The World’s Reserve Currency: What Challenges Does the U.S. Dollar Face?

Key Points – The World’s Reserve Currency: What Challenges Does the U.S. Dollar Face?

- The Status of the U.S. Dollar as the World’s Reserve Currency

- What Characteristics Should a Currency Have?

- The U.S. Dollar’s Biggest Challengers

- What Factors Need to Be Considered with Currency Exchange?

- 12 Minutes to Read

Turmoil Here, Turmoil There, Turmoil Everywhere

As you may have noticed, there is turmoil on almost every front these days. Whether at home or abroad, things seem unsettled. From the war in Ukraine to the battle over the debt ceiling here at home. From the fears of runaway inflation to the running crisis at our southern border. And from China sending spy balloons through our airspace to the BRICS’ countries floating the idea of a new currency to “replace” the dollar as the world’s reserve currency.

Will the Dollar Maintain its World’s Reserve Currency Status?

There’s no shortage of things to worry about. Today, I want to focus on the currency issue. There is nothing more frightening than the thought of the U.S. dollar being replaced as the world’s reserve currency. Well, except the thought of the U.S. going to a Central Bank Digital Currency (CBDC). That’s terrifying! These issues are related, so we’ll talk about both.

Let’s start with what a currency is, what its functions are, and what characteristics a currency should have. For the sake of this discussion, we’ll use the term money and currency interchangeably, as currency is indeed money in modern times. In history, lots of things have been used as currency—cows, beads, shells, stone wheels, corn, you name it. Today, those things are commodities purchased with money, and no longer used as currency. Why? Good question.

Characteristics of Currency

The St. Louis Federal Reserve says that a currency should have the following characteristics: durability, portability, divisibility, acceptability, and a limited supply. Most of the examples above fail this test on every level. They aren’t durable and aren’t really portable. Some are divisible and some are acceptable. And most don’t have a limited supply. Cows and corn can be raised, beads can be made, shells can be found almost anywhere, and no one wants a stone wheel.

So today, we use paper money. The world primarily uses the U.S. dollar as their money/currency of choice. So much so that 88% of all transactions in the world are settled in U.S. dollars. Money in general, and the U.S. dollar in fact, performs three critical functions. It is a store of value, a medium of exchange, and a unit of account.

History of the World’s Reserve Currency

Today, the U.S. dollar is the world’s reserve currency. Over the last almost 600 years, there have only been six currencies that held world reserve currency status. The others were Portugal from 1450-1530, Spain from 1530-1640, the Netherlands from 1640-1720, France from 1720-1815, and Great Britain from 1815-1920. The U.S. dollar has held the world’s reserve currency status since 1920, following the end of WWI, which left Great Britain’s economy in ruins.

According to Stephen Broadberry and Mark Harrison’s 2005 report titled, The Economics of World War I, Britain incurred 715,000 military deaths (with more than twice that number wounded), the destruction of 3.6% of its human capital, 10% of its domestic and 24% of its overseas assets and spent well over 25% of its GDP on the war effort between 1915 and 1918. Their problems lingered well into the 1920s and ushered the U.S. dollar in as the new world’s reserve currency.

The Composition of Foreign Currency Exchange Reserves

Today, according to the International Money Fund, the currency composition of official foreign exchange reserves (COFER) shows the U.S. dollar accounts for nearly 60% of the over $12 trillion held in reserve globally. The next currency isn’t even close. It’s the Euro, which only accounts for 20% of global reserves. The remaining 20% of currency reserves not represented by the U.S. dollar, or the Euro is made up of every other currency on the planet—including the Chinese Yuan—which accounts for only 2.6%. The once mighty British Pound now only accounts for 4.95% of world reserves.

The value of a currency is determined by supply and demand at its most basic level, meaning that if the currency is in demand and there’s a limited supply the price will go up. And if the inverse is the case, the price will go down. Currency prices fluctuate all day every day, as foreign exchange desks operate 24 hours a day to accommodate global trade. But what makes a currency more or less valuable to the market?

What Effects a Currency’s Value?

