401(k) Planning Considerations Throughout Your Career

Key Points – 401(k) Planning Considerations Throughout Your Career

- Happy National 401(k) Day!

- Why Starting to Save Early Matters

- How to Maximize Savings in Your 401(k)

- 6-Minute Read

Happy National 401(k) Day!

Did you know that Friday, September 5, is National 401(k) Day?1 Making strategic decisions today with your 401(k) can potentially make a big difference as you’re planning for retirement. To celebrate National 401(k) Day, let’s review some 401(k) planning considerations for different stages of your career.

Building Your Retirement Nest Egg

Before we dive into those 401(k) planning considerations, we’d be remiss if we also didn’t mention that our team specializes in working with other workplace retirement plans as well. Many of the planning considerations we’ll cover may also apply to 403(b)s and 457s. We also specialize in Savings Incentive Match Plans for Employees (SIMPLEs), Simplified Employee Pensions (SEPs), Profit Sharing Plans (PSPs), Employee Stock Ownership Plans (ESOPs), and cash balance plans.

Whether you’re in the middle of your career, nearing retirement, or have children/grandchildren just beginning their career, make sure to reach out to our team if you have any questions about workplace retirement plans and planning considerations when saving for retirement. We’ll help you explore how different retirement plan contribution strategies can significantly impact your retirement nest egg.

Early Career 401(k) Planning Considerations

Start Saving Early

Picture this. You’re about to graduate from college and accept a job offer that will have you making $X-amount of money to start your career. When you get your first paycheck, what are you going to do with it? Before you answer that, make sure that you’re contributing to your workplace retirement plan as soon as you’re eligible to do so to kickstart compound growth.

We understand that it can be difficult to have a long-term perspective about your finances, especially as you’re starting your career. Those first paychecks might not seem like very much after FICA taxes, rent/mortgage payments, and paying for food, utilities, and other necessities. Yes, it’s important to reward yourself here and there by spending money on something you enjoy. But that doesn’t mean that you should put off saving for retirement just so you can spend more now. Think of contributing to your retirement plan as paying yourself first. That’s a crucial element of retirement planning.

Tilt Your Asset Allocation Toward Stocks

Prolonged market downturns can be very uncomfortable for investors of all ages, but especially for retirees who no longer have a fixed salary to provide income. Investors who are in the early stages of their careers have time on their side and therefore might want to consider tilting their asset allocation more aggressively toward stocks or equity funds depending on their risk tolerance.

Take Advantage of the Employer Match

It’s also important to realize that most employers will reward you for saving for retirement via employer matching contributions! Did you know that more than 85% of 401(k) plans that Fidelity serves as the service provider for offer an employer-matching contribution?2 This is free money from your employer, so consider contributing enough to your retirement plan to get the full match.

Set Up Automatic Contribution Increases

Along with taking advantage of the employer match, one retirement plan consideration that Michelle Cannan, CPFA™, QKA®, QKC and David Hilton, AIF®, CPFA® covered for the Modern Wealth Management Educational Series was setting up automatic contribution increases. To see the potential long-term impact of increasing contributions by 1% each year until reaching 10%, check out that installment of the educational series with Michelle and David. It’s also important to consider increasing contributions to your retirement plan if you get a raise.

There’s No Shame in Seeking Professional Advice

If you’re unsure about setting up automatic contribution increases or any of the other 401(k) planning considerations we’ll cover, remember that you don’t have to make these decisions on your own.

Think about it this way. When you’re really sick, what do you do? Hopefully, you go see your doctor. When you’re having car trouble, what do you do? Unless you’re a mechanic or very knowledgeable about cars, you’ll probably take your car into the shop. So, when you’re wondering how to approach strategic decisions with your retirement plan, what should you do? You can probably connect the dots on this one.

If there are retirement plan specialists at your company, don’t hesitate to consult them about your 401(k) planning considerations. At Modern Wealth, Michelle and other members of our company retirement plan team have annual meetings with our employees to review their 401(k)s and plans for retirement. That’s right — even our financial advisors seek professional help with their retirement planning.

Michelle and David also mentioned how important it is to work with a team of professionals, especially once you’ve entered the middle-to-late stages of your career. At Modern Wealth, our financial advisors are supported by specialists in tax, estate planning, insurance, and investments, which they collaborate with to build a plan that’s tailored to your unique goals. If you’re already working with a financial advisor, make sure that they’re reviewing things like annual 401(k) contribution limits, 401(k) withdrawal rules, and other 401(k) planning considerations.

