More Interest Rate Hikes on the Way

Key Points – More Interest Rate Hikes on the Way

- Reviewing the Interest Rate Hikes So Far in 2022

- How Big of a Rate Hike Will We Still in December?

- How Many More Substantial Interest Rate Hikes Could We See?

- The Fed’s Main Goal Is to Stop Inflation, Even If It Means a Prolonged Recession

- 20 Minutes to Read | 38 Minutes to Listen

The Federal Reserve is determined to stop inflation. They’re so determined to stop inflation that they’re willing to implement more interest rate hikes that could lead us into a deep recession. Dean Barber and Bud Kasper discuss the latest on inflation, more interest rate hikes, and more on this episode of America’s Wealth Management Show.

Start Planning Schedule a Meeting

Show Resources:

Find links to the resources Dean and Bud mentioned on this episode below.

- Schedule: 20-Minute “Ask Anything” Session

- Sign Up for Our Educational Series Webinars

- Education Center: Articles, Videos, Podcasts, and More

The Markets Were Strong in October … Does That Mean the Bear Is Market Over?

Dean Barber: Thanks so much for joining us here on America’s Wealth Management Show. I’m your host, Dean Barber, along with Bud Kasper. How are you doing, Bud?

Bud Kasper: Dean, I’m doing great. We have a lot of information to talk about.

Dean Barber: Well, you know the good news.

Bud Kasper: Yes, I do.

Dean Barber: The bear market is over.

Bud Kasper: I like your optimism there.

Dean Barber: We had a great month in October. It’s supposed to be the spooky month, but it was very good. We have an S&P 500 up over 5% in the last 30 days, so that means the bear market is over, right?

Happy Birthday to Bud’s Daughter, Katie!

Bud Kasper: Yeah, sure it does. Thanks for listening, folks. Of course, Dean is being somewhat facetious unfortunately. Before we get started too far into the show topic of more interest rate hikes likely coming, I want to make sure that I wish my daughter a happy birthday. Katie is a senior at Lee’s Summit High School and has been having some health issues. I think we’ve got things back under control again, though. But, yes, happy birthday, Katie!

Dean Barber: Yeah, Katie, happy birthday from the orneriest non-uncle that you know.

Bud Kasper: Dean and Katie do have an interesting relationship, that’s for sure.

What’s in Store for the Remainder of 2022 and for 2023?

Dean Barber: Yes, but I always wish the best for Katie. Bud, this has been a very trying year for investors. This has been a trying year for people who are headed into retirement or for people who are relying on their portfolio to deliver income to them in retirement. Since January 1, the dynamics have changed dramatically.

Our show topic today certainly ties in with these dramatic changes, as we’ve experienced some substantial interest rate hikes in 2022. We’re going to be looking into whether more interest hikes are on the way. That goes for the FOMC’s final meeting in 2022 and going into 2023. What is the balance of 2022 and all of 2023 going to look like?

More Interest Rate Hikes, More Inflation, and a Recession?

We have a lot of issues. Of course, we have inflation. We have a recession that a lot of people are calling for, but we really don’t know. It’s a crystal ball that nobody has. Nobody knows when inflation is going to go away. We keep having more interest rate hikes with what the Fed has been doing this year. And that has been impacting bonds.

We’ve had interesting things happening with technology stocks. We also have an inverted yield curve. It’s steeper than any other one that I’ve ever seen. Even when the yield curve inverted pretty significantly back toward the end of 2007, just before the Great Recession, I don’t believe it was inverted as deeply as it is today.

Bud Kasper: I agree. The significant issue that everybody is curious about is when the Federal Reserve is going to stop raising rates. How many more interest rate hikes can we expect?

Interest Rate Hikes of 2022 in Review

Look at what has happened with interest rates this year. In March, we had an 0.25% increase. In May, we had an 0.5% increase. And then in June, July, September, and November, we’ve had four consecutive 0.75% moves.

While more interest rate hikes are coming, I’ve been hoping that there will only be a 0.5% hike announced at the December 13-14 FOMC meeting. And then, if needed, I’ve been hoping that the FOMC will announce 0.25% hikes in January and February. That would at least indicate that we’re starting to get some evidence that the rate hikes are working and they can start to taper down. Then, maybe we can get that back to some sense of normality. The reality, though, is the language that was in Jerome Powell’s last report wasn’t pretty. It was quite discouraging because it sounds like he’s still going to be making more huge interest rate hikes. I think it could repeat itself In December, Dean.

