Paying for Your Child’s Wedding Costs Without Derailing Your Retirement

There are few things more exciting than learning about your child’s engagement. Sometimes, that news can come as a big surprise, like in this clip from Father of the Bride.

Hopefully, that surprise eventually comes as a delight to you and your family. That delight can quickly turn into stress once it is time to discuss financing your child’s wedding. Paying for your child’s wedding costs typically comes later in your career when you’re saving for retirement. That’s why it’s crucial to have a solid plan, so you can avoid derailing your retirement.

Without a plan, you may end up in the 10% of parents who used retirement savings to cover wedding expenses. This could come at a very high price if your plan has significant penalties for early withdrawals. On the other hand, you, or worse, your children, could take on serious debt to finance the wedding.

Try to Avoid Wedding Debt

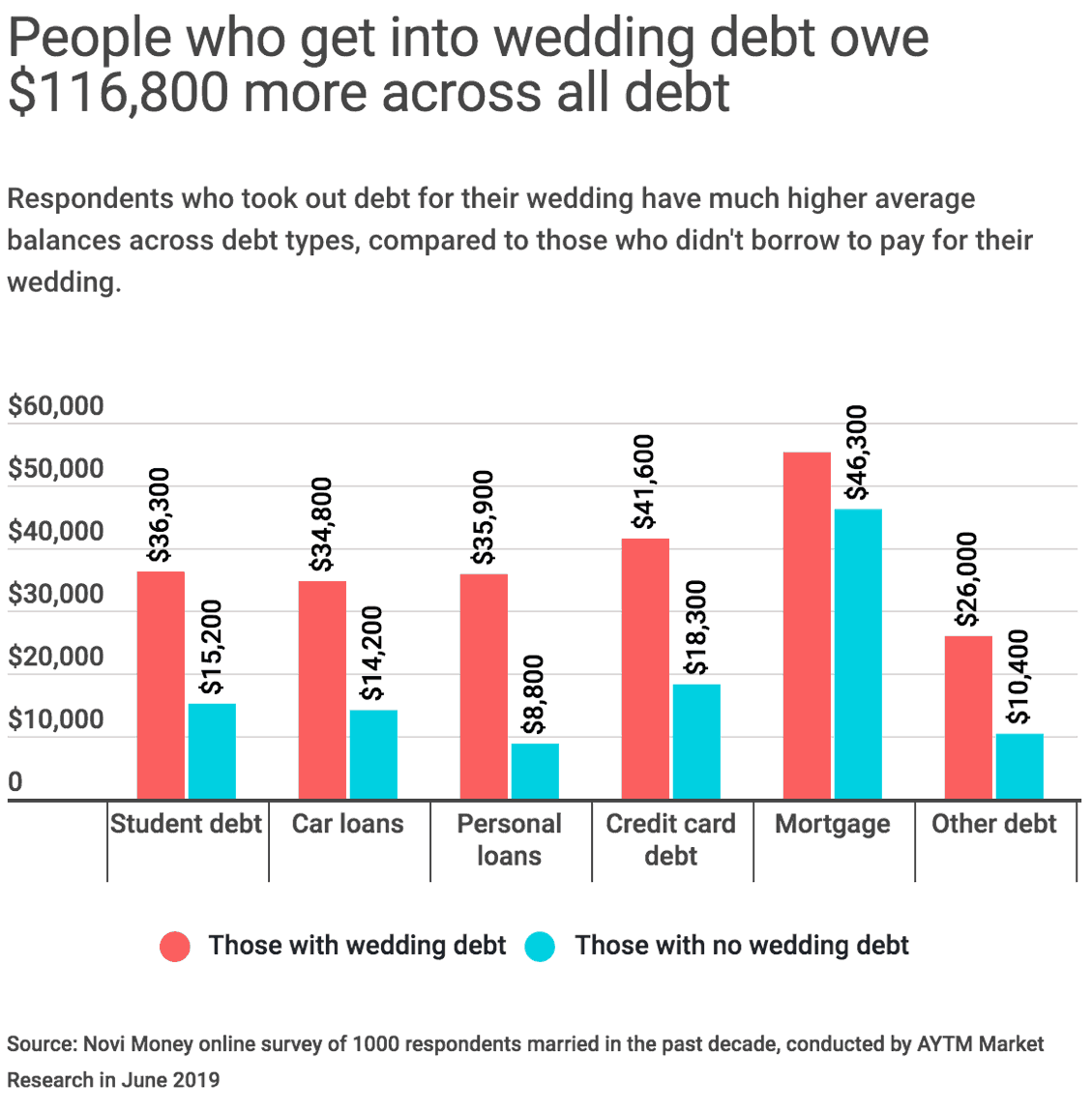

Debt is a reality for most Americans. Some debt can be advantageous when used at the right time and in the proper interest rate environment. Wedding debt is common, CNBC reports 20% of parents use credit cards to pay for a child’s wedding costs. However, taking on debt to pay for a wedding correlates with higher consumer debt overall. A novimoney.com survey found people with wedding debt owed 2.5x – 4x more consumer debt than those without wedding debt. The graph from that study goes into more detail below. But how can you and your child avoid going into debt to cover the cost of their wedding?

Source – Infogram.com

Start Saving Early for a Child’s Wedding

It may be a while before your child’s wedding, but it is never too early to start planning. If you are planning on paying for your child’s wedding costs in the future, you can avoid significant financial stress by saving early. A study by WeddingWire.com found that nearly 1 in 4 parents had savings in place for their child’s wedding before they were engaged. Over half of those parents began to save during their child’s teenage years. Even if your child doesn’t get married, those savings could help them pay off student loans or purchase a home. However, you should be careful about re-allocating those funds too quickly.

