10 Financial Planning Steps

An Overview of Financial Planning Basics

In this webinar, Will Doty, CFP®, discusses reviews 10 Financial Planning Steps that are a basic overview of financial planning. These action items will benefit those early on in their career, approaching retirement, and anyone in between. Join us to ensure your taking the right steps in your financial journey.

Complimentary Consultation Share this Video

Items Mentioned in this Webinar:

Podcast: The Guided Retirement Show

Video Transcript

Thanks for joining me today. My name is Will Doty, and I’m a CERTIFIED FINANCIAL™ and Accredited Investment Fiduciary® with Modern Wealth Management. Today we’re going to be talking about 10 Financial Planning Steps. Think of this as an overview of financial planning basics for those who want to learn and are probably a little bit younger and getting started in life.

10 Financial Planning Steps

All right, so let’s talk about the 10 Financial Planning Steps that you need to consider.

- Setting Goals: What is important to you? What are you trying to accomplish? Making it meaningful?

- Budgeting: Understand understanding what you have coming in and going out? And that way, you can plan and make adjustments as needed.

- Emergency Fund: Making sure that you have set aside money in case something bad has happened.

- Insurance: Having the proper insurance, not just car insurance, but homeowner’s, life, long-term care, disability. There are quite a few that you need to consider.

- Using Credit: Good debt, bad debt. How do you use it? How do you get qualified for it?

- Investing: Understand how to put your money to work for you.

- Tax Planning: The need to understand how taxes play a part in your daily life today, as well as your long-term plans.

- Saving for College: If you wind up having children, how do you fund their college?

- Retirement Planning: Get started early. The most successful clients wind up starting early on the retirement plan, so a crucial step.

- Estate Planning: What happens if you’re incapacitated, and what happens if you pass away with any of the net worth you have built?

Financial Planning Step 1: Setting Your Goals

So first, set your goals. What’s important to you? What’s around the corner? Buying a house, getting your first credit card, whatever it may be, you need to learn how to set your goals.

When setting your goals, you want to use the acronym SMART. You want to make sure your goals are specific, measurable, attainable, relevant, and timely. Write down and prioritize those goals as well.

Financial Planning Step 2: Budgeting

Budgeting. You need to understand what are all of your income sources. For many of you, it may just be a paycheck. Others may have investments income, have rental income, or farm income. Next, figure out what your expenses are—and then understanding whether or not you are at a surplus, or unfortunately if you’re at a deficit.

Financial Planning Step 3: Emergency Fund

Emergency fund planning. Having an emergency fund is very important. Things happen, things that we can’t control. You could be in a car wreck and have a very large bill to replace your car. You want to make sure that you’re setting aside money to handle these issues. And maybe start small with a goal of three months as you’re getting started. As you continue to have more income, maybe try to obtain six months’ worth of living expenses for your emergency funds.

Financial Planning Step 4: Risk Management with Insurance

The next is risk management. So how do we offset risk? We use insurance. So you want to understand the different key components of insurance and what you may or may not need.

Things like health insurance, auto insurance, life insurance, property insurance, liability insurance, and disability insurance – you need to understand what all of these components do concerning your life. You need health insurance to cover health expenses. Your auto insurance protects your car.

Life insurance may or may not be needed. If you have a spouse and children, you may need some income replacement—property insurance for your home. Liability insurance is an important one that gets missed often, especially for us younger people. Having an umbrella is relatively inexpensive and dramatically increases your ability to handle liabilities if an issue should arise.

Disability insurance. What happens if you have a health event that makes you disabled, and you still have 20 years of work left, and you still have a family to provide for? Disability insurance can be critical. Lastly, long-term care insurance. And this will be something more for planning for later in life.

Financial Planning Step 5: Using Credit

The next step is using credit. So what type of credit? What is your capacity? What are your character and collateral?

Things like home loans are collateralized loans. If you cannot pay your payments, you could eventually be foreclosed on, and the bank will own your home. Very similar to a car.

Where uncollateralized would be things like your credit cards, it’s more of a signature of good faith. How do creditors determine your worthiness? Through a credit report. So be very mindful when you open credit, and the same thing with your utilities, make sure to pay everything on time.

Also, make sure not to carry a large balance on your credit cards, as these are all things that could adversely affect your credit report—and again, understanding how to use these sources of debt—the types of debt, secured and unsecured.

