Market Conditions Falter to Round Out August

Key Points – Market Conditions Falter to Round Out August

- Market Conditions Decline Following Decent Start of August

- We’re in a Housing Recession

- What’s the Latest with Inflation?

- Staying Patient Amid All This Uncertainty Remains Critical

- 5 Minutes to Read | 9 Minutes to Watch

What Went Up, Quickly Came Back Down

The month of August has been a shock all around with these market conditions. It started out well, but things have fallen apart in recent weeks. Every index is in negative territory. Federal Reserve Chairman Jerome Powell says to look for more pain ahead. The National Association of Homebuilders has declared a housing recession and has said that the situation has become worse in the past few days. Dean Barber discusses all that and more in August’s Monthly Economic Update.

Bad News and Uncertainty Are Here, There, and Everywhere with Market Conditions

There is no shortage of news right now, that’s for sure. I’m sure that any of you that are turning on the news want to turn it off as fast as you turn it on. It seems like there is more bad news and uncertainty everywhere you turn.

The 10-year treasury yield is rising rapidly again. The yield on it is roughly 0.4% lower than the two-year treasury. And it’s been like that for quite some time now. It’s a steep inverted yield curve. As we’ve previously discussed, inverted yield curves have led to recessions in the past.

The Housing Recession Is Deepening

The National Association of Homebuilders just declared that the housing recession has deepened. Mortgage applications have declined substantially. The 30-year mortgage also touched 5.8% recently.

If you’ve listened to America’s Wealth Management Show, Bud Kasper and I predicted about three months ago that the 30-year mortgage rates would be somewhere north of 6.5% by the end of the year. That’s creating a little bit of an ease on the upward trend of housing prices. But we need to remember that as housing goes, so goes the rest of the economy.

The Uncertainty Will Continue with These Market Conditions

We’re not out of the woods yet. There is still a lot of uncertainty. That is just some of what is going on domestically, let alone all the geopolitical situations. It’s all creating a lot of uncertainty. The stock market does not like all that uncertainty.

You can still find some pockets of things that are doing OK, but by and large, most of the major averages are off significantly for the year and for August. We had a little bit of a summertime rally in July. People started to think that this was over and that everything was going to be better now. The 10-year treasury yield started to decline. People started thinking that things were good and that inflation is cooling off.

A Time for Patience

I think that this is going to be a little bit more prolonged than what anyone originally thought. Like I’ve said over the last several months, this is a time for patience.

It’s not like the companies that are trading down stocks are going broke. They’re not going away. These type of market conditions are normal. They occasionally occur and are just always uncomfortable. But it’s not that they’re abnormal. Again, it’s a time for patience.