According to an article on WeddingStats.org, the average age of women getting married is 27.1, and for men, the number is 29.2. The same article estimates couples average almost five years together before marriage and a 20-month engagement. This scenario can allow a longer ramp-up time for you and your child to be financially prepared. However, it can also make financing the wedding more complicated for parents due to their age and employment status. Will it be during the last few years before retirement when you pay for your child’s wedding costs? Or will you already be retired and trying to pay for your child’s wedding on a fixed income? What if there are factors outside of your control that cause a market downturn? Are you prepared?

Talk with Family First About Paying for Your Child’s Wedding Costs

We have a “Family First” mentality at Modern Wealth Management and believe planning is better together. It is essential to talk with your family about how much you want to contribute to your child’s wedding costs. Get on the same page with your wife on the amount you will be paying for your child’s wedding. You may both decide to contribute a fixed dollar amount to the total wedding or may want to cover specific items like the venue, catering, band/DJ, or wedding dress. Some couples take a hybrid approach saying, “We’d like to pay for the wedding venue, up to $3,000.” Having these talks as a couple first allows you to be a united front when talking to your child.

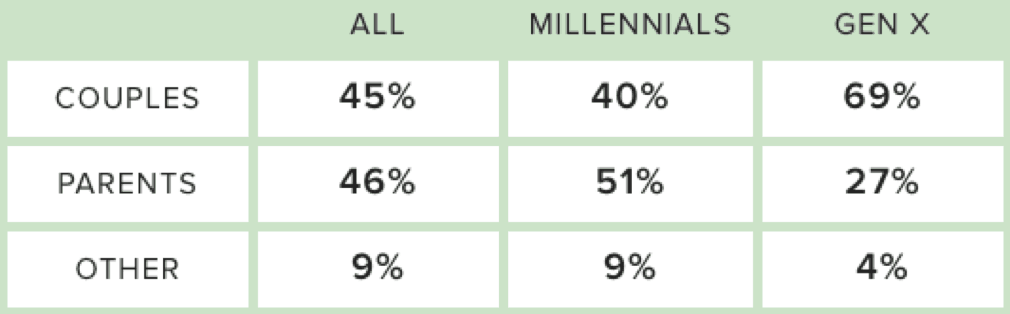

On average, the couple getting married is footing the bill of 45% of their wedding costs. You can see from the chart below using data from WeddingWire.com that there is a vast difference between the amount millennial couples contribute (40%) compared to how much Gen X couples contribute (69%). While these numbers can be helpful to get an idea of current trends, experts say it’s best for both couples and parents not to fall into playing the comparison game.