As we mentioned earlier, secured debt such as a home mortgage or your car loan. Unsecured would be more like a signature loan. It’s a loan in good faith, your credit cards. You want to understand the amount of your debt, as well as the interest rate. These are all critical things to consider.

Financial Planning Step 6: Investing

So after you have figured out a way to build up your emergency fund, making sure that you have proper risk mitigation, and you’re continuing to build your net worth, investing becomes important to make your money work for you.

You want to make sure that you have a sound investment strategy that may have some risk and stability for future growth.

You also want to understand your risk tolerance level. Some of us can accept a large swing in investing; others may not. That should also help guide you on what type of investments make sense for you, much like the old bull and bear. So you want to understand what kind of appetite of risk you can accept.

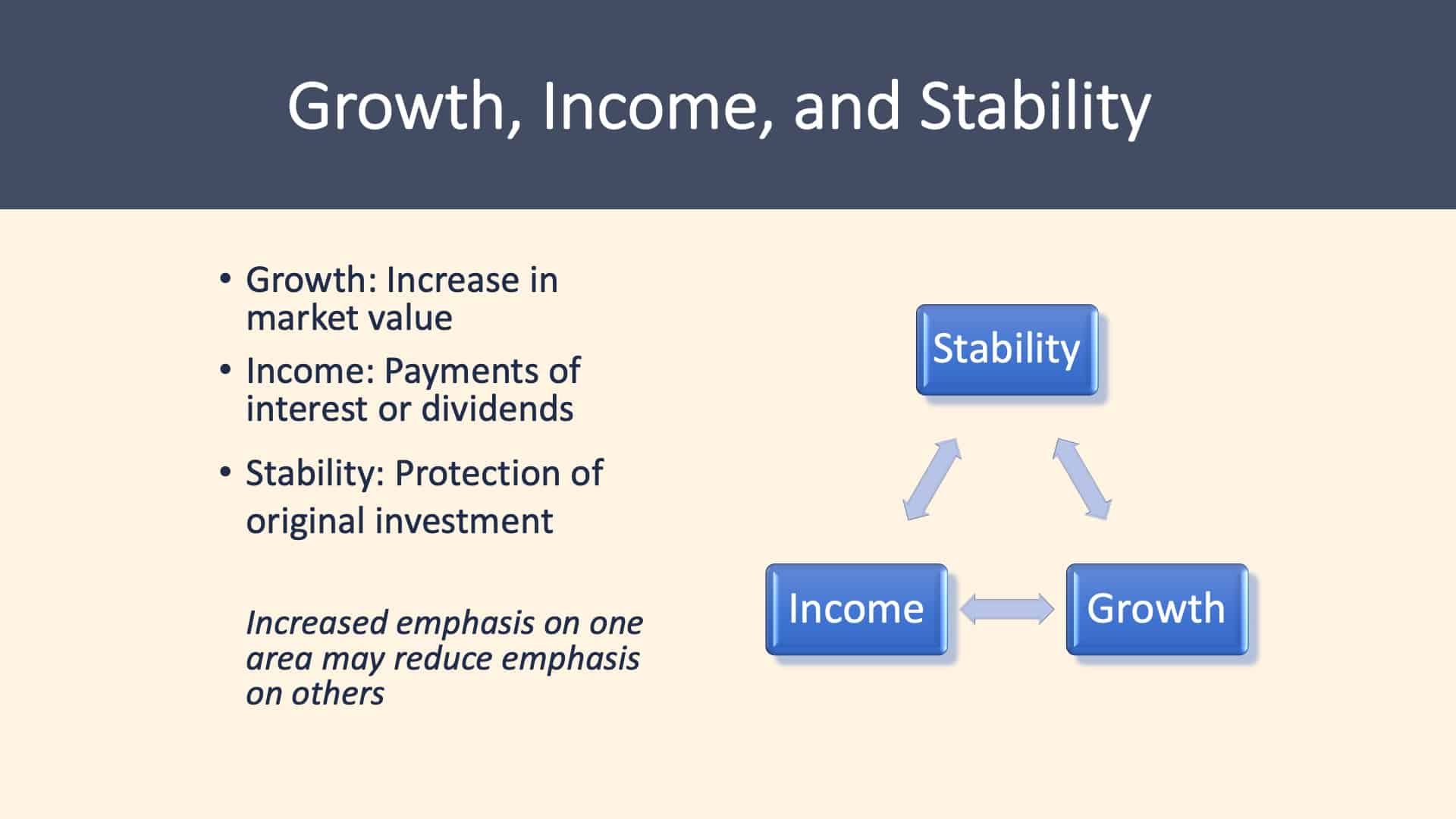

You then want to understand with your investing the three areas, whether it be growth, income, or stability. You’ll need to understand that you may compromise the other areas if you lean heavily into one.