Dean Barber: To paraphrase, Jerome Powell was basically saying that the Fed may have to go further than what they thought to stop inflation. This is really wreaking havoc on the stock market and on the bond market. People are looking for some sort of refuge. What can we do? Earlier today, I asked Bud what he thought and whether he believed this is all over.

This Looks Like a Bear Market Rally

We had a nice little run up in October. Bud and I wish the bear market was over, but it isn’t. So, when I was saying earlier that the bear market is over, I was being facetious. I don’t think that we are at the end of this bear market. I think we’re experiencing a short-term bull run in the middle of a longer-term bear market that still has a ways to unwind.

Bud Kasper: We call that a head fake. It feels good again. It’s nice to have some positive numbers coming back into the equation based upon what we’ve experienced so far this year. However, I’m not sure that this is a reliable indicator that things are over and it’s going to be OK.

What I will say, though, is that once the Federal Reserve start to lower their extreme pressure that they’re putting on right now, you’re going to see the market climb. When that happens, I think it’s going to climb quickly and heavily.

There Are Still Opportunities Out There

Dean Barber: We talked about that last week. I told Bud that I knew exactly when the market was going to start going up. It will be the day that Jerome Powell says they’re done raising rates and they’ve got inflation under control. Then, you’ll see both the stock and the bond market go up.

But between now and then, I believe there’s opportunity. Regardless of what’s happened to this point, you need to ask yourself, if the market were to fall by another 15-20%, what would that mean for your portfolio? Is there something that you should be doing today to protect yourself if that happens? The way that you make money in a bear market is by not losing as much as what the market loses. Then, be flexible and get back into the market when it does rebound.

Bud Kasper: And if you’re right, and you very well could be, it would suggest that we would be down 35%, which would be closer to what we had in 2008 at -38.5%.

A Financial Plan Can Give You Some Much-Needed Clarity

Dean Barber: We’re going to go through some statistics and things that you could do. We’ve been going through our clients’ financial plans and sharing with them what has been happening to their portfolios. And they’re not without losses because virtually everything is down this year. The question is, what does it really mean? Can you still do the things you want to do?

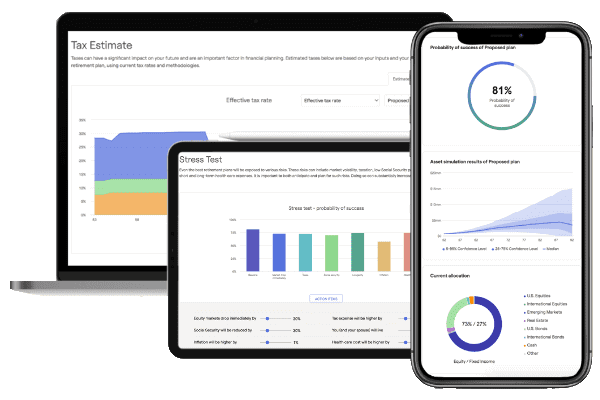

Well, if you have a plan, you just update the numbers. Ours are updated live every day anyway. We’ve still seen so many instances where someone has had a 97% probability of success before reviewing their plan and then still have a 97% probability of success afterward. That gives people the clarity that they need. You need clarity and a strategy through this tough economic time.

Predictions from Renowned Money Manager Nouriel Roubini

As I was saying earlier, more interest hikes are on the way and inflation is still here. Inflation is impacting a lot of people. Bud and I were not in this industry the last time inflation was rearing its ugly head like it is today. Before we get into the numbers on inflation and what we’re anticipating, Nouriel Roubini, who is a renowned money manager and economist, has some predictions that Bud shared with me. Why don’t you share those predictions, Bud?

Bud Kasper: I’d be happy to. Nouriel Roubini reminds me of an old EF Hutton commercial. Do you remember the famous line of, “When EF Hutton talks, people listen?”

Well, when Nouriel Roubini talks, everybody listens. He has a brand new book called, MegaThreats: Ten Dangerous Trends That Imperil Our Future, And How to Survive Them. Roubini says that there is too much global debt. We know where our country is with this and the amount of additional debt that we’ve taken on just in the last two years alone. Roubini says we’re having a global recession. He thinks we have a mother of all debt crises. He says we could have a currency meltdown and a recession with high inflation and global stagflation.

What Is Stagflation?

