2022 Halftime Report

Key Points – 2022 Halftime Report

- No Lack of Craziness in the Markets and Economy

- What to Expect from the Fed

- Bonds, Bonds, Bonds

- Looking at the Great Recession and Dot-Com Bubble

- 15 minutes to read | 25 minutes to watch

Dean Barber and Bud Kasper give you their insights on what’s happened year-to-date and what they think is in store for the balance of 2022 in our 2022 Halftime Report. This conversation took place on May 25, so the numbers that Dean and Bud reviewed during this recording will reflect such.

Access Our Industry-Leading Financial Planning Software

2022 Halftime Report

Dean Barber: Hello, everybody. I’m Dean Barber, founder, and CEO of Modern Wealth Management, along with Bud Kasper. He’s president of our Lee’s Summit office. We’re here today to deliver the very exciting 2022 Halftime Report.

Bud Kasper: Exciting.

No Lack of Craziness in the Markets and Economy

Dean Barber: Well, I’ll tell you there has been no lack of craziness out there. It’s been a crazy five months, with most of the major indexes peaking sometime in December or early January. And we’ve seen a ton of volatility this year, which you and I both anticipated when we kicked off the year. We talked about that early on. I think both of us felt that it was at that time that the markets would finish higher by the end of the year. And while that’s still a possibility. There are some signs out there that that may not be the case.

Bud Kasper: Yeah, no, you’re right, Dean, there’s a lot of pressure on the Federal Reserve, and all arrows point to the Federal Reserve to be able to be the action that will need to get back on track. If you look at the Federal Reserve, they increased the benchmark, as we all know, by 0.5% because we were already at a quarter. That brings us to how the Federal Reserve presented 0.75% to 1%. There’s a quarter-point spread that they use in between that, but we’re at a 40-year high on inflation.

Dean Barber: I understand that, and the Fed has committed to continue its rate hikes throughout the year with a target of somewhere between 3% and 3.5% on the Fed funds rate by the end of the year. Yeah. And, of course, that is spooking the daylights out of the market.

What to Expect from the Fed

Bud Kasper: Yeah. And quite frankly, it should. I mean, that’s a radical move from that perspective. We’ve seen some of this before as we went through similar scenarios in the Dot-Com Bubble.

My point is that Ben Bernanke, Chairman of the Federal Reserve, says that the Federal Reserve is on track.

But I think the point we’re trying to make here is when will the market react favorably to it? In other words, when will the Federal Reserve’s action give back confidence to the stock market so it can improve over the woes we’ve experienced this year.

Dean Barber: The other thing is happening as the Fed is shrinking its balance sheet. So that is, that’s causing some concern as well. So we’re going to ultimately, that’s good because it is a good thing that has to be done, but the pain of getting there will not be any fun. That’s the problem.

Bud Kasper: I think our audience needs to understand that we had an increase in the Fed Funds buying program, which was $120 billion per month. Now, they will try to trim that down to $95 billion per month. So these are baby steps, but what matters most is reducing its debt. So we had $9 trillion worth of indebtedness on the back of the Federal Reserve at the beginning of the year. They intend to let the Federal Reserve’s massive portfolio, as these bonds are maturing, we will fall off the bow. They’re going to fall off the balance sheet, which will reduce the debt level.

Dean Barber: They want to get down to $4.5 to $5 trillion by the end of 2023.

Bud Kasper: Yeah, that’s right. I’m glad you put it that way. If it were any more radical than that, we’d have a really upset the market with that.