So if you lean very heavily into growth investing, you may not have the stability you’re looking for because it is an offset. So these are all things to consider.

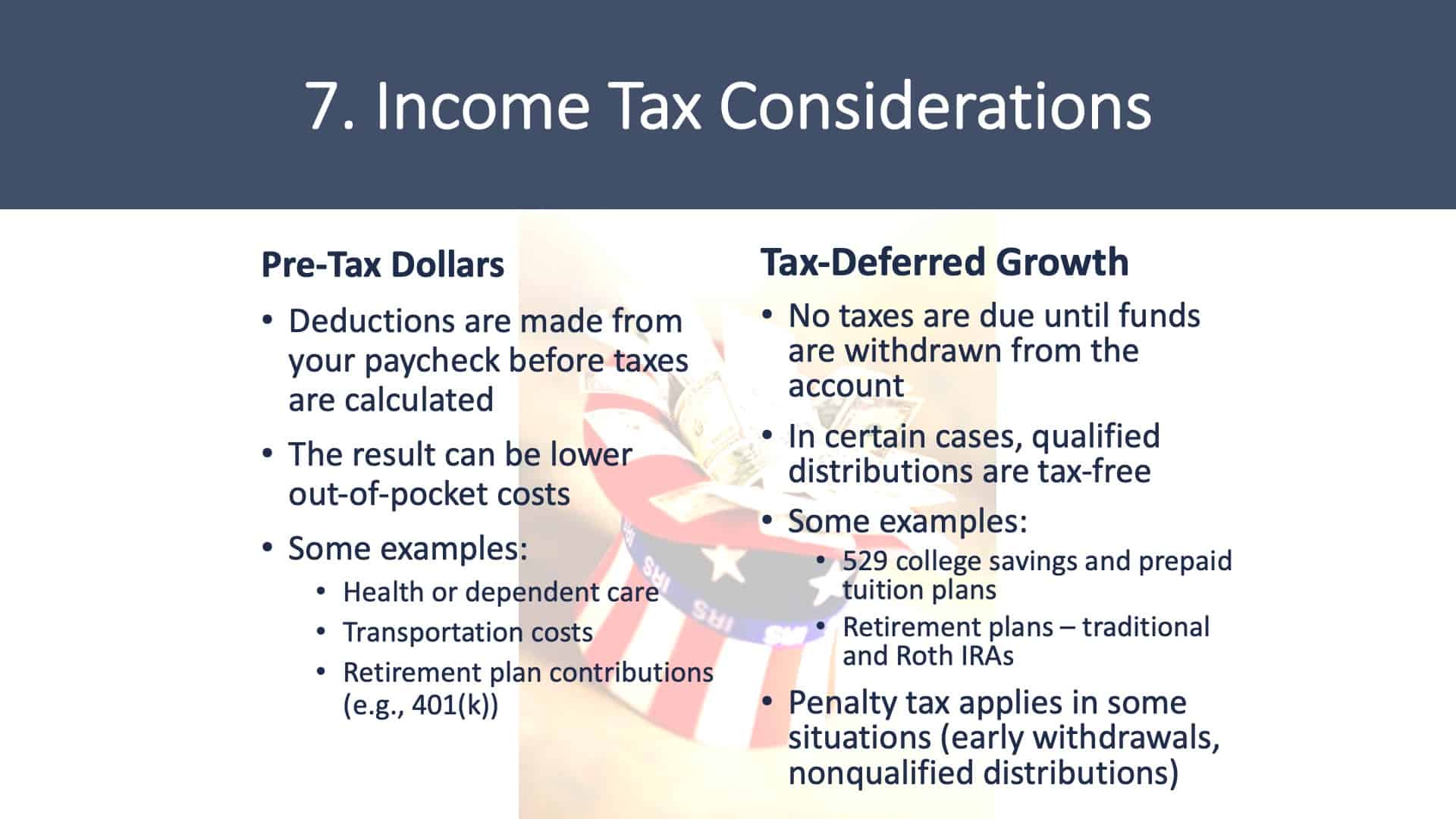

Financial Planning Step 7: Tax Planning

Understanding what is pre-tax, after-tax, and tax-deferred is very important as you begin to build your net worth. You should understand the positives and negatives of each side. So pre-tax, these are dollars deducted from your paycheck before your taxes are calculated, so you don’t pay taxes on them.