August Market Performances

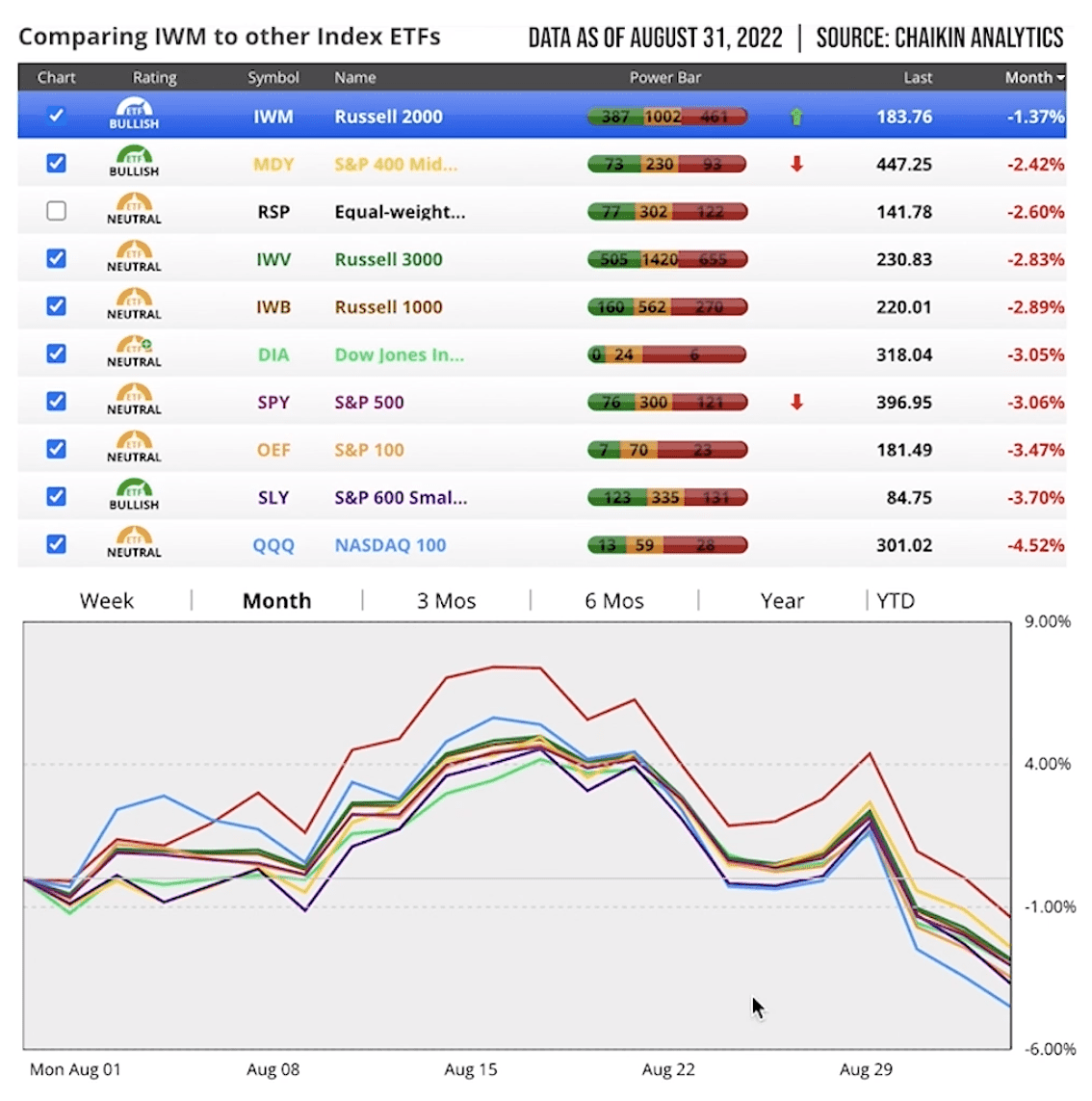

Let’s dive in and see what the major indices did in August. As you can see below in Figure 1, we started August with a little bit of a bang. But then, there was this recent sell-off to end the month.

FIGURE 1 – August Market Performances – Chaikin Analytics

The IWM, or the Russell 2000, was the best performer in August. It was down 1.37%. The NASDAQ 100 was the worst performer, down 4.52%. Everything in between was in the red.

One thing I’ve been pointing out in the last few Monthly Economic Updates has been the bullish or neutral ratings of these different indices. We don’t have anything that’s in a bearish trend. We measure that by looking at the total number of stocks that are bullish, neutral, or bearish.

You can see above in Figure 1 that the SLY, the SLP Smallcap, is bullish. So are the S&P 400 Midcap and the Russell 2000. Most everything else is neutral except for the Dow Jones Industrial Average, which is neutral plus. The DJIA has no stocks that are considered bullish at this time, but 24 of the 30 are considered neutral and six are considered bearish.