Looking at the Upset Market

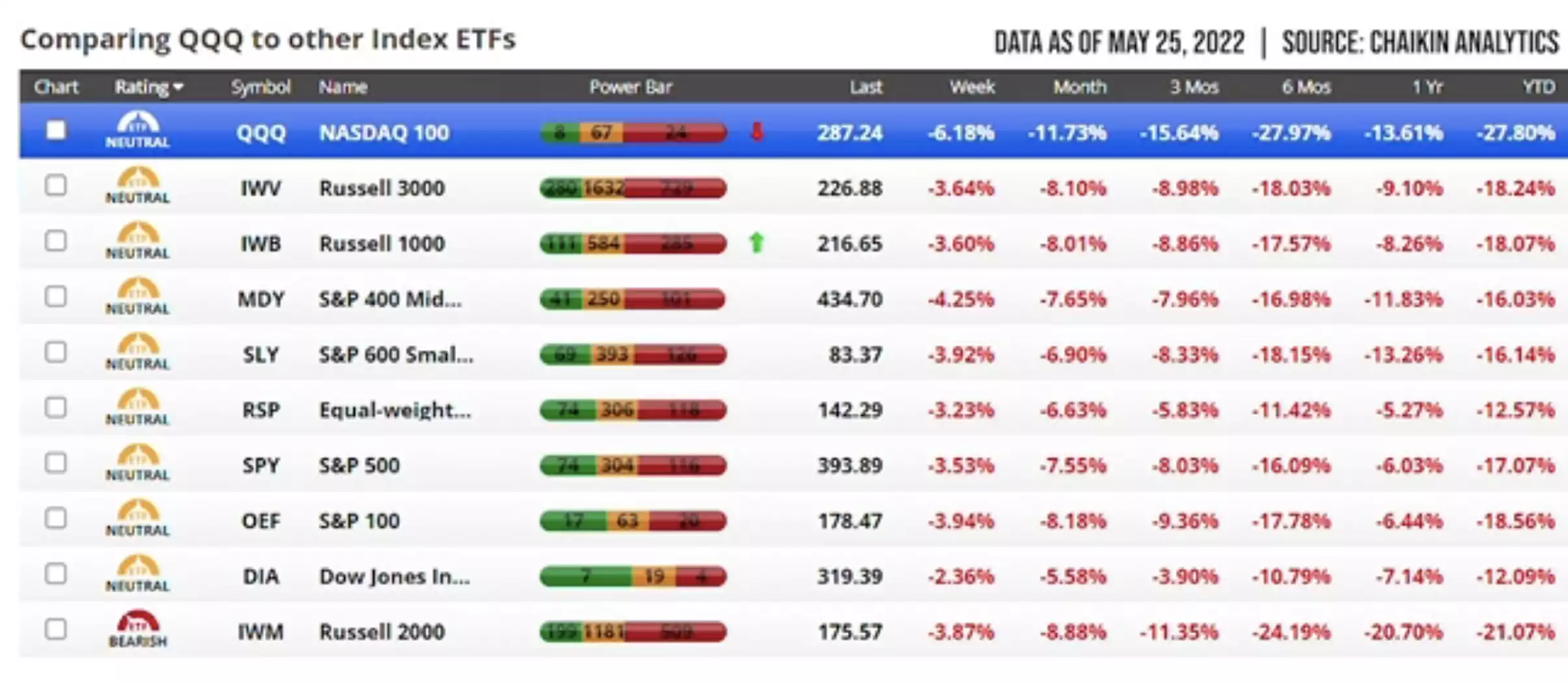

FIGURE 1 | Comparing QQQ to Other Index ETFs | Chaikin Analytics

Dean Barber: Well, we’ve got an upset market. Let’s go through some of the major indexes on a year-to-date basis in Figure 1. And again, this is through May 25. So, the NASDAQ composite is the worst performer year-to-date of all the major indexes, negative 27.8%, followed by the Russell 3000 and a negative 18.2%. For the Russell 1000. The negative 18%. S&P 400 mid cap negative 16.03%. Negative 16.14% on the S&P small cap.

The RSP equal-weight negative 12.57%, S&P 500, negative 17.07%. And then S&P 100 is negative 18.56%. The Dow Jones Industrial Average is the best performing major index year-to-date, but still negative 12.09%. Of course, the Russell 2000 is also in bear market territory with a negative 21.07%. All indications say that the entire market will likely fall into bear market territory. Do you think that that’s the case here?

Bud Kasper: I do, yeah. I don’t think there’s any way of escaping it. If we look at April alone during the US stock market, funds and ETFs dropped 8.4%, and technology lost 13.2%. Now, with all that occurring, and understanding that currently we don’t have the stimulus, you know, when the from the Federal Reserve, just the opposite, we have a breaking of the Federal Reserve. The question is, have we seen all of the negative consequences of this action at this time?