There are five key variables that can affect a currency’s value. They are inflation differentials between two currencies’ countries of origin, interest rates differences between countries, political and economic stability of the country of origin, current account deficit of the country of origin, and public debt held by the country of origin. All five affect the perceived value of a particular currency in the market, but economic and political stability, as well as the amount of public debt held weigh more heavily in the equation, especially where world’s reserve currency status is concerned.

Why the U.S. Dollar Will Be the World’s Reserve Currency for the Foreseeable Future

The world’s reserve currency status implies that others trust in the stability of the issuing country and its ability and willingness to honor its debts. Remember, money/currency should be a store of value, a means of exchange, and unit of account. None of those things can be said to be true of the currency of a country that is not economically and politically stable. That’s why I believe that the worries about some other currency coming along and supplanting the U.S. dollar as the world’s new reserve currency is highly unlikely…at least in my lifetime. And I believe the evidence for that is clear.

The Euro vs. the U.S. Dollar

The Eurozone was formed in 1992 to create an economic trading block of 20 countries. They adopted a common currency in which to trade as well as a common central banking system. The Euro, they said, would replace the dollar as the world’s reserve currency. The countries all have relative geography in common, but little else. They each have their own cultures, customs, languages, and economic challenges that are difficult to manage from a central bank perspective.

Thus, 31 years after its introduction, the Euro only accounts for 20% of world currency reserve holdings. I believe the Euro, as promising as it seemed at the time, is all the proof we need to know that the next challenger to the U.S. dollar’s dominance will fail, epically. And that next challenge will come in the form of a BRICS currency.

What About BRICS?

BRICS is an acronym for Brazil, Russia, India, China, and South Africa. The combined GDP of these five countries is roughly equal to those of the United States and the Eurozone, though China’s GDP is the lion’s share of their combined size. But the size similarity is where any favorable comparison for the BRICS ends.

Not only do these five countries not have geography in common, they don’t have ANYTHING in common. In fact, it’s not a stretch to say that they can’t stand each other and don’t trust each other. That’s not a good base to build a currency on, to say the least. They have their own independent political systems, monetary systems, and forms of government.

But here are some traits that they do have in common. None of them are politically stable, economically stable, or particularly trustworthy (especially China and Russia). Russia’s government is corrupt, as is China’s, South Africa’s, and India’s. Meanwhile, Brazil is facing threats to their current representative republic by their current president and his censorship campaign.

