How $750k Can Go as Far as $1 Million in Retirement

Key Points – How $750k Can Go as Far as $1 Million in Retirement

- Setting Up the Example

- The Average Couple’s Strategy

- Three Other Couples’ Strategies

- Lifetime Income Comparisons of All Four Couples

- 15 minute read

How $750k Can Go as Far as $1 Million in Retirement

Would you rather have $750,000 or $1 million? On its face, this question seems like a no-brainer. One million dollars is a larger number than $750,000, so that has to be the correct answer – right?

What if we asked the question in another way. Would you rather have $1 million in a traditional IRA, or $750,000, evenly distributed between a taxable brokerage account, a traditional IRA, and a Roth IRA? Now this question becomes a bit more challenging to answer.

Retiring with $1 Million

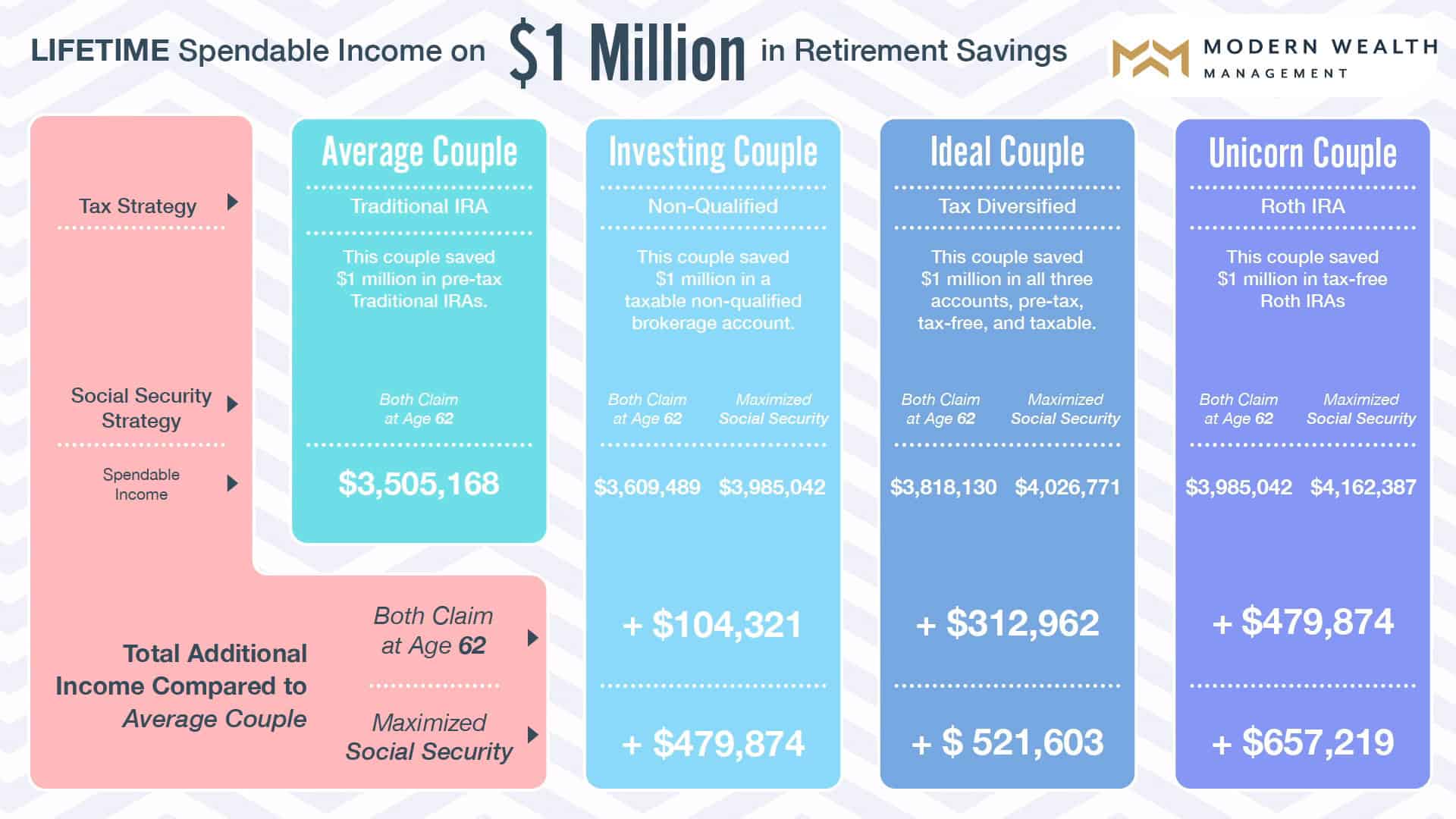

In a recent video about retiring with $1 million, we discussed four hypothetical retired couples:

- Average Couple: Saved $1 million in traditional IRAs

- Investing Couple: Saved $1 million in a taxable brokerage account

- Ideal Couple: $1 million saved between a brokerage account, a traditional IRA, and a Roth IRA.

- Unicorn Couple: Saved $1 million in Roth IRAs

All four couples had the same Social Security benefits.

Based on the same life expectancies, the first couple was able to spend $84,000 per year throughout their retirement, the second couple was able to spend $86,500, the third was able to spend $91,500, and the fourth, $95,500. We were trying to illustrate the difference between the types of investment accounts available to individuals. We’ve previously written about the difference between traditional and Roth investment accounts.

Granted, if someone had saved $1 million to a traditional IRA over their lifetime, they would likely have received lots of tax deductions over the years. However, compare them to someone who had accumulated $1 million in a Roth IRA. They would have likely missed out on those same tax deductions because contributions to a Roth IRA are not tax-deductible.

GRAPHIC 1

Nonetheless, the point stands that four couples with the same earnings history and the same Social Security benefits, all with $1 million saved in various types of investments accounts, would likely have drastically different retirements. In large part due to each couples’ tax situation, as you can see in the graphic above.

So, How Can $750k Go as Far as $1 Million in Retirement?

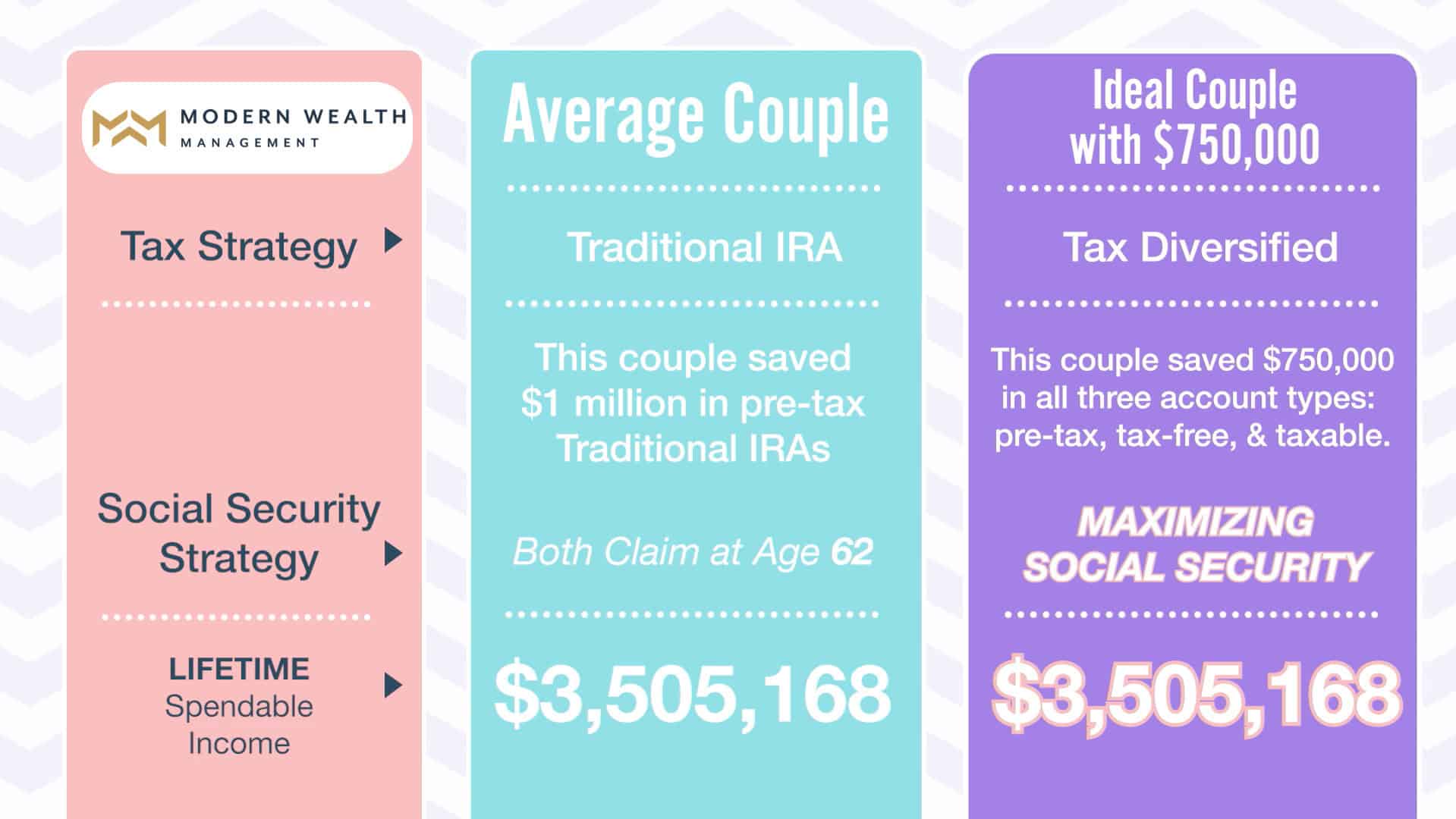

We wanted to take this case study one step further once we reviewed the data. Using our same assumptions for the first case study, what if we added a fifth couple. The fifth couple had “only” accumulated $750,000, but, like the ideal couple, they saved their money between a taxable account, a traditional IRA, and a Roth IRA. And using the same 80% confidence score in our Monte Carlo trial to solve the amount of annual, after-tax spendable income this couple could have. The results were interesting.

GRAPHIC 2

What we found was this fifth couple was able to spend $84,000 per year throughout their retirement. The interesting thing about that number is it is the same amount of after-tax spendable income as the couple who retired with $1 million in a traditional IRA. Over a lifetime, this equates to $3,505,168.

So the next time someone asks you what seems like a loaded question: Would you rather have $750,000 or $1 million? Be sure to ask a follow-up question: What type of account is the money held in? If they look at you like you’re crazy, be sure to forward them this post!

If you want to understand how you can employ strategies like this, schedule a complimentary consultation below. Or give us a call at (913) 393-1000. We’re happy to help.

Schedule Complimentary Consultation