Dean Barber: And I don’t believe we have and what the market fears here is that the Federal Reserve’s commitment to stop inflation will be too excessive and cause the economy to go into recession.

Bud Kasper: Right. And the term they use for that is can the federal reserve engineer a soft landing, meaning instead of being so radical that it just rattles the cages of every investor out there? Or can they smooth this out a little so that hopefully, by the time we get to the end of the year, we will see the results of inflation decreasing. And if we get confidence that the Federal Reserve is on the right track? Most certainly, you should then see the stock markets very to show some progress again.

Taking a Peak at the Fixed Income Market

Let’s discuss what’s going on in the fixed income market because the fixed income market doesn’t react very favorably to a rising interest rate environment.

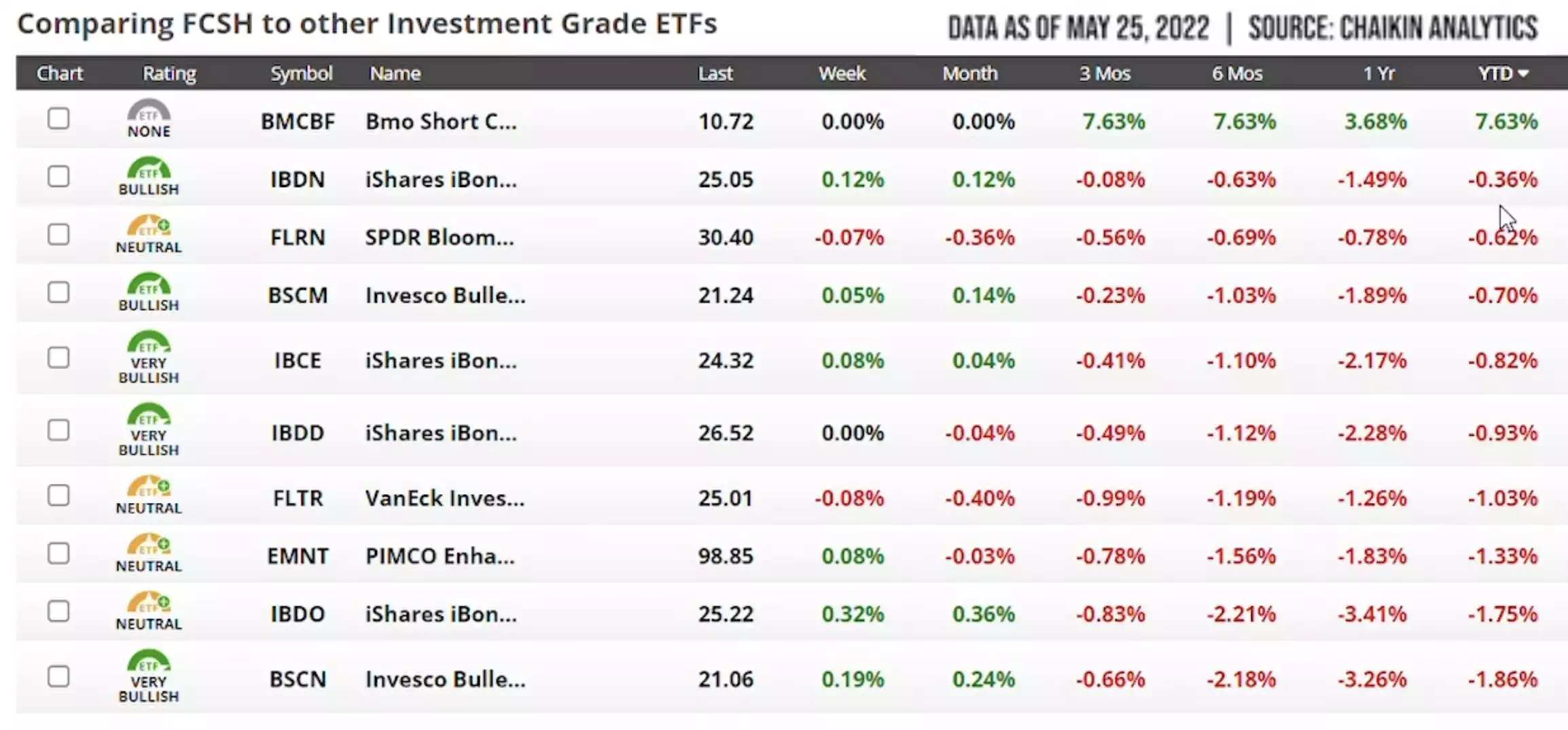

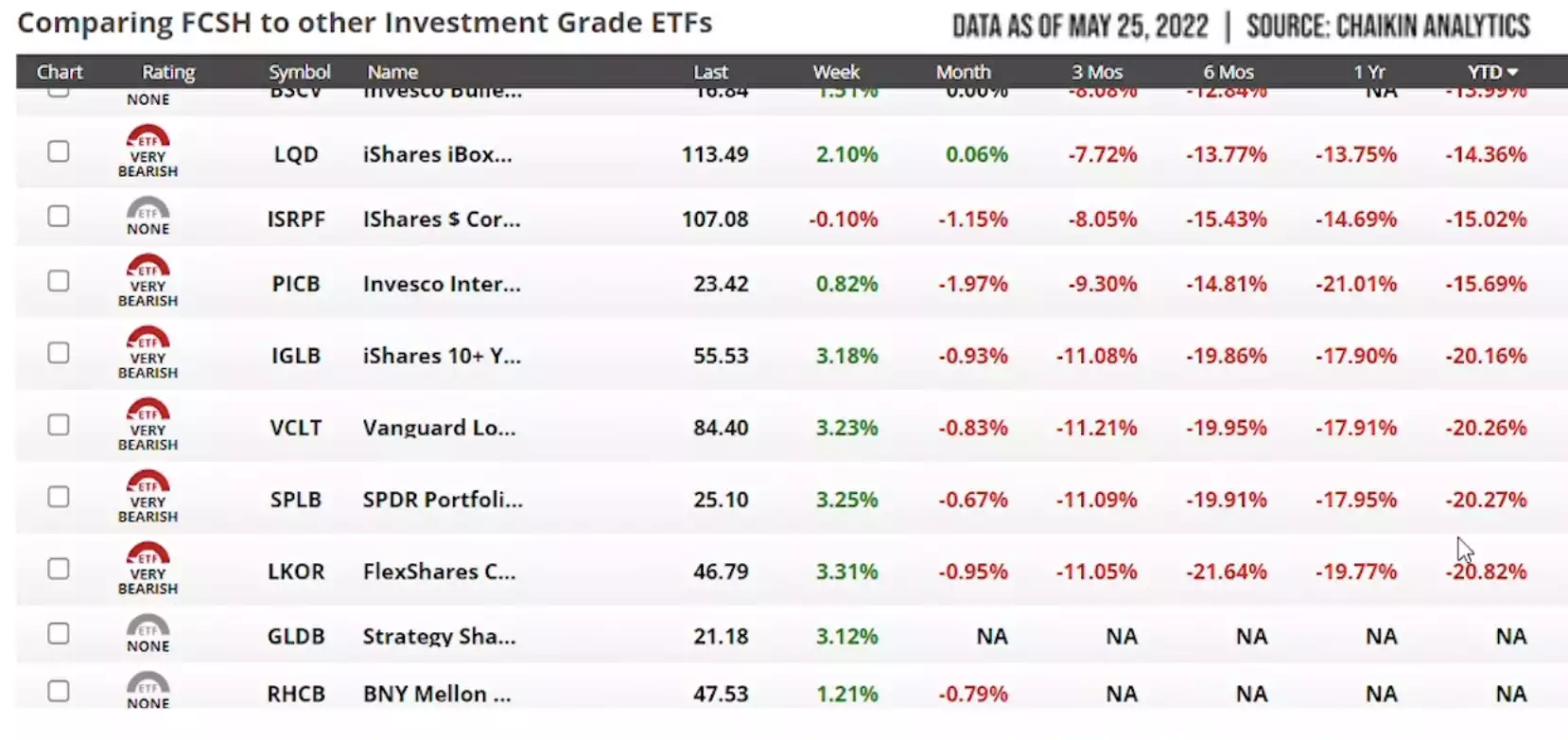

FIGURE 2 | Comparing FCSH to Other Investment Grade ETFs | Chaikin Analytics

In Figure 2 above, we have different investment-grade ETFs. Okay, the best investment-grade ETF on a year-to-date performance is a positive 7.63%. And that’s the BMO short corporate bond index ETF followed by the iShares bonds December 22, term corporate ETF of negative point three, six year-to-date, and other AI bonds ETFs down. You know, anywhere from point six to a little over 1%.