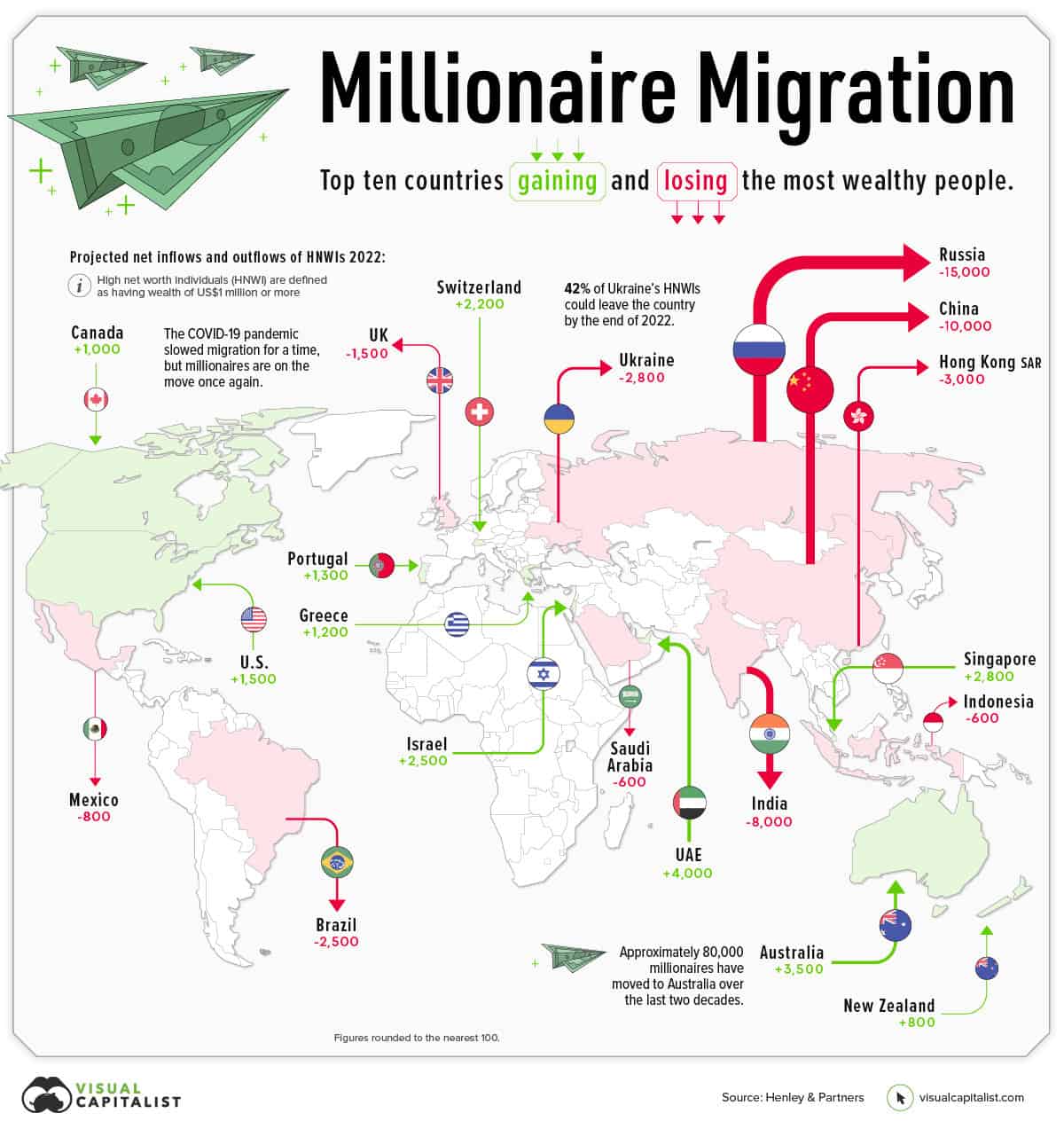

Millionaire Migration

The other thing they have in common is that they are hemorrhaging rich citizens, who are fleeing their country looking for better and friendlier places to take their money.

Russia lost 15,000 millionaires in 2022.

China lost 10,000 millionaires in 2022.

India lost 8,000 millionaires in 2022.

Brazil lost 2,500 millionaires in 2022.

South Africa either doesn’t have any, didn’t lose any, or they don’t keep track of immigration and emigration.

Either way, four of the five members of the BRICS countries are bleeding millionaires. Makes you want to put your money there, doesn’t it?

FIGURE 1 – Millionaire Migration – Visual Capitalist

Some Questions to Ask About Currency Exchange

So, if you can’t trust any of the countries responsible for the new currency, they’re not economically sound and not politically stable, why would you use their currency? How would it have value? Remember currency decisions are comparative. Would I rather use currency A or B if currency A is readily available, readily redeemable, and relatively stable, while currency B is not readily available, redeemable, or stable?

The answer is obviously A. And the reality is that any BRICS currency is going to fall under currency B in this scenario. There’s no possibility that that’s not the case. In which case their currency, and this little experiment are doomed to failure from the outset.

Acknowledging the Current Issues in the U.S.

I hear you all yelling at your screens right now about all the problems that the U.S. has. Those issues include our economy, the spending problem our government has, the amount of debt we have, and the political shenanigans going on in our country right now. Are those reasons that the dollar is going to fall from grace and be replaced by some “other” form of currency or by some other countries currency?

I hear it every day. And I’m not saying some of the points aren’t valid. I’m saying that they aren’t considering the whole picture. It’s a 4’ X 8’ painting and some people’s noses are pressed up against the canvas and they swear they can see what’s going on. You’ve got to step back from the canvas to see the whole picture.

