How Much Do You Need to Retire?

Dive deeper than basic retirement calculators to find data-driven answers using the same tools as our financial advisors.

What You Put In

Don’t settle for a small piece of the puzzle. See the complete picture of your retirement plan by putting all the pieces together. Start by answering basic questions to give our tool the data needed to build your plan.

Start by entering some basic information about you and your family.

Next, enter your retirement savings in taxable and tax-deferred accounts like 401(k)s and IRAs.

Next, enter your retirement savings in taxable and tax-deferred accounts like 401(k)s and IRAs.

List your assets and liabilities to track your net worth or link your financial accounts.

Enter your estimated general monthly expenses - not including the mortgage or insurance premiums.

Complete your plan by adding financial goals like desired retirement age and monthly income.

What You Get Out

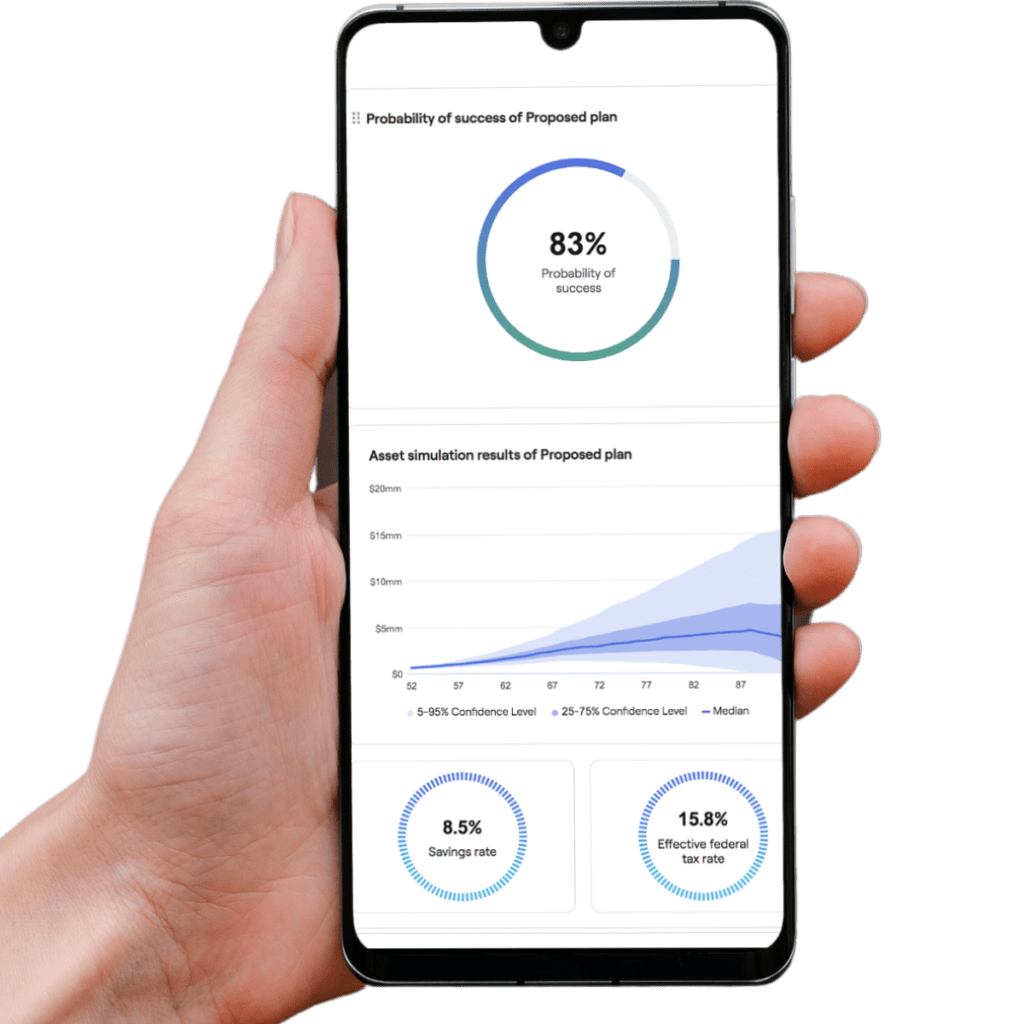

Seeing is believing. View interactive dashboards and in-depth charts that forecast your plan’s performance and identify areas for improvement. Find confidence and clarity by having the plans for your financial future at your fingertips.