Mid-Career 401(k) Planning Considerations

Some 401(k) planning considerations will remain consistent throughout your career, but there will be some additional considerations as you get closer to retirement. Working with a team of professionals can help you with the different 401(k) planning considerations for each career stage.

How Much Are You Contributing to Your 401(k)?

Contributing 1% more per year may be a realistic 401(k) planning consideration earlier in your career. But once you’re hopefully earning more later in your career, consider increasing your contributions beyond 1% more per year — potentially to the point where you’re contributing up to the maximum amount that’s permitted.

Rebalancing Your 401(k)

As you advance in your career, it’s important to begin thinking what your life in retirement is going to look like. Make sure that you’re reviewing your asset allocation and regularly rebalancing your investment portfolio. This may help with reducing the impact of market volatility, all while aiming to maximize growth of your investments.

Remember That Your 401(k) Savings Designated for Your Retirement, Not Other Expenses

When big expenses come up, it may become tempting to withdraw from your retirement accounts rather than emergency savings. There’s a reason that 401(k)s, 403(b)s, 457bs, and other employee benefit plans are accounts that are typically referred to as retirement plans. It might sound obvious, but it’s worth reiterating that the funds that you save to your workplace retirement plan are for retirement. There’s even a 10% early withdrawal penalty for taking funds from your 401(k) prior to age 59½, although there are a few exceptions. Remember that taking money from your 401(k) before retirement hinders long-term growth.

Late-Career 401(k) Planning Considerations

As you get closer to retirement, there are a few more 401(k) planning considerations to keep in mind. You might be able to guess some of them based upon the 401(k) planning considerations we’ve already shared, but here’s a quick overview.

Reduce Risk Exposure

Once you’re just a few years away from retirement, it’s time to consider shifting your asset allocation more toward bonds, fixed income, and more conservative assets rather than stocks and other higher-risk assets. Understanding your risk exposure is critical, especially during your peak-earning years.

What’s Your Retirement Withdrawal Strategy?

This actually applies more to the early career planning considerations, but before you save to your 401(k) or any investment vehicle, you should know the rules for withdrawing the money from the account.

If you have a traditional 401(k), keep in mind that the money within the account is growing tax-deferred. That means you won’t be required to pay taxes on that money until you take it out of the account. In other words, if you have, for example, $2 million in your 401(k) when you retire. You won’t have the entire $2 million at your disposal because you will be required to pay taxes on the amounts you withdraw.

Don’t Forget About Required Minimum Distributions

And no, you can’t just keep your money in your 401(k) for the rest of your life, not make any withdrawals, and then have it pass on to your beneficiaries. Your 401(k) is subject to Required Minimum Distributions (RMDs). As of January 1, 2023, the required beginning date for RMDs is April 1 of the year after you turn 73. RMD age is set to move up to age 73 in 2033.

It’s worth noting that Roth 401(k)s and Roth IRAs are not subject to RMDs. With Roth accounts, you must pay tax on the amount you contribute to the account, but the earnings will grow tax-free and the distributions are tax-free and penalty-free under certain conditions.