These Issues Are Fixable

First and foremost, I’d like to remind you all that the issues the U.S. faces today, economically, and fiscally are solvable. I know it seems like an insurmountable task, but it’s not. We have a 247-year track record of getting through tough times and coming out stronger and better on the other side. And before you say it, EVERY time we had to do that, the current population said, “we’ve never had to deal with something this bad, ever. We’ll never make it!” EVERY time. And yet, we persevered.

And, as much as we love to hate them, the Federal Reserve has a track record of making good on their mandates of stable prices, moderate long-term interest rates, and full employment. We may not like or agree with the timing or methods they employ, but we can’t argue with the results. That makes the U.S. the most economically stable country in the world long term.

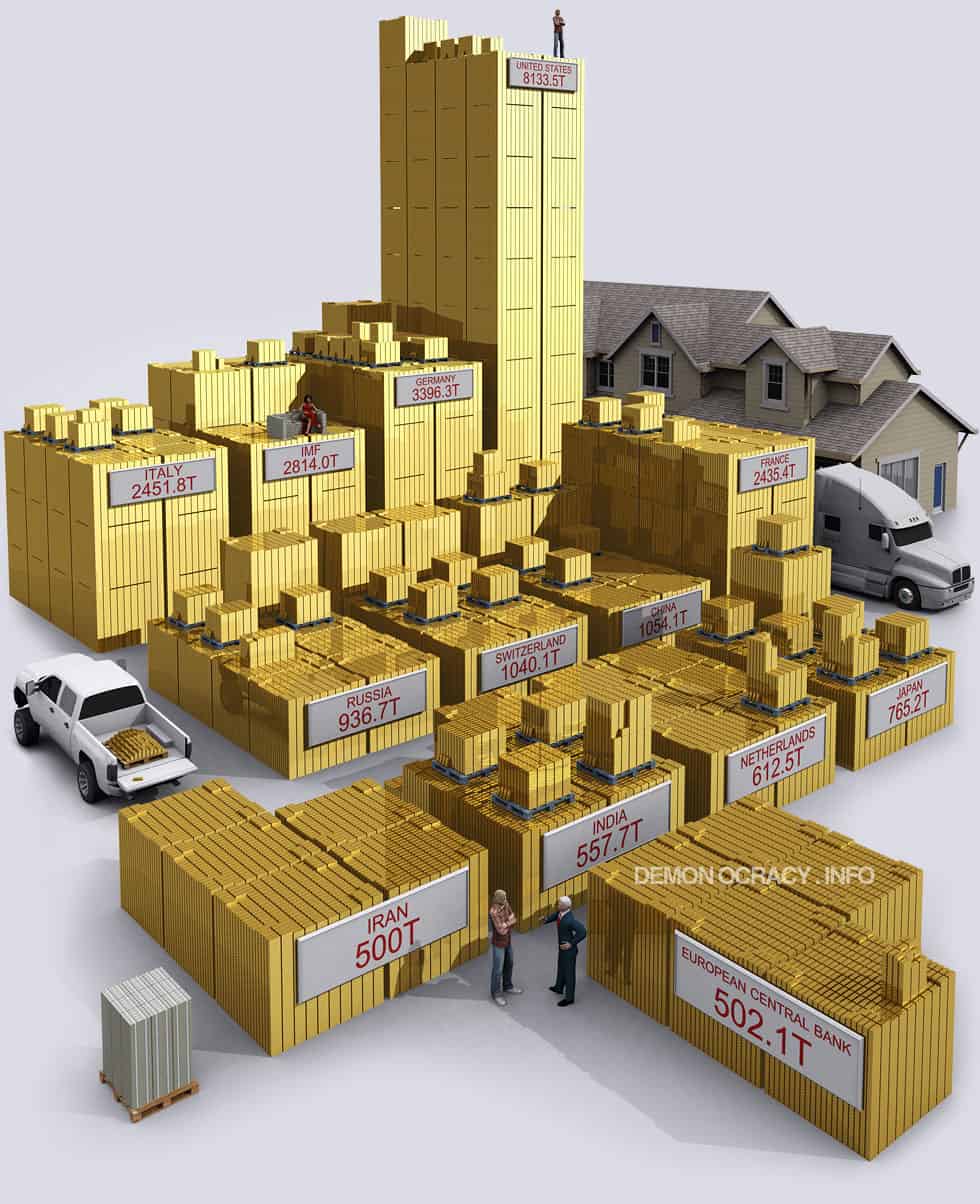

Global Gold vs. Global Debt

And, to add to the stability discussion, the U.S. holds the most physical gold of any country by a lot. We have roughly 8,134 tonnes of gold in reserve. That’s equal to 17,927,336 pounds…or 286,837,376 ounces…at $2,000 an ounce. That comes out to $573,674,752 billion in gold reserves, which far exceeds any other country.

FIGURE 2 – Gold Reserves – Demonocracy Info

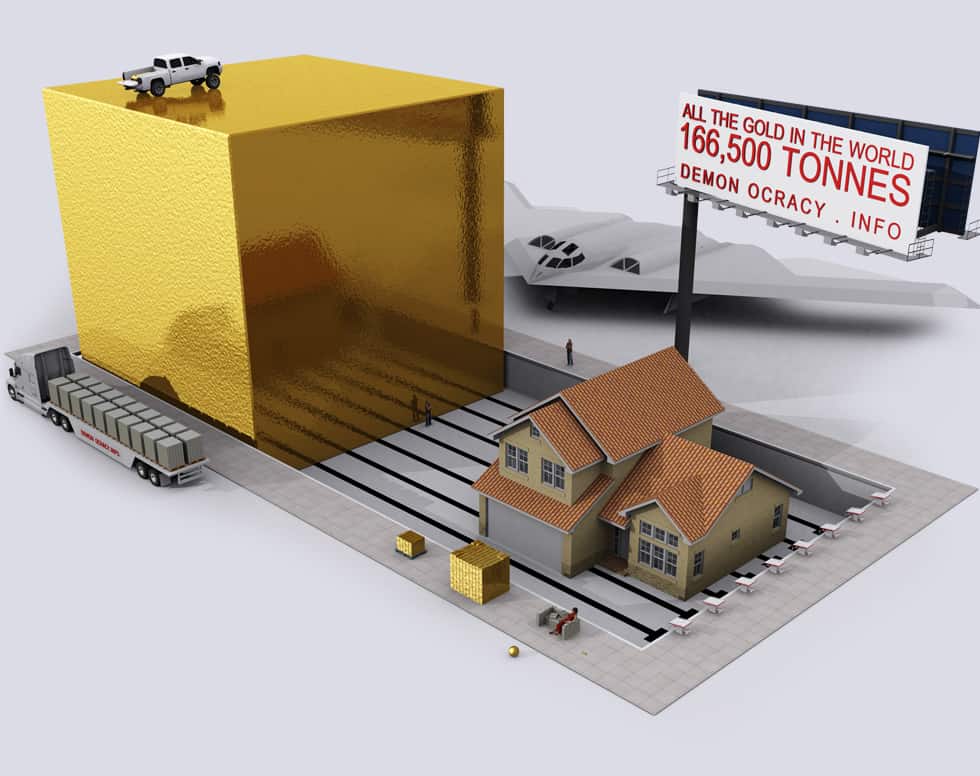

As a little rabbit hole detour, for all you on the “let’s go back to the gold standard” bandwagon, did you know that all the gold ever mined in the history of the world is currently worth just over $12 trillion?

