Donor-Advised Funds and How They Work

Key Points – Alternative Investing: What You Need to Know

- Why Have Donor-Advised Funds Become an Enticing Charitable Giving Strategy?

- Understanding How to Use a DAF

- How DAFs Can Fit within Your Charitable Giving Strategy

- 3-Minute Read

Does Charitable Giving Give You Joy?

Whether you’re still working or retired, ask yourself this: what’s your purpose? For so many people, it’s being a productive member of society and providing for their family. But what other things give you a sense of fulfillment? Is it important to you to financially support your church or alma mater or give to charities that support medical research or the less fortunate? Let’s take some time this holiday season to make sure that you feel a sense of connection when it comes to charitable giving options and other things in life that give you purpose.

For many people, Donor-Advised Funds serve as a key component of their charitable giving strategy. We’re going to review what Donor-Advised Funds are and how they could make sense for you.

What Are Donor-Advised Funds?

A Donor-Advised Fund (DAF) is a flexible giving vehicle where the donor contributes assets, takes an immediate tax deduction, and recommends grants to qualified charities over time. According to Fidelity Charitable®, which is an example of a DAF sponsor, DAFs are “the fastest growing charitable giving vehicle in the United States” due to being user-friendly and their tax advantages.1

How Do DAFs Work?

Any assets within a Donor-Advised Fund can be invested prior to being granted to the donor’s charity of choice. So, when the market grows, so can the funds within your DAF. In addition to getting an immediate tax deduction on DAF contributions, the donor won’t be taxed as the DAF grows since the funds belong to the charity. The tax-free growth from Donor-Advised Funds can help create tax flexibility (and tax diversification) for the donor.

Donors can contribute cash or highly appreciated long-term gain assets to a DAF. If the donor elects to donate cash to their DAF, they’ll be eligible to deduct up to 60% of their Adjusted Gross Income.2

If they prefer to donate publicly traded securities directly to a DAF, there are a few other tax advantages to keep in mind. Securities that you’ve held for a year or longer are eligible to be donated at fair market value. They would also not be subject to capital gains tax. Funding a Donor-Advised Fund through direct donations of appreciated assets would make the donor eligible for an immediate tax deduction of up to 30% of their AGI.3

There is a five-year carryforward for DAFs, meaning that the donor can carry over charitable donation deductions (cash or appreciated assets) that exceed the annual AGI limit for a maximum of five years. So, if you anticipate having a high-income year, the five-year carryforward may help you with making a higher contribution that can be deducted over time.

Stacking Charitable Contributions

DAFs are often used to stack charitable contributions in certain years to itemize deductions. The donor would then take the standard deduction the following year. Keep this in my as you’re doing year-end tax planning for 2025. There are changes in charitable contribution deductions beginning in 2026 as a part of the One Big Beautiful Bill Act that may make you want to consider front-loading your charitable contributions to get the itemized charitable deductions now.

Donor-Advised Funds vs. Qualified Charitable Distributions

One other advantage of Donor-Advised Funds is that there isn’t a minimum age limit to open an account. Many charitably-inclined individuals utilize DAFs prior to turning 70½, which is the minimum age to make Qualified Charitable Distributions. With QCDs, you can make donations to qualified charities directly from an IRA without it ever showing up on your tax return. QCDs can also help to reduce Required Minimum Distributions from your IRAs.