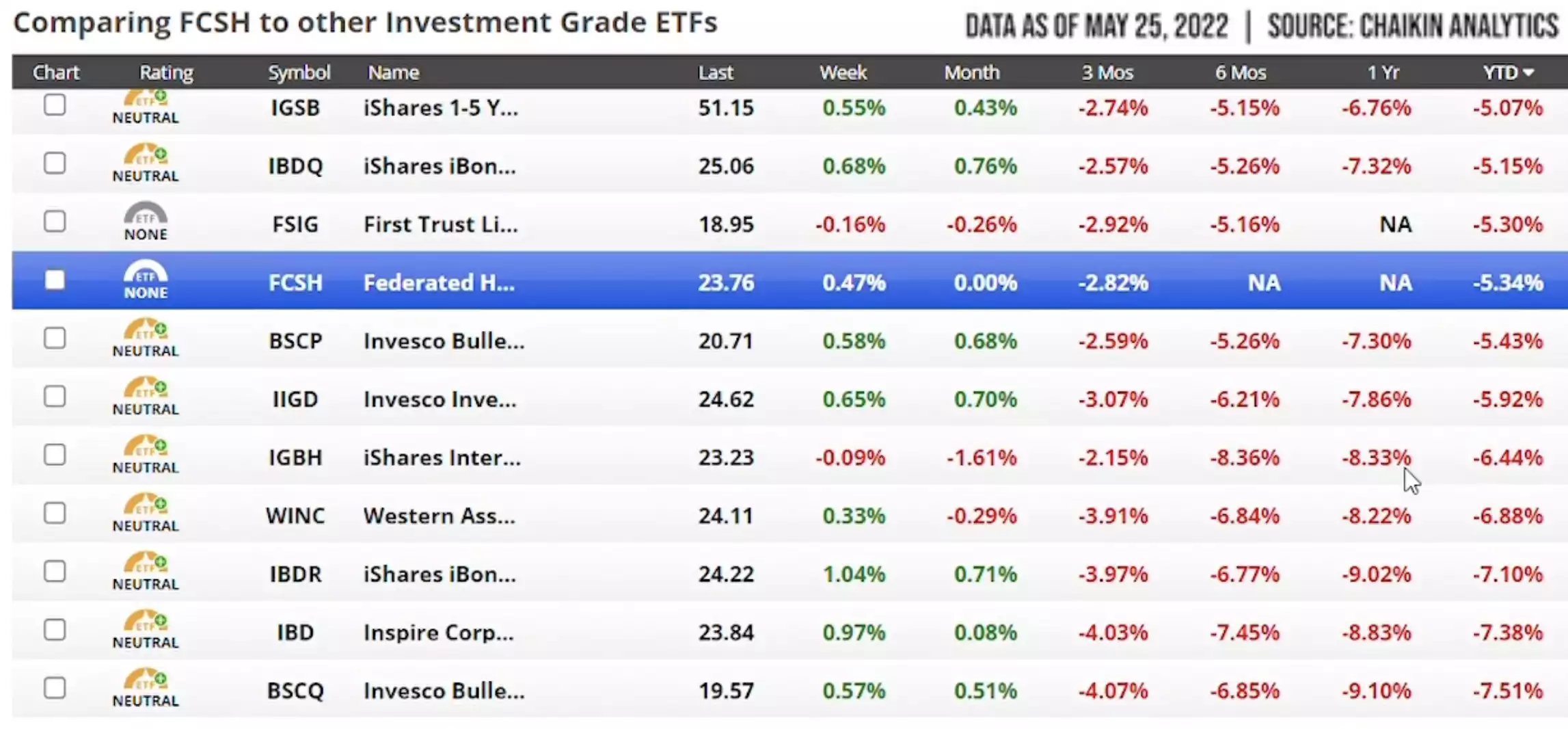

FIGURE 3 | Comparing FCSH to Other Investment Grade ETFs | Chaikin Analytics

So those don’t look too bad. But if you look at Figure 3, you have the federated short-term duration, corporate ETF negative 5.34%. So that’s the short duration.