FIGURE 3 – Global Gold – Demonocracy Info

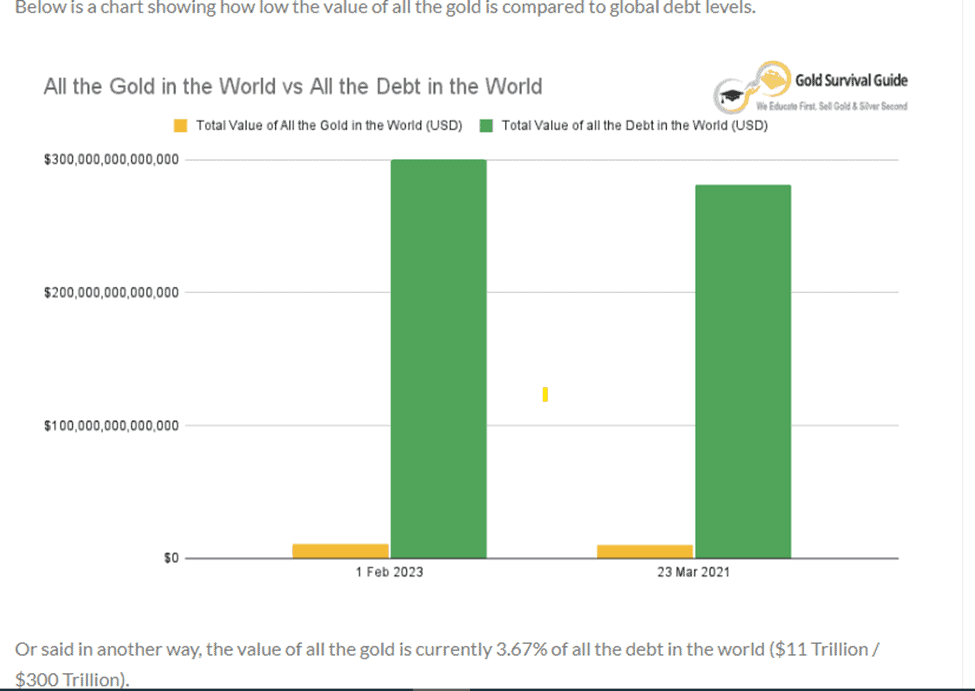

Did you also know that global debt is around $300 trillion?

FIGURE 4 – Global Gold vs. Global Debt – Gold Survival Guide

So, you don’t have to do the math. If all the debt in the world was backed by gold, the price of an ounce of gold would need to be $55,000.

But most of the gold ever mined became jewelry, so it can’t be used to back debt on a national level. Reinstating the gold standard is not feasible, nor wise, at this point. Exit rabbit hole.

The Best of a Bad Bunch?

Back to the U.S. dollar and its position as the world’s reserve currency. At the very least, the U.S. economy and the U.S. debt levels, compared to the rest of the world, and China in particular, are the best-looking house in a bad neighborhood.

China’s Major Issues

Yes, our debt to GDP is high, roughly 120%. Meanwhile, China’s is nearly 280%. Not to mention the fact that every Chinese business in China is either directly or indirectly owned by the state. No one trusts China, not even the Chinese people. The Chinese economy is not in good shape. The Chinese population is also aging and will begin to shrink just like Japan’s. China is in decline, permanently.

The Biggest Threat to the U.S. Dollar

China and the rest of the BRICS are not the threat most people think they are, nor the threat they wish they were to the U.S. dollar’s dominance on the global stage. So, where does the monetary threat exist? Sadly, right here at home.

Digital Money vs. Psychical Currency

That threat has a name, and the name is CBDC. It’s digital money rather than physical currency. And it would be held by…not your bank…but the Federal Reserve. Your deposits would become liabilities of the Federal Reserve Bank and could end up on the 5,000th page of some bill authorizing Congress to spend the money you deposited, on whatever the spending bill authorized, just like happened with the Social Security “trust fund.” You remember that, right? In what world does that make any sense? Not in mine, I can tell you that!

But that is just the tip of the iceberg.

Potential CBDC Drawbacks

A digital currency like the CBDC can be tracked and deactivated instantly. That leaves you with no way to buy goods or services. Digital currencies can limit your ability to travel by disallowing purchases of fuel for your vehicle or for airline tickets to certain destinations deemed unacceptable. It can prohibit you from purchasing something the government doesn’t want you to buy, like a book by a certain author, or a subscription to a certain website. It can prohibit you from subscribing to content providers the government disagrees with.