A big reason couples overspend when paying for a child’s wedding is trying to create the “Instagram-worthy” wedding. Not sure what deems a wedding “Instagram-worthy?” Neither are we. Chances are your child doesn’t either. So don’t assume you know what your child wants for their wedding. It is critical to talk with your child to understand what is most important to them. Then allocate funds to have the most significant impact on them as your paying for your child’s wedding costs.

Source – WeddingWire.com

Creating an Accurate Budget for a Child’s Wedding Costs

Plan on Changing Costs for Your Child’s Wedding

The budget is the hardest thing to determine when planning a wedding. By estimation, couples miscalculate expenses by 45% when budgeting wedding expenses. Budgeting is increasingly tricky because wedding dates are further into the future than ever with longer engagements. Murphy’s law definitely applies to weddings. Anything that can go wrong, will go wrong. Sometimes that will happen in a way you could never predict. For Example, while writing this article it was reported that the coronavirus outbreak is causing a wedding dress shortage.

According to an article from kmbc.com, it is estimated that over 80% of wedding dresses produced come from China. Hopefully, when it’s time for your child’s wedding, it won’t be adversely affected by any foreign disease epidemic. However, the odds are high that significant obstacles will arise to alter your original budget. This can make planning extremely difficult, so be resourceful and be flexible. Create a wedding budget that allows for adjustment in certain areas to maintain manageable costs.