FIGURE 4 | Comparing FCSH to Other Investment Grade ETFs | Chaikin Analytics

In Figure 4, we see the worst performing fixed income ETF is flex shares. And that’s the flex shares credit score’s us long corporate bond index fund bond maturities negative 20.82%.

Bonds, Bonds, Bonds

Bud Kasper: Yeah, and that’s what’s shocking people.

Dean Barber: So you get, but you get these, like the target date funds that are out there that that are holding, you know, longer-term debt. And the bonds are down, like the bond aggregate is down, around 10% as we do this program here. So your bonds are supposed to be a part of your portfolio that acts like a balance that keeps the portfolio buoyed up when the stock market’s going down.

But it hasn’t been the case this year. So, if you have a 60/40 portfolio with the S&P down almost 18% and fixed income down 10%, you’re down in that 14% to 15% range. You’re supposed to be in a balanced portfolio, and many target-date funds are down that much or more. And even the shorter duration, target-date funds, like a target date, 2020 or target date 2025. Those are all down pretty heavily this year as well.

And the result of the reason that’s happening is because of what’s going on with fixed income. So I think it’s vital that we mention to people that when you look at fixed income, you have to look at the duration of the ETF or the mutual fund. And if you multiply that duration by the increase in the 10-year treasury, that is the approximate amount of loss that you would have.

For example, if you had a duration of 10 years and the 10-year treasury were to increase by 1%, you would see a 10% loss in the net asset value of that ETF or mutual fund. If you had a duration of five years, a 1% increase would translate into a 5% loss.

Buy and Hold to Buy and Bust?

Bud Kasper: You know, the old buy and hold theory is going to cost people a ton of money and a longer timeframe to recover. So if you’re working with somebody who is not engaged with what’s happening in the markets and making adjustments, I’m afraid you will be pretty disappointed.

Dean Barber: I agree with that. But here’s where I think people have to pay attention. And that is if the Fed is committed to raising interest rates. They want to get the Fed Funds overnight rate to a point where it’s 3% to 3.5%, then that means that we’re probably going to see some continued increase in the 10-year treasury.

So as we speak, here, the 10-year treasury is at 2.747%. In my mind, Bud, there’s very little chance that we see the Fed get the overnight lending rate to three and three and a half percent. And that 10-year treasury stays at 2.747%, it will have to go up, and could go up, as high as 4%. So if you own those longer-term bonds, you need to pay attention to that duration because those still have room to fall as the Fed is committed to raising rates.

Bud Kasper: Yes. And for people who are not familiar with the markets but think they are, one of the issues we have is okay, the stock market’s down, which means bonds are supposed to be up.

TIPS, STIP, Etc.

Not this time, it’s a cash game from that perspective or a very selective group of bonds that can appreciate. We refer to these as TIPS, or Treasury Inflation protections. But let me add to that, Dean, you can’t be in a typical TIPS. So, looking at the ETF TIP, you will find it’s down relatively significantly.

However, if you look at the one that’s zero to five years, it’s only down about a half a percent. My point is you want to be on the ultra-short side of the fixed income market with this for the simple reason that the volatility is so low. So if that TIP is a 6.5%

Dean Barber: So I was looking at STIP, and it’s down 1.85% on the year as of today. And so we look at it. But it does have a good yield on it right now. So the yield on the STIP is 5.7%. So if rates stabilize, in other words, if rates go up 1%, that loses 5% because it’s zero to five years, you’re going to be even, right, right. If rates stabilize, you’re going to get to 5.7%.

