are generally big buyers, such as home builders and truss fabricators who are now selling their inventory. And that’s not the only selling going on.

According to the same article, Weyerhaeuser, PotlachDeltic, and Rayonier, executives have recently engaged in selling their companies’ stock at levels that haven’t been seen in quite some time. Ben Silverman, Director of Research at InsiderScore, believes this selling indicates that these company executives know that peak lumber prices are behind us.

Agricultural Commodity Inflation

As I alluded to at the outset of this article, lumber wasn’t the only commodity to experience a sharp increase in price in a short amount of time. Let’s briefly look at what has happened to those agricultural commodities I mentioned, corn, wheat, and soybeans.

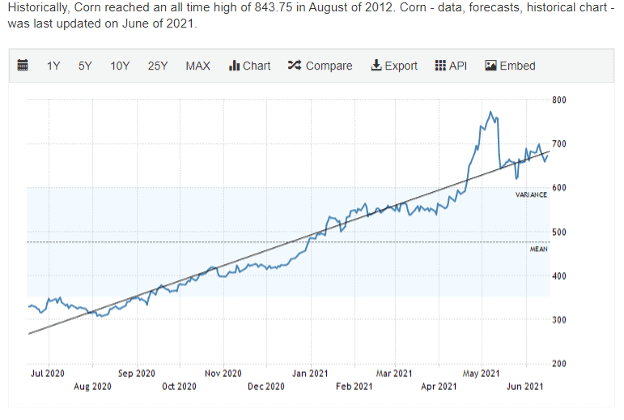

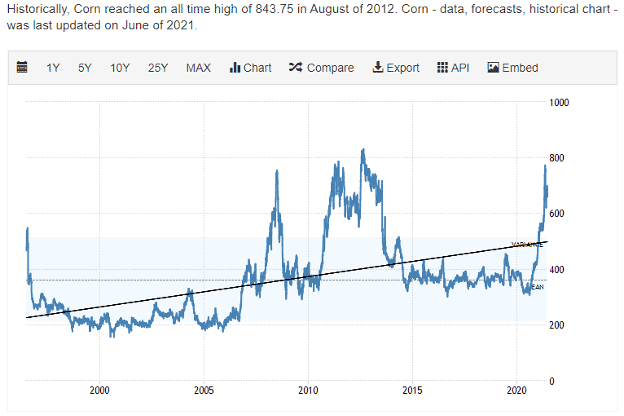

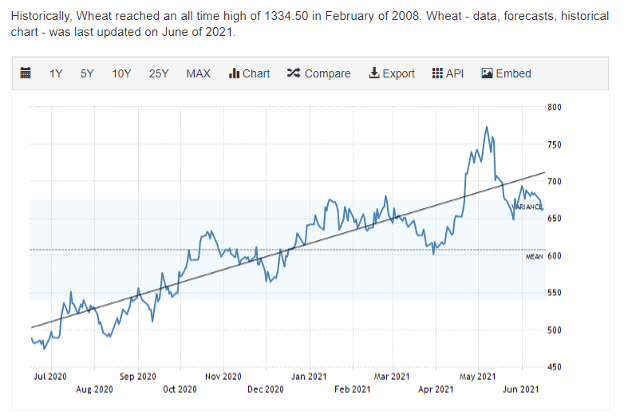

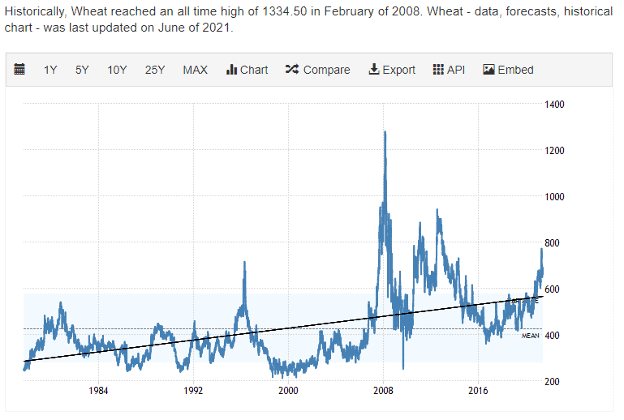

Figure 7 | Source: Trading Economics

Fig. 8 | Source: Trading Economics

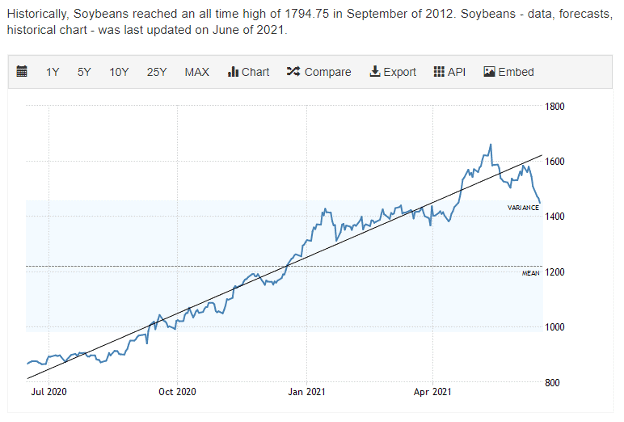

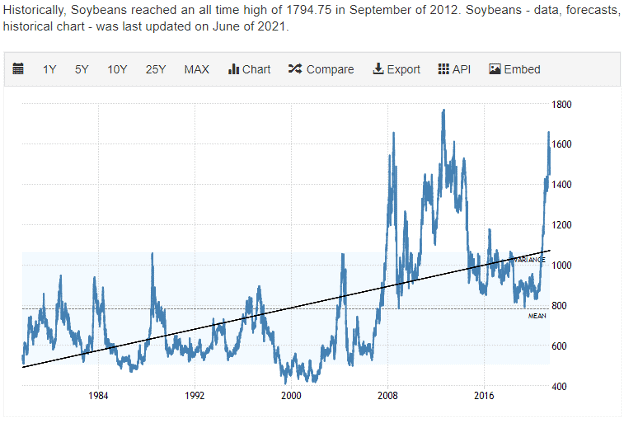

Figure 9 | Source: Trading Economics

Fig. 10 | Source: Trading Economics

Figure 11 | Source: Trading Economics

Fig. 12 | Source: Trading Economics

Above, I’ve included two charts per commodity (Figures 7-12). They show a one-year price trend and a longer-term price trend. The historical volatility in these commodities requires a longer-term historical trend to get an idea of what is likely. Prices were so elevated ten years ago that the 10-year price trend line is deflationary and not necessarily probable. That is the reason these trend lines are for more extended periods.

Note that, except for corn, which is just below the 1-year trend line, these have reversed dramatically from their early May peaks, have broken their 1-year support lines, and have a long way to fall before they reach the support of the long term trend line. Many things outside usual supply and demand forces affect the price of commodities, so they’re typically more volatile short term. However, the prices don’t stay elevated for extended periods for the same reasons. We’ll see them come back to earth, and sooner rather than later.

Commodities Forecast