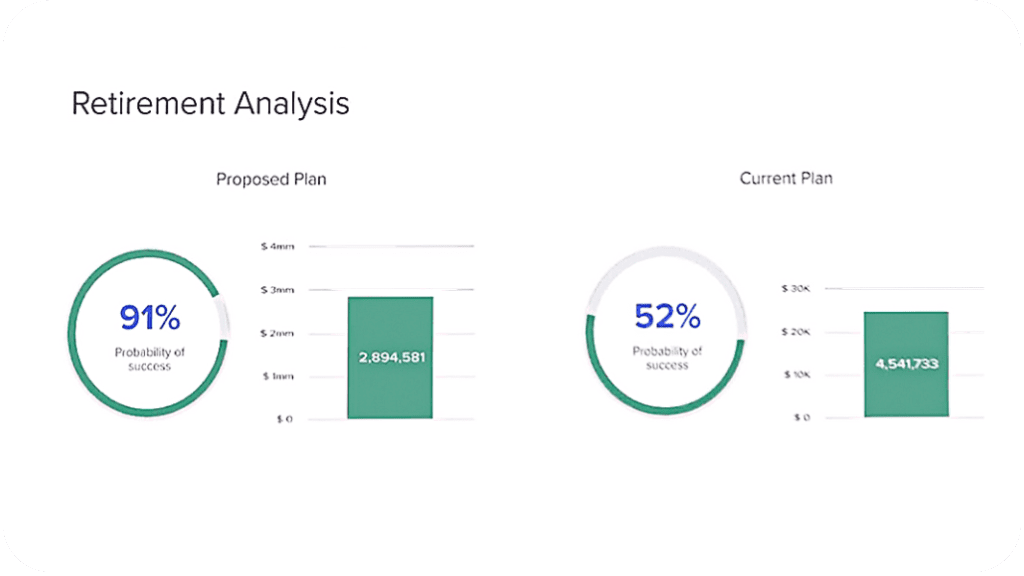

Interactive Retirement Analysis

Compare your current retirement plan with a proposed plan to see how changes impact your probability of success.