Watch the Fed Funds Rate

Bud Kasper: Yeah, in the context of that, you know, people need to understand that when interest rates go up, the dollar value of a bond will go down. When you have a TIPS fund, a treasury inflation protection security, what will end up happening is when the Federal Reserve raises rates, your income is going to increase with that as well. If we’re going to get a half-a-point increase in May and another half-a-point increase in June, I will make a point that we’d probably be closer to six 6.3% in the yield of the SDI P zero to five year one, right? I would rather be in that than anything this longer than five years because there you’ll get the pressure of the downside is more significant than that.

Dean Barber: I agree with you. So I just pulled up the TIP. And it’s negative 7.96% for the year, but it does have a yield of 6.42%.

Bud Kasper: So well, if the situation is going to start moving the way we anticipate it will, they will allow people to enjoy a little bit more income with that rising rates. At some point, the Federal Reserve is going to stop this. When they stop, that downside pressure on it goes away.

“I think the last time we saw anything like what we’re witnessing today was 2008.” – Dean Barber

Dean Barber: That’s the critical point of the inflation-protected treasuries. You have to be really careful with the fixed income side of things today. Just as careful as you are with the equity side of things. We’re saying that it’s been a tough first half of the year. There’s no question about it, it’s been a tough five months. But I think the last time we saw anything like what we’re witnessing today was 2008.

Remember, in 2008, you and I talked to each other and said, Well, there’s no place to hide. Because fixed income wasn’t making money, real estate wasn’t making money. You weren’t making any money in the stock market. It was a bloodbath. Across the board, the only safe place was CAD.

With all the inflation coming, there is a substantial fear that we will go into a stagflation environment. Of course, the last time that happened was the late 70s and early 80s, when you had a stagnating economy, but inflation was still rampant.

Looking Back Even Further, The Dot-Com Bubble

Bud Kasper: Oh, you’re so right. If you go back to the Dot-Com Bubble in 2000, 2001, and 2002. Now, there’s a circumstance where bonds were the bastion of safety in that particular period. So what are we saying here? We’re saying things are always different. They’re always different. And therefore, we have to make adjustments, especially for our retirees.

As you and I have discussed so many times, putting cash aside as income to live on. And if we did that, and we harvested some of those gains that we had last year, that was so nice, we’re still in positive territory, even if you look at it over the last, let’s say, 16 months. Right?

Dean Barber: Right. Well, and you know, if you look over the last, you know, you go through 2020 and 2021, and then this first five months of 2022, a balanced portfolio should still be up and averaging in that eight to 9% per year range. That’s fair. Yeah. And so, I think people need to understand that times of uncertainty are inevitable. But they’re not times of panic. There are times to be making tactical adjustments as they’re needed.

Every Recession and Bear Market Has Ended

But nobody can predict the future. Nobody knows where we’re going to be. But I can tell you this: every recession and bear market has ended. There is always recovery, and this time will be no different. You don’t know the duration or the depth of the recession. And you don’t know a bear market’s duration or depth. They’re all different, but bear markets are generally far shorter than bull markets.

Bud Kasper: Yeah. And I think one of the things that have been the nemesis of this downturn has been technology. But technology has done incredibly well over the last few years, with it being down fairly severely this year. You know, you probably do need to cut your exposure at this point.

Dean Barber: Well, we talked earlier this year about some of the outrageous price-to-earnings ratios on some of the technology companies on the Dot-Com Bubble. And, look, you can’t have a company that’s trading at 50, 60, 70, 100 times earnings and expect that, you know, earnings will have to catch up to that. So it gets back into a more fair valued 17 or 18 times earnings than the, you know, ludicrous types of earnings that they have.

Corporations Are Positioning Themselves

Bud Kasper: You know, on a positive note, though, corporations are pretty adept at going in and making necessary changes to try to become profitable. I have a lot of confidence in America’s corporations because the women and men who are running these corporations with the, you know, hundreds of people that support their businesses, they understand what we’re going through. They’re making adjustments as we speak.

We should also understand that the consumer is still in the game. Granted, prices are higher from that perspective, the housing industry is an excellent example. But I still believe that if we have a strong consumer, you know, what we’re lacking is supply. Right? And that will correct itself.