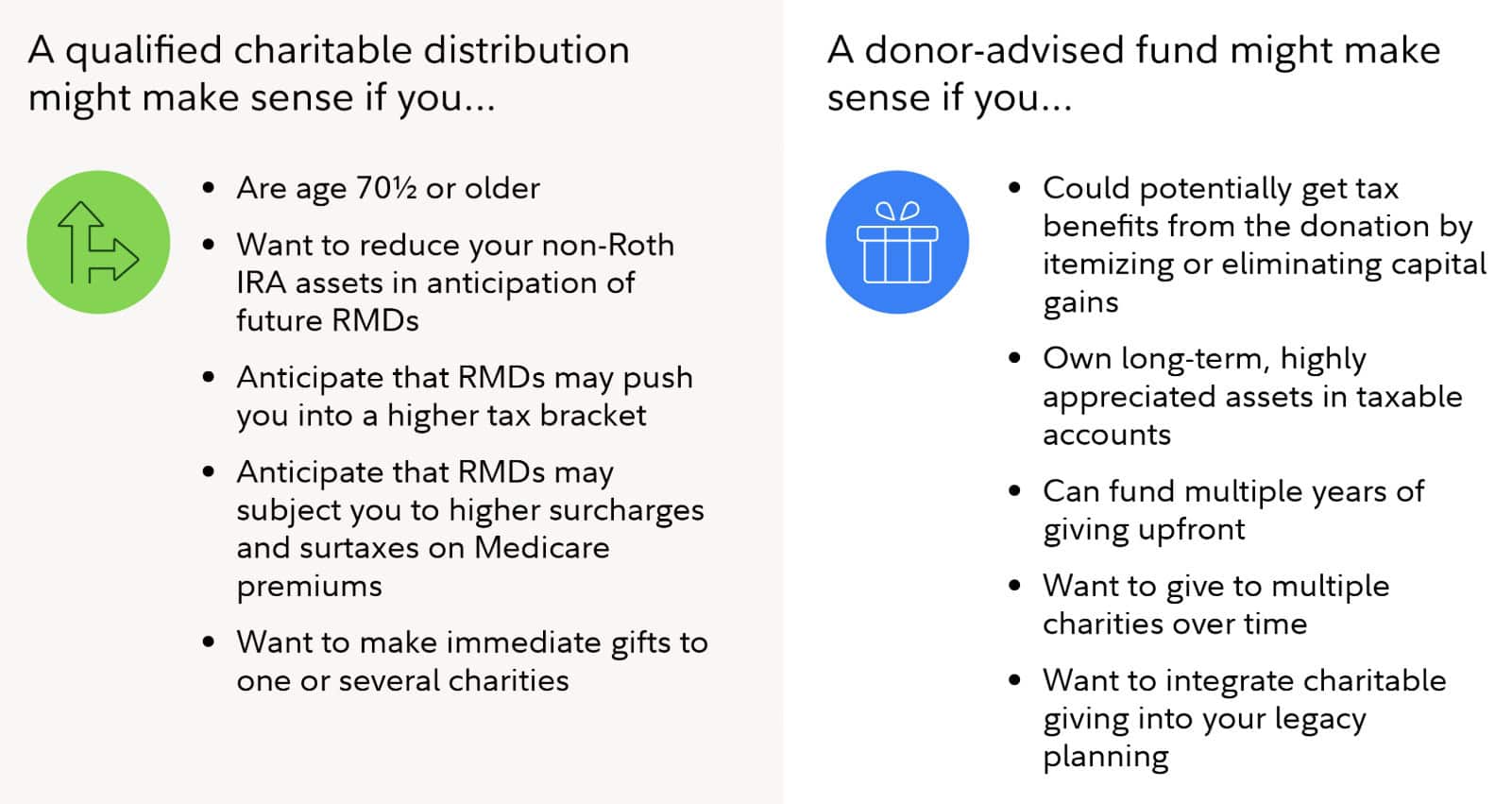

But that doesn’t mean that DAFs are only effective before you turn 70½. It truly depends on your situation and your charitable giving goals. It may even make sense to contribute to a DAF and make QCDs once you turn 70½. Here’s a side-by-side comparison from Fidelity about potential advantages of both charitable giving options.4

FIGURE 1 – Donor-Advised Funds vs. Qualified Charitable Distributions – Fidelity

Thinking Long-Term About Charitable Giving

It’s important to understand that Donor-Advised Funds serve a purpose both while you’re living and after you’re gone. DAFs can be a beneficiary on retirement accounts and Charitable Remainder Trusts. Naming a DAF as a beneficiary on your retirement accounts allows your beneficiaries to use the funds for charitable contributions instead of paying income taxes on inherited IRAs.

Do You Have Any Questions About DAFs?

We hope that this article about Donor-Advised Funds has helped to show how they can play a pivotal role in an individual’s charitable giving strategy. If you have any questions about how a DAF works and how it could work within your charitable giving strategy, start a conversation with our team today.

We look forward to learning more about your “why” this holiday season, whether that involves charitable giving, providing for your family, or whatever it may be. Our team is ready to help connect you with all the things that give you purpose. It’s our goal to help you enjoy today while preparing for tomorrow.

Resources Mentioned in This Article

- Tax Benefits of Charitable Donations

- What You Need to Know About Tax Deductions

- What Is Modified Adjusted Gross Income (MAGI)?

- 2026 Tax Brackets: IRS Makes Inflation Adjustments

- What Is Tax Diversification?

- What Is a QCD? Qualified Charitable Distribution

- How to Reduce RMDs with 5 Strategies

- Charitable Remainder Trusts vs. Charitable Lead Trusts

- 2025 Year-End Tax Planning

- New Tax Provisions in the One Big Beautiful Bill Act

- Inherited IRAs and the SECURE Act

Other Sources

[1] https://www.fidelitycharitable.org/guidance/philanthropy/what-is-a-donor-advised-fund.html

[2, 3] https://www.irs.gov/publications/p526

[4] https://www.fidelity.com/learning-center/wealth-management-insights/QCD-or-donor-advised-fund

Investment advisory services offered through Modern Wealth Management, Inc., a Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management a Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.