Do Your Research on Wedding Costs

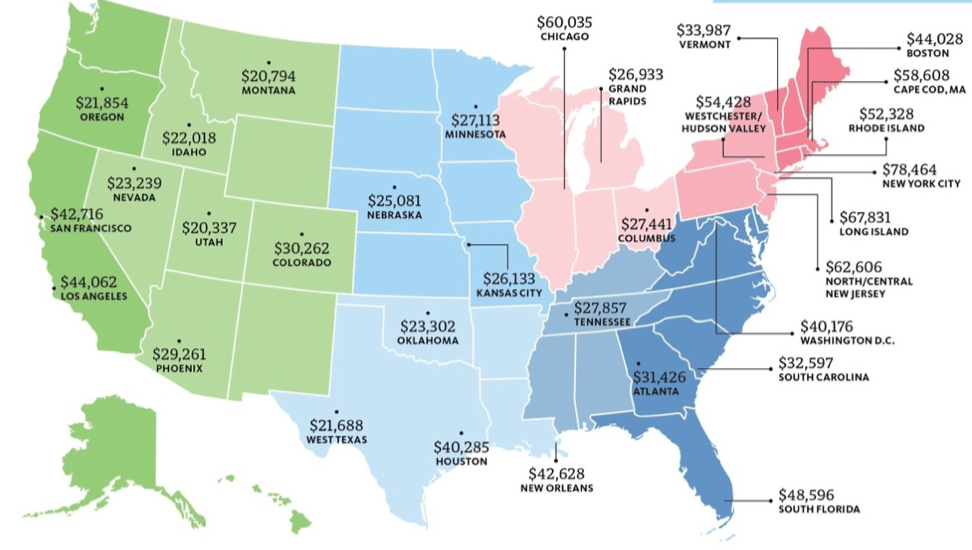

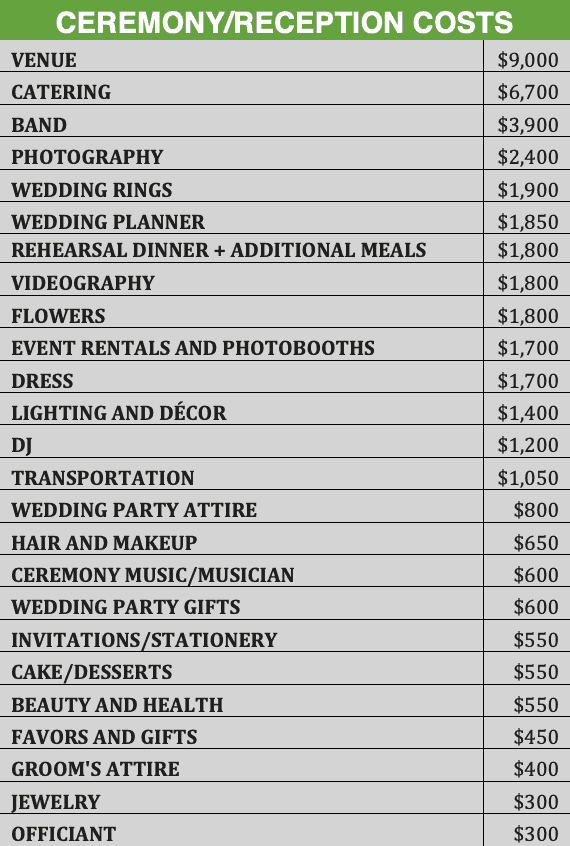

The wedding industry generates over 60 billion dollars a year. Let that sink in for a moment. $60 billion a year! The average cost of a wedding in the U.S. for 2019 was over $38,000, according to the WeddingWire.com Newlywed report. Because the industry is massive and weddings are so expensive, there are a lot of resources available for building a budget. Use the abundance of data on the costs once you start talking to vendors. The charts below from the Knot show wedding costs across the country and a breakdown of wedding costs per item.

Source – WeddingWire.com

Source – WeddingWire.com

For the majority of our readers in Kansas City, the average cost of a wedding is on the lower end at $26,133. Especially when you’re looking at an average price of $60,035 in Chicago or $83,000 in New York. However, nearly 60% of couples surveyed paid under $10,000 for their wedding. With the rising costs of purchases that correlate with marriage like purchasing a home or having children, less expensive weddings are becoming more popular. Again, this is why it is so essential to understand what is most important to your children. Researching wedding costs on your own is an excellent first step, but you will eventually need to get others involved.

Consult with Experts on Wedding Expenses

Talking with professionals within the industry is necessary to get a more accurate picture of your child’s wedding costs. Because there are so many different vendors to select (14 vendors for one wedding on average), many couples elect to work with a wedding planner to manage it all. WeddingWire.com found that 27% of couples hired a wedding planner to help organize the big day. Wedding planners can be expensive but can end up saving you money in some cases. Planners help ensure you stay on budget and can utilize their industry connections for discounts on vendors and suppliers.

Even if you can’t afford a wedding planner, it can be beneficial to consult with a friend or family member who has been through the process with their children. They can recommend local venues, give tips on areas to save money, and even help with day-of coordination. If you enlist the help of another family member or friend, make sure that help is welcomed by your child. Whether you go with a paid professional or experienced family member or friend, make sure to delegate some of the planning. Trust us that you’ll benefit from having someone in your corner with valuable experience to help plan your wedding. The same is true when navigating to retirement while paying for a child’s wedding costs.

Don’t Go it Alone

Reviewing your financial plan for retirement upon the news of your child’s engagement is vital on so many levels. It allows you to make adjustments and re-prioritize this new life event into your plan. You may want to sacrifice certain things to contribute more when paying for your child’s wedding costs. Whatever the case may be, the big news provides an opportunity for conversation about adjusting your family’s financial plan.

Meet with our team of fiduciary advisors to discuss paying for your child’s wedding costs on your way to retirement. Once we understand your goals for retirement, we can help you adjust your current plan or build one with your child’s big day in mind. We also have resources available to help your children learn important financial strategies for their 20’s and 30’s.

If you have questions about how paying for a child’s wedding affects your retirement plan, please contact us by scheduling a complimentary consultation below or calling us at 913-393-1000.

Schedule a Complimentary Consultation

Select the office you would like to meet with. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Lenexa Office Lee’s Summit Office North Kansas City Office

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.