Dean Barber: That will correct itself. But I think the problem when you say the strong consumer is, yes, consumer spending remains the same, or maybe it’s going up. Still, it’s not because the consumer wants to spend more on certain things. A lot of consumer spending results from the rampant inflation we have right now. Think about it from a daily spending activity. Your meals are up 10% in the last year. Well, did you get a 10% Raise?

So, inflation is causing people to forego some of the discretionary spending they might be doing. And so you’re seeing massive pressure in the consumer discretionary stocks right now. Consumer staples, those stocks are holding up far better than the discretionary.

Lower Incomes Are Getting Hit the Hardest

Bud Kasper: Yeah, and the sad part, when you look at America as a whole, are people that have lower incomes, they’re getting hit the hardest.

Dean Barber: They are getting hit the hardest, the lower to middle-income people are getting hit the hardest, there’s zero question about that the people that are on a fixed income or have very little except for Social Security, and maybe a pension that doesn’t have an inflation adjustment on it, those people are getting hit harder and harder. And, you know, the money supply has just gone through the roof. But you know, incomes have not followed suit.

And that’s where I think the consumer will continue to feel pressure. And I think that goes back to the possibility for inflation to remain yet have a stagnating economy. Because if the consumer is tapped out, and they’re still spending, but they’re, but they’re not able to do the other things that will slow the economy’s growth at the same time, you will still have inflation.

Bud Kasper: Yeah. And to conclude, you know, the Federal Reserve will do whatever is necessary to get inflation under control.

Whether or not it’s two more times or two more times plus a quarter, I don’t know what the answer is there.

Dean Barber: It’s going to remain to be seen. And I will tell you that we have our thumb on the pulse here. We are paying attention to this every day. We’re talking about it every day. We’re analyzing it every single day and we’re making adjustments as necessary. And we want to ensure that the plans we’ve built for you are all intact and doing the right things for your personal plan.

Access Our Industry-Leading Financial Planning Tools

And they were built to survive uncertain times like this. So most of you should be able to rest assured that things are in the proper position and that the plan is built to withstand this, but we stress test plans all the time. And if you’re not a client of ours, and you’d like to get started on utilizing some of our industry-leading financial planning software, you can do that here.

We’ll get that you can get started right from the comfort of your home there, all you have to do is enter your name and email address, and it’ll get you access to that industry-leading software.

So you can find out whether or not you’re on track to do all the things you want to do in retirement. But I wish I had a rosy outlook for the year’s second half. I think what I’m predicting, and I want to get your predictions here real quick, is more volatility, more uncertainty.

Escalation in Ukraine Could Bring More Rockiness

The worst thing that could happen to the global economy is an escalation in Russia’s invasion of Ukraine, where Russia takes this into other countries. That could rock the markets. And that would be something that You can’t predict, right. Vladimir Putin is an absolute maniac, and nobody can predict what he will do.

Bud Kasper: No, I agree. That is the grand disruptor, if you will, for the markets in general. Outside of that, let’s let the Federal Reserve do its work. You know, and I think we’ll see a positive result from that action before the year is out. I think they will whether or not the stock market reacts favorably to that news. And that’s why I believe there is a chance we could be back in positive territory.

Dean Barber: It’s possible. Some people are calling for much more pain ahead. There are also people that are saying –

Bud Kasper: There will be more pain ahead. But that isn’t where we’re going to be at the end of the year, in my opinion.

To Conclude the 2022 Halftime Report, This is a Time for Patience

Dean Barber: This is a time for patience. And you have to be patient here. You have to understand that a company like Apple. That’s down 21% this year. So you would say Apple is in bear market territory?

Absolutely. It is. Well, its price to earnings is back down to 22.83. Now, more favorably valued as like to see that in the 1718 times, but Apple is a company that can cause that price to earnings ratio to decline, not just from a stock price drop, but because they’re earning more money.

Bud Kasper: And by the way, one of the few technology companies that pay a dividend.

Dean Barber: Yeah, not very much of a dividend. What is it 0.65%?

Well, we appreciate you joining us here for the 2022 Halftime Report. I’m Dean Barber, along with Bud Kasper. Thanks for joining us.

Start Building Your Plan

Use our industry-leading financial planning tool to start building your plan from the comfort of your home today.

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.