Dean Barber: Stagflation is simply when you’ve got an economy that is stagnating, not growing, or even potentially contracting, and inflation is still there. We know that the Fed’s main objective for raising rates as many times as they have.

The Fed thinks that their job in this situation is to kill the economy. From a global standpoint, bankers around the world are saying that we need to raise rates to a point where it stops inflation. That’s the case even if it means sending the economies of the world into a recession.

They want higher unemployment. They want people to slow down the spending, slow the demand, and calm the inflationary pressures because it’s hurting the average consumer in a very big way.

How Did We Get to This Point?

Bud Kasper: I agree. It’s true. I think that COVID was the genesis of what we’re experiencing today. What was the reaction as the market had its fastest route to a bear market in stock market history? There was a 35% peak to trough drop in a matter of four weeks. And suddenly, it stopped. Well, did the caseloads associated with COVID stop? Heck no. They were getting worse. We had beds in hallways and people dying from this. It was a megatrend of bad health from that perspective.

As that was happening, we had two events that took place from an economic perspective. First off, zero interest rate policy from the Federal Reserve and a $5 trillion package to pay people to stay home, even though they were getting paid by their companies to stay home to isolate and keep COVID in check.

The Great Financial Experiment During the Great Recession

Dean Barber: I agree. But I think it all began well before COVID-19. I believe that it all began in the Great Recession. We had a great financial experiment that occurred in the Great Recession to bail out the big banks and insurance companies. We had a zero interest rate policy for almost four years. And we finally had started to normalize the Fed policy and started to shrink the balance sheet.

Then, COVID-19 hit. They dusted off the playbook from the 2008 Great Recession and pumped in mountains of steroids into it. Their plan was to make this even bigger than what we did in 2008 and that would turn things around. Well, it sure did. But it caused massive inflation too.

A New Normal on Interest Rates?

That makes me think of the Beaulieu Brothers. My Vistage group, which is a nationwide CEO group, has used them for decades as their chief economist. They believe that the new normal on interest rates—home loans—is going to be 7-9%. That’s going to be the new normal. We’re going to go back to where we were prior to the Dot-Com Bubble. That’s the last time we had home mortgages where they are today. That’s the last time we saw treasuries where they are today. I can get a three-month treasury bill that’s going to pay me 4.2%, a six-month treasury bill that’s going to pay me 4.6%, and a one-year treasury that’s going to pay me 4.7%.

Again, There Is Still Opportunity to Be Had Despite the More Interest Rate Hikes That Are on the Way

Bud Kasper: Yeah. Sometimes opportunity is born out of the ashes of pain. That’s what this is because of the inverted yield curve that we talked about earlier.

Dean Barber: The 10-year yield is only 4.15%.

Bud Kasper: So, why would you go out 10 years for it, unless you wanted to lock in that number, when we have on the short side as good, if not better, than what the 10-year is?

Watch Out for the Annuity Salespeople

Dean Barber: We said earlier that with this chaos is going to create opportunity. But we need to make sure that we have some dry powder. We need to make sure that we have some assets that are protected and have liquidity. Liquidity is key right here. Bud and I said earlier that the annuity salespeople are coming out of the woodwork. And by the way, I’m not a big fan of annuities. I think in certain circumstances they have a place, but they’re not the end all be all.

The closest thing that I’ve seen that makes any sense at all would be a three-year fixed annuity, paying 4%. But look at what treasuries are doing today. It would be stupid to put money into a three-year annuity paying 4% because you don’t have any liquidity.

Bud Kasper: Especially when there’s a surrender charge to get your money out if you need it.

Dean’s Argument Against Annuities

Dean Barber: Correct. There’s an opportunity here for the markets to bottom out once inflation gets under control and the Fed says that they’re done raising rates. You’re going to see a rally in the bond and stock markets, both of which will occur quickly. If you have all your money tied up into a fixed annuity or something where you must pay a penalty to get it out, it doesn’t make any sense. Annuities don’t provide the liquidity that you need to take advantage of those opportunities.

Let me just run through an example. Let’s say that I split up the money that I want to keep safe into thirds. One third of it will be a three-month treasury, one third will be a six-month treasury, and the last third will be a one-year treasury. My average return is going to be a little over 4.5% with liquidity every 90 days.

I can sell these any day I want to. It’s possible that I could sell them for less than what I paid for them. Because if interest rates rise, you need to hold those to maturity to be guaranteed to get those rates of return. But if interest rates happen to drop a little bit, I could get a little bit of premium. I could make more than those numbers.