You can also use this as a function of saving taxes today. Depending upon where your income is, you may want to increase your deferred tax savings, things like your 401(k).

On the other side, you may want to look at increasing money in your Roth account, which can also be done potentially inside a 401(k), dependent upon your provider.

Again, just understanding that dynamic of your taxes today and what you think your taxes will look like long-term can help determine which bucket to continue to build. Understanding tax-deferred growth versus taxable growth is also important.

It doesn’t mean that you don’t want money in one of these buckets; we still want to have a diversified plan but understanding the dynamics behind them.

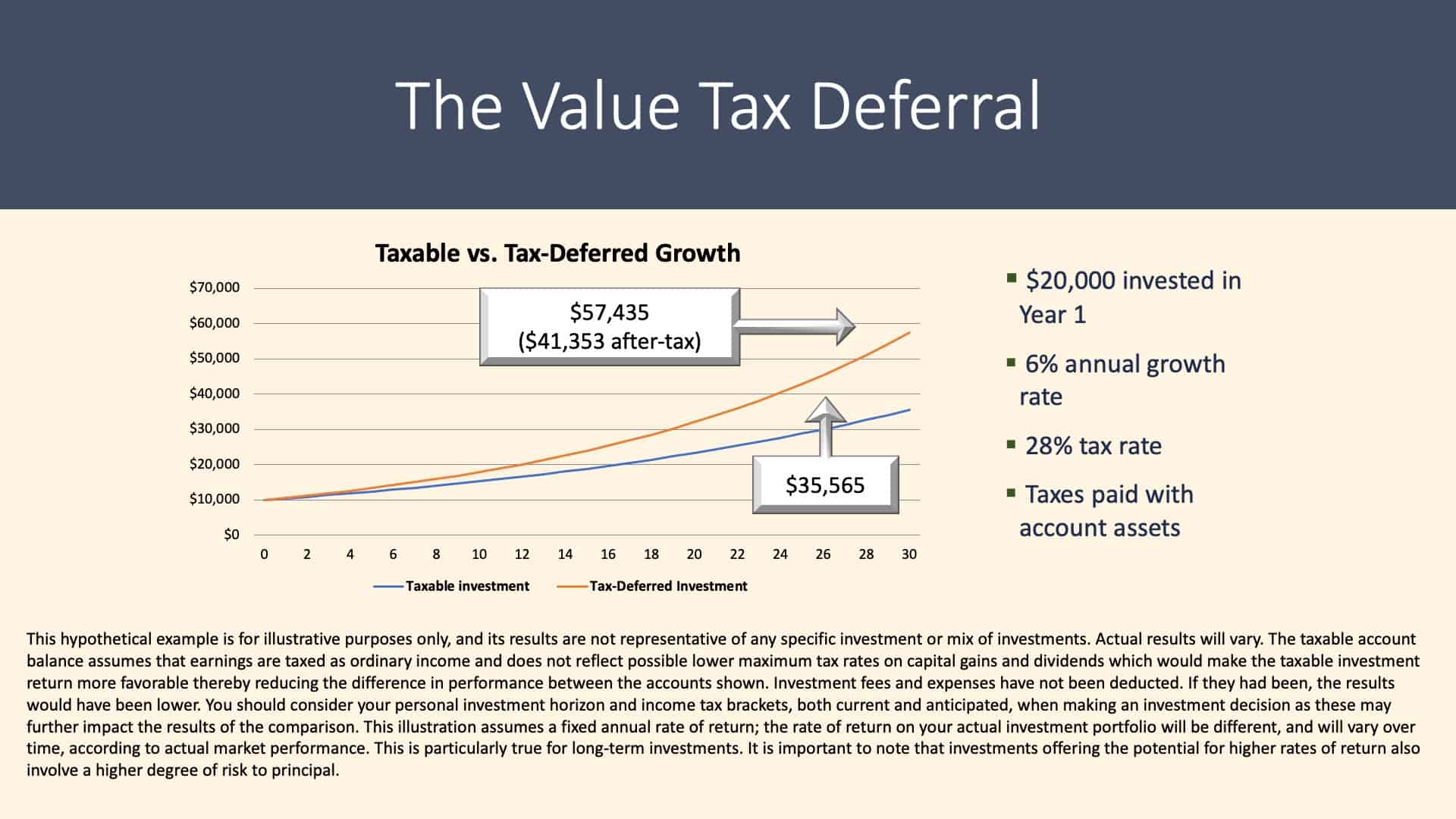

Let’s look at the portfolio that we invested $20,000 in growth over time at an average of 6% compounding.

The tax-deferred has no taxes due until you take a withdrawal, the taxable, we are paying off the taxes as the portfolio grows, so therefore it does dampen some of that growth. Now that might not be the situation you find yourself in, but understanding that dynamic is important.