A digital currency like the CBDC can limit or eliminate your ability to purchase certain items…say tobacco or firearms…or whatever your thing is that the current regime doesn’t like. It can limit your choice of physician, pharmacy, drugs, health care procedure, and medical devices. It allows the government to fine you for engaging in activities they don’t like and take the money right out of your “account” without any warning.

A digital currency like the CBDC can track exactly what you buy, when you buy it, where you buy it, and in what quantity you buy it, every time you spend money. Want to surprise your spouse with a gift? Not anymore. They’ll know instantly what you got them and how much you spent thanks to your CBDC being linked to your mobile device…not by choice, but by force.

The Element of Control with CBDC

The idea of a CBDC is borne out of a desire to compete with and eventually crush other forms of digital currencies—think Bitcoin and others—because the government can’t control those other currencies. Which brings us to the other reason to want to have a CBDC…control. Only the most naive of us believe that those in positions of power in government don’t want to exercise a certain amount of control over us lowly citizens. I was once that naïve. I was also once 16. Now, I’m neither.

A CBDC of any iteration is an epic invasion of your privacy, an irredeemable attempt to take away your most basic freedoms, including and especially freedom of speech, and the end of private transactions between friends and family. There are no redeeming qualities to a CBDC. None. This is my opinion, and my opinion only, but every single American who values privacy, freedom, and freedom of speech, should resist this trend and reject outright any attempt to implement a CBDC.

Freedom vs. Control

And I want to be clear here. My argument is not for one political side or the other. Political power changes hands frequently and sometimes radically. You can be sure that you will eventually be on the wrong side of the prevailing “wisdom” about what is acceptable and what is not. Your “money” will be at risk of being held hostage or confiscated at moment’s notice if a CBDC becomes a reality. That, my friends, from any side of the political aisle, is 100% unacceptable. Don’t let this become my side versus your side discussion. This is a freedom versus control discussion regardless of the party in power at any given time.

The good news for the moment is that implementation of a CBDC would take years, maybe a decade or more, so there’s time for cooler heads to prevail. The better news is that the U.S. dollar is likely to maintain its position as the world’s reserve currency for the foreseeable future.

The best news is that we live in the greatest country in the world, with the greatest blessings in the world, and the greatest economy in the world, surrounded by some of the best people in the world. Despite all the noise around us, we have it really good.

The next time you get worried about the U.S. and our position in the world, and the standing of the dollar as the world’s reserve currency, come read this article again. It’s likely the words will be as true then as they are now.

Confidence, Freedom, and Time

The feeling of freedom is something that we take very seriously at Modern Wealth Management. Specifically, we want you to have freedom from financial stress. Educating yourself about global currency and in this case, the U.S. dollar’s status as the world’s reserve currency, is critical so that you can position yourself to have freedom from financial stress.

Freedom from financial stress ties right in with having confidence that you’re doing the right things with your money and spending time doing the things that you love. All three components are critical to a successful retirement. And to have confidence in doing the right things with your money, freedom from financial stress, and time to do the things that you love, you need a financial plan.

Building Your Financial Plan

Our Modern Wealth team has a few different ways to help you get started with building a plan that’s unique to you. We’re giving you the chance to dive right into building your plan with our industry-leading financial planning tool. It won’t take long for you to see that there’s much more that goes into planning for retirement than what you can enter into a retirement calculator.

Building your financial plan requires some time and dedication on your part, but this is your retirement we’re talking about. The planning needs to be thorough, which is why our tool thoroughly incorporates factors such as your goals, taxes, estate planning, risk management, and investments that will impact your retirement. To begin building your plan today, click the “Start Planning” button below.

And while building your plan does take some effort on your part, our team can help guide you through that process. I meant what I said about wanting to give you confidence, freedom, and time in retirement. If you have questions, whether they be about the U.S. dollar’s status as the world’s reserve currency, building your financial plan, or anything else that can impact your retirement, let us know. Simply click here to schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals. We can meet with you in person, virtually, or by phone—it’s whatever works best for you.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.