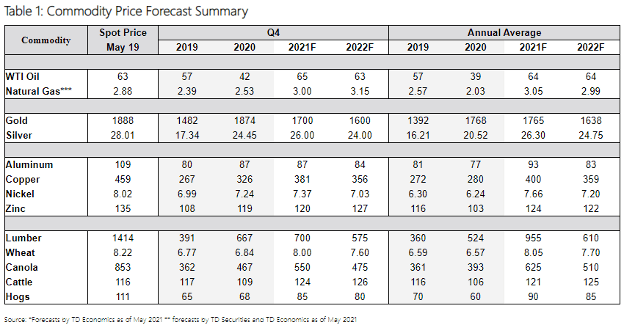

Table 1 | Source: TD Ameritrade

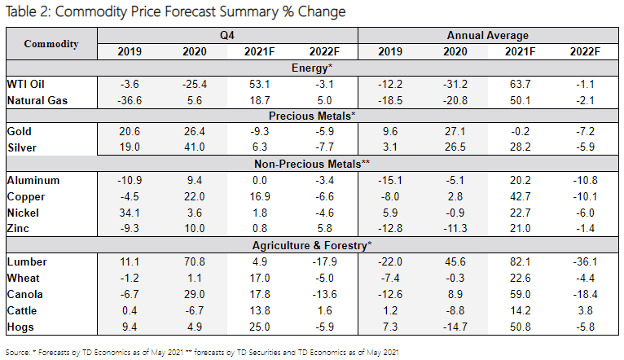

Table 2 | Source: TD Ameritrade

TD Ameritrade published their forecast for a basket of commodities seen in Tables 1 and 2 above. Though their view is not as favorable as to where the bottom is, it aligns with what we’re seeing. This isn’t what the fear mongers are trying to convince you it is. Instead, it is a transitory effect of the unintended consequences of supply chain decisions made with the best intentions but made without enough foresight.

Inflation Less Than Expected

When you hear reports about the inflation rates we saw in March, April, or May, think about what you’ve seen in these charts. The peak of the price inflation has passed, and the inflation numbers that the media will report for June will be substantially less than “expected.” I always find it entertaining to hear how “surprised” the “experts” are by economic data. Either they’re not good at their jobs, they aren’t experts, or they didn’t stay at a Holiday Inn Express. Something!

All this is not to say that you won’t be treated to more hyperinflation hysteria because you undoubtedly will be. Just ignore it. It intends to elicit a response in you to do or buy something as protection, or a hedge, against said impending hyperinflation. You know. Like buy bitcoin, buy gold, buy silver, buy commodities (I kid you not, I saw this one) buy my snake oil.

By the end of the year, my guess is this will be nothing more than a bad memory if anyone remembers it at all. Given the length of our collective memory, not many will. And, if it is not going to affect you by the end of the year, you shouldn’t worry about it in the present. Our economy is an incredibly resilient and robust machine that has, does, and will always find a way to correct itself and its temporary imbalances. It is a beautiful thing!

Have a wonderful week, and don’t pay any attention to the inflation hucksters.

Shane Barber

Partner

Schedule Complimentary Consultation

Select the office you would like to meet with. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Lenexa Office Lee’s Summit Office North Kansas City Office

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.