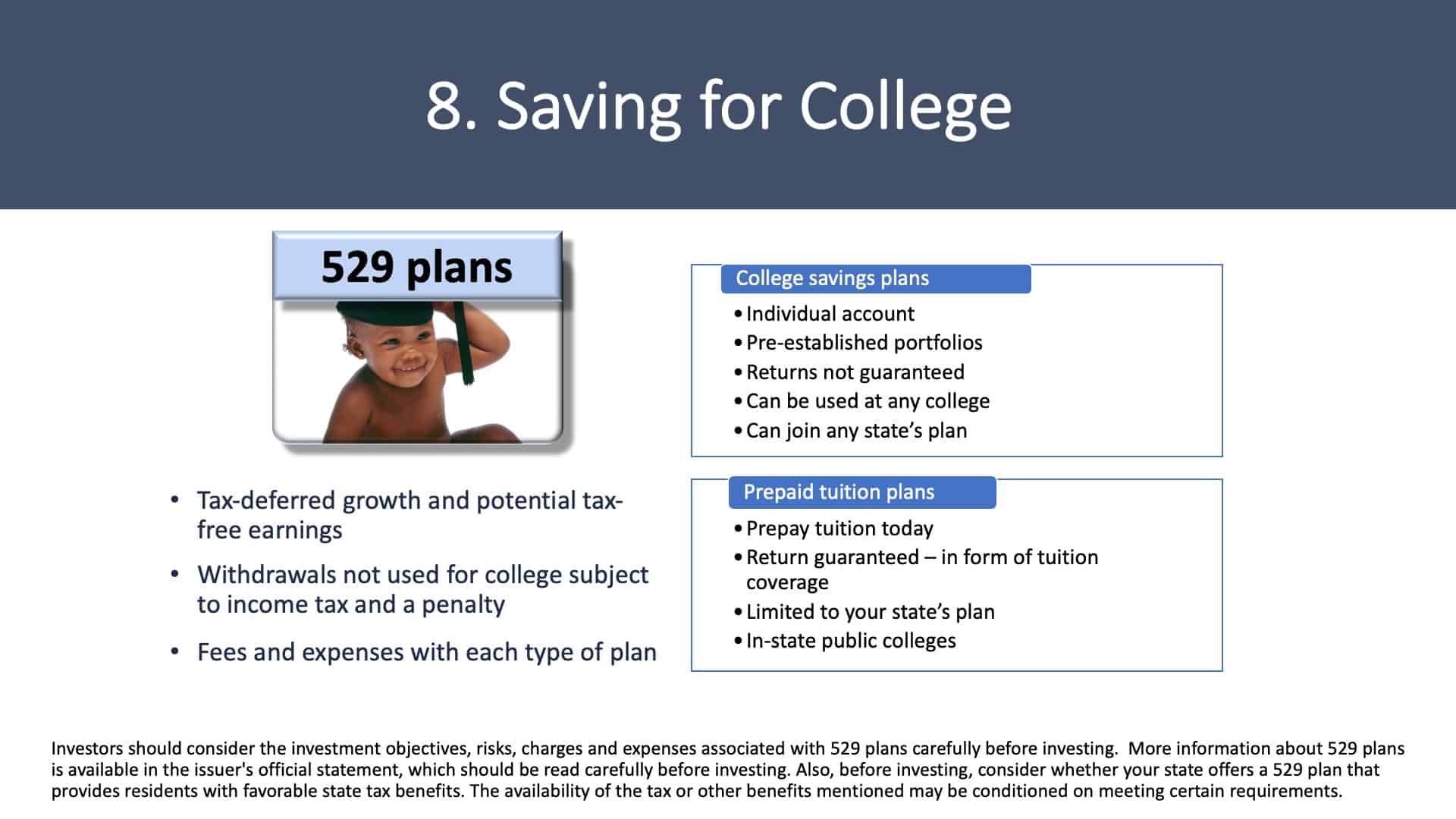

Financial Planning Step 8: Saving for College

For those of you that have little ones at home, you may be trying to figure out, “Well, how do I help my child go through college?” So you want to look at the different types of savings plans that are out there.

A prevalent one is the 529 plan. It has some great attributes as well as disadvantages, so you want to understand both. So a 529 plan allows you to invest money today after-tax; you may or may not get a state tax deduction. So that is something important to look into, whether it’s a state-sponsored plan and your state allows a tax deduction.

The more important part is that the money will now grow tax-deferred and become tax-free at withdrawal if used for qualified college expenses.