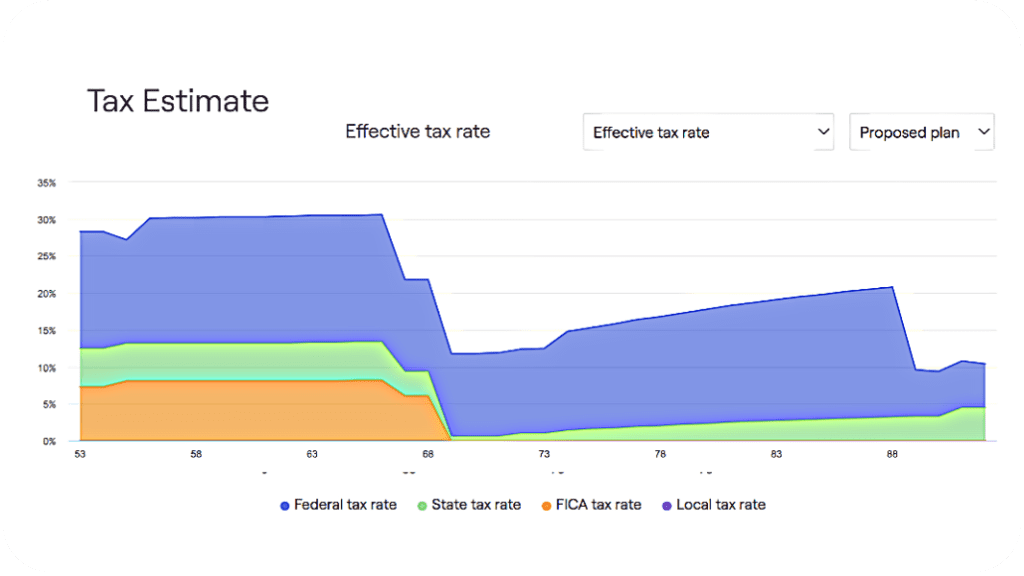

Tax Planning Tools

Estimate your tax rate based on different scenarios within your retirement plan.

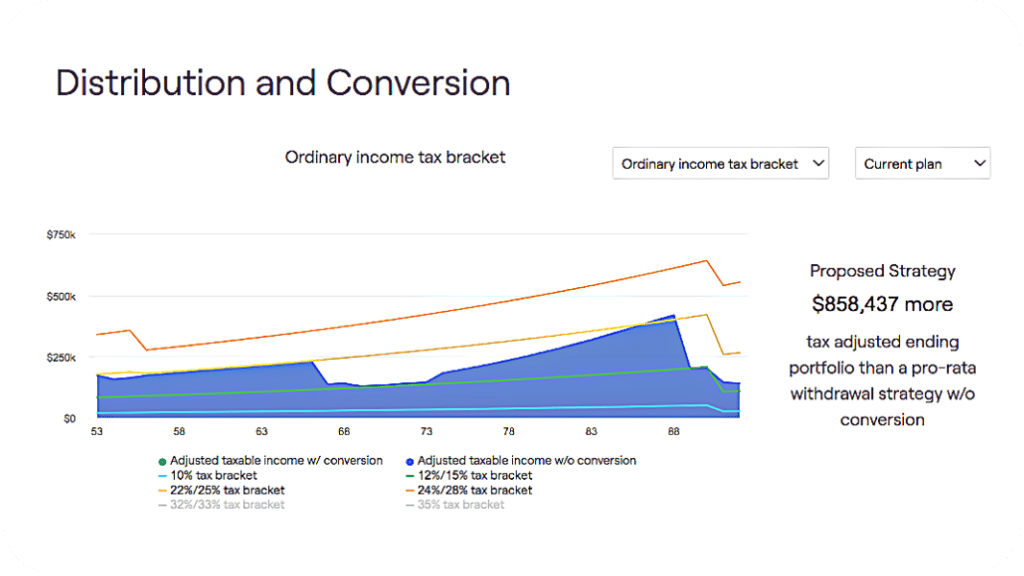

Distribution and Conversion Calculators

Test different withdrawal strategies for RMDs and calculate the best Roth conversion options for 401(k)s and IRA(s).