The Importance of Keeping Liquidity

The point is that I wouldn’t lock my money up now. I think that’s a bad decision. You need to keep this liquidity. And you can do it and make a reasonable return while you’re doing it. You have 100% liquidity. In some cases, you may have to sell that treasury for a little bit less than what you paid for it. But that would mean that interest rates had continued to rise very rapidly.

Bud Kasper: And just to be clear, if you’re buying a 90-day bond, CD, or whatever the case may be, remember that at issue here is that if you get out early, you’re not exactly getting your principal back from that perspective.

Understanding Your Options

Dean Barber: But the point is that there are options aside from the traditional stock and bonds. You need to understand what your options are. We can help you understand what your options are, take a deep dive into what you own today, and let you know what kind of risk you’re exposed to and what kind of opportunities might be there in front of you.

The Issues Surrounding Unemployment

Let’s shift gears here to the stock market. We talked early that inflation is stubbornly high and the stock market doesn’t like it. Bud and I talked a little bit this week about unemployment. There are still too many jobs open and too few people to fill them.

That’s continuing to cause wage inflation where employers are being forced to pay more than what they would have a year ago, and especially more than they were two years ago for the same help. It’s created an environment that the Fed wants to kill. The Fed needs unemployment to rise. Did you ever think we would be talking about a Federal Reserve that is trying to make unemployment go up?

The Fed Purposely Wants to Cause a Recession So It Can End Inflation

Bud Kasper: You’re right on target. The Fed needs to destroy the economy to make the recession complete.

Dean Barber: They need to destroy the economy to kill inflation, which will mean that they must put the economy into a recession.

Bud Kasper: Purposely. That’s right. Therein lies the issue as they continue to do that by raising rates. The handicapped number right now is favoring another 0.75% hike at December’s FOMC meeting.

A Scary Statement from the Last FOMC Meeting

Dean Barber: I agree. They originally said that we’re going to go somewhere between 4.5% and 4.75%. But at the last FOMC meeting, Jerome Powell said that the Fed may need to go further than what it initially thought because inflation is remaining stubbornly high. More interest rate hikes are likely on the way.

Bud Kasper: It was a scary statement.

This Is Far from the Normal Relationship Between Stocks and Bonds

Dean Barber: Look at what this has caused. Looking back 12 months, the S&P 500 is -18.58%. The bond aggregate trailing 12 months is -17.89%. Bud and I have never witnessed this in our careers. I’ve been in the industry for 35 years and Bud has been in it for 39 years. We’ve never seen the bond aggregate at nearly -20%.

Bud Kasper: It’s crazy. Mostly everybody understands that there’s a relationship between bonds and stocks. Usually when stocks are failing, bonds are your friend. And when bonds are failing, stocks are your friend.

Dean Barber: Because normally when stocks are failing, it means we’re going into a recession. And when stocks are failing and we’re going into a recession, you normally have a Federal Reserve that is lowering interest rates, which causes bond values to go up. This isn’t the case now.

Finding Places of Safety

We have runaway inflation that the Fed is trying to kill by raising rates. With rates being higher, the three-month treasury is paying 4.26%, the six-month is paying 4.6%, and a one-year is paying 4.7%. And the stock market is negative, negative, negative. The NASDAQ is -33.5% over the last 12 months. So, where do you hide?

You hide in places of safety, but you must have opportunity. There are multiple places where you can position yourself today. And I’m not going to give away the answers to where you hide because it’s going to be a different solution for everybody.

The purpose of America’s Wealth Management Show is not to tell you what to do or to give investment advice. The thing that we need you to understand is that there are alternatives to the traditional way that people think about investing stocks, bonds, and those types of things. There are alternatives to protect yourself, make a little bit of money, and be patient for what will be real opportunities.

Bright Light at the End of a Very Dark Tunnel

At some point in the next six to 18 months, there are going to be some amazing opportunities. And when those opportunities finally turn this market around, there are going to be double-digit returns to be made in a very short time in both the stock and bond markets.

Bud Kasper: It’s so difficult for retirees when you’re seeing your portfolio slide and you’re also taking distributions. That’s what I refer to as double-negative compounding. And it’s hard. It’s very difficult from that perspective, but you must look past the pain points and see that there’s really opportunity that’s born out of that. That opportunity could be a once in a lifetime opportunity.

Dean Barber: Yeah, no question.