Select the office you would like to meet with. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Lenexa Office Lee’s Summit Office North Kansas City Office

Investment advisory services offered through Modern Wealth Management, Inc., a Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management a Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.

RightCapital is a financial planning software that integrates retirement, tax, investment, and estate planning, allowing advisors to create personalized plans based on client data. It uses scenario modeling to project future outcomes, incorporates tax-efficient strategies, and tracks progress over time. The software considers a limited set of asset classes, such as U.S. Large Growth, International Equities, Emerging Markets, Bonds, and Cash, which are broad categories and not specific securities or products. These asset classes are not exhaustive, and other investments with similar or superior characteristics may exist. Assets not classified into these categories are grouped under “Other.” RightCapital cannot guarantee a complete or accurate depiction of a user’s financial situation or goals. In its Monte Carlo Simulation, asset classes are grouped into six categories with estimated return assumptions based on historical index data, not actual investments. Past performance of indices does not guarantee future results, and no investor has achieved the exact performance shown.

This article utilizes RightCapital software. Please note that Modern Wealth Management LLC and RightCapital are separate and unaffiliated entities. The data presented is believed to be sourced from reliable and reputable sources, though it should not be interpreted as a recommendation to buy or sell any security, strategy, or investment. The information provided is for general informational purposes and should not be construed as financial, tax, or legal advice specific to your individual situation. Your financial outcomes may differ based on a variety of factors, including but not limited to your unique investment portfolio, actual returns, income levels, tax circumstances, investment objectives, and goals. The analysis provided is based on hypothetical assumptions, and past performance or historical data is not necessarily indicative of future results. Therefore, any example provided in this article is purely illustrative and should not be taken as a guarantee of future performance or outcomes. Modern Wealth Management offers financial advice only to clients with whom we have a formal agreement to provide such services. Please note that financial situations vary widely from person to person, and outputs from this tool may change based on individual inputs, the nature of the investments considered, and other factors. We strongly encourage you to consult with a qualified tax, financial, or legal professional before making any decisions or taking any actions based on the information presented in this article.