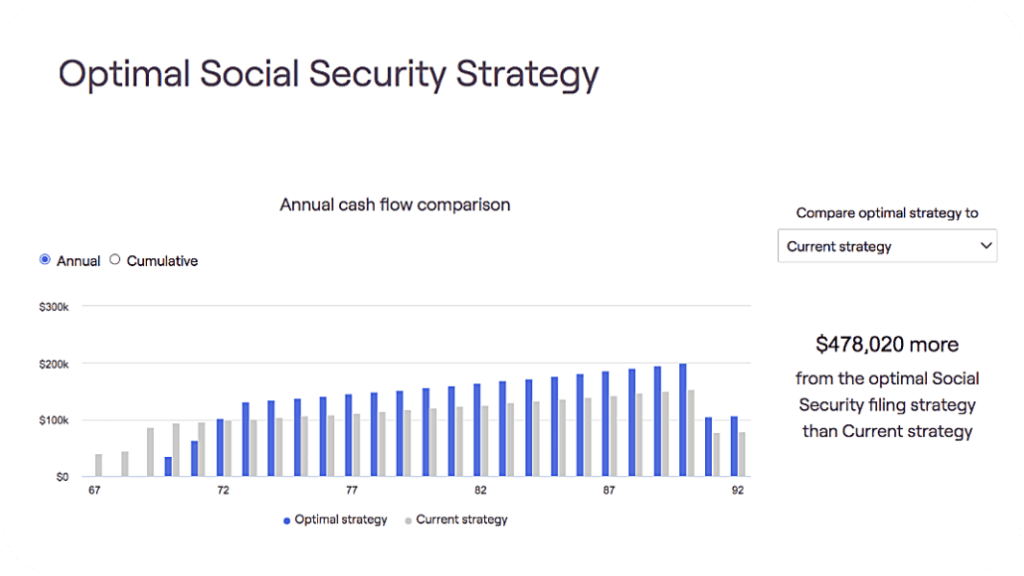

Social Security Optimization

Chart different cash flow scenarios based on Social Security claiming strategies and retirement age.

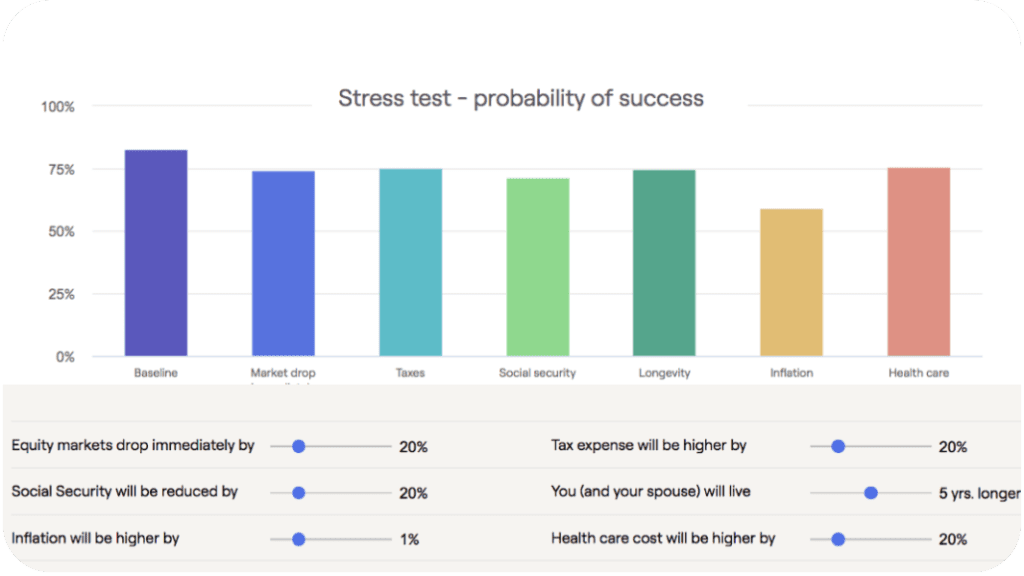

Test the Way You Invest

Stress-test your investment portfolio to determine how it could be affected by changes in several factors:

- Drop in the Equity Markets

- Social Security Reduction

- Rise in Inflation

- Increased Tax Expense

- Longer Life Expectancy

- Higher Health Care Cost

Get Started With Help From Our Team

Schedule a 20-minute virtual meeting with our team of CFP® Professionals to walk through getting started with our tool. Click the button below, provide your contact info, and select the 20-minute ask anything session to see available times.

Retirement Plan Checklist

Have you checked all the boxes in your retirement plan? Download our Checklist to find out.

Who is Modern Wealth Management?

At Modern Wealth Management, our goal is to reimagine the delivery of financial advice. We are designed to anticipate the needs of Americans at every stage of life by providing a full suite of wealth management services. The Modern Wealth Management team is built with experts specializing in financial planning, tax planning and preparation, risk management, estate planning, and more.

Providing our clients with the confidence that they’re doing the right things with their money, the freedom from financial stress, and the time to spend doing the things they love is what we care about. Confidence, freedom, and time.

Learn more about us and our approach to retirement planning, here.