The Definition of a Recession

Bud Kasper: But when we look at the definition of recession, it’s two consecutive quarters of negative GDP growth. We’ve met that definition. So why isn’t the White House willing to say that we’re in a recession and it’s that unemployment number that needs to rise for that to legitimately be that way.

Dean Barber: Now, you could argue that the housing market is now in recession. The average price of a house is now down 11% from its peak early this year. So, that’s going to help. A couple of months ago, we also talked about automobile debt. At that time, there was $11.42 trillion of automobile debt. More than 11% of those automobile loans were in default.

That’s going to cause a flood of used cars to come onto the market as those vehicles get repossessed and sold at auction. That’ll cause the used vehicle prices to start to come down. In fact, we’ve already started to see that ease a bit. Once you have a bigger supply there, that will loosen up demand for the brand-new vehicles. And that should allow people to maybe make a deal on a vehicle over the next 12-18 months.

Coming Back to Reality

Bud Kasper: There’s no doubt that there’s going to be a slowing of the economy through all the actions of the Federal Reserve. But do you know what, though? We really need to come back to reality. The reality is that the low interest rate policy is not something that can be continued for decades. We have these changes that take place and challenges at the time that we’re going through those. But we will get through them.

As an investor, you need to step back, be calm in your approach, and understand that there is opportunity. You need some exposure to some degree for that so that when the stock market turns, you’ll have a piece of that. That doesn’t mean to overexpose yourself to that, but there are other assets that you were referring to earlier that we can utilize to generate some positives.

Dean Barber: That’s right. If the Fed does need to implement more interest rate hikes like Bud and I think they will, that is going to continue to put some pressure on the equity markets and traditional bond markets. We can pick up some quality fixed income at discounted prices right now. You can look at a yield to maturity on some individual issue bonds and get 6-7% now. They’re trading at discounts to their par value.

There are opportunities out there, you must understand what to look for. And it’s not as simple as indexing it as everybody has been so brainwashed to do. Sometimes that makes sense, but not all the time.

Diving into More Data from Nouriel Roubini

Let’s get into a little bit more about what Nouriel Roubini was saying. Bud has some things from him that he thinks are important for people to know.

Bud Kasper: I know him name is not familiar to a lot of people, but…

Dean Barber: Back in the 1990s, he ran a Neuberger Berman growth fund. I don’t remember the exact name of the Neuberger Berman fund that he ran, but it was a very popular fund. It had some unbelievable performance numbers during the 1990s.

Worldwide Economic Hardships

Bud Kasper: Yeah. He’s wrote a book called, MegaThreats: Ten Dangerous Trends That Imperil Our Future, And How to Survive Them. The book discusses a global recession. Look at what’s going on in Europe. They have some incredible economic disruptions going on that we’re not experiencing. And thank goodness for that. Will it cross over? Will it eventually catch up to us? Probably to a degree. However, I think the Federal Reserve does have the hammer and will keep things under pressure.

As we mentioned earlier, we do expect more interest rate hikes from the Fed. I think we’ll see another 0.75% rate increase in December. The markets will read part of that into the activity, which has been positive as of late. It could be positive as we move toward the end of the year. But we don’t know if that’s necessarily going to be the case long-term. It always comes down to fundamentals.

So Much Debt

This is no different than how you run your household. You can’t keep putting debt on the books and not have a consequence to it. With the $5 trillion package that we did in COVID and now this college loan repayment plan, we can’t just keep fabricating money and throwing it out there without there being a consequence.

Some Collaboration in Congress Would Be Nice

The only reason that the dollar is so strong right now is because the rest of the world is in worse shape than us. But we’re not in great shape either. We must get some fiscal responsibility out of Congress. Now that midterms are over, maybe we can get some collaboration between the parties and start working on what I think is fundamental to how the market can succeed, and that is to reduce our debt.

This Debt Didn’t Accumulate Overnight and It Won’t Disappear Overnight Either

Dean Barber: But we didn’t just get into this situation overnight. And we’re not going to get out of it overnight. This is a process. Remember what I said earlier about the Great Recession and the great financial experiment.

I was at a business class for a couple of days at MIT about three years ago. One of the professors of economics at MIT was part of the Federal Reserve during the Great Recession. He basically said that the Fed knew it had to do something. They did all the quantitative easing, bond buying, and flooded the market with liquidity, and went with a zero interest rate policy. He said that they didn’t have any idea how to get out of it or how it would unwind. They didn’t know how to write the end of the story.