Financial Planning Step 9: Retirement Planning

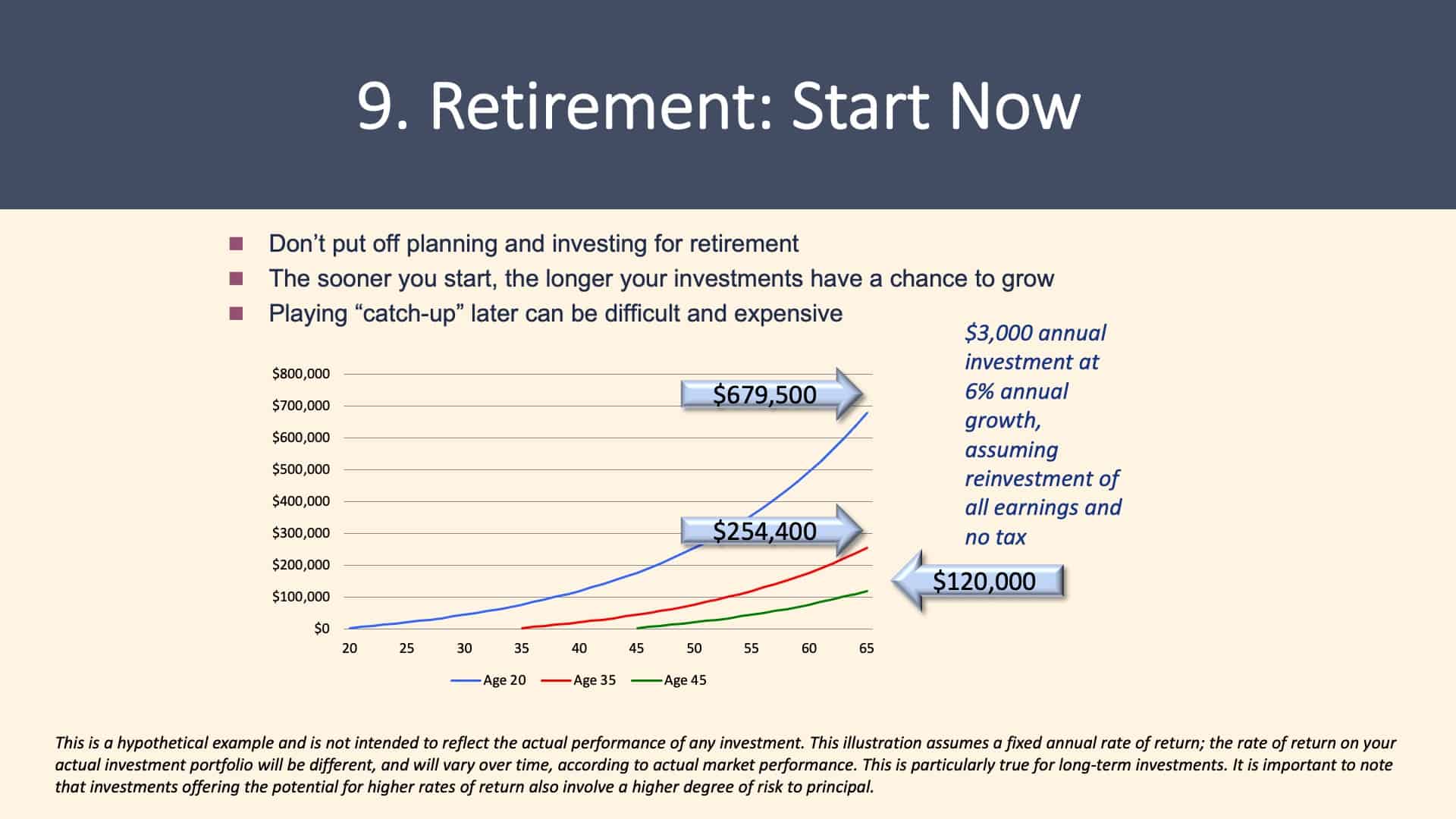

Start this now, as soon as you possibly can. The most successful clients I work with started very young and allowed their money to work for them. Start as soon as you can. This is a perfect example of why you want to start sooner than later.

We can look at the three individuals that started saving at 20, 35, and 45. And over time, what their money wound up doing is quite substantial.

The individual that started saving early now has over $670,000 saved for retirement.

The person that began in their mid-30s now only has $254,000. The individual that started late, at 45, only has $120,000, which may not be enough to give them the retirement that they want. So again, always start early and pay yourself first.

Retirement: Basic Considerations

There are some things that you want to take into consideration when you’re thinking about your retirement plan. When do you want to retire? What does life look like when you’re retired? And one that’s a little hard to figure out is how long retirement will last.

Obviously, we don’t know how long we’re going to live, and that’s a big component. So we always suggest stressing a longer life than maybe what was anticipated to help mitigate the risk of running out of money before you run out of life.

Retirement: More Basic Considerations

Other things you want to consider, especially if you’re going to retire early, you can not claim Social Security until 62. You also have to be concerned with health insurance and how do you cover, because you don’t start Medicare until 65.

You want to think about your lifestyle as well, and what you’re trying to do. Do you want to be financially independent? Do you want to have the opportunity to travel or maybe even help fund education or gifting to children and grandchildren? These are all things to be thinking about.

Retirement Planning: Tax-Advantaged Savings Vehicles

For retirement savings, you want to think through how you are going to save. You could wind up having great growth with tax-deferred, but we also want to be able to use Roth if possible to give you multiple different types of buckets of money to be able to draw down later on in life when you’re retired.

Financial Planning Step 10: Estate Planning