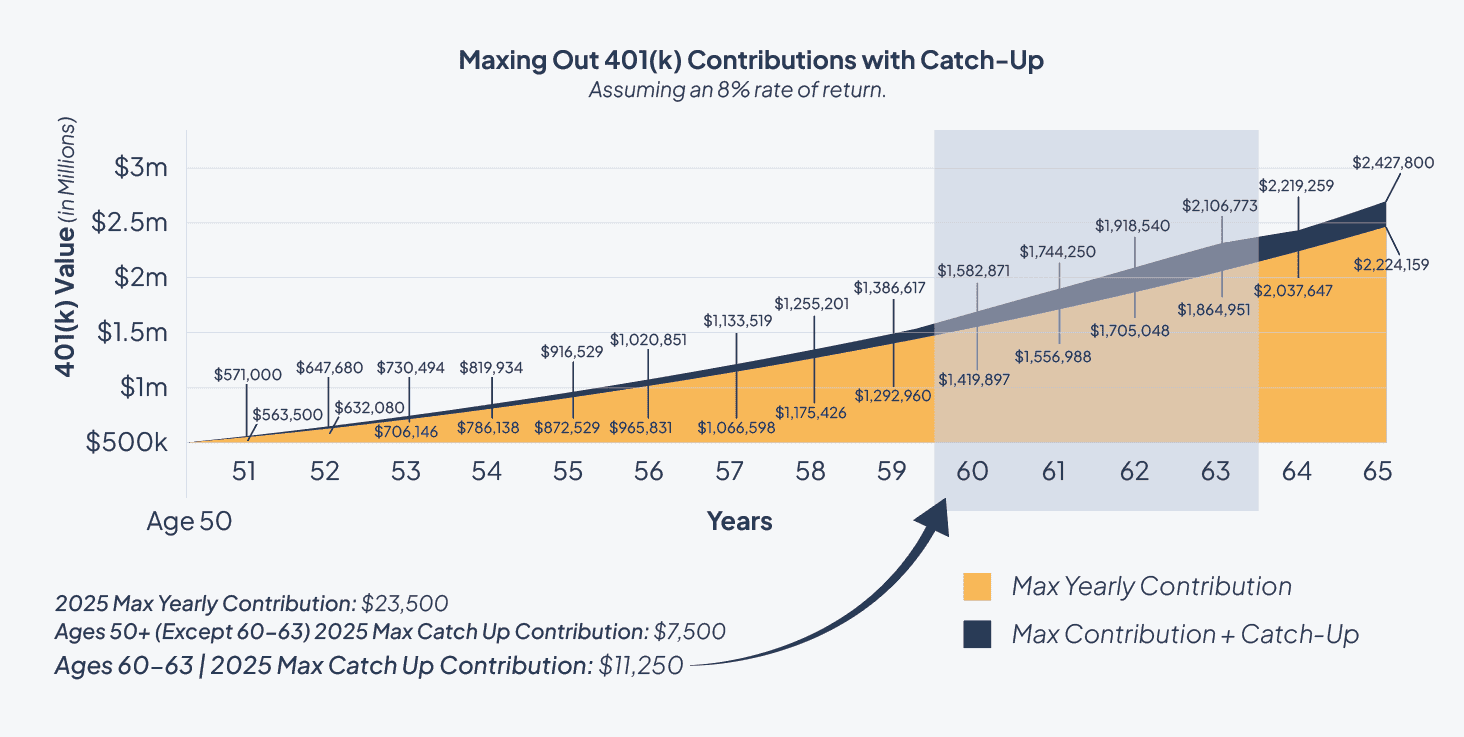

Catch-up and Super Catch-up Contributions

For 2025, the maximum amount that an individual who is 49 or younger can contribute to their 401(k) is $23,500. However, those who are 50 or older have a couple of opportunities to contribute more than that amount in 2025. Individuals who are 50 and older can contribute an additional $7,500 via a catch-up contribution. And new in 2025, individuals ages 60-63 are eligible to contribute an additional $11,250 via a super catch-up contribution.

FIGURE 1 – Maxing Out 401(k) Contributions with Catch-up

Do You Have Any Questions About These 401(k) Planning Considerations?

We hope that you learned a few things from the 401(k) planning considerations we shared in this article, regardless of how far along you are in your career. If you have any questions about these 401(k) planning considerations, start a conversation with our team below. We’re here to help you determine if you’re on track for your retirement savings goals and explore different scenarios based on your goals.

Resources Mentioned in This Article

- 7 Tips on Saving for Retirement

- How Does a 401(k) Work with Michelle Cannan, CPFA™, QKA®, QKC

- Retirement Planning in Your 40s

- 5 Years Before Retirement

- Family Matters: A Multi-Generational Approach to Financial Planning

- 10 Steps to Reach Your Financial Goals

- Monthly Expenses for Everyone’s Budget

- Tips to Reach Your First Million

- Your 401(k) Employer Match and How It Works

- Strategies to Maximize Your 401(k)

- What If I Retire During a Recession?

- Proper Portfolio Construction with Stephen Tuckwood, CFA

- DIY Retirement Planning: What Can Be Overlooked?

- Why You Need a Financial Planning Team with Jason Gordo

- 5 Types of Financial Plans

- 2025 401(k) and IRA Contribution Limits

- 2025 Withdrawal Strategy for Retirement

- 15 Years Before Retirement

- Rebalancing Your 401(k)

- 7 Retirement Strategies to Retire Successfully

- 5 Long-Term Strategies for Retirement

- The IRA Early Withdrawal Penalty: How to Avoid the 10% Penalty

- 5 Years Before Retirement

- What to Know About CDs, Bonds, and Treasuries

- Setting Up Your Portfolio for Retirement

- Required Minimum Distribution Case Study

- What’s Your Required Beginning Date?

- Traditional vs. Roth 401(k)

- Taxes on Roth IRAs

- 7 Tips on Saving for Retirement

- Super Catch-up 401(k) Contributions: Are You Eligible to Make Them?

Downloads

Other Sources

[1] https://www.psca.org/industry-content/resources/401k-day/

[2] https://www.fidelity.com/learning-center/smart-money/average-401k-match

Investment advisory services offered through Modern Wealth Management, Inc., a Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management a Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.