The Great Recession’s History Remains Relevant

And when COVID hit, the Fed dusted off the playbook for the monetary policies that worked during the Great Recession. We know it worked temporarily, but now suddenly we’ve exacerbated that problem. And it’s bigger than it was before. I think Roubini is right. There’s too much debt. We don’t know how this is going to end. How are we going to unwind $30 trillion of debt in the United States? And that’s not to mention all the unfunded liabilities with Medicare and Social Security.

Bud Kasper: Yeah. And I didn’t like the campaign to take Social Security away. Are you crazy? Do you think that could possibly happen? If you wanted to see an internal war of wars, it’ll be all the retirees coming out and said, “Don’t you dare touch my Social Security.”

Dean Barber: Don’t even get me started on that.

Bud Kasper: We touched a nerve. Dean Barber is speechless.

Dean Barber: It’s the same thing that they’ve been saying for decades. And it’s just not a true statement.

Quantitative Tightening

Bud Kasper: You’re right. I want to come back to this indebtedness. The Federal Reserve has a massive portfolio of bonds that they have bought. Well, when that bond money comes due every week, instead of taking that money to go buy more bonds like they’ve done in the past, which props up the price of the bonds, now they’re letting it drop off their sheet.

Dean Barber: Quantitative tightening.

Bud Kasper: Yeah. That’s a good thing. It is constructive. But how much can they reduce off $30-plus trillion of indebtedness? I’m not sure.

What Are the Alternatives to Traditional Stocks and Bonds?

Dean Barber: It’s a number that’s bigger than most people can fathom. The bottom line is that the economy from a consumer standpoint still seems to be resilient. But the Federal Reserve is intent on stopping that. They’re intent on raising unemployment. They’re intent on softening the economy and pushing us into recession to stop inflation. That will continue to put pressure on traditional stocks and bonds.

People need to ask the question, what are the alternatives? And there are multiple alternatives. One thing that I would not do is take my money and tie it up for any length of time outside of… I want liquidity at least every 90 days. I don’t want to put my money into something where I’m not going to be able to take advantage of opportunities that are going to present themselves over the coming months.

Bud Kasper: Dean gave the statistic that people need to know, and that is the bond market is performing as bad, if not worse, than the stock market is. And that isn’t normal. Well, the people who are doing it on their own are probably asking themselves a question as well. Whether they’re going with a 60-40 or 40-60 portfolio, will that continue to work? At some point, this bond market, which is as ugly as I’ve ever seen in my career, is going to be attractive again.

A Bear Market in the Bond Aggregate

Dean Barber: Bud, do you remember back in summer when we were talking about what bonds were doing and where the Fed was going, and what was happening with the 10-year yield? We raised the question, could we see a bear market in the bond aggregate? And it seems unfathomable. Bonds are struggling. Let me look up the TLT.

Bud Kasper: The TLT is an ETF that you can invest in. It’s based on the 20-year treasury. If you want the equivalent of a 20-year treasury bond, you can buy the TLT and get that. But TLT’s down this year as well.

Dean Barber: By 36%.

Bud Kasper: Oh my gosh.

The Bottom Line: Despite More Interest Rate Hikes Coming, There Are Opportunities Out There

Dean Barber: Yeah. But still, there are opportunities despite more interest rate hikes that are likely on the horizon. People need to find them. That’s the key.

What’s happening in the traditional stock and bond markets is not going to stop anytime soon. That makes it that much more important to have a financial plan that gives you clarity, confidence, and control.

Having a Financial Plan Is Key As We Prepare for More Potential Interest Rate Hikes

We’re giving you the opportunity to start building your own plan from the comfort of your own home with the same financial planning tool that our CERTIFIED FINANCIAL PLANNER™ professionals use with our clients. You can use it at no cost or obligation by clicking the “Start Planning” button below.

I also encourage you to at least get a conversation started with one of our CERTIFIED FINANCIAL PLANNER™ professionals. Let’s look at what you’re doing and help make sure that you’re protected and that you have the availability for opportunity that will present itself over the course of the next several months.

You can schedule a 20-minute “ask anything” session or a complimentary consultation with one of our CERTIFIED FINANCIAL PLANNER™ Professionals by clicking here. We can meet with you in person, virtually, or by phone. Thanks for joining us on America’s Wealth Management Show. I’m Dean Barber, along with Bud Kasper. Everybody stay healthy, stay safe. We’ll be back with you next week same time, same place.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.