The final step is estate planning. What happens if you die and you do not have a plan? That falls under intestacy; therefore, your assets may wind up going to something like probate, to the courts, for the courts to decide where things are supposed to go. This can be very costly, and your estate will be publicized.

If you want to avoid this, you have to understand and put into place things like wills, possibly even a trust, depending upon your situation. And then finally, with estate planning, you want to think about incapacity. What happens when you are no longer able to make financial or healthcare decisions?

Estate Planning: Wills

Let’s talk about a will. A will is a very important document that is written and signed by you, as well as a witness.

Your will covers all of your wishes, where you want money to go. If you have young ones, who will step in and be the guardian? Who do you want to be there to help process your estate?

This is the only time you get to name it before being incapacitated, or unfortunately, dead. So very important that you have a will established so that all of your wishes are in place.

Estate Planning: Planning for Incapacity

Another very important part of estate planning is incapacity planning. So what happens if you become incapacitated? What if you get in a car wreck, and unfortunately, in a vegetative state?

Who’s going to be there to step in to talk to the medical staff? Who’s going to be there to make sure that your bills are being paid?

Again while you’re here, this is the only time you get to write down who you want to step in and fulfill those duties for you. You also provide any medical directives so that people don’t have to get the court to appoint them and make difficult decisions that you may not have wanted.

There is a Lot to Consider

There’s a lot to consider, so ask questions and start planning now. Thanks for joining me today for 10 Financial Planning Steps.

Other Educational Webinars and More

If you’d like to get more in-depth information on any of these steps, we’ll have links below to other planning areas that dive into these steps:

- Claiming Your Social Security

- Health Care Costs in Retirement

- Are You Fully Covered?

- ABCs of Medicare

Also, feel free to subscribe our podcast, with a lot of great content there. If you’d like to learn more or meet with us, please schedule a complimentary consultation below.

Schedule Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.