Year-to-Date Market Performances

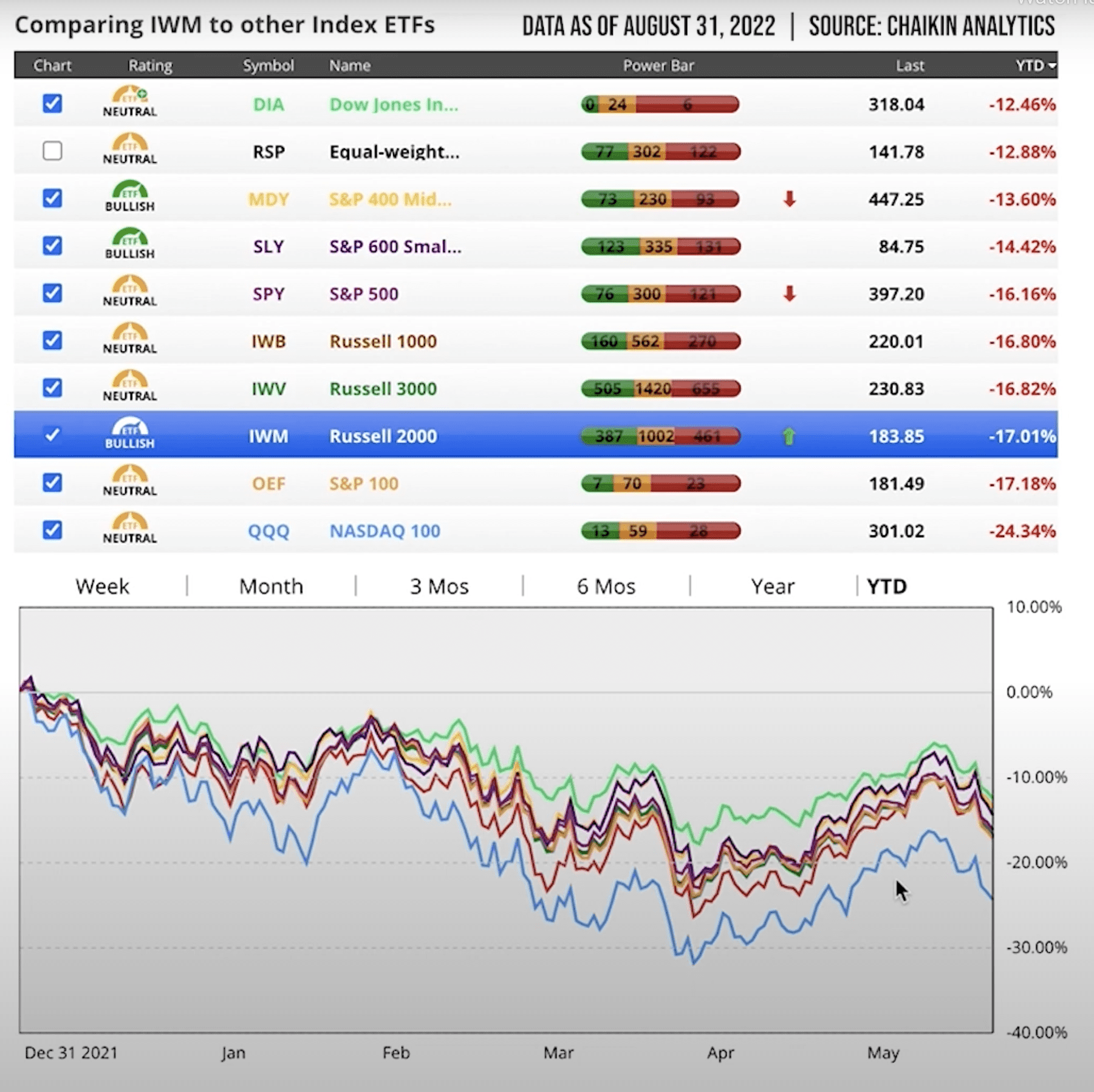

Nothing here is flashing that we should run for the hills. There is still uncertainty out there. So, you’re going to get these wild swings like we’ve seen. Let’s look next at the year-to-date performances below in Figure 2 to get a better perspective of those wild swings.

FIGURE 2 – Year-to-Date Market Performances – Chaikin Analytics

By the end of March, we probably had the worst of the worst for market performances. Then, we started to come up and had some decent returns through July. Some of the indices were getting up to where they weren’t too negative. But that changed in August and it all went away.

When we start looking at these market conditions, we want to look for higher highs. Right now, we’re going to have to test and see where this next low point takes us. Is this next low point and downward trend going to take us below the last low point? We want to pay attention to the lows and if they’re getting lower after we have a run-up. Or are the lows going to stop before that and turn around?

Powell Expects More Pain Ahead, More Rate Increases

That can give us some signal as to where real support is in the markets. Federal Reserve Chairman Jerome Powell talked recently about expecting a lot more pain ahead. The Fed has a lot of work to do. There are several Fed governors that are now saying that they’d like to see the Fed funds rate near 4% by the end of next year.

What’s Up with Inflation?

That means that there are quite a few more increases to come. What is going to happen? We don’t know. What is inflation going to do? We don’t know. Is it going to cool? A lot of problems with inflation domestically aren’t just the supply chain issues. There are all kinds of issues that are causing this inflation.

Like it or not, some of the things that this current administration is doing is not helping this situation. In fact, it’s hurting the situation. The new Inflation Reduction Act that was just passed does very little, if anything at all, to reduce inflation.

The Federal Reserve is still walking a tightrope. The Fed knows that inflation is harming the average American far more than a recession will harm wealthy Americans. They need to stop inflation and they’re committed to that. Until we start to see inflation reduced by a meaningful amount, it’s doubtful that we start to see the Fed start to ease up on interest rate hikes.

This Bear Market Will Pass, But Again, We Need to Be Patient

All that to say, we’re not out of the woods yet. We need to be patient. This bear market that we’re in right now will pass just like all bear markets have in the past. The question that you need to be asking yourself is, “Are you OK with your current asset allocation?”

Reach Out to Your Advisor with Any Questions

You need to visit with your CERTIFIED FINANCIAL PLANNER™ Professional. Your asset allocation should already be built into your plan. What is the probability of success with your plan? Let’s focus on that. Remember, we stress test for poor market conditions at any point during the planning process, so it should’ve already been taking into consideration.

Keep the lines of communication open with your advisor. Let them know what you’re feeling and thinking. We’re here to help you. We know that you may need a little bit more help during these times of uncertainty. We’re happy to do that.

I’ll be talking to you toward the end of September or early October with September’s Monthly Economic Update. For those of you who aren’t clients of Modern Wealth Management, if you’d like to learn more, check out our industry-leading financial planning tool. By clicking the “Start Planning” button below, you can start utilizing the same financial planning tool that we use with our clients from the comfort of your own home.

If you have any questions about what these poor market conditions or how to navigate our financial planning tool, you can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® professionals at no cost or obligation. Thanks again for joining me, and make sure to share this video with your friends.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.